Daily Market Outlook - Tuesday, Sep. 30

Image Source: Pixabay

Gold has reached a record high, climbing above $3,865 an ounce, amid concerns over a potential US government shutdown. This surge has positively impacted shares of Asian metals producers, with Zijin Gold International Co., a subsidiary of a Chinese miner, experiencing a remarkable 66% increase in its Hong Kong debut. Meanwhile, Treasuries remained relatively unchanged after gaining in the previous session, and a gauge of the dollar continued to show losses. Futures indicate a weaker opening for European shares. This year's impressive 47% rise in gold prices marks the largest annual gain since 1979, driven by worries about the US government shutdown, global trade tensions, skepticism regarding US exceptionalism, and anticipated Federal Reserve rate cuts. Despite these concerns, stocks have also rebounded from their April lows, reaching record highs as tariff worries eased and optimism surrounding artificial intelligence overshadowed growth and inflation fears.

Asian shares have continued to advance, positioning themselves for a sixth consecutive month of gains, the longest winning streak since 2018. Vice President JD Vance expressed his belief that the US government is on course for a shutdown, following President Donald Trump's unsuccessful meeting with congressional leaders ahead of the October 1 deadline, which did not resolve the demands of Democrats. In China, factory activity has continued to decline for six consecutive months, marking the longest slump since 2019, as the economy slows down after an initial growth spurt at the beginning of the year. Nevertheless, Chinese equities are on track for their best monthly performance in seven years. Additionally, the Australian dollar strengthened after the Reserve Bank of Australia maintained its key interest rate, emphasising a cautious approach to the economic outlook, with future decisions contingent on economic data.

The publication of the Quarterly National Accounts revealed that UK Q2 GDP growth remained unchanged at 0.3% quarter-on-quarter. However, there was an adjustment in annual terms, with the year-on-year growth for Q2 revised up to 1.4%, from the previously reported 1.2%. This change reflects updates to prior quarters, as is customary at this time of year. Notably, there were shifts in the composition of growth for Q2, particularly concerning trade. Nevertheless, government expenditure continued to be the primary driver of growth, contributing 0.27 percentage points to the overall 0.3% quarter-on-quarter increase. In contrast, household consumption growth only added 0.05 percentage points to the total. It is important to note that Q1 growth may have been somewhat influenced by timing effects related to Stamp Duty changes and corporate strategies anticipating tariffs. As a result, Q2's performance has heavily relied on public sector activity. Although the Bank of England (BoE) has revised its estimate for Q3 GDP growth upwards by 0.1 percentage points to 0.4% quarter-on-quarter during the September Monetary Policy Committee meeting, concerns remain regarding the sustainability of this growth if private sector activity does not keep pace.

Overnight Headlines

- Trump Sets 10% Tariff On Lumber Imports, 25% On Cabinets, Furniture

- Tariffs, Uncertainty To Slow Asia’s Economic Growth, ADB Says

- RBA Keeps Cash Rate Target Steady At 3.60%, As Expected

- BoJ Summary Shows Debate Taking Hold On Timing Of Raising Rates

- Japan’s Two-Year Bond Auction Sees Weakest Demand Since 2009

- France’s Debt Threatens To Suffocate The Economy, Villeroy Says

- Gold Hits Fresh Record Above $3,800 On US Shutdown Jitters

- Zijin Gold Debut In HK After Biggest Global IPO Since May

- HSBC Chair’s Exit Leaves Bank With A Leadership Vacuum

- Deloitte UK’s Revenues Fall For First Time In 15 Years

- China’s Factory Activity Slump Extends To Longest Since 2019

- Shell’s CEO Surprised By Record LNG Buildout Amid Gas Exuberance

- Canada To Provide C$400M Financial Support To Algoma Steel

- Boeing Planning New Single-Aisle Jet To Succeed 737 Max

- Trump Says Netanyahu Backs US-Sponsored Gaza Peace Proposal

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1695-1.1700 (2.4BLN), 1.1705-15 (1BLN), 1.1725-30 (871M)

- 1.1750 (403M), 1.1770-75 (1BLN), 1.1800 (2.5BLN)

