Daily Market Outlook - Wednesday, Sep. 24

Image Source: Pexels

Asian markets pared their losses following a rally in Chinese tech stocks, with Alibaba Group Holding Ltd. announcing plans to boost investments in artificial intelligence. Chinese semiconductor companies also experienced gains following Morgan Stanley's upgrade of their outlook on the industry, while Huawei Technologies Co. revealed its intentions to surpass Nvidia Corp. in the AI chip sector. Alibaba’s shares increased by as much as 7.2% in Hong Kong, despite low trading volumes as the city experienced Super Typhoon Ragasa. The MSCI index for Asian shares was down 0.1%, recovering from earlier lows. Treasury yields remained stable as Federal Reserve Chair Jerome Powell expressed concerns about ongoing risks in the labor market and inflation, acknowledging the challenge policymakers face in considering further easing measures. Global equities have seen a rebound this year as fears surrounding Trump's tariff conflicts diminished and investors anticipated additional rate cuts by the Fed. A significant portion of this recovery has been driven by technology shares, buoyed by optimism regarding artificial intelligence and demand for AI-oriented companies, which have helped alleviate concerns about slower growth and rising interest rates. Alibaba's stock climbed to its highest point in nearly four years following its announcement to significantly increase AI infrastructure spending to better compete against U.S. rivals. The company anticipates a rapid global surge in AI investment. CEO Eddie Wu stated that Alibaba plans to bolster its previous commitment made in February to invest over 380 billion yuan ($53 billion) in AI model development and infrastructure over the next three years. In global political developments, Trump adopted a more favorable stance on Ukraine’s potential for success in the war and suggested NATO allies intercept Russian aircraft that breach their airspace. Asian defense stocks, including Hanwha Aerospace Co., saw positive movement. Oil prices continued to rise due to increasing concerns over Russian supply disruptions, stemming from Ukrainian strikes on energy facilities and escalating tensions with NATO. Brent crude approached $68 a barrel after a 1.6% increase on Tuesday. Russia is also considering imposing restrictions on diesel exports for select companies.

The key takeaway from yesterday’s flash September PMI business surveys was the shift in the UK’s economic momentum. Previously signaling expansion at a pace comparable to the US, the UK has now slowed to align more closely with the euro area. Specifically, the UK Composite PMI dropped to 51.0 from 53.5, while the euro area remained relatively stable at 51.2, and the US maintained its lead at 53.6. For an economy that has recorded flat or negative monthly GDP figures in four out of seven months this year, a PMI closer to the neutral 50 mark seems more reflective of current conditions. A notable point within the UK data was the weakness in export orders, possibly underscoring the impact of tariffs. Across Europe, aside from some stronger figures in Germany’s services sector, most activity and price indices softened in September. From the Bank of England’s perspective, while slower expansion is evident, there may be some relief that it hasn’t been accompanied by stagflationary pressures, as price indices did not rise simultaneously. However, the persistence of pricing pressures in the UK remains a concern. The input price index for services, while not increasing further in September, still significantly outpaces comparable indices in the euro area. Against this backdrop, the relatively hawkish tone of BoE chief economist Huw Pill in his speech yesterday was unsurprising.

Overnight Headlines

- German Ifo Set To Edge Higher After Berlin Budget Approval

- ECB's Cipollone Says Risks To Inflation Are ‘Very Balanced’

