Daily Market Outlook - Tuesday, Feb. 11

Image Source: Pixabay

Gold surged close to the $3,000-an-ounce threshold during the Asia session overnight, serving as a pressure release for the market's uncertainty surrounding Donald Trump. Central banks have been major purchasers for several months, along with investors looking for safety. Concerns regarding U.S. tariffs on gold have triggered a rush to transport the metal from London vaults to the U.S. On Tuesday, stocks generally stabilised as Trump indicated he was contemplating exempting Australia from steel tariffs after a conversation with the Australian Prime Minister, bolstering investors' perception that negotiations are always possible. Trump appreciates that the U.S. has a trade surplus with Australia, noting, "the reason is they buy a lot of airplanes. They’re quite distant and require many airplanes." He has promised to enforce reciprocal tariffs on nations within the next two days. Chinese tariffs on U.S. energy and certain goods started on Monday, yet the Hang Seng reached four-month highs as investors bet on a potential agreement. The Hang Seng has surged over 12% in a month due to investor excitement surrounding artificial intelligence and semiconductor stocks. Mainland China stock indexes experienced a slight decline.

China’s earlier Lunar New Year holiday boosted January inflation, with food prices rising 1.3% month-over-month and consumer goods and services up 0.3% and 0.9%, respectively. The Consumer Price Index (CPI) increased 0.7% monthly, raising the annual rate to 0.5% from December’s 0.1%. Core prices also rose year-on-year to 0.6% from 0.4%. However, this spike is temporary, as post-holiday price effects typically fade, and February inflation is expected to slow. Stimulus measures, like $11 billion for consumer goods trade-ins, drive short-term spending but fail to boost long-term consumption. Weak consumer confidence, high savings, deflation in the Producer Price Index (PPI), and export prices highlight overcapacity issues, compounded by property sector struggles and global trade challenges.

German parliamentary elections on 23 February see the centre-right CDU/CSU (~30%) leading over the hard-right AfD (~21%) and Chancellor Scholz’s SPD (~15%). If polls hold, Friedrich Merz is set to become chancellor, facing coalition-building and economic recovery challenges, including reviving the manufacturing sector. Germany’s 'debt brake' rule, capping the structural deficit at 0.35% of GDP, limits fiscal flexibility. Merz hinted at potential reform during a TV debate but only as a last resort for boosting defence spending. Analysts now project a 2.0% budget deficit (up from 1.5%) amid tariff risks, while German bonds have hit their cheapest levels against swaps since the Eurozone's inception, underscoring the government’s upcoming domestic and geopolitical hurdles.

Stateside, Fed Chair Powell is scheduled to address the Senate Banking, Housing, and Urban Affairs Committee on Tuesday for his semiannual testimony regarding monetary policy. Markets are expected to pay close attention to his remarks concerning tariffs and inflation. Benchmark 10-year Treasury yields finished at 4.495% and remained inactive during the Asia session due to a public holiday in Japan, as traders temporarily disregarded Trump's recent questioning of U.S. government debt statistics. Markets are eager for more clarity regarding the implications of this, amidst speculation that Trump may have been alluding to the ownership of U.S. debt by internal departments or the accounting practices related to Treasuries.

Overnight Newswire Updates of Note

- Trump Sets 25% Tariffs on Steel, Aluminum as Trade War Grows

- NY Fed: Consumers' Inflation Expectations Hold Steady In January

- Trump Orders Halt To Enforcement Of Us Anti-Corruption Law

- Starmer Lines Up Trip To Washington DC For Last Week In February

- ECB's Lagarde: Conditions For A Recovery Remain In Place

- France’s Premier Survives Another No-Confidence Vote Over Budget

- UK Inflation Less Of A Threat As Corporate Pricing Weakens, BoE's Mann

- Microsoft Hit By French Antitrust Probe Over Rivals’ Bing Access

- Merck KGaA In Talks To Buy US Cancer Biotech Firm Springworks

- Trump: Gaza Cease-Fire Should End Saturday If Hostages Not Released

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0250 (695M), 1.0275 (2.1BLN) , 1.0300-05 (1.9BLN)

- 1.0320-30 (2.5BLN), 1.0375 (954M), 1.0400 (2.5BLN)

- USD/CHF: 0.9100 (371M)

- GBP/USD: 1.2295-1.2305 (1BLN), 1.2350 (378M), 1.2400 (282M)

- EUR/GBP: 0.8290 (230M), 0.8305 (805M), 0.8360 (200M), 0.8400-10 (828M)

- AUD/USD: 0.6195 (1BLN), 0.6280 (412M). AUD/NZD: 1.1000 (443M)

- USD/CAD: 1.4355 (460M). EUR/JPY: 158.45 (300M)

- USD/JPY: 151.65-75 (530M), 152.00 (1.2BLN), 153.00 (464M)

CFTC Data As Of 7/2/25

- In the latest data release for the week ending on February 4th. The Euro is weighed down by a significant net short position of -58,614 contracts, contrasting with the Japanese Yen's more optimistic stance holding a net long position of 18,768 contracts. The cryptocurrency realm sees Bitcoin riding a wave of positivity with a net long position of 786 contracts. However, the Swiss Franc finds itself in the red with a net short position of -42,258 contracts, while the British Pound struggles with a net short position of -11,323 contracts.

- Equity fund speculators have significantly dialed down their net short position by 69,618 contracts, marking a reassuring dip to 333,211 contracts. Meanwhile, equity fund managers have made a noteworthy adjustment by reducing their net long position by 40,756 contracts, resulting in a total of 920,415 contracts.

