Daily Market Outlook - Tuesday, Feb. 18

Image Source: Pexels

The surge in banking and defence stocks across Europe continued in Tokyo, with shares of Mitsubishi Heavy Industries rising by 3% to approach all-time highs. The spotlight is on Ukraine and the anticipation that Europe will increase defence expenditure in the wake of any peace agreement. European markets are marginally up, indicating a market opening that aligns with the record highs reached on Monday, when the defence sector contributed to the overall gains of indices like the pan-European STOXX 600 and Germany's DAX. Arms manufacturer Rheinmetall saw a remarkable 14% increase. U.S. President Donald Trump has initiated bilateral peace discussions with Russia, set to commence later on Tuesday in Saudi Arabia. British Prime Minister Keir Starmer expressed readiness to deploy peacekeeping forces to Ukraine, although European leaders did not commit to similar actions during emergency discussions in Paris on Monday. The potential resolution of the conflict has bolstered the euro and European stocks, diverting some attention away from tariffs and interest rates. Hong Kong stocks surged to their highest level since October during morning trading, driven by tech shares reaching a three-year high following a rare meeting on Monday between President Xi Jinping and business leaders. Investor focus is also shifting to corporate earnings, with Chinese search giant Baidu set to release its results later on Tuesday and Alibaba following on Thursday. Baidu's shares steadied after a previous session selloff triggered by the absence of its founder, Robin Li, from a symposium in Beijing.

The latest UK labour market report offers little new for the MPC compared to recent projections. The unemployment rate remained at 4.4% in Q4, slightly below the expected 4.5%, while private sector regular pay growth was 6.2% 3m/y, just shy of the anticipated 6.3%. These minor deviations are not significant. Employment rose by 107k 3m/3m in Q4, yet total hours worked slightly declined, with average weekly hours per worker dropping from 32.1 to 31.8. This suggests labour hoarding, where softer economic demand has led to underemployment rather than higher unemployment.

In Australia, as anticipated, the Reserve Bank of Australia (RBA) reduced the policy rate by 25 basis points to 4.1%. However, the accompanying statement stressed that the Board "remains cautious on prospects for further policy easing." In her post-meeting comments, Governor Bowman explicitly pushed back against the market's expectations for additional rate cuts. The Australian dollar (AUD) remains relatively stable against the US dollar (USD) but has strengthened against certain currencies, including the Japanese yen (JPY) and New Zealand dollar (NZD).

In the United States, Federal Reserve Governor Waller expressed a preference for "holding the policy rate steady" until there is clarity on whether the "wintertime lull in progress" on inflation moderation is merely temporary. Echoing comments from Harker, Waller suggested that seasonal factors in inflation data recording might be contributing to stronger early-year readings. He advocated for waiting until later in the year to reassess the need for a potential rate cut. Today's macro slate includes remarks from ECB's Holzmann and Cipollone, BoE's Bailey, ZEW economic sentiment data, Canadian CPI figures, US Empire State Manufacturing and NAHB Housing Market surveys, as well as commentary from the Fed's Daly and Barr.

Overnight Newswire Updates of Note

- ZEW German Investor Morale Poised For Gains As Election Nears

- Fear Of German Industrial Decline Takes Hold; Fall In Manufacturing Jobs

- UK PM Vows To ‘Spend More’ On UK Defence; Other Areas Face Cuts

- ECB Holzmann: Rate-Cut Decisions Getting Harder

- RBA Cuts 25bps; Further Cuts Implied By Market Not Guaranteed

- Fed’s Bowman: Inflation Progress Needed Before Further Cuts

- Fed’s Waller Plays Down Inflation Risks From Trump Tariffs

- Goldman Sachs Raises Year-End Gold Price Forecast To $3,100

- Oil Futures Mixed; Traders Weigh Potential Delay To OPEC+ Output Hikes

- Boeing's Air Force One Program Could Be Delayed Until 2029, Or Later

- Honda To Re-Enter Nissan Talks If Japanese Rival’s Chief Uchida Leaves

- China Pumps The Brakes On Tesla’s Autonomous Cars

- China’s Government Bonds Drop On Cash Squeeze, Stocks Optimism

- Japan’s Bond Market Surges As Firms Secure Funding Ahead Of Hikes

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0400 (1BLN), 1.0425-30 (946M), 1.0440-50 (1.7BLN)

