Daily Market Outlook - Monday, Feb. 10

Image Source: Unsplash

The Dollar strengthened after President Trump announced a 25% tariff on steel and aluminium imports, heightening concerns over global trade tensions. While Hong Kong stocks continued their rally, driven by technology for a third straight session, the broader performance of equities was mixed. Asian stocks saw their largest decline in a week, while US and European futures posted slight gains. The Dollar index rose 0.2%, reflecting fears that increased tariffs could spark inflation and limit the Federal Reserve's ability to cut interest rates. Trump's tariff announcement deepened market anxieties ahead of Federal Reserve Chair Jerome Powell's semi-annual congressional testimony and the potential for further retaliatory tariffs aimed at multiple nations. Although Trump mentioned the tariffs would be applied universally, he did not clarify the timeline for implementation. The modest rise in US stock futures during Asian trading hours suggests tentative buying interest after Friday's 1% drop in the S&P 500.

It is anticipated that the US CPI report for January, which is scheduled to be released on Wednesday, will be the most significant macro data point of the week. Additionally, annual revisions are expected. Economists anticipate a month-over-month increase in the headline CPI of +0.22%, which is a decrease from +0.4% in December. The core CPI measure is expected to increase from +0.2% to +0.28%. Analysts anticipate a consistent month-over-month increase of +0.2% for the PPI report, which is scheduled to be released on Thursday. Retail sales and industrial production reports will provide updates on US economic activity on Friday. Markets anticipate that total retail sales will remain constant at +0.4%, as observed in December, and that industrial production will increase by +0.3% month over month, as opposed to +0.9% previously. Investors will closely observe Fed Chair Powell's semiannual testimonies before the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday, in addition to economic indicators.

In the UK, the upcoming release of Q4 GDP (Thursday) is anticipated to indicate that the economy is teetering on the brink of recession, with the February BoE MPR forecasting a decline of -0.1% q/q after a flat Q3, and a modest growth of just +0.1% q/q expected for Q1. However, before we reach that point, Mann (Tuesday), Bailey (Tuesday), and Greene (Wednesday) are all scheduled to speak, which may provide further insights into the factors influencing the March vote. In the eurozone, there will be a reevaluation of Q4 GDP on Friday and the release of the ECB Bulletin on Thursday. Therefore, in addition to any news regarding Trump’s tariffs, expect speeches from Powell and BoE officials to influence the market sentiment.

Overnight Newswire Updates of Note

- Trump To Announce 25% Steel, Aluminium Tariffs In Latest Trade Escalation

- Trump Will Announce Reciprocal Tariffs On Many Countries Next Week

- Musk’s DOGE Team Now Seeks Access T o Treasury’s Accounting Data

- France To Announce €109 Billion In AI Investments, Macron Says

- UK Recruiters Say Toughest Conditions In Jobs Market Since Covid

- Japan PM Ishiba, After Meeting Trump, Voices Optimism Over Averting Tariffs

- China's Consumer Inflation At 5-Month High, Producer Deflation Persists

- China Imposes Retaliatory Tariffs On $14Bn Worth Of US Goods

- South Korean Opposition Leader Proposes $21 Billion Extra Budget

- Baltic States Switch To European Power Grid, Ending Russia ties

- Brookfield To Spend €20 Billion On France’s AI Infrastructure

- Activist Elliott Said To Build Stake In Struggling Oil Major BP

- Kremlin Declines To Confirm Or Deny Putin Call Trump Hints At

- Zelenskiy Says 'Let's Do A Deal', Offering Trump Mineral Partnership

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0450 (EU3.18b), 1.0550 (EU2.69b), 1.0400 (EU2.04b)

- USD/JPY: 145.00 ($2.56b), 135.00 ($2.52b), 154.00 ($1.94b)

- USD/CAD: 1.4425 ($1.16b), 1.4175 ($977m), 1.4400 ($695.8m)

- AUD/USD: 0.6405 (AUD759m), 0.6350 (AUD361.6m)

- USD/CNY: 7.3000 ($811.5m), 7.2000 ($704.4m), 7.1500 ($545.8m)

- EUR/GBP: 0.8345 (EU442.2m)

CFTC Data As Of 7/2/25

-

In the latest data release for the week ending on February 4th. The Euro is weighed down by a significant net short position of -58,614 contracts, contrasting with the Japanese Yen's more optimistic stance holding a net long position of 18,768 contracts. The cryptocurrency realm sees Bitcoin riding a wave of positivity with a net long position of 786 contracts. However, the Swiss Franc finds itself in the red with a net short position of -42,258 contracts, while the British Pound struggles with a net short position of -11,323 contracts.

