The FTSE Finish Line

FTSE Flat To Start The First Full Trading Week Of 2025

U.K. stocks are rotating around the flatline on Monday, with the upside impacted by rating downgrades of several prominent companies. The benchmark FTSE 100 is trading just above the pivotal 8225 levels. On the economic side, the S&P Global UK Services PMI increased to 51.4 in December 2024, rising from November's 13-month low of 50.8 and surpassing expectations of 51, according to preliminary data. Meanwhile, the S&P Global UK Composite PMI remained steady at 50.5 in December 2024, unchanged from the previous month and roughly aligning with market expectations of 50.7, based on a flash estimate. The aerospace and defense sectors experienced the largest losses among the major FTSE 350 categories, dropping 2.1%, primarily due to a 2.8% decline in Rolls-Royce after Citigroup lowered its rating on the engineering firm from "buy" to "neutral." Meanwhile, a measure of consumer staples fell by 1.2%, with index leader Unilever decreasing by 1.7% following RBC's downgrade of the consumer goods company from "sector perform" to "underperform." On a positive note, industrial support services rose by 1%, with Spectris increasing by 2.9% after HSBC upgraded the scientific instruments manufacturer from "hold" to "buy."

Single Stock Stories:

-

Shares of Unilever fell 1.6% to 4485p, the lowest since July 24, 2024, making it one of the top losers on the FTSE 100, which is down 0.13%. RBC downgraded the stock to "underperform" from "sector perform" and reduced the price target to 4,000p from 4,800p, citing challenges in achieving 2% volume growth due to weak market dominance and underperforming brands. Analysts noted that volume growth has averaged less than 1% per annum since 2014 and that increased capex is necessary for meeting growth goals. The stock is down approximately 1.28% year-to-date..

Broker Updates:

-

Shares of Rolls-Royce have fallen by 3.4% to 565.4p, making it the top percentage loser on the FTSE 100. This decline follows a downgrade by Citi, which changed its rating from 'buy' to 'neutral.' Citi stated, "After a robust recovery from the depths of Covid, we believe Rolls-Royce shares are now approaching what we consider to be their current fair value." The brokerage has raised Rolls-Royce's price target from 555p to 641p. Citi also noted that Rolls-Royce's cash flow is anticipated to exceed profits significantly for the foreseeable future. Despite the recent dip, Rolls-Royce shares have risen by approximately 91% in 2024.

-

UK stocks have been outperforming their European peers since the beginning of 2024, a trend that JP Morgan believes will persist as investors shift towards dividend strategies and domestic companies receive a boost. "The UK has historically been a low beta, defensive market that tends to perform well relatively during downturns. Current positioning is light. If global equities stabilize, the UK could emerge as a relative winner," states JPM's equity strategy team. Additionally, UK stocks are currently trading at near record low valuations, having significantly de-rated after Brexit. This remains the case even when excluding banks and energy from the analysis, according to JPM. As per LSEG Workspace, the FTSE 100 is trading at approximately 11.1x on a 12-month forward PE ratio, in contrast to 21.3x for the S&P 500. The region also boasts the highest dividend yield among major developed markets, even when excluding commodity sectors. "...dividend strategies are likely to gain popularity if our prediction of declining bond yields is confirmed," notes JPM. Therefore, if investors do gravitate towards dividend strategies, the UK's substantial share of income funds could see benefits. JPM favors the domestically-focused FTSE 250 over the blue-chip FTSE 100, a stance that originated from the bank's June 2024 decision to reverse its long-standing preference for large caps. A stabilization in GBP should support this "FTSE 250 vs FTSE 100 trade," and UK domestic stocks typically rally as the Bank of England starts to cut rates.