- 1.0500 (1.3BLN), 1.0525 (441M)

- EUR/GBP: 0.8315 (650M), 0.8385-90 (300M)

- GBP/USD: 1.2600 (614M), 1.2620-30 (330M)

- AUD/USD: 0.6350 (228M) . AUD/NZD: 1.1150 (550M)

- USD/CAD: 1.4185 (472M), 1.4275 (481M), 1.4295-1.4300 (2BLN)

- USD/JPY: 152.75 (448M), 152.90 (314M), 154.00 (1.1BLN)

- EUR/JPY: 155.50 (640M), 159.00 (233M), 160.00 (280M)

CFTC Data As Of 14/2/25

- The Euro holds a net short position of 64,425 contracts, while the Japanese Yen shows a net long position of 54,615 contracts. Bitcoin maintains a net short position of 367 contracts, and the Swiss Franc reports a net short position of 38,745 contracts. The British Pound registers a net short position of 3,168 contracts.

- Equity fund managers have increased their net long position in S&P 500 CME futures by 9,526 contracts, bringing the total to 929,941 contracts. Conversely, equity fund speculators have expanded their S&P 500 CME net short position by 33,021 contracts, reaching a total of 366,233 contracts.

- Speculators shifted to a net long position in CBOT US Treasury bond futures, climbing to 44,001 contracts for the week ending February 11, compared to the previous 4,927 contracts. Additionally, they reduced the net short position in CBOT US ultrabond Treasury futures by 3,675 contracts, now standing at 239,941 contracts. However, speculators increased the net short position in CBOT US 2-year Treasury futures by 79,988 contracts, totaling 1,298,612 contracts, and raised the net short position in CBOT US 10-year Treasury futures by 43,331 contracts, now at 751,034 contracts. Meanwhile, the net short position in CBOT US 5-year Treasury futures was trimmed by 65,931 contracts, bringing the total to 1,861,735 contracts.

