Daily Market Outlook - Wednesday, Jan. 8

Image Source: Pixabay

Asian markets declined, mirroring the moves in the U.S. overnight, as concerns about rising inflation led to a selloff in Treasuries and a negative sentiment towards China influenced market dynamics as trade tariffs from the incoming Trump administration remain a concern. MSCI's regional equities index is set to post its largest single-day decline in over two weeks, erasing gains made on Tuesday. China's main stock index has plunged to its lowest level since September, fuelled by ongoing investor anxiety about the potential for increased U.S. tariffs. The S&P 500 dropped by over 1% on Tuesday following a report that revealed inflation among U.S. service providers has reached its highest point since early 2023. Economic worries are dampening investor confidence across Asia, particularly in China, where there are growing fears of a potential deflationary spiral. This concern is compounded by credit yield premiums nearing their lowest levels since the global financial crisis, causing scepticism about investor appetite for a surge of deals in global debt markets. In China's $11 trillion government bond market, investor sentiment has turned increasingly pessimistic, with 10-year bond rates recently hitting all-time lows, falling over 300 basis points below those of the U.S., even after the Chinese government, led by President Xi Jinping, announced several economic stimulus measures. In other markets, oil prices increased for the second consecutive day on Wednesday, driven by industry data showing another decline in U.S. inventories, while Bitcoin fell below $100,000.

The dollar gained strength on Wednesday, supported by rising Treasury yields following robust U.S. data that reignited concerns about a potential rebound in inflation. This left European stocks facing a sluggish start as traders prepared for differing monetary policy trajectories. While traders are becoming accustomed to the prospect of a gradual interest rate reduction cycle from the U.S. Federal Reserve, they anticipate significant cuts from the European Central Bank, even after Tuesday's data indicated that inflation in the euro zone accelerated in December. Markets are forecasting 99 basis points of easing from the ECB this year, while they expect the Fed to reduce borrowing costs by 37.5 basis points by the end of 2025, with the first cut fully anticipated in July. The benchmark 10-year Treasury yields reached an eight-month peak on Tuesday, as data suggested a resilient U.S. economy with a stable labour market but also indicated the re-emergence of inflation risks.

Today's calendar highlights include key economic indicators such as euro area confidence and producer price index (PPI) data. In the U.S., the ADP employment report will be released, along with the minutes from the Federal Reserve's latest meeting. Additionally, a speech from Fed official Christopher Waller is expected, which may provide insights into the central bank's views on current economic conditions and monetary policy.

Overnight Newswire Updates of Note

- Nvidia Unveils More Plans To Revolutionize Massive Markets

- Niklas Zennström: Europe Can Still Win In AI Despite US Dominance

- Bond Market Target 5% US10Y Yield As Trump Inauguration Nears

- US API Weekly Crude Oil Stock Plunges By 4.022M Barrels

- Exxon Predicts $700M Hit To Profit From Lower Oil Prices

- Markets Sound Alarm Over Deflationary Spiral In China

- Hong Kong Banks Hoard Record Piles Of Cash As Economy Sputters

- Chinese Investors Flock Abroad; Local Markets Lag, MRF At Limits

- China Renews Car Trade-In Subsidy To Boost Hybrid, EV Sales

- Aussie Treasurer Chalmers Hails Progress In Nov Inflation

- ANZ: Modest Dec Commodities Gains Cap Strong 2024 Growth

- New Zealand House Prices Tipped To Show Modest Gains In 2025

- Nippon Steel Bets On Trump To Salvage $15B US Steel Deal

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0300 (235M), 1.0350 (720M), 1.0370-80 (665M), 1.0385 (450M)

- USD/CHF: 0.8975 (293M), 0.9000 (250M)

- GBP/USD: 1.2450 (380M)

- EUR/GBP: 0.8300 (1.7BLN), 0.8385 (576M)

- AUD/USD: 0.6215-20 (508M)

- USD/CAD: 1.4350 (854M), 1.4400 (323M), 1.4460 (1.4BLN), 1.4500 (307M)

- USD/JPY: 157.50 (1.7BLN), 157.65 (301M), 158.00 (375M), 158.95 (670M)

- AUD/JPY: 99.00 (556M), 99.30 (240M)

CFTC Data As Of 3/1/25

- Swiss franc has a net short position of -28,382 contracts.

- The British pound shows a net long position of 19,323 contracts.