- USD/CHF: 0.7880 (630M)

- EUR/GBP: 0.8740 (237M), 0.8760 (1.3BLN)

- GBP/USD: 1.3465 (225M), 1.3480 (176M)

- AUD/USD: 0.6595-0.6600 (1.5BLN), 0.6650 (531M)

- NZD/USD: 0.5785 (1BLN), 0.5860 (332M), 0.5875 (372M), 0.5890 (301M)

- USD/JPY: 148.00 (1.3BLN), 148.30 (578M), 148.50 (570M)

Banks are providing model signals for month-end rebalancing forecasts, with CACIB indicating moderate USD selling overall. The most significant sell signal is for USD against AUD. The bank's corporate flow model suggests buying EUR and selling GBP at month-end. CACIB utilized this signal to purchase EUR against a weighted basket of USD and GBP on Wednesday. Unless they are stopped out, they plan to maintain the trade until 17:00 BST on September 30.

CFTC Positions as of the Week Ending 26/9/25

- Speculators trim CBOT US Treasury bonds futures net short position by 15,347 contracts to 78,791

- Speculators trim CBOT US Ultrabond Treasury futures net short position by 7,408 contracts to 270,759

- Speculators increase CBOT US 10-year Treasury futures net short position by 24,817 contracts to 844,116

- Speculators increase CBOT US 5-year Treasury futures net short position by 16,670 contracts to 2,453,444

- Speculators trim CBOT US 2-year Treasury futures net short position by 103,272 contracts to 1,300,198

- Equity fund managers raise S&P 500 CME net long position by 20,454 contracts to 912,089

- Equity fund speculators trim S&P 500 CME net short position by 31,451 contracts to 443,946

- Japanese yen net long position is 79,500 contracts

- Euro net long position is 114,345 contracts

- British pound net short position is -1,964 contracts

- Swiss franc posts net short position of -23,018 contracts

- Bitcoin net long position is 79 contracts.