Technical & Trade Views

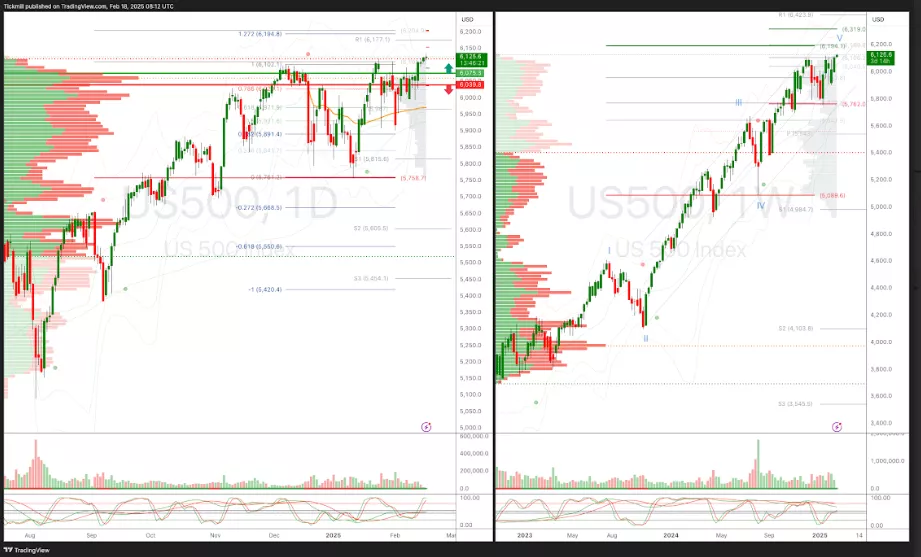

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

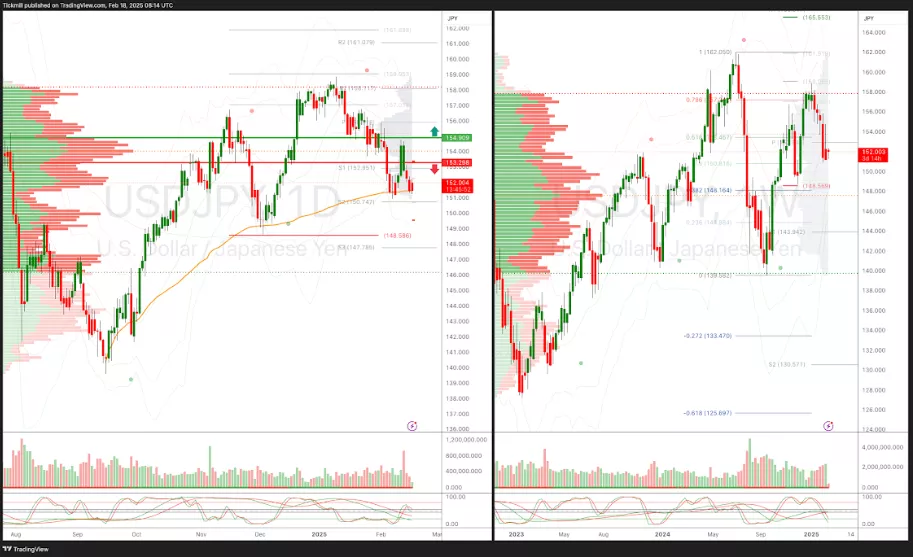

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

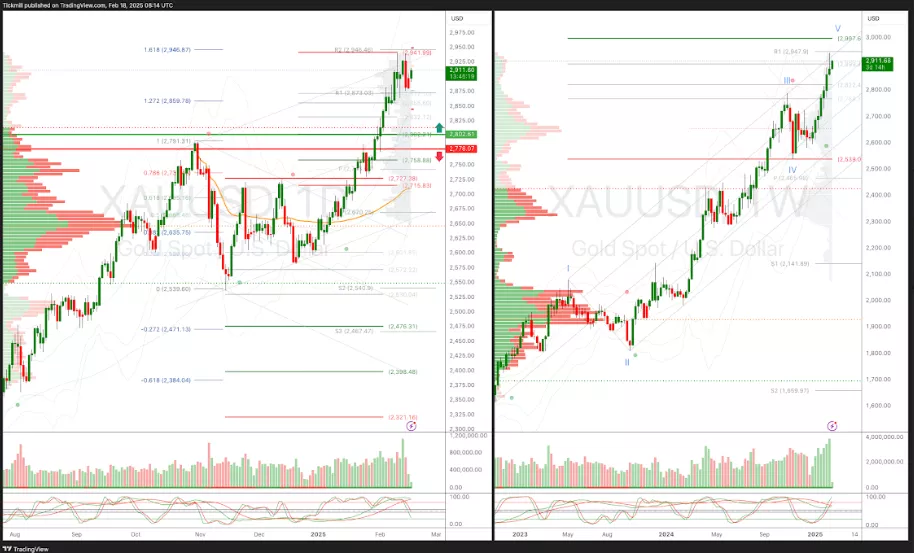

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

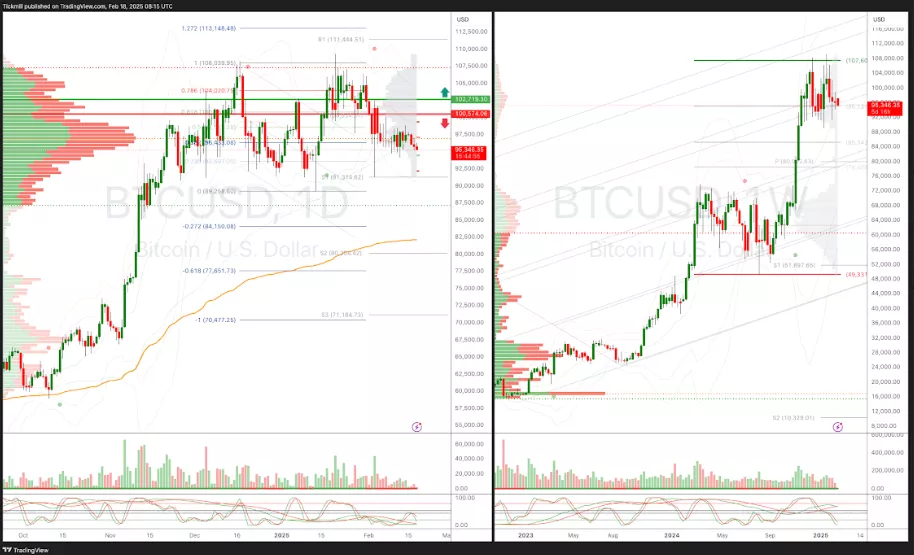

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Targets

The FTSE Finish Line - Monday, Feb. 17

Daily Market Outlook - Monday, Feb. 17