Technical & Trade View

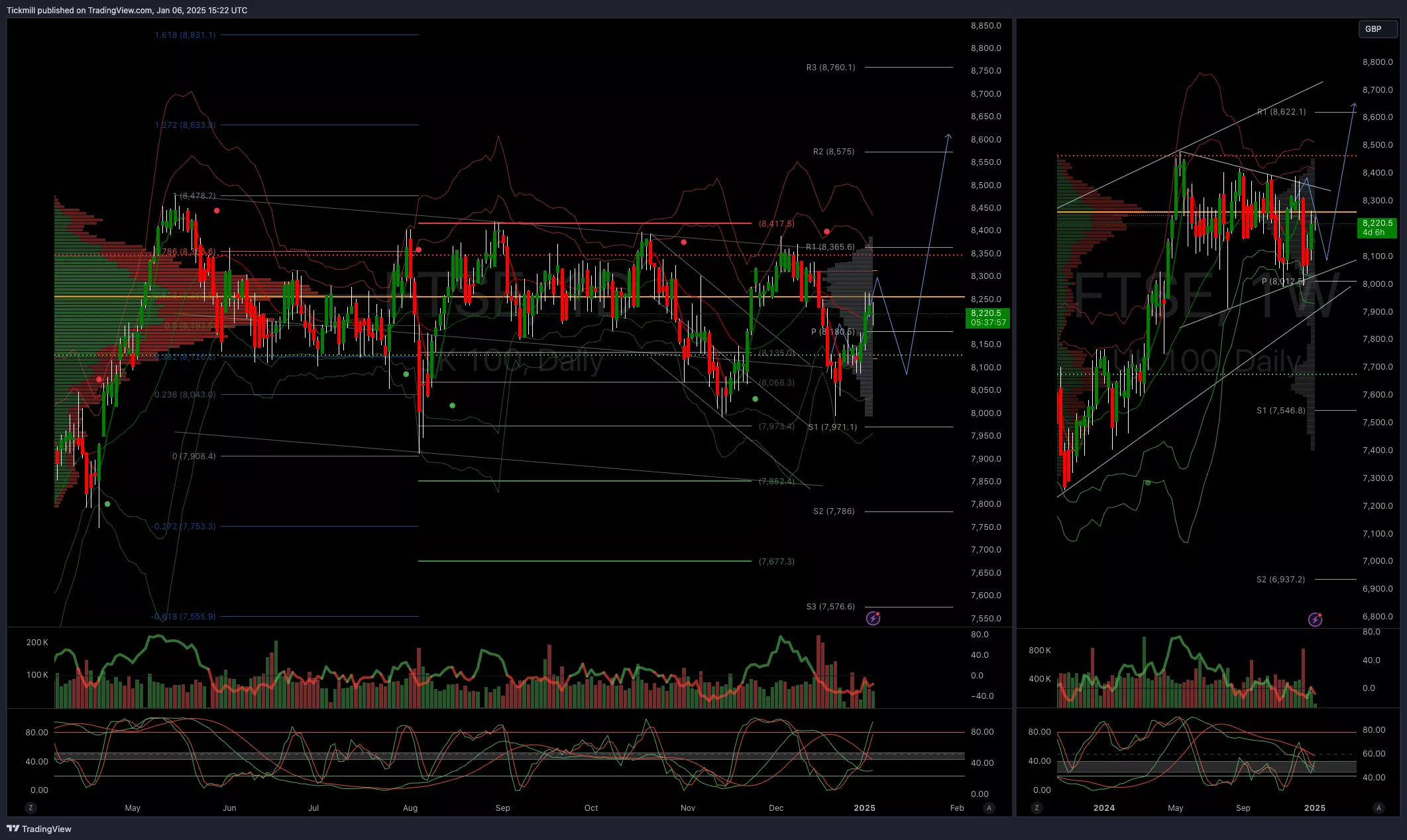

FTSE Bias: Bullish Above Bearish below 8225

-

Primary support 8000

-

Below 8000 opens 7855

-

Primary objective 8600

-

Daily VWAP Bullish

-

Weekly VWAP Bullishpa

(Click on image to enlarge)

More By This Author:

SP500 Weekly Action Areas & Price Targets - Monday, January 6

FTSE Recover Modestly From Two Month Lows Ahead Of Fed & BoE Decisions

Daily Market Outlook - Wednesday, Dec. 18