Technical & Trade Views

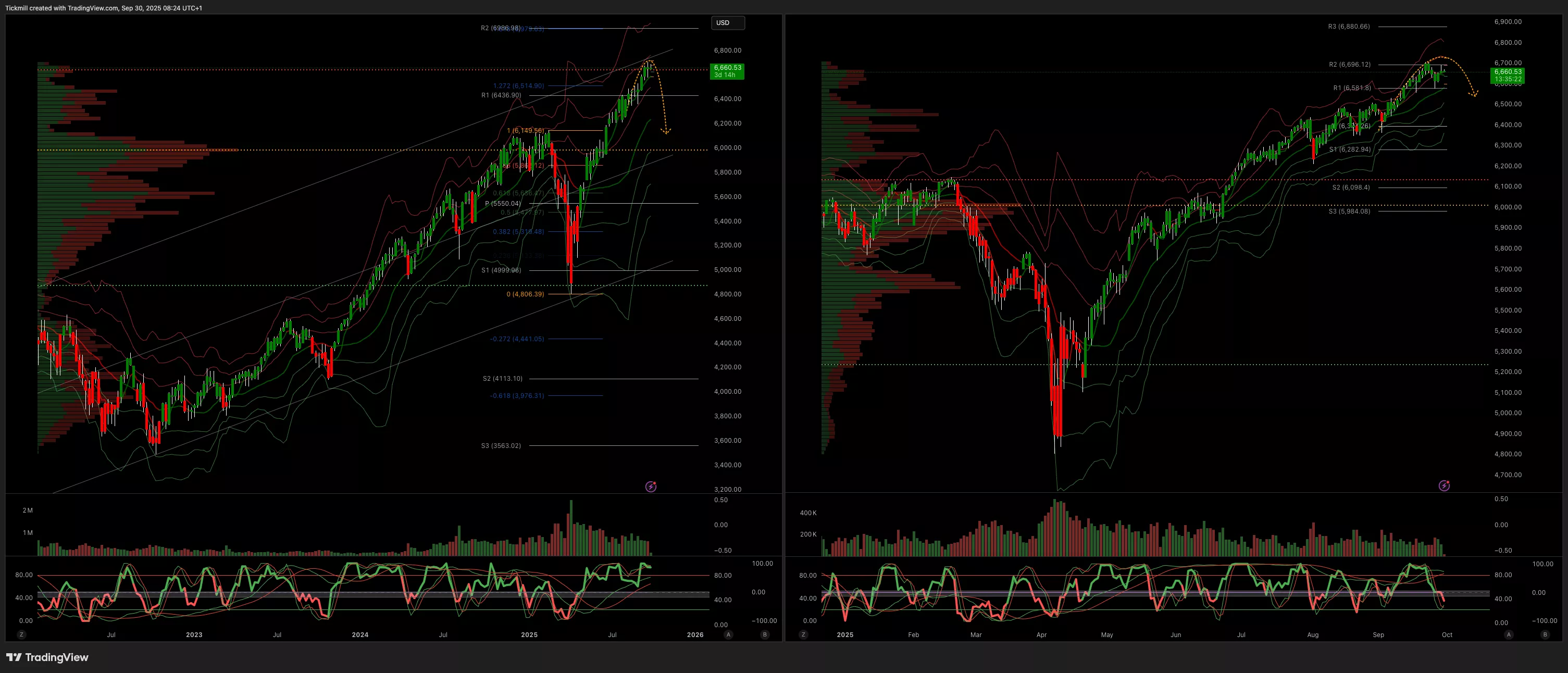

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6600 Target 6500

(Click on image to enlarge)