- In Treasury futures, speculators have been quite active. The CBOT US 5-year Treasury futures witnessed a notable surge in net short positions, spiking by 151,611 contracts to sit at 1,927,666 contracts. Similarly, the CBOT US 10-year Treasury futures witnessed a modest uptick in net short positions, increasing by 7,061 contracts to stabilize at 707,703. Moving on to the CBOT US 2-year Treasury futures, speculators have boosted net short positions by 17,065 contracts, bringing the total to 1,218,624 contracts. Additionally, the CBOT US Ultrabond Treasury futures show an uptick in net short positions by 2,024 contracts, resting at 243,616.

- A noteworthy shift has occurred in the CBOT US Treasury bonds futures segment, where speculators have transitioned to a net short position of 4,927 contracts. This marks a stark departure from the 28,584 net long positions reported just a week prior, signifying a notable change in market sentiment and positioning.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

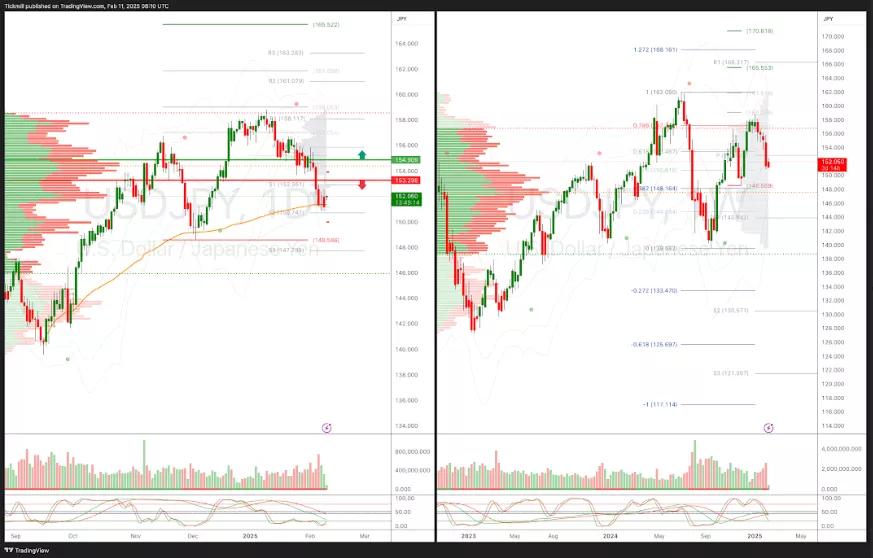

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

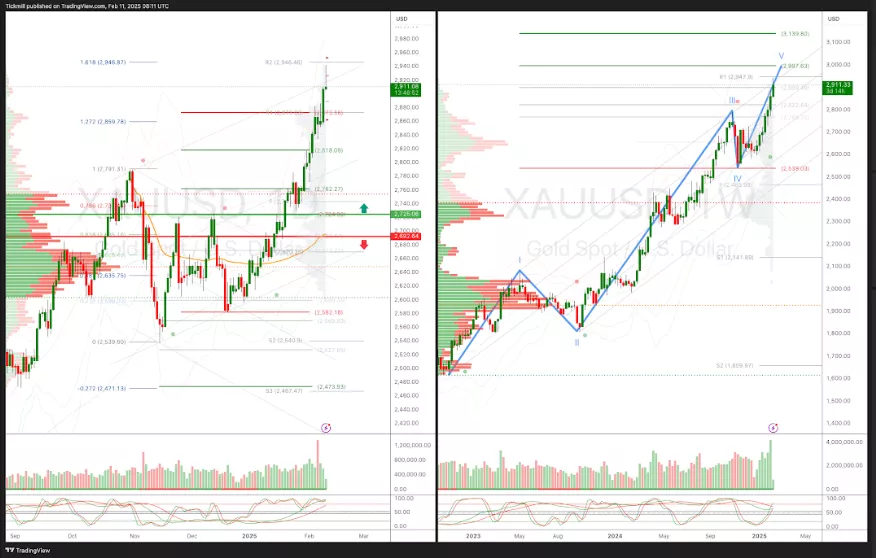

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

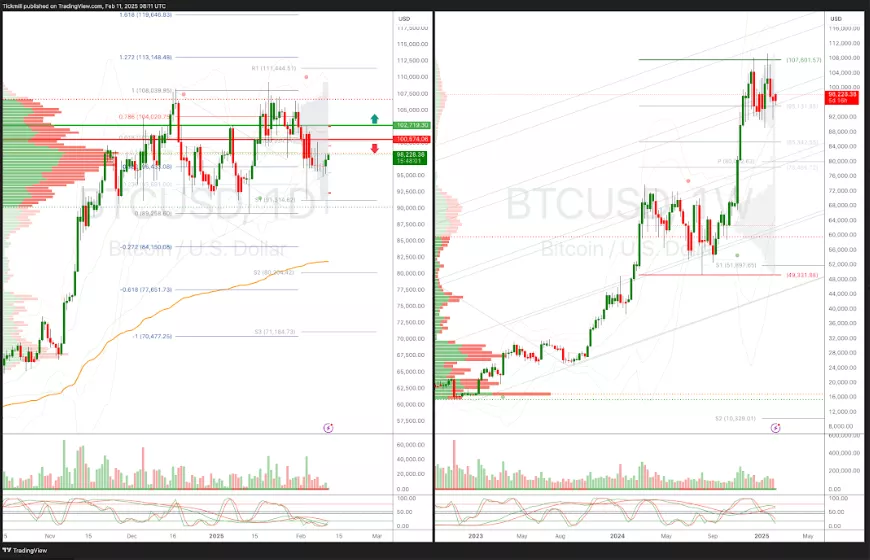

BTCUSD Pivot 101,960

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE At All-Time Highs As BP Surges On Activist Investment

S&P 500 Weekly Action Areas & Price Targets - Monday, Feb. 10

Daily Market Outlook - Monday, Feb. 10