-

Equity fund speculators have significantly dialed down their net short position by 69,618 contracts, marking a reassuring dip to 333,211 contracts. Meanwhile, equity fund managers have made a noteworthy adjustment by reducing their net long position by 40,756 contracts, resulting in a total of 920,415 contracts.

-

In Treasury futures, speculators have been quite active. The CBOT US 5-year Treasury futures witnessed a notable surge in net short positions, spiking by 151,611 contracts to sit at 1,927,666 contracts. Similarly, the CBOT US 10-year Treasury futures witnessed a modest uptick in net short positions, increasing by 7,061 contracts to stabilize at 707,703. Moving on to the CBOT US 2-year Treasury futures, speculators have boosted net short positions by 17,065 contracts, bringing the total to 1,218,624 contracts. Additionally, the CBOT US Ultrabond Treasury futures show an uptick in net short positions by 2,024 contracts, resting at 243,616.

-

A noteworthy shift has occurred in the CBOT US Treasury bonds futures segment, where speculators have transitioned to a net short position of 4,927 contracts. This marks a stark departure from the 28,584 net long positions reported just a week prior, signifying a notable change in market sentiment and positioning.

Technical & Trade Views

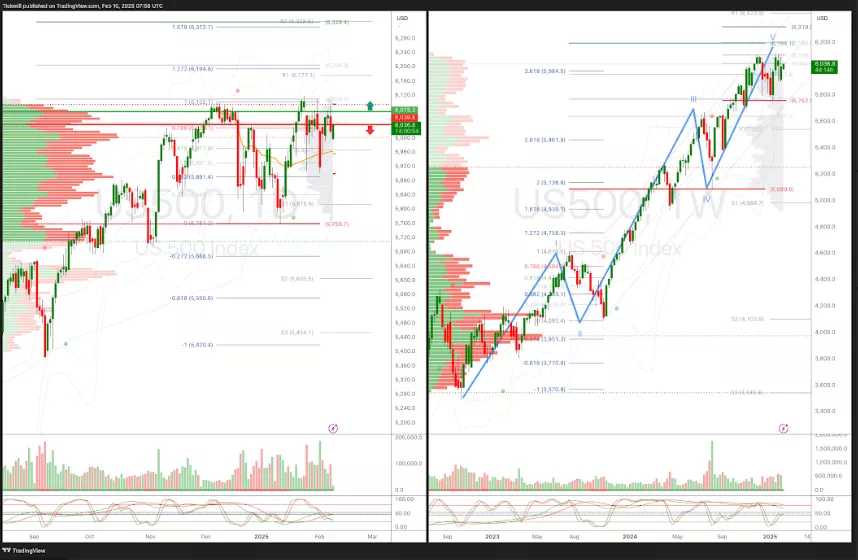

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

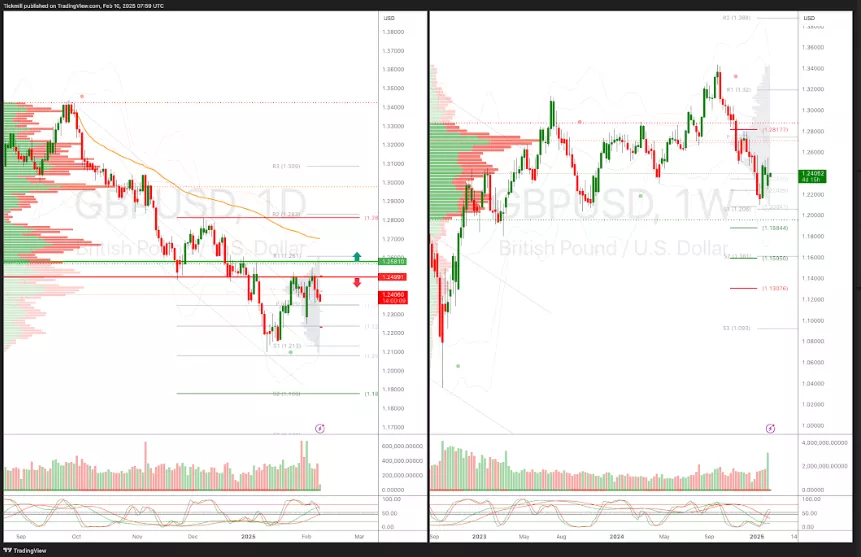

GBPUSD Pivot 1.2614

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

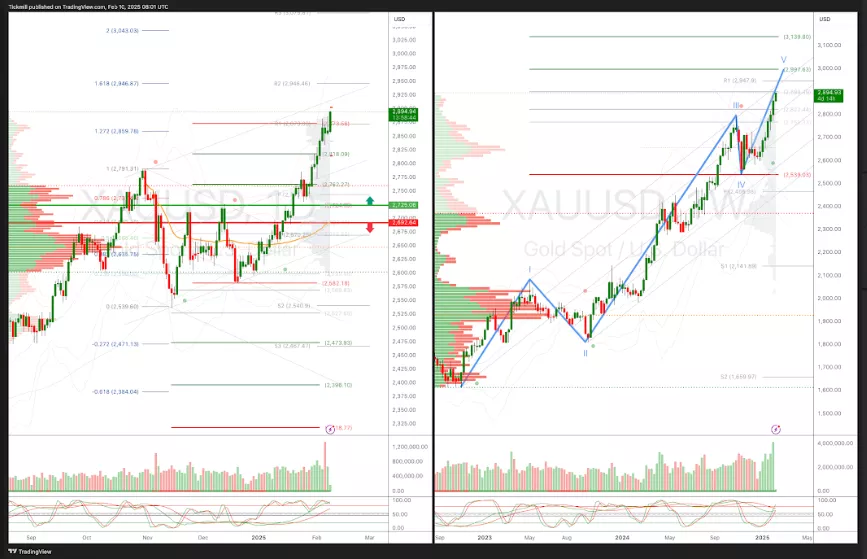

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2873

- Below 2692 target 2475

(Click on image to enlarge)

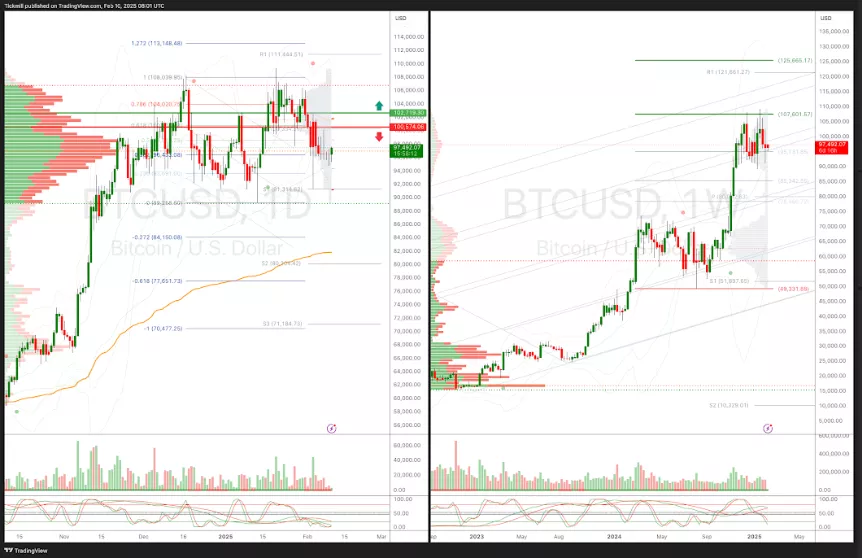

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Feb. 7

FTSE Bid As Pound Gets Pounded On Growth Concerns

Daily Market Outlook - Thursday, Feb. 6