The FTSE Finish Line - Thursday, Feb. 20

Image Source: Pixabay

Britain's leading index extended its losses on Thursday, weighed down by a continued slump in major healthcare stocks amid fears of higher U.S. tariffs. Mixed corporate earnings reports did little to bolster investor confidence, as the blue-chip FTSE 100 slipped 0.3%.

Single Stock Stories & Broker Updates:

- Lloyds shares rose 1.9% to 64p on the FTSE 100. The bank reported Q4 net income of £4.4 billion, surpassing the expected £4.3 billion, and announced a £1.7 billion share buyback. The 2024 dividend increased to 3.17p per share from 2.76p in 2023. Lloyds allocated £700 million for potential UK regulator penalties over auto financing misselling. Despite concerns over this provision, analysts highlighted strong underlying performance. Shares are up 14.8% in 2024.

- Anglo American emerged as the top percentage gainer on the FTSE 100 index, with its shares climbing 3.4% to 2,451 pence. The company announced a strategic merger of its Los Bronces copper mine in Chile with state-backed Codelco's Andina mine, a move expected to boost annual copper production by 120,000 tonnes starting in 2030. This partnership is also projected to reduce Los Bronces' production costs by 15%, enhancing overall profitability. Despite reporting an annual loss of $3.1 billion due to $3.8 billion in impairments related to its struggling diamond unit, Anglo American's stock surged approximately 42.2% over the year.

- Among the top gainers on the FTSE 100, which is currently down 0.62%, is Centrica, the owner of British Gas. Its stock has surged 8.3% to 147p, marking its highest level since May 22. The company announced a 13% increase in its 2024 dividend to 4.5p per share, with plans to further raise it to 5.5p in 2025. Additionally, Centrica has expanded its share buyback program by £500 million ($630.3 million), bringing the total to £2 billion. The company maintains that its outlook for 2025 remains unchanged, with its stock up approximately 5% in 2024.

- Shares of consulting firm Ricardo dropped approximately 1.8% to 222p. Peel Hunt has downgraded the stock to "hold" from "add" and reduced the price target to 237p from 454p. The brokerage anticipates that PLC costs may negatively impact profits and margins due to the company's smaller scale. Last month, the company projected its FY 24/25 results would fall short of consensus expectations due to order delays. The average rating is "hold," with a median price target of 440p, according to LSEG. Year-to-date, the stock has declined around 46% as of the last close, in contrast to a roughly 4% rise in the FTSE 100 index.

Technical & Trade View

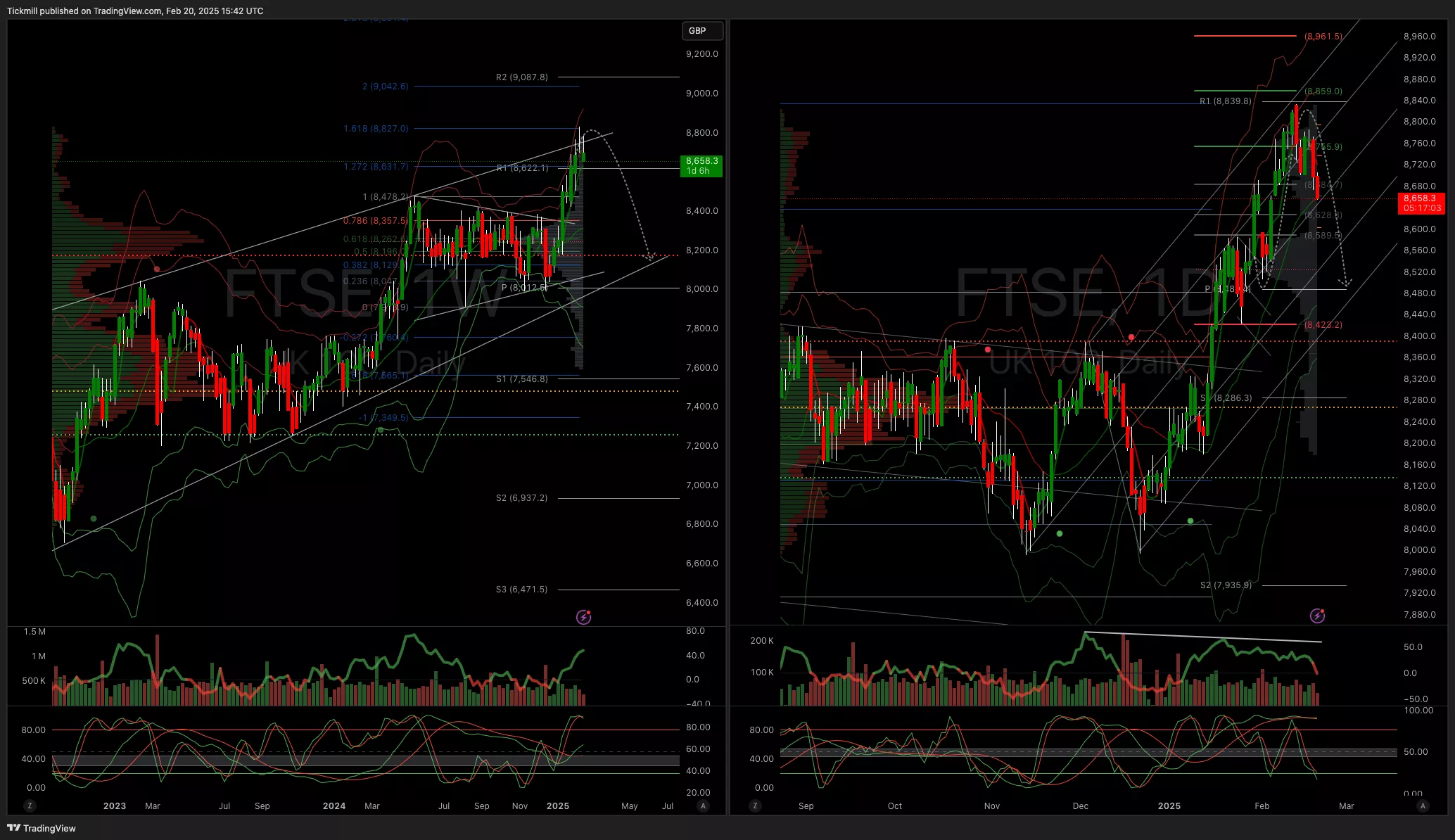

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8839

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Feb. 20The FTSE Finish Line - Wednesday, Feb. 19

Daily Market Outlook - Wednesday, Feb. 19

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!