Daily Market Outlook - Wednesday, Feb. 19

Image Source: Pixabay

In Asia, focus has shifted to Chinese technology companies, which have recently shown strong performance, fuelled by the rise of AI startup DeepSeek and a promising dialogue between Xi Jinping and industry leaders that has bolstered optimism. Signs of economic recovery are emerging in China, with DeepSeek providing a significant boost to the tech sector. Despite persistent trade risks, confidence in the technology industry remains robust, as the potential for affordable AI applications inspires a reassessment of growth prospects. Meanwhile, Hong Kong's Hang Seng Index dipped 0.14% due to profit-taking, though it has surged 14% in 2025, vying with Germany's DAX index for the title of the world's best-performing market.

A new day brings fresh threats from "tariff man," Trump, this time targeting pharmaceutical and semiconductor imports. Investors, however, seem to be taking the news in stride, viewing these measures as part of a broader negotiating tactic. U.S. President Donald Trump announced tariffs on pharmaceuticals and semiconductor chips starting at "25% or higher," with the potential to increase significantly throughout the year. He also revealed plans to impose similar tariffs on automobiles by April 2. Trump, who often refers to himself as "tariff man," has been signalling these moves for months, suggesting much of the impact may already be priced into the market. While investors remain cautious, they appear to be looking beyond immediate tariff concerns. Meanwhile, the spotlight is on the strong performance of European stocks early in the year. The pan-European STOXX 600 index hit record highs on Tuesday, nearing a 10% gain for 2025. Futures suggest a subdued market opening. Additionally, the rising probability of increased military spending in Europe, coupled with ongoing peace efforts to resolve the Russia-Ukraine conflict, has lifted defence stocks. With no resolution in sight, the defence sector is poised to mark its ninth consecutive day of gains.

UK CPI inflation reached 3.0% y/y in January, surpassing the BoE's expectations by 0.2ppts, while the services sector rose less than expected to 5.0% y/y. The core inflation rate increased to 3.7% y/y, meeting forecasts. The main contributor to the headline increase was food prices, which rose to 3.1% y/y, exceeding the anticipated 2.4%. The mixed policy outlook suggests that, despite earlier-than-expected inflation, rate cuts by the MPC in March remain uncertain.

Today's macro slate includes US housing starts data, the release of FOMC minutes, and a speech by the Fed’s Jefferson.

Overnight Newswire Updates of Note

- RBNZ Cuts Rates 50bps, Flags Steeper Easing Cycle To Revive Economy

- Japan's Long Rates Hit 15-year High As Domestic Inflation Kicks In

- Trump Says Likely To Impose 25% Tariffs On Autos, Drugs, Chips

- Porsche, BMW Need Germany Pivot For Way Out Of Crisis

- BYD’s Strategy Shift Is Bad News For Global Automakers

- HSBC Sets $300M Savings Goal For 2025 Under Restructuring Plan

- Le Pen Wants to Make France Great Again Without Trump’s Help

- KKR Confronts €449M Earnings Hole As Flagship Italian Deal Sours

- Investors Call For Vote On Any BP Rowback On Climate Goals

- Trump’s Late-Night Posts Send Traders To Asia’s Currency Markets

- Trump’s Commerce Secretary Pick Howard Lutnick Confirmed By Senate

- US Sec Rubio: US Won’t Lift Russia Sanctions Before Ukraine Deal

- FTX Estate Begins To Repay Bankrupt Exchange Creditors In Cash

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0300-15 (7BLN), 1.0350 (1.2BLN), 1.0400-15 (1.5BLN)

- 1.0450 (650M), 1.0480 (685M), 1.0500 (1.8BLN), 1.0550 (637M)

- USD/CHF: 0.9000 (361M), 0.9080-85 (566M). EUR/CHF: 0.9460 (370M)

- GBP/USD: 1.2450 (415M), 1.2560-75 (270M), 1.2650-65 (353M)

- AUD/USD: 0.6325 (607M), 0.6375 (203M), 0.6390 (354M)

- NZD/USD: 0.5650 (525M), 0.5800 (864M)

- USD/CAD: 1.4115 (300M), 1.4200 (367M). EUR/JPY: 156.00 (500M)

- USD/JPY: 151.45-50 (661M), 151.65 (330M), 152.00 (1.5BLN), 152.50 (923M)

CFTC Data As Of 14/2/25

- The Euro holds a net short position of 64,425 contracts, while the Japanese Yen shows a net long position of 54,615 contracts. Bitcoin maintains a net short position of 367 contracts, and the Swiss Franc reports a net short position of 38,745 contracts. The British Pound registers a net short position of 3,168 contracts.

