Daily Market Outlook - Thursday, Sep. 25

Image Source: Pixabay

Global stock markets appear to be hitting a pause as investors grapple with concerns over high valuations. This comes in the wake of a surge that has seen markets rise relentlessly recently. Wall Street recorded its second consecutive day of losses, offering little inspiration for Asian markets, where stocks largely moved within narrow ranges. Bucking the trend, Chinese blue-chip stocks surged, fueled by their alignment with the global wave of AI-driven investments. Asian stocks have soared 9% this quarter, with Japan's Nikkei surging an impressive 13%, sparking speculation about potential month-end or quarter-end rebalancing flows. Adding to the markets more cautious tone is the stance adopted by several Federal Reserve officials on the timing of rate cuts. Futures now point to a 92% chance of a Fed rate cut in October, though expectations for total easing have scaled back to 100 basis points from 125 basis points just weeks ago. San Francisco Fed President Mary Daly, mirroring the views of her colleagues, acknowledged the need for further rate cuts but stressed uncertainty surrounding their timing. Investors are eagerly awaiting more clarity, as key Fed officials, including New York President John Williams, are set to speak later today, potentially offering fresh insights into the board's dovish outlook amid President Donald Trump's relentless scrutiny. Meanwhile, Treasury Secretary Scott Bessent is gearing up for interviews next week to identify Jerome Powell's potential successor as Fed Chair, adding another layer of intrigue to the unfolding financial landscape.

Market focus today will be on weekly U.S. jobless claims and the final estimate for second-quarter U.S. GDP, leading up to the crucial Personal Consumption Expenditures (PCE) report on Friday. An increase in jobless claims—now more significant due to the scrutiny on the labor market—could strengthen the argument for two additional rate cuts this year, while a robust outcome might support the dollar and elevate short-term yields. Thursday's macro slate also include US durable goods dat, as well as speeches from six Federal Reserve officials: Austan Goolsbee, John Williams, Jeffrey Schmid, Michelle Bowman, Michael Barr, and Mary Daly. Additionally, the U.S. Treasury will auction $44 billion in 7-year notes.

Overnight Headlines

- SNB Set To Lower Hold Interest Rate At Zero Amid Weak Inflation

- Top Fed Official Warns Against Quick Series Of Rate Cuts

- Daly Says More Rate Cuts Likely But Fed Should Move Cautiously

- BoJ July Meeting Minutes Signal Divided Board On Inflation Outlook

- UK Minister: Govt Wants To End Pricing Feud With Drug Companies

- G7 Weighs Price Floors For Rare Earths To Counter China’s Dominance

- Jaguar LR To Bear Full Cost Of Cyber Attack Given Lack Of Insurance

- KB Home Lowers Outlook As Slow Housing Market Bites

- US Sets Stage For Tariffs On Robotics, Medical Devices

- Big Banks Resume Hiring In Hong Kong As Dealmaking Booms

- Intel Seeks Apple Investment As Part Of Comeback Bid

- EU Concedes Trump Trade Deal Falls Short Of WTO Rules

- EU’s Kallas Urges Hungary To Stop Buying Russian Energy

- Trump Pledges To Prevent Israeli Annexation Of Occupied West Bank

- Russia To Raise VAT Rate To 22% As War Weighs On Economy

- Zelenskiy Tells UN: Stop Russia’s War Or Face Arms Race

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0700 (EU4.95b), 1.0000 (EU2.48b), 1.1500 (EU2.03b)

- USD/JPY: 150.00 ($922.6m), 145.40 ($720m), 142.00 ($615.4m)

- USD/BRL: 5.5000 ($454.2m), 6.2220 ($340.4m)

- AUD/USD: 0.6730 (AUD466.6m), 0.6900 (AUD434.8m), 0.6400 (AUD323.6m)

- USD/CAD: 1.3795 ($998.6m), 1.3600 ($663.3m), 1.3870 ($450.6m)

- USD/CNY: 7.1000 ($325m), 7.1180 ($300m), 6.7500 ($300m)

- EUR/GBP: 0.8750 (EU1.34b), 0.8764 (EU692m), 0.8650 (EU380m)

- GBP/USD: 1.2400 (GBP434.2m), 1.2500 (GBP430.1m), 1.3800 (GBP424.6m)

- USD/MXN: 22.75 ($463.9m), 20.55 ($359.3m), 18.69 ($351.7m)

CFTC Positions as of the Week Ending 1/9/25

- Equity fund speculators have boosted their net short position in the S&P 500 CME by 55,766 contracts, bringing it to a total of 475,397 contracts. At the same time, equity fund managers have increased their net long position in the S&P 500 CME by 9,074 contracts, now totaling 891,634 contracts.