- The euro has a net short position of -68,507 contracts.

- The Japanese yen reflects a net long position of 2,311 contracts.

- Bitcoin is in a net short position of -129 contracts.

- Speculators have reduced the net short position in CBOT US Treasury bonds futures by 19,961 contracts, bringing it to 26,342.

- The net short position in CBOT US ultrabond Treasury futures has been trimmed by 15,012 contracts to 204,292.

- The net short position in CBOT US 2-year Treasury futures has decreased by 6,298 contracts to 1,252,975.

- The net short position in CBOT US 10-year Treasury futures has been cut by 141,543 contracts to 591,374.

- The net short position in CBOT US 5-year Treasury futures has been reduced by 1,895 contracts to 1,760,422.

- Equity fund managers have increased the S&P 500 CME net long position by 2,531 contracts to 1,042,431.

- Meanwhile, equity fund speculators have raised the S&P 500 CME net short position by 78,396 contracts to 347,102.

Technical & Trade Views

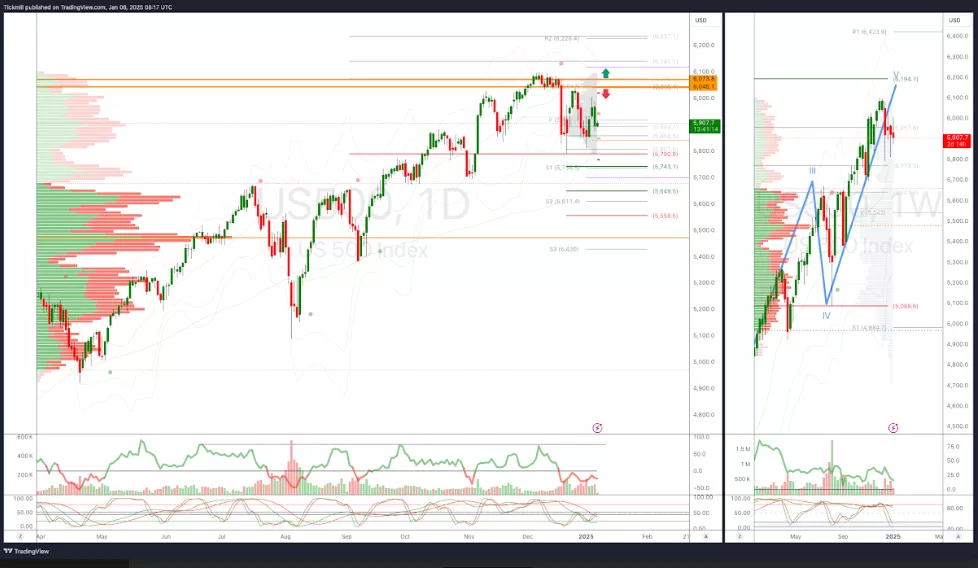

SP500 Short Against 6045

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into Jan 20th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Short Against 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Short Against 1.2614