- Equity fund managers have increased their net long position in S&P 500 CME futures by 9,526 contracts, bringing the total to 929,941 contracts. Conversely, equity fund speculators have expanded their S&P 500 CME net short position by 33,021 contracts, reaching a total of 366,233 contracts.

- Speculators shifted to a net long position in CBOT US Treasury bond futures, climbing to 44,001 contracts for the week ending February 11, compared to the previous 4,927 contracts. Additionally, they reduced the net short position in CBOT US ultrabond Treasury futures by 3,675 contracts, now standing at 239,941 contracts. However, speculators increased the net short position in CBOT US 2-year Treasury futures by 79,988 contracts, totaling 1,298,612 contracts, and raised the net short position in CBOT US 10-year Treasury futures by 43,331 contracts, now at 751,034 contracts. Meanwhile, the net short position in CBOT US 5-year Treasury futures was trimmed by 65,931 contracts, bringing the total to 1,861,735 contracts.

Technical & Trade Views

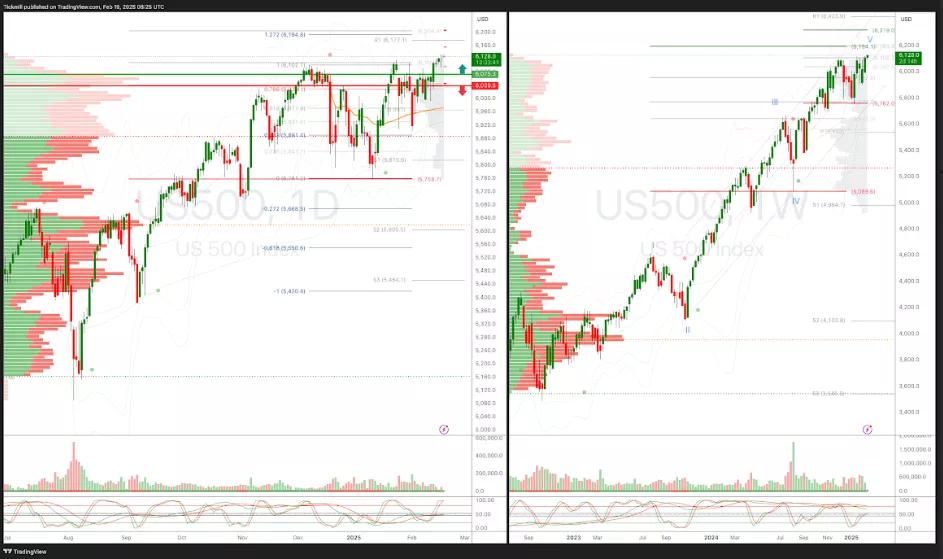

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

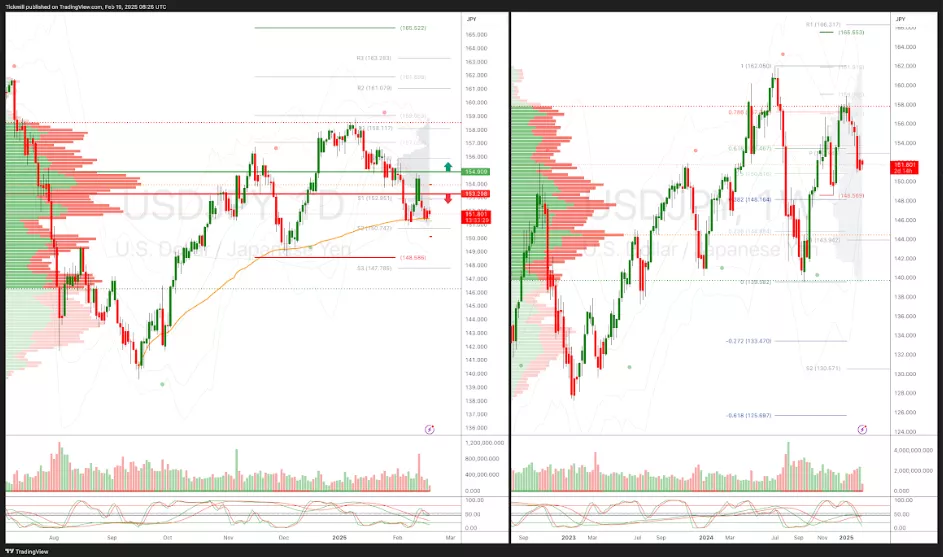

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

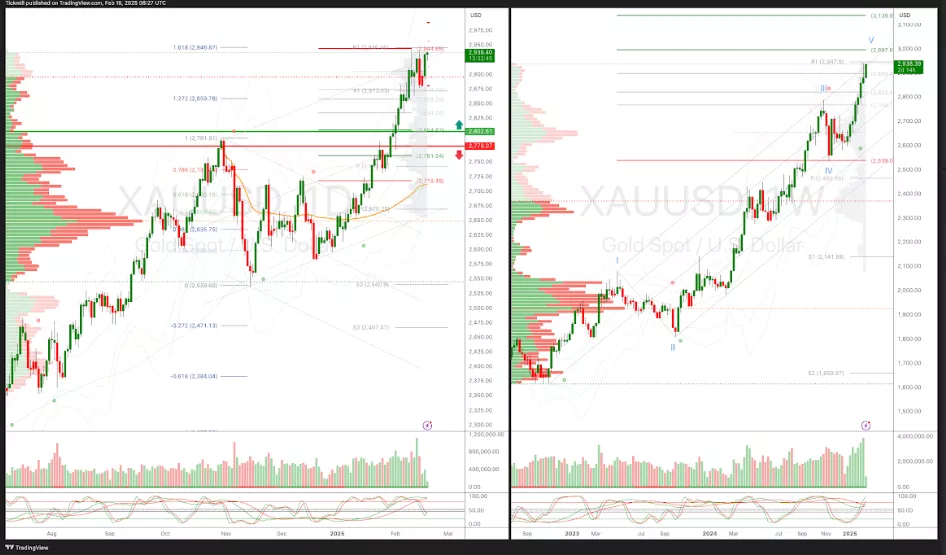

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

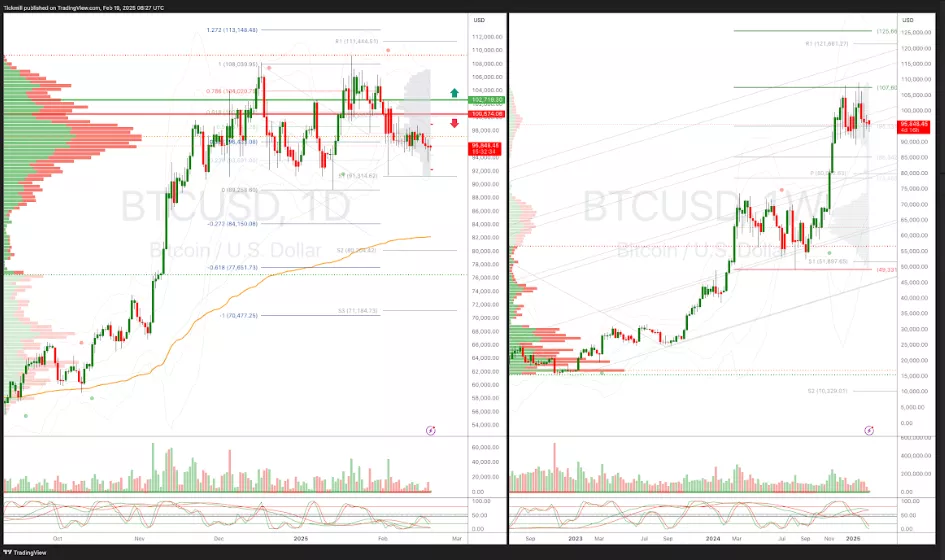

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, Feb. 18

Daily Market Outlook - Tuesday, Feb. 18

S&P 500 Weekly Action Areas & Price Targets