FTSE Bid As Pound Gets Pounded On Growth Concerns

Image Source: Unsplash

The British pound was poised for its biggest one-day drop since early January on Thursday, following a rate cut by the Bank of England (BoE) and a major fall in its growth expectations, while simultaneously warning that inflation is projected to rise "quite sharply" this year. The pound had already been dropping and was trading around 1.1% down at $1.2371. It was on track for its greatest daily decline since January 2, following a four-week high the previous day. The Bank of England dropped interest rates from 4.75% to 4.5%, however, two members of the rate-setting Monetary Policy Committee (MPC) urged for a larger 50 basis point fall, with one earlier favouring a stable rate. The indication that two MPC members pushed for a significant 50 basis points reduction, despite increasing the near-term inflation outlook, reflects the deep concerns some policymakers have regarding the challenges to growth. Investors first ignored the sharp increase in the Bank of England's inflation forecasts and raised their expectations for interest rate cuts this year, expecting an extra 65 basis points of easing, as opposed to the previous forecast of 60 basis points. Even as yields in the U.S. and Europe increased after the announcement, the yields on Britain's two-year bonds, which are quite sensitive to predictions about changes in the BoE rate, fell to their lowest level since October. Later on, though, they levelled off, trading at 4.107%, down 3 basis points. The FTSE 100 stock index advanced.

Single Stock Stories:

-

AstraZeneca emerged as a top percentage gainer on the FTSE 100 index after reporting Q4 results that slightly exceeded expectations. The drugmaker posted Q4 total revenue of $14.9 billion, surpassing the $14.2 billion estimate, and core EPS of $2.09, edging past the $2.07 forecast. Shares climbed as much as 4.6% to 11,636p, marking their highest level since October 2024.According to LSEG data, analysts project a 6.5% rise in sales and a 12.6% increase in profit for 2025. However, AstraZeneca forecasts high single-digit percentage growth in revenue and low double-digit percentage growth in core earnings. Astra appears on track to meet its $80bn revenue target by 2030, but some may be disappointed that it hasn't been raised. Over the past year, AstraZeneca's stock has risen approximately 10%.

-

UK homebuilders index rose by 2% following the Bank of England's decision to lower interest rates by a quarter point to 4.5%. While economists had anticipated this move, based on a Reuters poll, two external members of the Monetary Policy Committee, Catherine Mann and Swati Dhingra, advocated for an even steeper cut to 4.25%. Among homebuilders, Vistry led the gains with a 3% increase. FTSE 100-listed firms Barratt Developments, Redrow, Persimmon, and Taylor Wimpey saw respective rises of 1.8%, 2.2%, and 2.4%. Meanwhile, Bellway, a midcap homebuilder, climbed nearly 2%.

Broker Updates:

-

Anglo American, a leading global mining company, emerged as one of the top gainers on London’s FTSE 100 index, which rose 0.91%. Its shares climbed 4.6% to 2,440p. The company reported copper output of 198 Kt in Q4, marking a 9% quarter-on-quarter increase. Copper production forecasts are set at 690 Kt to 750 Kt for 2025 and 760 Kt to 820 Kt for 2026, compared to an expected 773 Kt in 2024. However, due to reduced demand, Anglo American lowered its rough diamond production outlook for 2025 and 2026. Barclays analysts characterised Anglo American’s Q4 production as a solid year-end performance, with major divisions meeting expectations. Among peers, London-listed Rio Tinto shares rose 1.8%, while Antofagasta and Glencore gained 3% and 1.8%, respectively. As of the latest closing, Anglo American shares had gained approximately 2.4% year-to-date.

Technical & Trade View

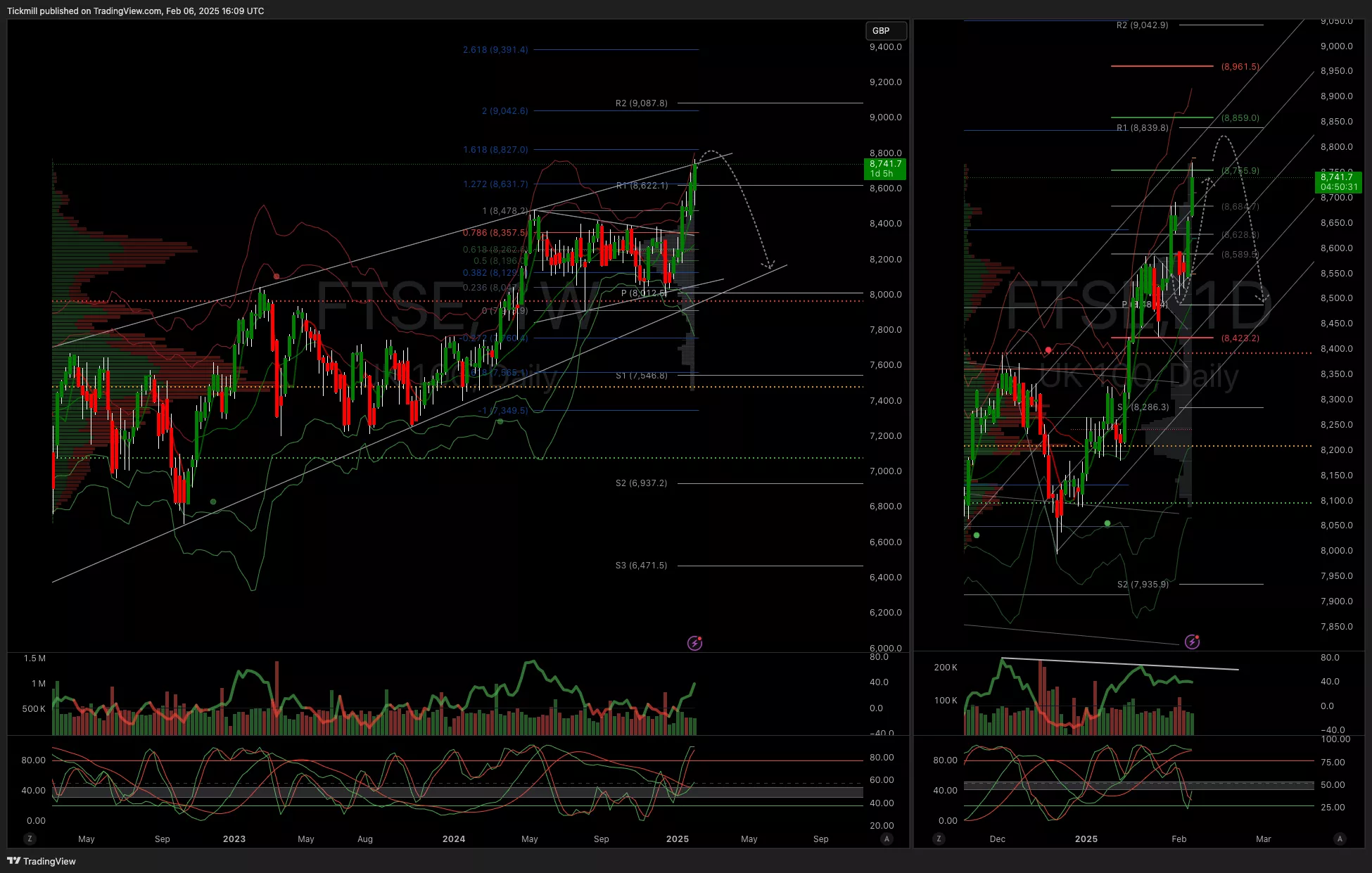

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8600

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Feb. 6FTSE Ticks Higher As Pound Stalls Out After Early Gains Fade

Daily Market Outlook - Wednesday, Feb. 5