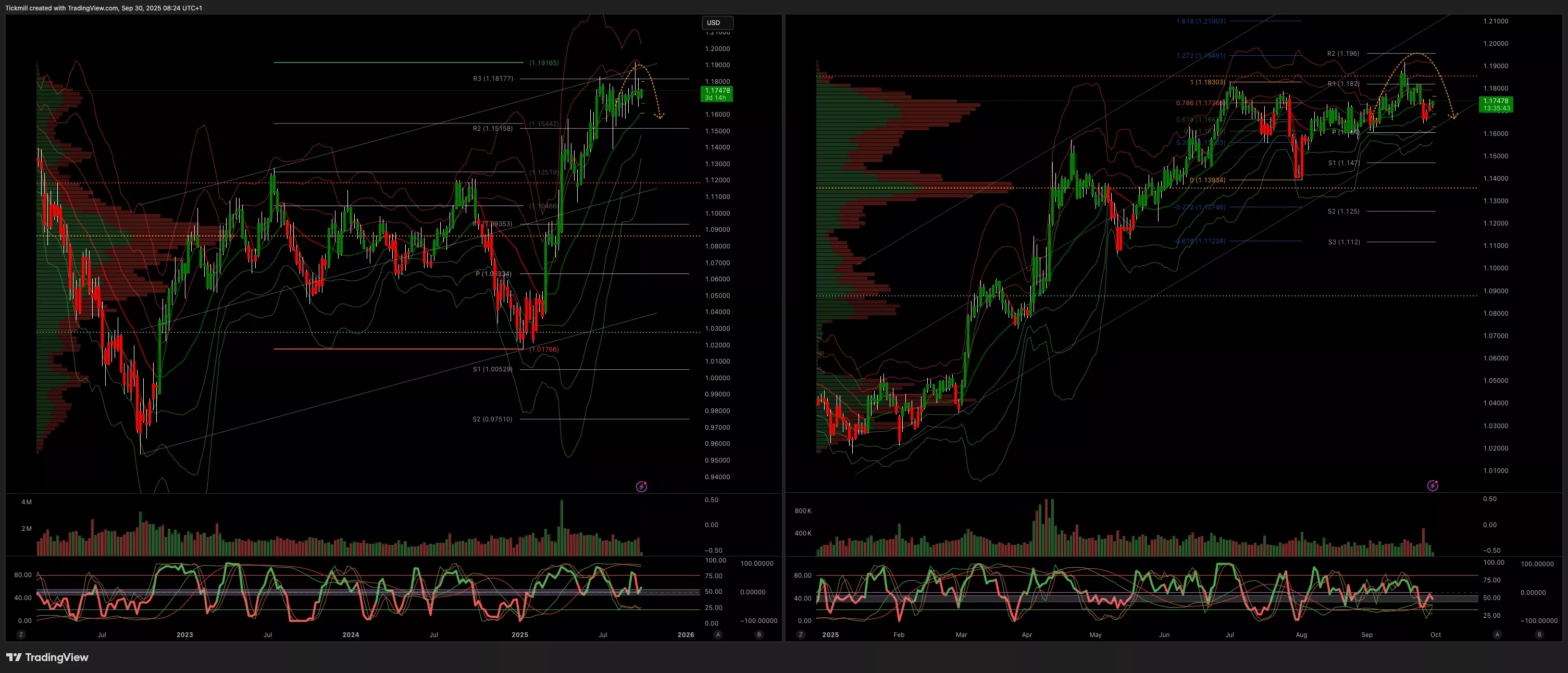

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

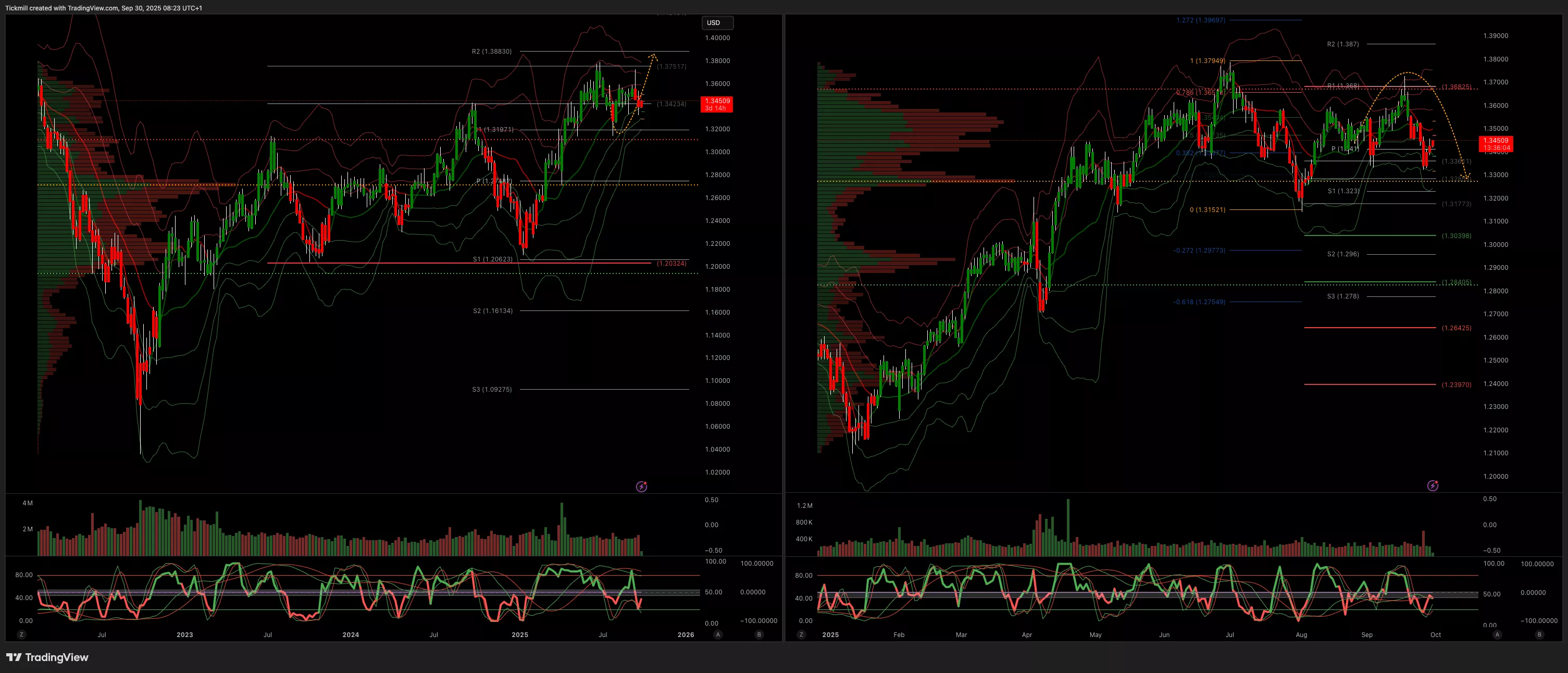

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

.webp)

