FTSE At All-Time Highs As BP Surges On Activist Investment

Image Source: Unsplash

The U.K. market reached new record highs on Monday morning, buoyed by significant increases in BP Plc, one of the world's largest oil and gas companies. Investors are also closely watching U.S. President Donald Trump's forthcoming actions regarding tariffs. Over the weekend, Trump indicated that he would reveal new 25% tariffs on all steel and aluminum imports, raising concerns about a potential global trade war and its effects on the world economy. China's tariffs on U.S. goods will take effect later today, and Trump has mentioned that he will announce corresponding tariffs on Tuesday or Wednesday that reflect the tariffs those countries impose on American exports.

Single Stock Stories:

- BP has emerged as the top performer on the FTSE 100 following news that activist investor Elliott Investment Management has acquired a stake in the company. Shares of BP surged 5.6% to 457p, marking it as the biggest gainer on the FTSE 100. Elliott Investment Management, known for its push for corporate reforms, has reportedly built a position in the oil giant, though the exact size of the stake remains undisclosed. According to Bloomberg News, Elliott's holding in BP is described as "significant." The firm is said to be advocating for major strategic changes aimed at boosting shareholder value. So far this year, BP shares have climbed approximately 16%, reflecting growing investor confidence in the company.

- Shares of Filtronic PLC, a UK-based designer and manufacturer, have increased by 13% to 105 pence, marking its highest point since November 2000. The company has secured a contract with SpaceX worth $20.9 million, which is set to be fulfilled in fiscal years 2025 and 2026. Filtronic now anticipates exceeding market expectations for revenue and profit in those fiscal years. As of the last close, the stock has risen approximately 38.16% year-to-date.

- Ensilica's share price drops as much as 7.8% to 45.2p. The company makes mixed-signal Application Specific Integrated Circuits (ASICs) and reports a core profit of 200,000 pounds ($248,000), down from 500,000 pounds the previous year. HY revenue falls 3% year over year. ENSI says it invested 2.6 million pounds in intellectual property and tooling during the reported period, less than the 3 million pounds it spent the previous year. Stock rose about 9% in 2024.

- Directa Plus's share price rises 8.3% to 6.50p, marking its highest level since January 6. The graphene-based product supplier's subsidiary, Setcar, secures a $1.5 million contract with Midia International SA and renews a €1.1 million ($1.1 million) agreement with Ford Otosan, a subsidiary of Ford Motor Company. As of the previous close, the stock had gained 7.69%.

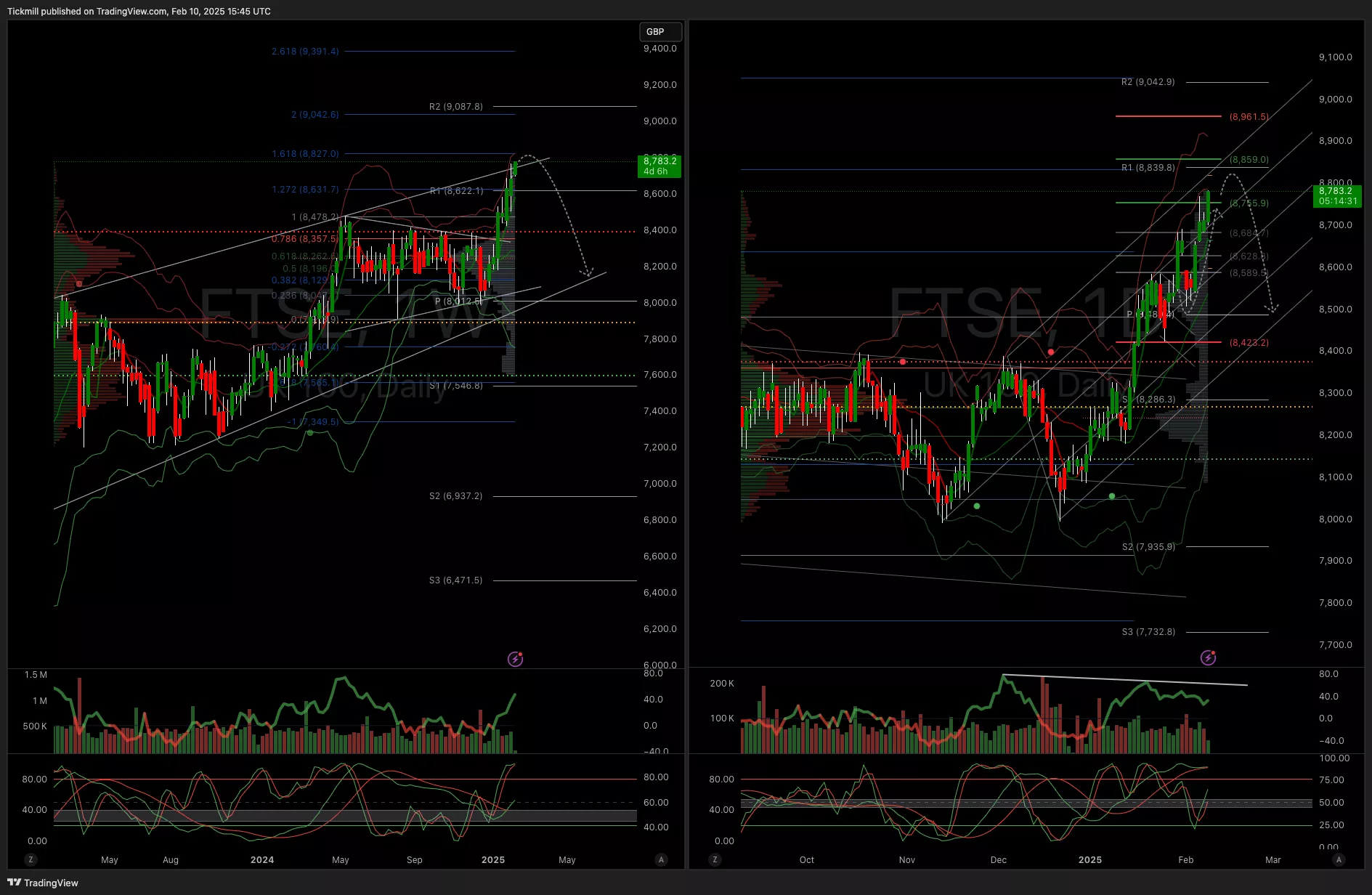

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Targets - Monday, Feb. 10

Daily Market Outlook - Monday, Feb. 10

Daily Market Outlook - Friday, Feb. 7