The FTSE Finish Line - Monday, Sep. 22

Image Source: Pexels

London stocks dipped on Monday, influenced by a decline in automakers and a rising pound, as investors looked forward to remarks from various Federal Reserve officials later in the day. Stocks of British automobiles and parts dropped by 1.6%, reflecting declines in the broader European automobile market after Porsche reduced its electric vehicle rollout plans, leading both the luxury sports car manufacturer and its parent company Volkswagen to revise their 2025 profit forecasts downward. The British luxury automaker Aston Martin saw a decline of 3.2%. The strength of the British pound against the US dollar also impacted export-orientated companies, as investors took a breather following Friday's market selloff driven by fiscal worries. Last week, the Bank of England decided to keep key interest rates steady while facing persistent inflation and uncertainty regarding jobs and economic growth. Overall sentiment was cautious following a report on Friday that indicated Britain's borrowing surpassed official estimates, increasing pressure on Finance Minister Rachel Reeves ahead of her budget announcement in November. Precious metal mining stocks surged by 5.1%, leading among sectors, as gold prices reached a record high amid growing expectations of a more lenient monetary policy. Miner Fresnillo was one of the top gainers in the FTSE 100, rising by 4%, while Hochschild experienced an 8.8% jump.

Shares in airlines listed in London fell due to delays at European airports caused by a cyberattack. Several airports, including Heathrow, Brussels, and Berlin, experienced check-in and boarding delays after Collin Aerospace's software was targeted in a cyberattack over the weekend. EasyJet's shares dropped by 1.6%, while British Airways' parent company IAG declined by 1.3%. Both companies are among the biggest losers on the FTSE 100 index, which is down by 0.07%. Wizz Air also saw a 1.3% decrease in its shares.

Shares of British food ingredients manufacturer Tate & Lyle dropped as much as 5.8%, reaching 470.8p, making it the biggest loser on the FTSE mid-cap index. Morgan Stanley downgraded the stock from "equal-weight" to "underweight" and reduced the price target from 590p to 500p. The firm perceives an increased risk to Tate & Lyle’s mid-term objectives following Tyson Foods' announcement that it will phase out sucralose from its U.S. branded products, raising concerns that other consumer packaged goods companies may follow suit. Including the losses from this session, the stock is down 27.4% year-to-date.

Shares of Wilmington Plc rose by 5.67%, reaching 354p. The UK-based information and data provider reported an adjusted profit before tax of £28.4 million ($38.27 million), an 18% increase from the previous year. The company indicated that Q1 trading is promising, with revenue and profit aligning with expectations. Despite the gains in this session, the stock is still down 8.7% year-to-date.

Shares of Van Elle Holdings fell by 17.6%, reaching 30.5p. The company announced that its fiscal year revenue and profit are expected to be significantly below market expectations, citing spending constraints and contract delays, including approvals related to the Building Safety Act for high-rise residential buildings. Brokerage Peel Hunt has reduced its target price from 55p to 45p. Including the losses from this session, the stock is down approximately 15% year-to-date.

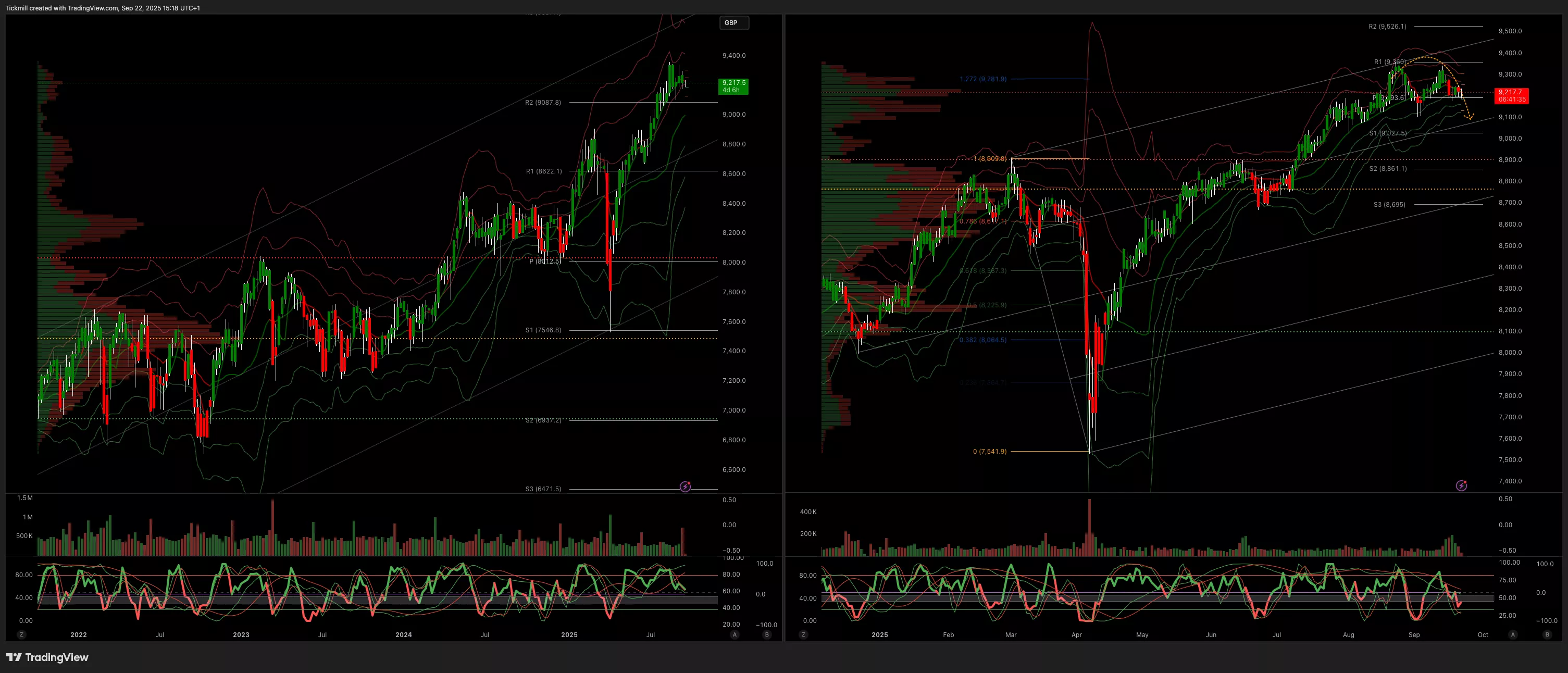

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

- Primary support 9000

- Below 8900 opens 8600

- Primary objective 9600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Sep. 22Daily Market Outlook - Monday, Sep. 22

The FTSE Finish Line - Friday, Sep. 19