Daily Market Outlook - Wednesday, Feb. 12

Image Source: Pixabay

As investors await the next US CPI data, bond yields rose as Fed Chair Powell signalled a cautious approach to additional interest rate cuts. Alibaba and BYD's gains propelled Hong Kong equities higher. Futures for the US equities index fell, while contracts for Europe saw modest increases. Following Tuesday's general decline in treasuries, money markets were fully expecting the Fed to slash interest rates at least once this year. For the first time since 2008, the yield on Japanese 5-year bonds has increased to 1%. The 10-year yields in Australia also increased. For three days in a row, the value of the yen has declined. Growing concerns that Trump's tariff approach may target Japan are causing the Yen to plunge into its longest run of losses in more than a month. Among its peers in the Group of 10, the Euro performed the worst on Wednesday. The Japanese government also asked Trump on Wednesday to spare its businesses from potential tariffs. Industry Minister Yoji Muto stated on Wednesday that the government has sought an exemption from the tariffs imposed by the U.S. on steel and aluminium. Gold's unyielding ascent to new record highs encountered a hurdle on Wednesday as the precious metal diminished in value, though the $3,000 per ounce mark remains in the bulls sights. Concerns regarding the inflationary effects of a global trade war are not the sole factor contributing to bullion's 10% increase this year, but they play a significant role. Central banks have been major purchasers for several months, alongside investors looking for security. Anxieties about U.S. tariffs on gold have also triggered a rush to transport the metal out of London vaults and across the ocean.

Chair Powell's testimony before the Senate Banking Committee offered limited new insights into policy discussions. Stripping away the political theatrics, he painted a picture of robust economic health, driven by strong consumer spending and a "solid" labour market. While inflation remains somewhat elevated—core PCE stands at 2.6% year-over-year—the employment situation is not contributing to inflationary pressures, and price expectations remain stable. Powell emphasised there is "no need to rush to alter our policy approach," noting that the current monetary stance is "significantly less restrictive than it had been." He highlighted the dual risks of premature policy adjustments and pointed out that the neutral rate has risen. Compared to the two rate cuts projected in the Fed’s December Summary of Economic Projections, Powell’s remarks suggest a more measured assessment of current conditions. Although markets may still anticipate some cuts this year, such moves appear unlikely without a weakening labor market or a slowdown in economic growth. Even a faster pace of disinflation may not prompt action, given the tight balance between supply and demand, improved confidence since the election, and ongoing policy uncertainty.

The market expects a mild US consumer prices report on Wednesday, forecasting a 0.3% month-over-month and 2.9% year-over-year headline increase, unchanged from December. Core prices are also projected to rise 0.3% month-over-month, possibly lowering the year-over-year rate to 3.1% from 3.2%. Gasoline price increases and higher used car prices may drive transportation costs up, while easing shelter costs and moderating rent hikes could offset these pressures. Seasonal adjustment updates might slightly revise figures but won’t alter the broader disinflation trend. However, strong demand and an improving labour market leave little economic slack, keeping the Fed cautious.

Goldman Sachs Scenario Analysis For The SPX On The CPI Release

Core MoM

0.20% - 0.25% SPX +1.00%

0.26% - 0.30% SPX +0.75%

0.31% - 0.34% (GSe 0.34%) SPX +0.50%

0.35% - 0.39% SPX - 0.50%

0.40% - 0.44% SPX -1.00%

>0.45% - SPX - 1.50%

*SPX implied move through tomorrow’s close = ~0.70%

Overnight Newswire Updates of Note

- Powell Sidesteps Trump’s Tariff Policies, Repeats Support For Free Trade

- Trump Moves To ‘Significantly’ Reduce Federal Workforce

- Trump Advisers Eye Bank Regulator Consolidation After Targeting CFPB

- U.S. Economic Growth To Slow With Evolving Risk Environment, Fitch

- Reeves Is In The Red After UK Watchdog Downgrades Growth Call

- Japan Considers $44B Invest. In Alaska Gas Pipeline, Boost US Relations

- EIA Raises US Oil Production Forecast For 2025

- Super Micro Computer Cuts FY Guidance After Preliminary Q2 Miss Est

- Ukraine’s Zelensky: Ukraine Prepared To Offer Territory Swap With Russia

- Israel’s Netanyahu Warns Hamas Must Free Hostages By Saturday

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0270-75 (2BL), 1.0300 (2.1BL), 1.0315-25 (1.8BL), 1.0340 (908M)