- Speculators have reduced their net short position in CBOT US 5-year Treasury futures by 117,989 contracts, resulting in a total of 2,436,774 contracts. They have also decreased their net short position in CBOT US 10-year Treasury futures by 38,673 contracts, now at 819,299 contracts. Conversely, speculators have raised their net short position in CBOT US 2-year Treasury futures by 28,509 contracts, reaching 1,403,470 contracts. Additionally, there has been an increase in net short position in CBOT US UltraBond Treasury futures by 12,686 contracts, totaling 278,167 contracts. Speculators have trimmed their net short position in CBOT US Treasury bonds futures by 4,470 contracts, reducing it to 94,138 contracts.

- The net long position for Bitcoin stands at 20 contracts. The Swiss franc has registered a net short position of -26,040 contracts, while the British pound's net short position is -6,580 contracts. The euro has a net long position of 117,759 contracts, and the Japanese yen holds a net long position of 61,411 contracts..

Technical & Trade Views

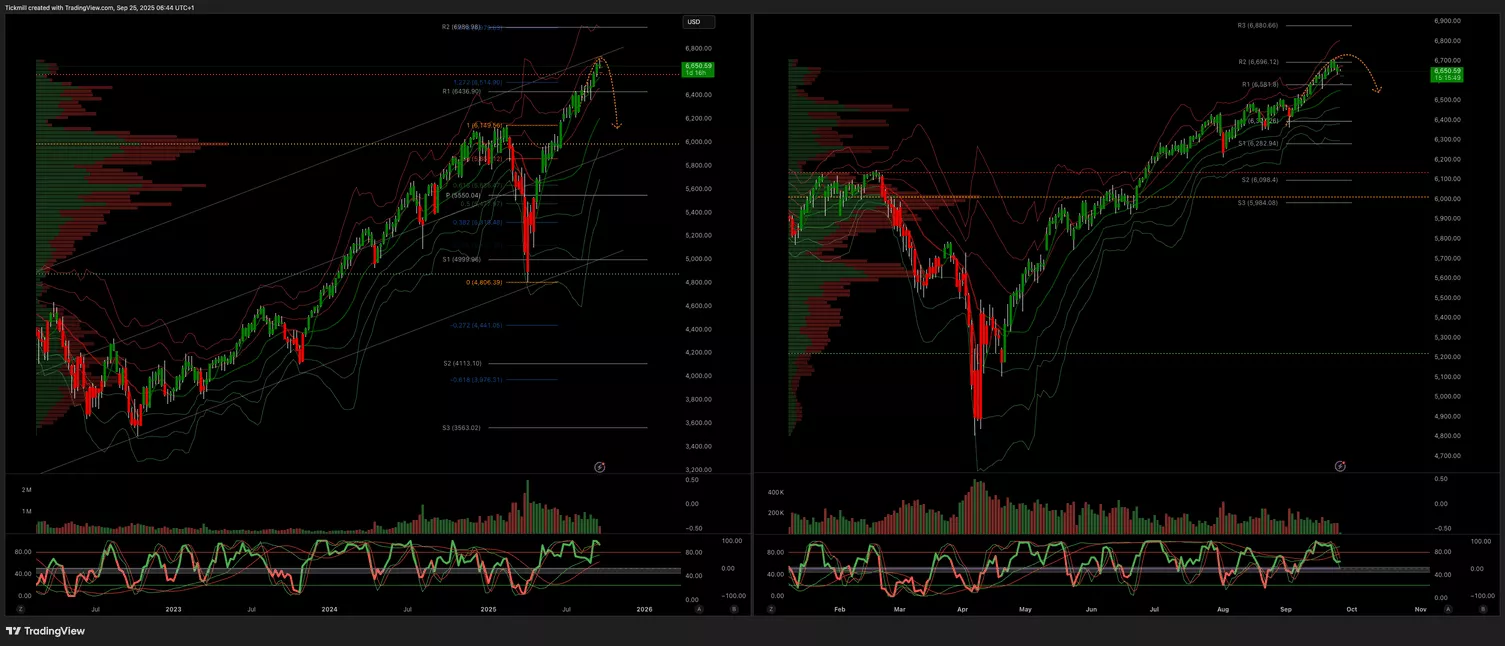

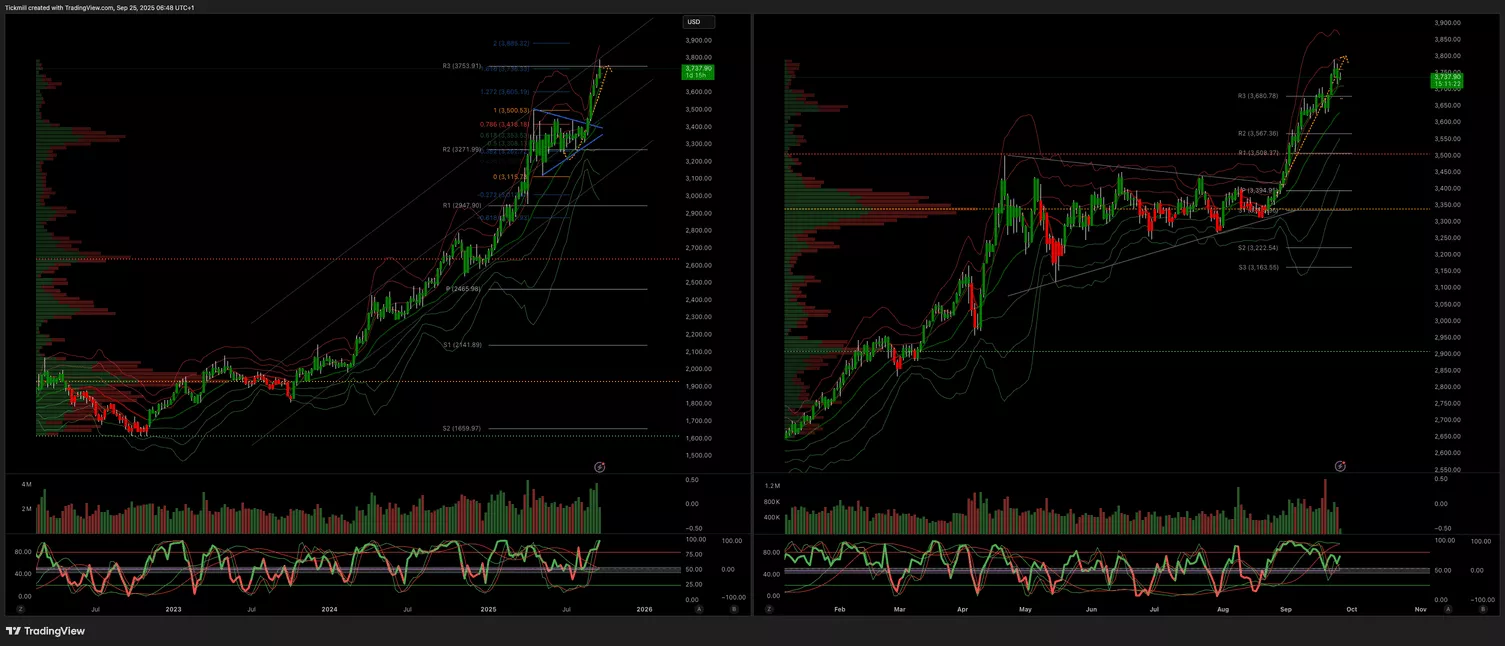

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6600 Target 6500

(Click on image to enlarge)