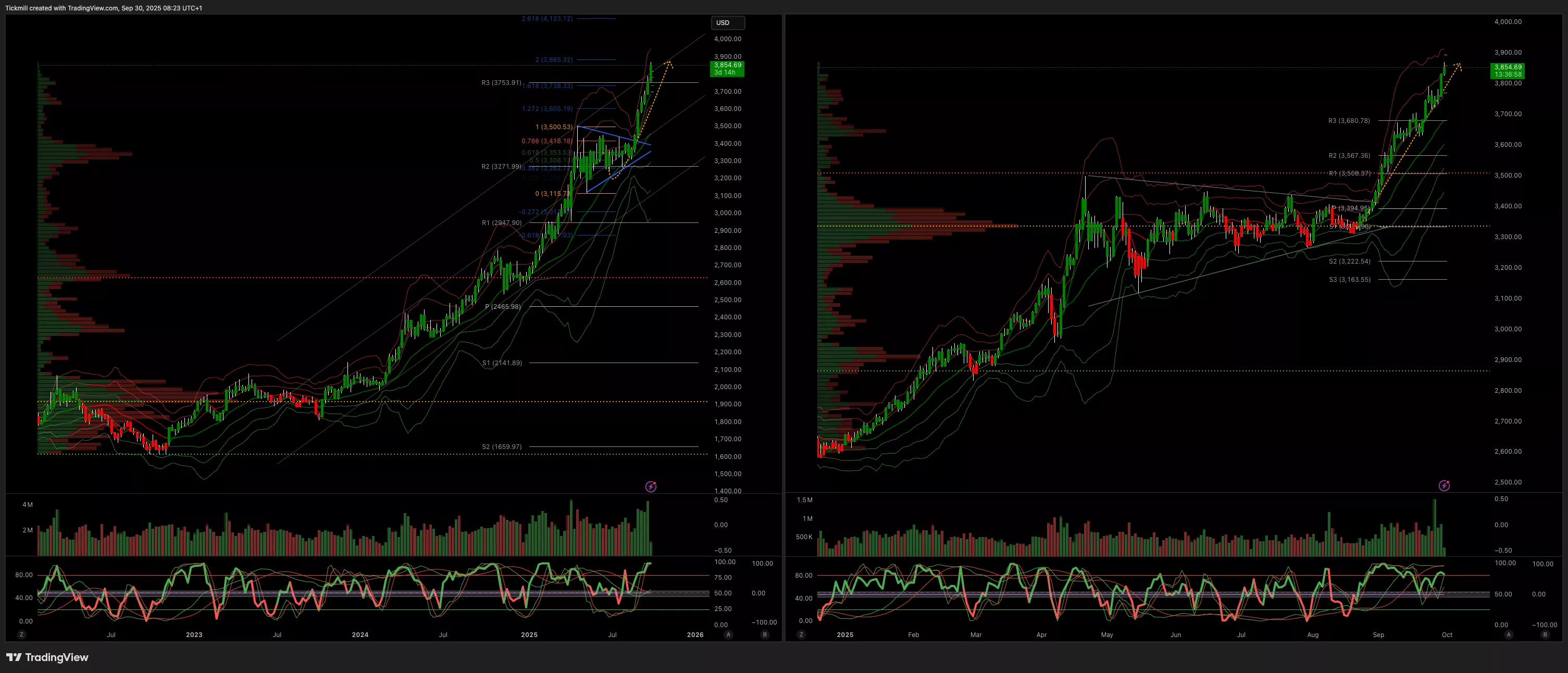

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3600 Target 3885

- Below 3500 Target 3400

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, Sep. 29

Daily Market Outlook - Thursday, Sep. 25

Daily Market Outlook - Wednesday, Sep. 24