- 1.0375-80 (579M), 1.0390 (834M), 1.0400-05 (1.4BLN), 1.0450 (1BLN)

- USD/CHF: 0.9100 (311M), 0.9175-80 (286M)

- GBP/USD: 1.2400-05 (505M), 1.2450 (630M)

- EUR/GBP: 0.8385-90 (813M)

- AUD/USD: 0.6175 (925M), 0.6200 (1.2BLN), 0.6285 (232M), 0.6300 (282M)

- 0.6320 (386M), 0.6350 (592M)

- NZD/USD: 0.5725 (400M), 0.5740 (264M). AUD/NZD: 1.1100 (292M)

- USD/CAD: 1.4380-85 (756M), 1.4395-1.4405 (727M)

- USD/JPY: 153.10-15 1BLN), 153.50 (865M), 153.70-75 (826M)

- EUR/JPY: 156.50 (675M), 158.50 (900M)

CFTC Data As Of 7/2/25

- In the latest data release for the week ending on February 4th. The Euro is weighed down by a significant net short position of -58,614 contracts, contrasting with the Japanese Yen's more optimistic stance holding a net long position of 18,768 contracts. The cryptocurrency realm sees Bitcoin riding a wave of positivity with a net long position of 786 contracts. However, the Swiss Franc finds itself in the red with a net short position of -42,258 contracts, while the British Pound struggles with a net short position of -11,323 contracts.

- Equity fund speculators have significantly dialed down their net short position by 69,618 contracts, marking a reassuring dip to 333,211 contracts. Meanwhile, equity fund managers have made a noteworthy adjustment by reducing their net long position by 40,756 contracts, resulting in a total of 920,415 contracts.

- In Treasury futures, speculators have been quite active. The CBOT US 5-year Treasury futures witnessed a notable surge in net short positions, spiking by 151,611 contracts to sit at 1,927,666 contracts. Similarly, the CBOT US 10-year Treasury futures witnessed a modest uptick in net short positions, increasing by 7,061 contracts to stabilize at 707,703. Moving on to the CBOT US 2-year Treasury futures, speculators have boosted net short positions by 17,065 contracts, bringing the total to 1,218,624 contracts. Additionally, the CBOT US Ultrabond Treasury futures show an uptick in net short positions by 2,024 contracts, resting at 243,616.

- A noteworthy shift has occurred in the CBOT US Treasury bonds futures segment, where speculators have transitioned to a net short position of 4,927 contracts. This marks a stark departure from the 28,584 net long positions reported just a week prior, signifying a notable change in market sentiment and positioning.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

