The FTSE Finish Line - Wednesday, Feb. 19

Image Source: Pexels

Britain's primary stock index dropped on Wednesday as inflation surpassed expectations, compounded by a decline in Glencore's shares after the company forecasted lower earnings for 2024. The FTSE 100, a leading blue-chip index, slid 0.63%. UK inflation surged to a 10-month high of 3.0% in January, exceeding forecasts and challenging the Bank of England's confidence that inflationary pressures will ease over time. Earlier this month, the BoE cut its key interest rate from 4.75% to 4.5% and predicted inflation could climb to 3.7% later this year—nearly double its 2% target. The UK housebuilders' index also declined by 1.6%, with firms such as Persimmon, Taylor Wimpey, and Barratt Redrow seeing losses between 1.6% and 2.4%. Rising interest rates have pushed up mortgage costs, dampening demand for new housing.

Single Stock Stories & Broker Updates:

- British paper and packaging company Mondi's shares increase by up to 2% to 1,313.5p. The stock is one of the top gainers in the UK FTSE 100 index. JP Morgan raises its price target to 1,480p from 1,272p and rates the stock as "neutral." The broking anticipates kraftline prices to rise in March and indicates that the supply-demand situation for the company is improving. JPM analysts predict that MNDI will benefit from a possible ceasefire between Russia and Ukraine as the latter begins to rebuild, with demand for cement bags and sack kraft. According to data gathered by LSEG*, the median PT of the 12 analysts covering the stock is 1,460 p, with nine having a "buy" or higher recommendation, two having a "hold" rating, and one having a "sell" rating. Over the past 12 months, the stock has dropped about 6%.

- Miner and commodity trader Glencore saw its shares on the London market decline by 3.4%, settling at 342.5p. The stock is the biggest loser on London's FTSE 100 index, which remains unchanged. The company's adjusted EBITDA dropped 16% to $14.36 billion in 2024, down from $17.1 billion the previous year, falling short of analysts' consensus expectations of $14.55 billion. It stated that lower commodity prices impacted its earnings. Analysts at Jefferies noted, "The bottom line is that we don't foresee significant, positive commodity trends for Glencore until next year." The company has reintroduced a share buyback plan, intending to return $2.2 billion to shareholders. Overall, the stock has decreased by about 25% in 2024.

- Jet2's shares fell 9.3% to 1,420p, making it the biggest loser among London stocks. The British travel firm reports ongoing inflationary pressures exceeding the headline CPI rate in hotel stays, aircraft maintenance, as well as general airport and Eurocontrol costs. It anticipates further operational expenses due to aircraft shortages during peak summer caused by delays in Airbus deliveries. The company projects a year-over-year profit increase of 8-10% for FY25, estimating between £560 million ($706.9 million) and £570 million. Additionally, summer 2025 seat capacity is set to rise 8.5% year-on-year to 18.6 million. Jefferies states that while trading seems solid, macroeconomic factors and "pressures on consumer discretionary incomes" are creating limited visibility amid continued last-minute bookings. However, analysts note that robust trading is being countered by rising cost inflation. In 2024, the stock increased by 26.7%.

- Antofagasta's shares reached their highest level since October 2024 and were recently up 2.9% at 1,886.5 pence in early trading. J.P. Morgan double upgrades stock to "overweight" from "underweight," citing a near-term boost in copper demand from China's additional fiscal stimulus announcement anticipated in March. Operational setbacks that limited copper output over the previous two years have been addressed, and the broking states that "copper guidance of 660-700kt appears achievable." The stock is the top gainer on the UK's blue-chip index. J.P. Morgan raises its target price to 2,400 pence from 1,600 pence, representing a ~31% upside from the last close 7 out of 20 brokerages rate the stock "buy" or higher, 9 "hold," and 4 "sell" or lower; their median PT is 1,925 pence - LSEG data. The Chilean copper miner reported an 11% increase in annual core profit on Tuesday, helped by higher copper prices. ANTO was up 15% year-to-date as of the previous closing; in 2024, the stock dropped 5%.