- Swiss C. Bank Is Set To Avoid Going Negative On Rates This Week

- Pimco Bets Fall In UK Inflation Will Open Door To More Rate Cuts

- Trump Says Ukraine Can Win Back All Of Its Territory Seized By Russia

- Divided Fed Has Bond Traders Hedge Wide Range Of Policy Outcomes

- BoC’s Tiff Macklem: Canada Needs To Chart New Economic Course

- Canada Looks To Ease Tensions With China As FM Plans Visit

- Australia’s Faster Inflation Boosts Case For Slower RBA Cuts

- Deutsche Bank, JPMorgan, StanChart Among Banks Hiring In HK

- Boeing Chooses Palantir To Boost AI Adoption In Defense, Space Unit

- Eli Lilly To Build $6.5B Texas Facility To Boost US Ingredient Manufacturing

- Carmakers Urge Rollback Of US Emissions Rules Forcing EV Sales

- Micron Technology Revenue Jumps 46%, Guidance Tops Street’s Estimates

- OpenAI Expands Stargate With Five New Data Center Sites Across US

- Alibaba Shares Jump After CEO Reveals Plans To Raise AI Spending

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1675-85 (951M), 1.1700-10 (1.2BLN), 1.1720-30 (1.7BLN)

- 1.1745-50 (1.72BLN), 1.1760 (423M), 1.1775 (506M)

- 1.1790-00 (1.8BLN), 1.1810-20 (834M), 1.1840-50 (2.1BLN)

- 1.1855-60 (2.4BLN), 1.1900. (1.3BLN)

- USD/JPY: 146.50 (708M), 147.00-10 (1.4BLN), 147.25-30 (340M)

- 147.40-50 (960M), 147.90-00 (642M), 148.20-25 (291M), 148.40-50 (1.4BLN)

- 149.50 (275M)

- USD/CHF: 0.8030 (237M), 0.8200 (286M). EUR/CHF; 0.9475 (254M)

- GBP/USD: 1.3360 (743M), 1.3450 (254M), 1.3470 (231M), 1.3500 (1.4BLN

- 1.3550 (921M). EUR/GBP: 0.8740-45 (1.35BLN)

- AUD/USD: 0.6525 (230M), 0.6540 (433M), 0.6600 (958M), 0.6620-30 (1.3BLN)

- 0.6640-50 (580M), 0.6720 (1.8BLN. NZD/USD: 0.5890-00 (723M)

- USD/CAD: 1.3750 (884M), 1.3765-80 (913M), 1.3815-25 (975M)

- 1.3850 (1.2BLN), 1.3880-95 (537M)

CFTC Positions as of the Week Ending 1/9/25

- Equity fund speculators have boosted their net short position in the S&P 500 CME by 55,766 contracts, bringing it to a total of 475,397 contracts. At the same time, equity fund managers have increased their net long position in the S&P 500 CME by 9,074 contracts, now totaling 891,634 contracts.

- Speculators have reduced their net short position in CBOT US 5-year Treasury futures by 117,989 contracts, resulting in a total of 2,436,774 contracts. They have also decreased their net short position in CBOT US 10-year Treasury futures by 38,673 contracts, now at 819,299 contracts. Conversely, speculators have raised their net short position in CBOT US 2-year Treasury futures by 28,509 contracts, reaching 1,403,470 contracts. Additionally, there has been an increase in net short position in CBOT US UltraBond Treasury futures by 12,686 contracts, totaling 278,167 contracts. Speculators have trimmed their net short position in CBOT US Treasury bonds futures by 4,470 contracts, reducing it to 94,138 contracts.

- The net long position for Bitcoin stands at 20 contracts. The Swiss franc has registered a net short position of -26,040 contracts, while the British pound's net short position is -6,580 contracts. The euro has a net long position of 117,759 contracts, and the Japanese yen holds a net long position of 61,411 contracts..