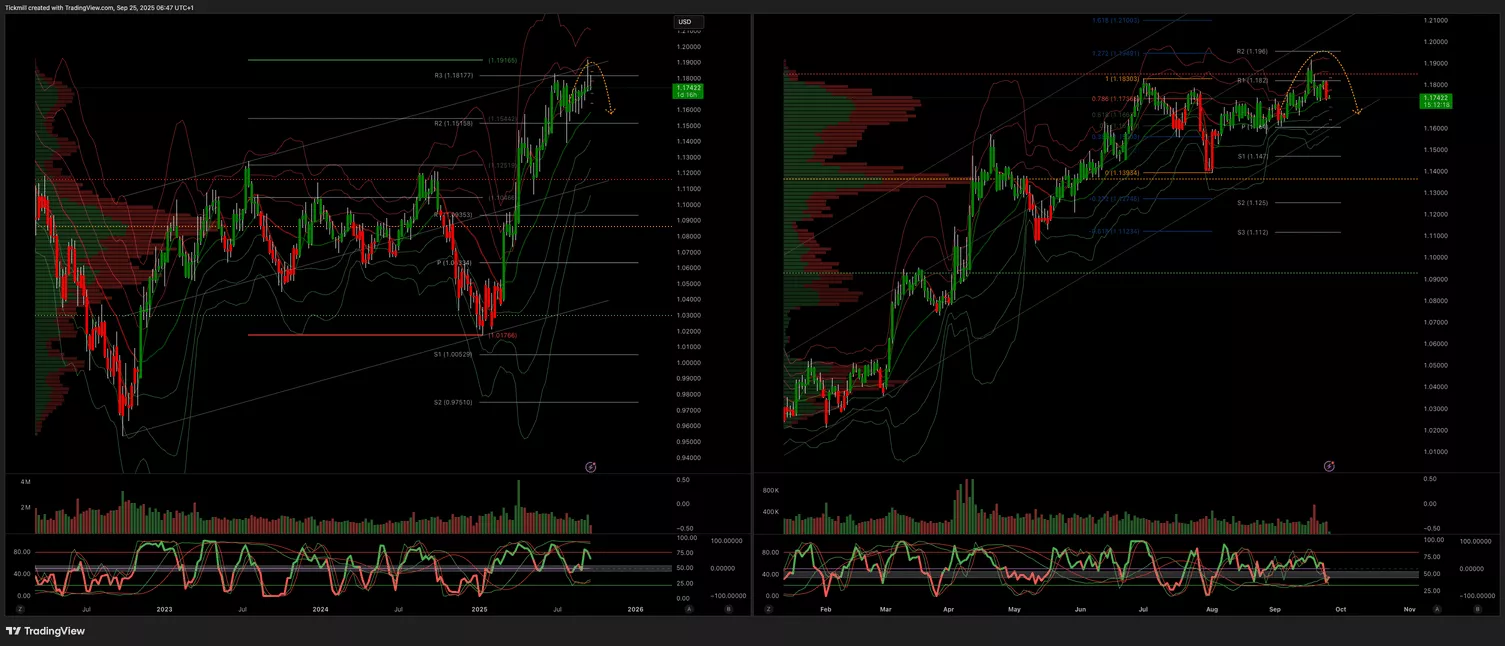

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

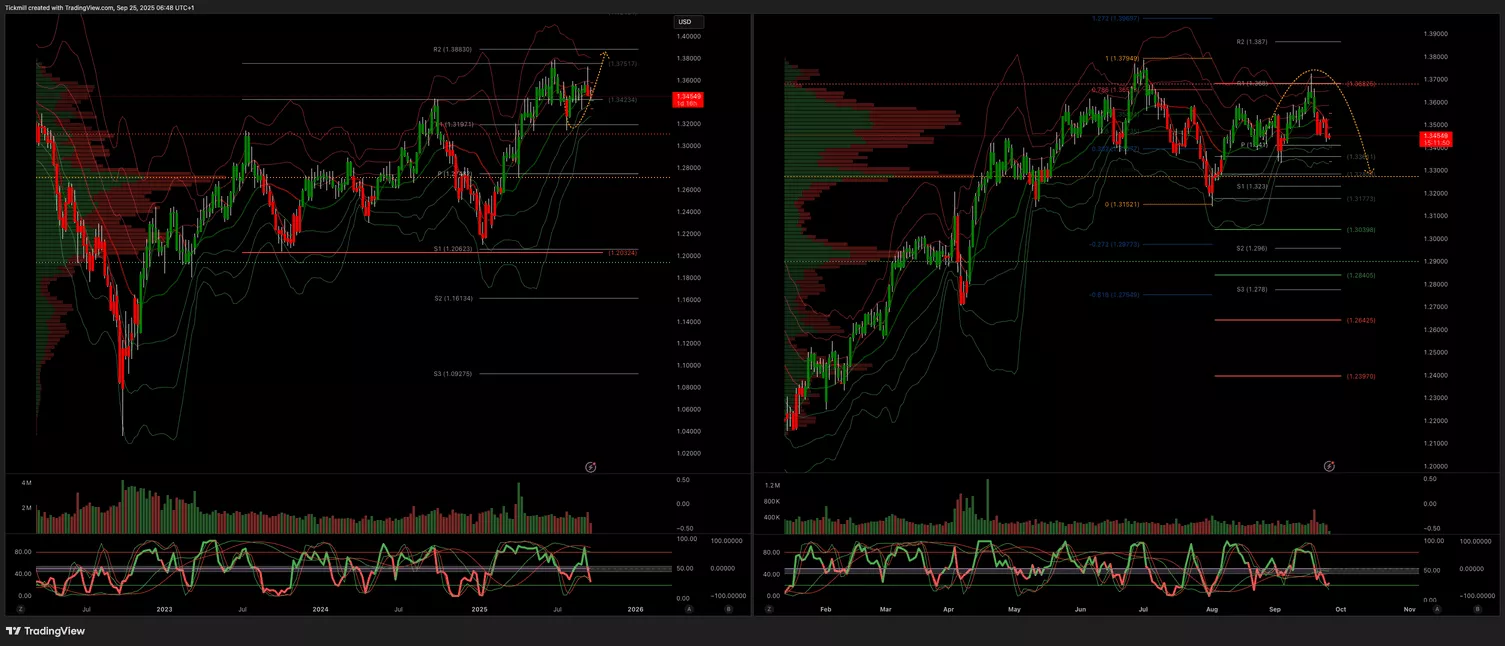

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

