Daily Market Outlook - Tuesday, Feb. 25

Image Source: Pixabay

President Trump indicated that the tariffs planned for Mexico and Canada in February, which were delayed for a month, are ‘advancing very quickly’ and ‘on schedule.’ The Fed's Goolsbee reiterated the now-familiar ‘wait-and-see’ approach of the FOMC, highlighting the need for greater clarity on the implications of Trump's policies. Meanwhile, in the UK, arch-MPC dove Dhingra clarified her recent vote in favor of a 50 basis point cut. While acknowledging the rise in inflation, she emphasized that ‘consumption weakness isn’t subsiding,’ also pointing out the relatively high household savings rate. Asian stocks experienced their largest decline in three weeks after US President Donald Trump proceeded with tariffs on Canada and Mexico and imposed restrictions on Chinese investments, which negatively affected risk appetite. The Trump administration is looking to strengthen semiconductor restrictions on China, building upon and broadening the Biden administration's initiatives to curtail Beijing's technological advancement, as reported by Bloomberg News on Monday. U.S. officials have recently conferred with their counterparts from Japan and the Netherlands regarding the limitation of Tokyo Electron and ASML engineers from servicing semiconductor equipment in China, according to the report. Additionally, some officials from the Trump administration are looking to impose tighter controls on the volume and variety of Nvidia chips that can be sold to China without a license, as per sources familiar with the situation. Shares across the region dropped, with significant losses reported in Japan, Taiwan, and Hong Kong. In Asia, Treasury 10-year yields fell by three basis points to 4.4%, following a record high for gold on increased demand for safe-haven assets. Bitcoin, regarded as part of the "Trump trade," also decreased alongside other cryptocurrencies.

In Germany, Chancellor-designate Merz is aiming to leverage a lame-duck session of the outgoing parliament to significantly increase defence spending swiftly, as the new parliament's makeup gives opposition parties a blocking minority regarding changes to the debt brake rule. Reports suggest a potential agreement between the CDU and SDP could allow for up to €200 billion, though not all of this would necessarily constitute new additional funding.

The drop below 50 in the S&P Global Services PMI released on Friday was a noticeable downside surprise. Just last November, the index stood at 56.1, and it was the euro area that was experiencing a contraction in its services sector—now it seems to be the US. The accompanying press release highlighted worries such as uncertainty surrounding 'federal government policies regarding domestic spending cuts and tariffs.' As these policies continue to develop, it is too early to draw firm conclusions about their long-term effects; however, for this month, the uncertainty is clearly having a negative impact. What implications does this have for February's ISM report scheduled for next week? Typically, the Services ISM (business activity) index remains above the PMI by an average of about four points. This discrepancy arises from various factors like sector coverage, weighting, sample sizes, and definitions. A notable distinction is that the PMI exclusively accounts for private sector healthcare and education, excluding public administration, while ISM encompasses all these areas. Thus, normally if the Services PMI is at 49.7, one might expect the ISM to remain above 50 for the same period due to the usual difference. However, in this case, considering the DOGE dynamic, there may be a concentration of weakness in the segments of the public sector included by ISM but not captured by the PMI. While variance is possible, the Services ISM may be even lower than the disappointing PMI this time.

Today's data slate includes wage negotiations led by the ECB, the UK CBI Distributive Trades survey, US consumer confidence data, S&P housing price statistics, and remarks from the Fed's Logan, Barr, and Barkin. Additionally, insights will be shared by the BoE's Pill and the ECB's Nagel and Schnabel.

Overnight Newswire Updates of Note

- BoE’s Dhingra: Gradual Rate Cuts Would Be A Drag On Economy

- EU Vows Swift Response If Trump Takes Action Over Big Tech Rules

- Canada’s Frontrunners Debate Over Toughest PM Opponent To Trump

- BofA: OPEC+ To Hike Oil Output As Trump Seeks Lower Prices

- BP To Abandon Pledge To Cut Oil, Gas Output; CEO Seeks Survival

- Trump Wants Canada’s Keystone XL Oil Pipeline Built ‘Now’

- Trump: Planned Tariffs On Canada, Mexico ‘Going Forward’ On March 4th

- Trump Team Seeks To Toughen Biden’s Chip Controls Over China

- Chinese Manufacturers Speed Up Efforts To Dodge Trump’s Tariffs

- Chinese Investment Surge Into Vietnam Raises Risk Of Trump Retaliation

- China’s Repo Market Hit Hard As Yuan Defense Sparks Cash Squeeze

- Huawei Improves AI Chips In Breakthrough For China’s Tech Goals

- Top Japan Regional Bank Holds JGB Buying On Bet Rates To Climb

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0390-1.0400 (2.5BLN), 1.0450 (931M), 1.0525 (1BLN)

- 1.0550 (1.4BLN)

- USD/CHF: 0.9040 (400M). EUR/CHF: 0.9450 (230M)

- EUR/GBP: 0.8350-55 (435M)

- AUD/USD: 0.6345-55 (730M). NZD/USD: 0.5665 (456M), 0.5685 (220M)

- AUD/NZD: 1.1035 (200M), 1.1130 (307M)

- USD/JPY: 149.00 (570M), 149.55 (558M), 151.50 (481M)

- EUR/JPY: 155.70 (513M)

CFTC Data As Of 21/2/25

- Positions Report from the CFTC for the Week Ending February 18th

- The net short position in euros stands at -51,420 contracts.