Technical & Trade Views

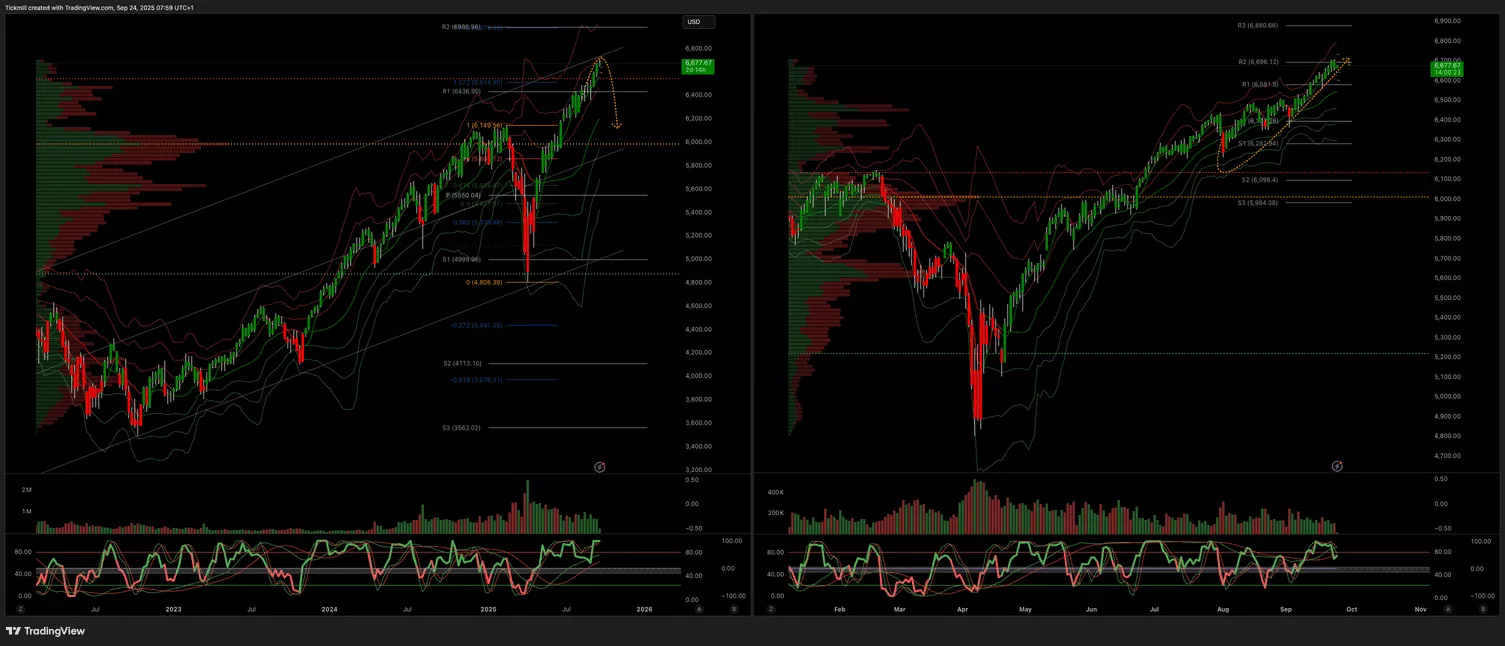

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6666

- Below 6420 Target 6370

(Click on image to enlarge)