Technical & Trade View

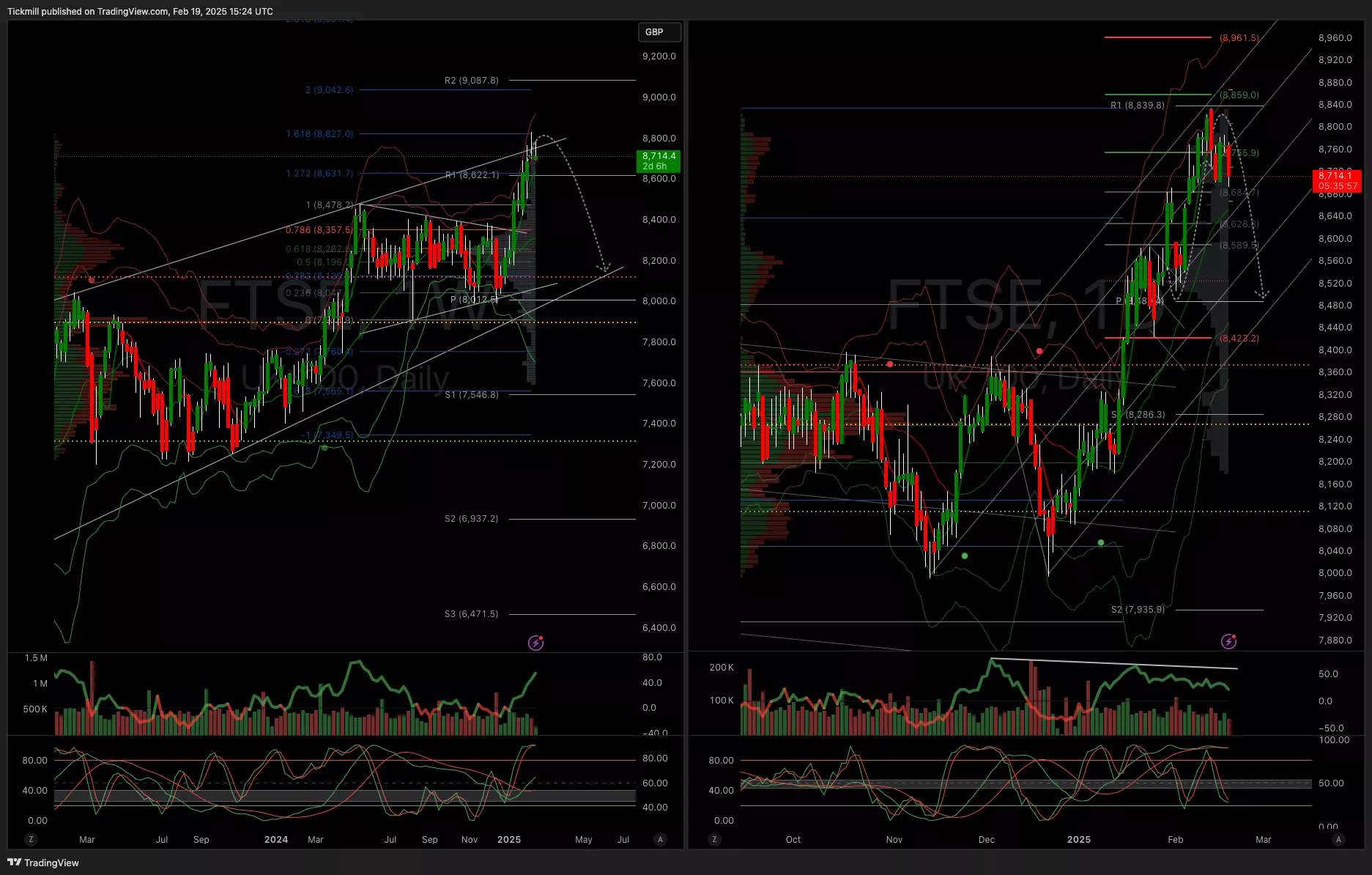

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8839

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Feb. 19The FTSE Finish Line - Tuesday, Feb. 18

Daily Market Outlook - Tuesday, Feb. 18