- The net long position for the Japanese Yen stands at 60,569 contracts.

- The Swiss franc has recorded a net short position of -38,359 contracts.

- The net short position for the British pound stands at -579 contracts.

- The net short position for Bitcoin stands at -367 contracts.

- Equity fund managers have increased their S&P 500 CME net long position by 18,069 contracts, bringing the total to 948,011. Meanwhile, equity fund speculators have reduced their S&P 500 CME net short position by 332 contracts, resulting in a total of 365,901.

- Speculators have raised their positions on CBOT. The net long position in US Treasury Bonds futures has risen by 3,780 contracts, reaching a total of 47,781. Speculators are increasing their activity on the CBOT. US Ultrabond Treasury futures net short position decreased by 6,301 contracts, totalling 246,242. Speculators have reduced their positions. Chicago Board of Trade US 2-Year Treasury futures have seen a net short position decrease of 9,093 contracts, bringing the total to 1,289,519. Speculators are reducing their positions on the CBOT. The net short position in US 10-Yr Treasury futures has decreased by 41,507 contracts, bringing the total to 709,527. Meanwhile, speculators have reduced their net short position in CBOT US 5-Yr Treasury futures by 124,202 contracts, resulting in a total of 1,737,533.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

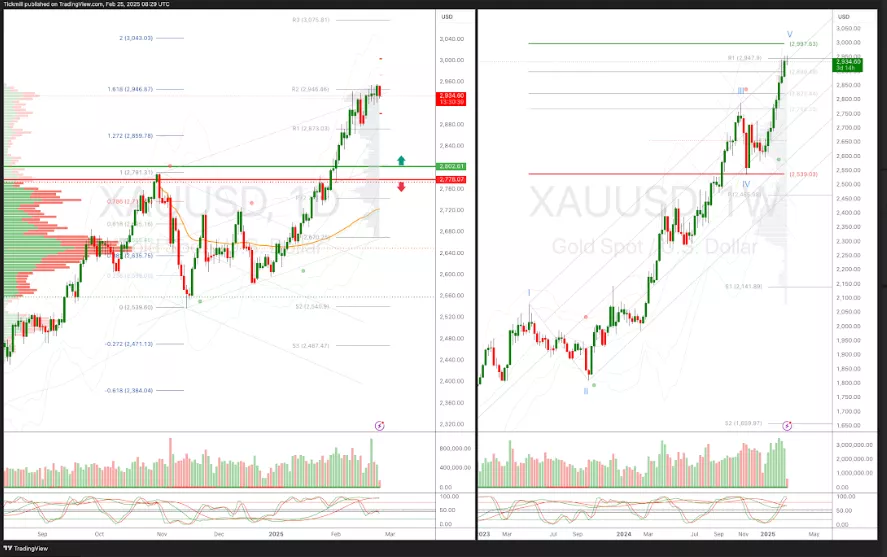

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

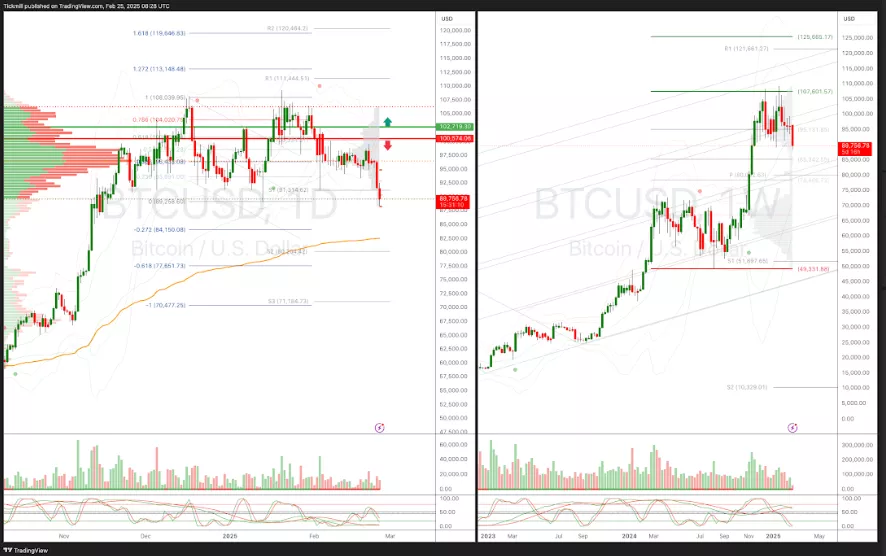

BTCUSD Pivot 101,960

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, Feb. 20

Daily Market Outlook - Thursday, Feb. 20

The FTSE Finish Line - Wednesday, Feb. 19