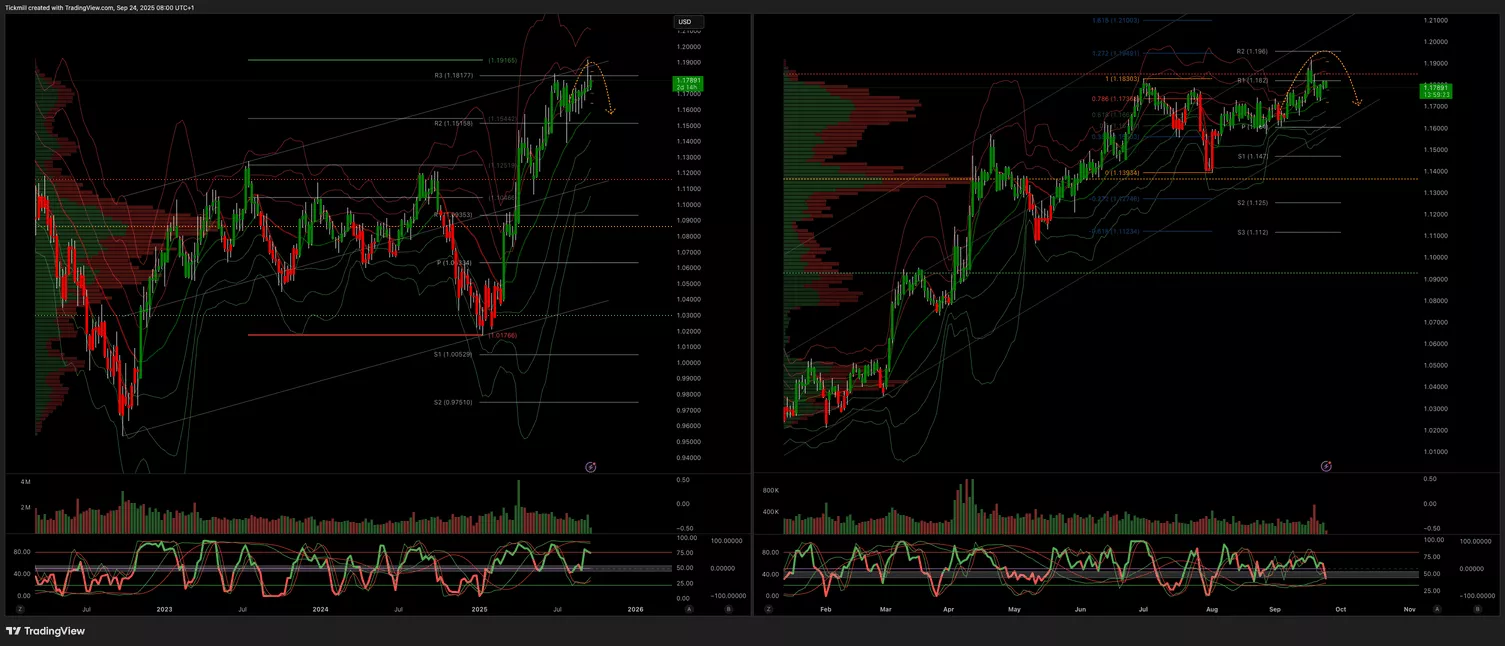

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

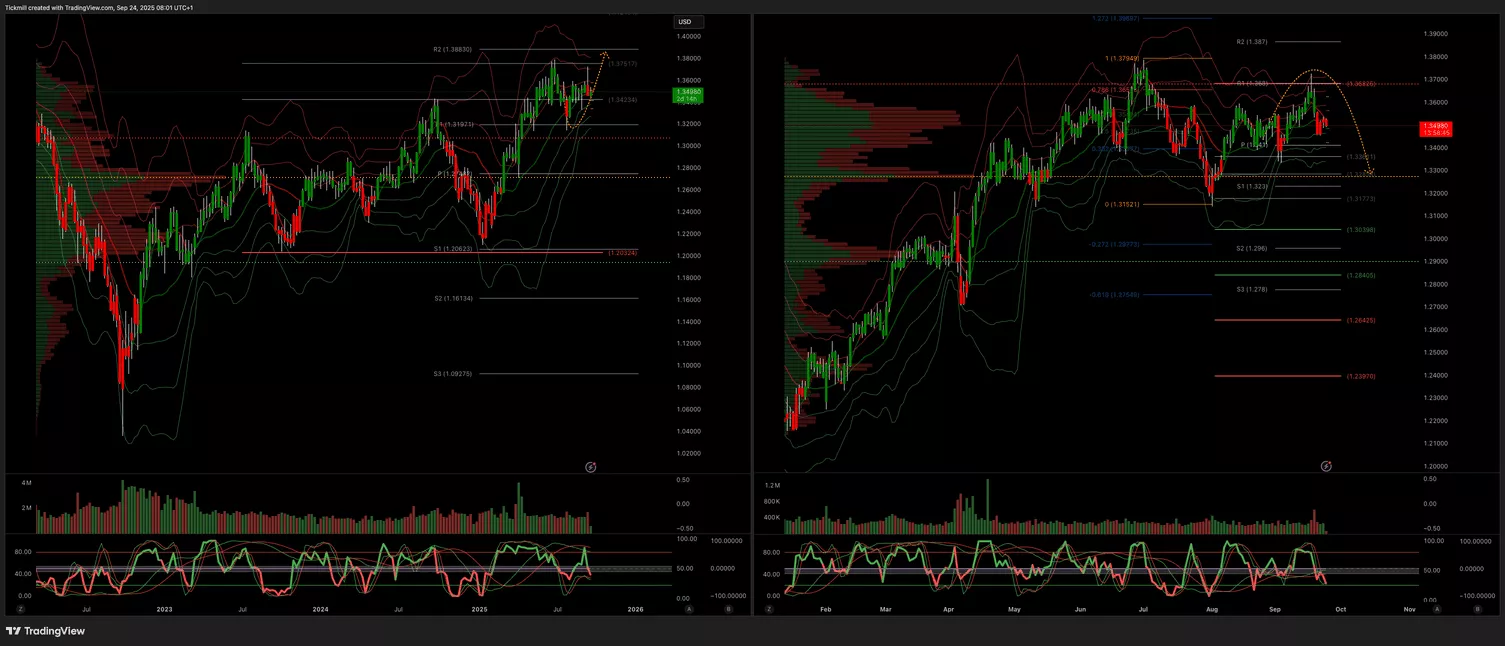

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