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

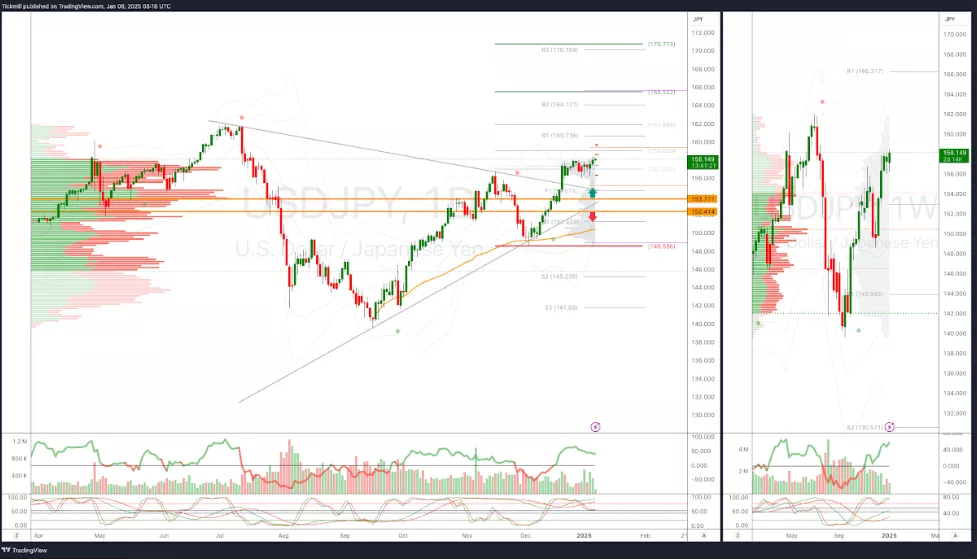

USDJPY Long Against 153.77

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

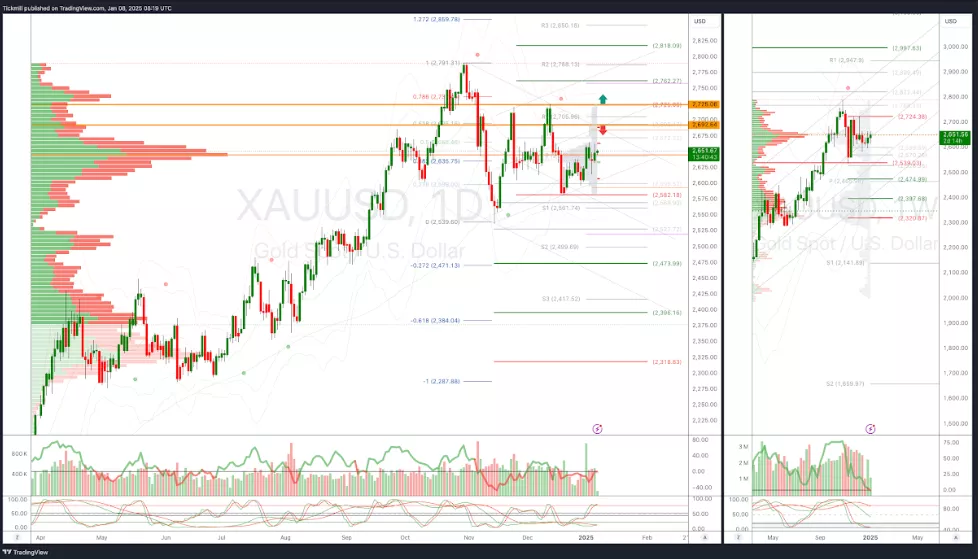

XAUUSD Short Against 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into Jan 15th

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

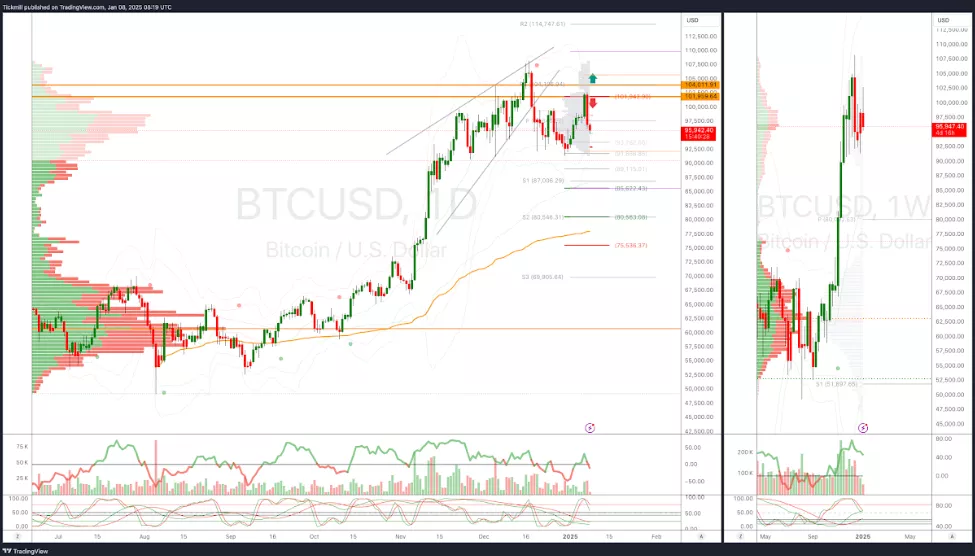

BTCUSD Short Against 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into Jan 15th

- Above 104,020 target 110,000

- Below 101,942 target 90,600

(Click on image to enlarge)

More By This Author:

FTSE Recovers Early Losses To Trade In The Green For The Day

SP500 Weekly Action Areas & Price Targets - Monday, January 6

The FTSE Finish Line