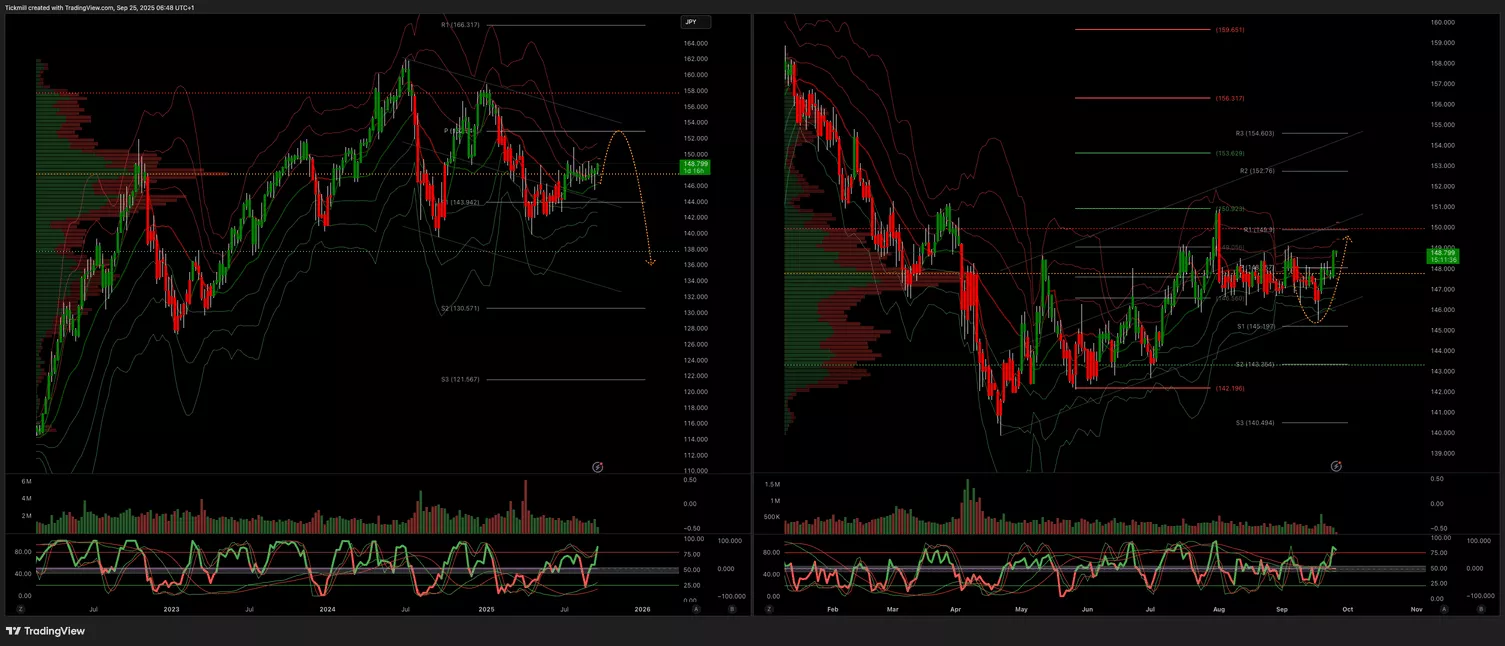

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

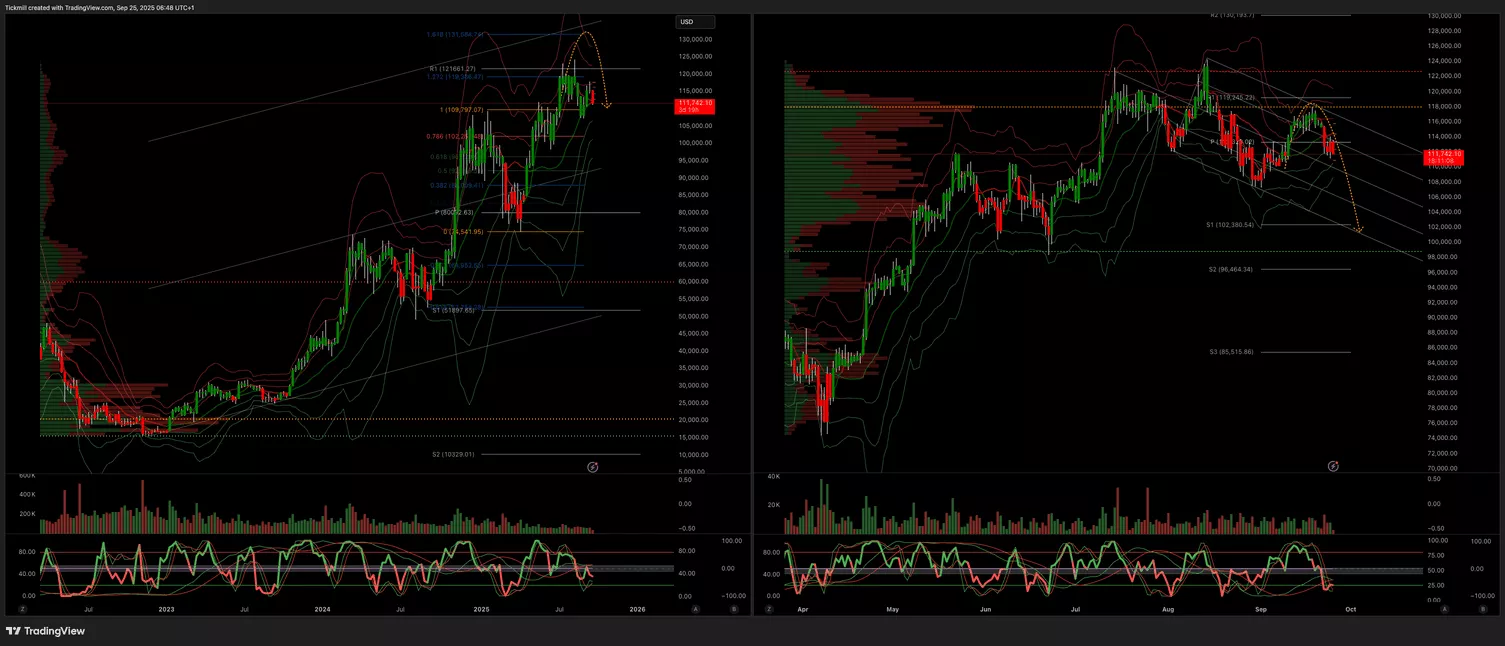

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3600 Target 3800

- Below 3500 Target 3400

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Sep. 24

The FTSE Finish Line - Tuesday, Sep. 23

Daily Market Outlook - Tuesday, Sep. 23