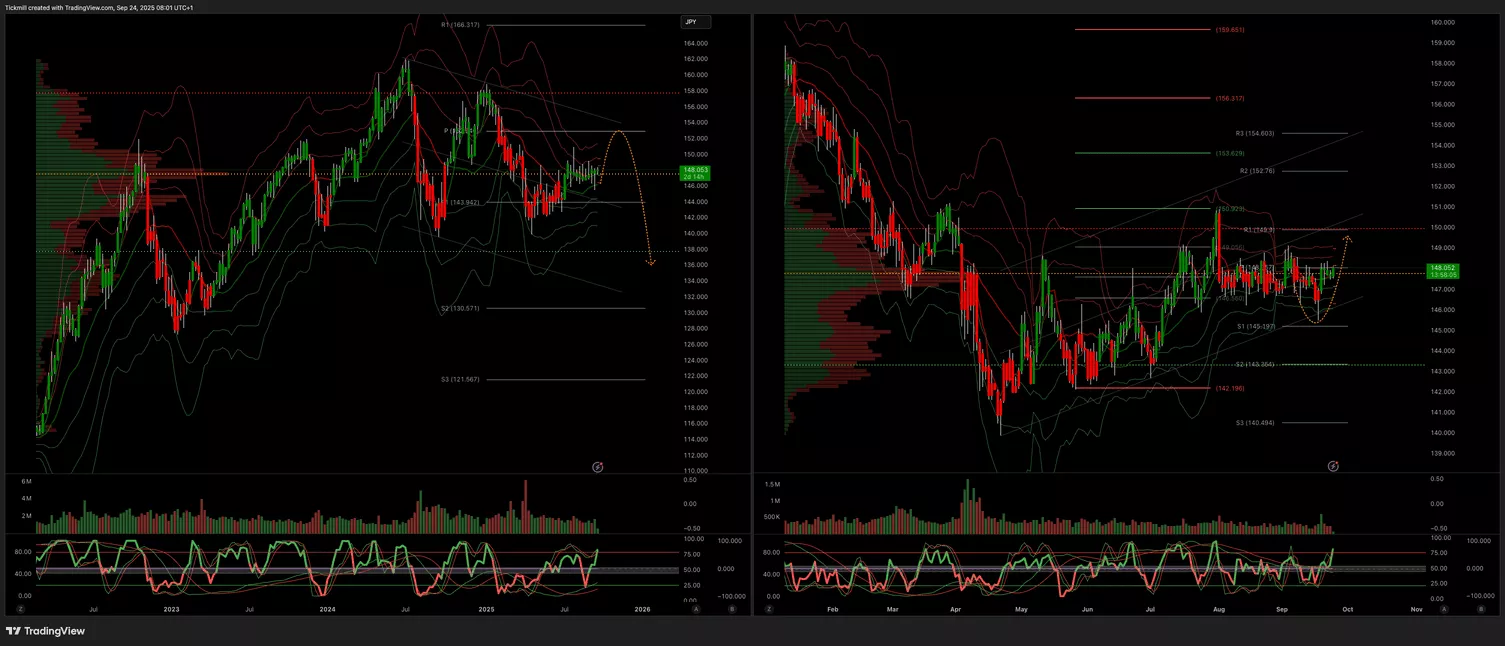

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3600 Target 3800

- Below 3500 Target 3400

(Click on image to enlarge)