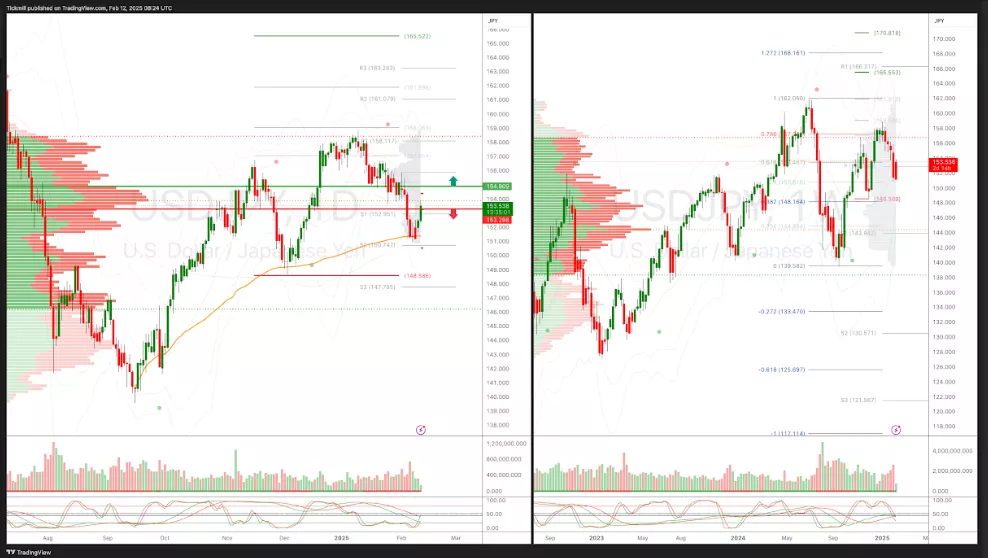

USDJPY Pivot 153.77

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

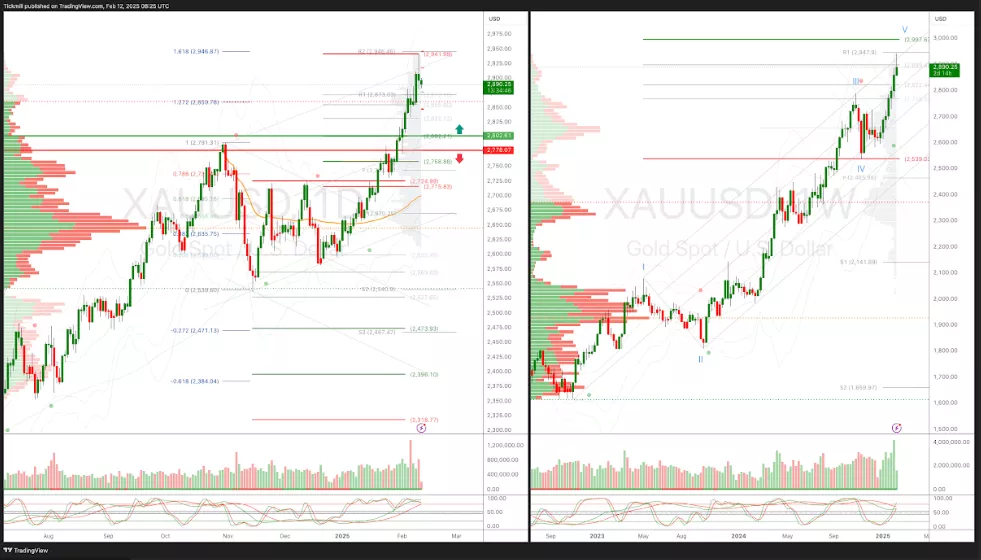

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

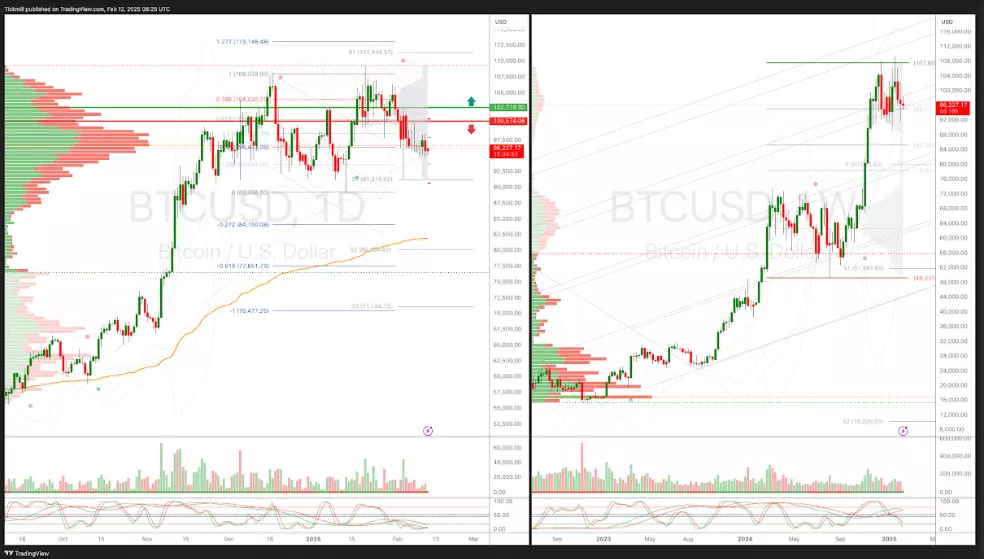

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE Retreats From All-Time Highs AS Tariff Concerns Persist

Daily Market Outlook - Tuesday, Feb. 11

FTSE At All-Time Highs As BP Surges On Activist Investment