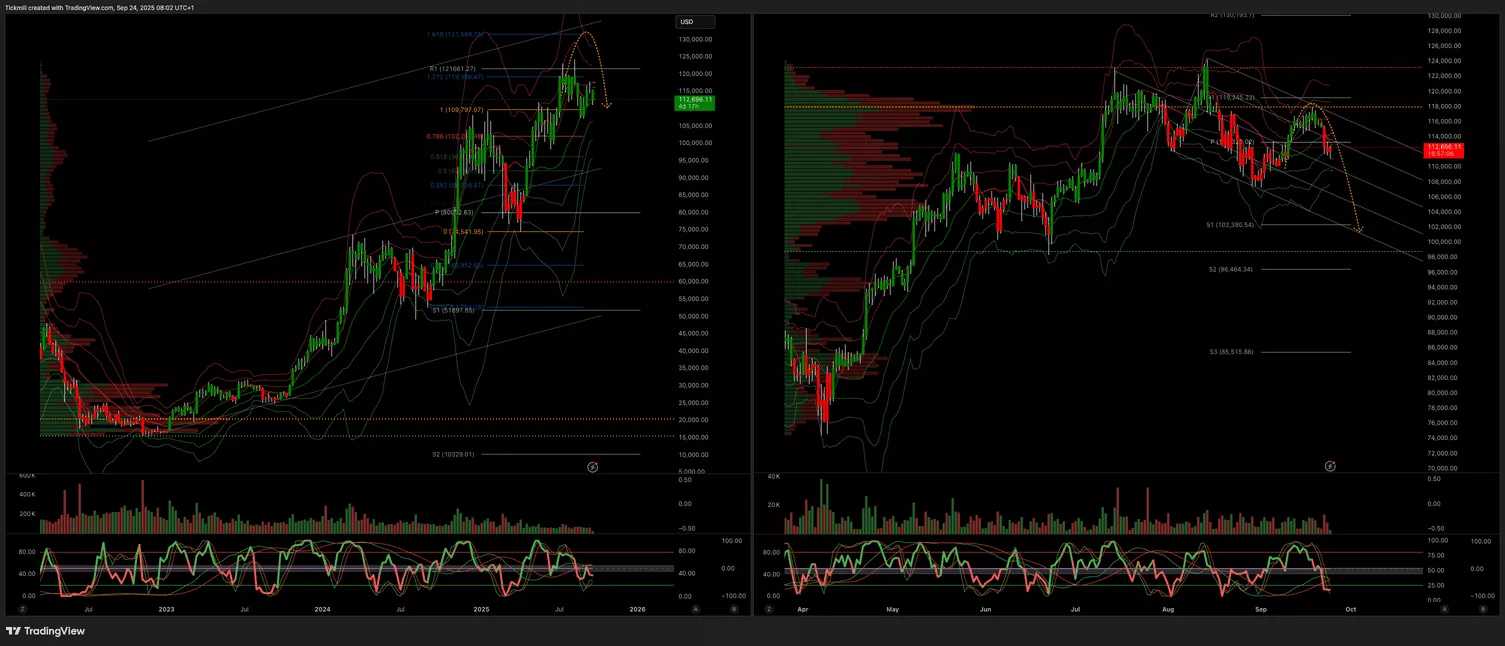

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, Sep. 23

Daily Market Outlook - Tuesday, Sep. 23

The FTSE Finish Line - Monday, Sep. 22