Daily Market Outlook - Thursday, Sept. 4

Image Source: Pixabay

Asian markets stalled as a deepening selloff in Chinese stocks driven by regulatory crackdown concerns overshadowed earlier optimism about potential Federal Reserve policy easing sparked by disappointing US job openings data. Treasuries and the dollar remained steady, while oil prices declined and gold retreated after a seven-day rally. Japanese bond futures gained traction following a closely watched auction of 30-year government bonds, which saw demand levels broadly in line with the 12-month average. In Japan, investors expressed relief as the auction helped ease concerns about demand amid a global debt selloff. Traders had been wary of potential challenges due to domestic political uncertainties and ongoing questions surrounding debt sustainability. Globally, the bond market has seen a surge in activity, with more than $128 billion in debt issued this week alone, drawing strong investor interest for newly offered securities. U.S. stock futures maintained their relief rally increase, as US investors felt more optimistic following remarks from Federal Reserve officials, including Governor Christopher Waller, who affirmed their support for rate reductions in the upcoming months. President Donald Trump's nominee for an open position on the Federal Reserve Board, Stephen Miran, also expressed his commitment to safeguarding the central bank's independence ahead of a Senate confirmation hearing scheduled for later today. Traders are currently estimating a 96.6% chance of interest rate cuts during the Fed's September meeting, based on the CME Group's FedWatch tool.

The July JOLTS report provided further evidence of a cooling U.S. labour market, with job openings declining faster than anticipated during the month. Openings fell from 7.357 million to 7.181 million, marking the lowest level since last September. This brings the number of job openings in line with the number of unemployed individuals, resulting in a ratio of 1.0—a level not seen since the height of the post-pandemic recovery. For comparison, the JOLTS-to-unemployed ratio stood at approximately 1.2 before the pandemic. The hiring trend remained subdued, with 5.308 million hires—just 41,000 above last month’s figure. Separations totalled 5.289 million, leaving net hiring at a mere 15,000, which is weaker than payroll data for the second consecutive month. Within separations, layoffs and discharges rose to 1.808 million, while quits remained unchanged. The continued increase in forced separations suggests that companies are taking a more proactive approach to resizing their workforce, rather than relying solely on slower hiring rates. This marks a shift away from the earlier narrative of labour hoarding. Although the JOLTS data is lagging, it remains a key indicator for the Federal Reserve and aligns with the softening demand reflected in recent downward payroll revisions. In short, this adds another reason for the FOMC to consider a rate cut in September.

Overnight Headlines

- Trump Appeals To The Supreme Court To Preserve His Sweeping Tariffs

- Chancellor Reeves’ Damage Control Budget Raises UK Growth Fears

- US Army Awards Lockheed $9.8B Contract To Bolster Missile Defence

- Australia Trade Surplus Beats Forecast At A$7.31B

- Nidec Shares Plunge 22% On Probe Into Improper Accounting

- Google, Shein Hit With Huge French Fines Over Cookie Breaches

- Salesforce Projects Lacklustre Sales Growth, Fueling AI Anxiety

- HPE Gives Tepid Profit Forecasts, Renews Concern About Margins

- Meta Faces Heat In Singapore Over FB Marketplace Scams

- OpenAI Boosts Size Of Secondary Share Sale To $10.3B

- New Crypto Venture Backed By Trump Sons Surges In Market Debut

- US Treasury Market Banks On Revenue From Trump’s Tariffs

- Exxonmobil Explores Sale Of European Chemicals Plants

- Thousands Of Lloyds Staff Face Axe In Performance Overhaul

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600 (EU2.11 billion), 1.1700 (EU1.66 billion), 1.1470 (EU1.3 billion)

- USD/JPY: 143.20 ($1.15 billion), 147.10 ($970.2 million), 146.50 ($673.4 million)

- AUD/USD: 0.6600 (AUD967.9 million), 0.6445 (AUD945 million), 0.6595 (AUD867.3 million)

- USD/CAD: 1.3755 ($537.1 million), 1.3975 ($482.8 million), 1.3990 ($306.7 million)

- USD/CNY: 6.9500 ($1.9 billion), 7.0500 ($680 million), 6.9800 ($400 million)

- GBP/USD: 1.3150 (GBP743.2 million), 1.3000 (GBP452.3 million), 1.3400 (GBP389.8 million)

- USD/BRL: 5.3900 ($470 million), 5.4300 ($374.3 million), 5.7650 ($348 million)

- USD/MXN: 18.80 ($612.3 million), 18.40 ($320 million)

- EUR/GBP: 0.8670 (EU409.4 million), 0.9000 (EU311.1 million)

CFTC Positions as of the Week Ending August 29

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 15,030 contracts, bringing the total to 36,013. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 6,783 contracts, resulting in a total of 248,945. Speculators have cut their net short position in CBOT US 10-year Treasury futures by 61,687 contracts, now totaling 883,829. The net short position in CBOT US 5-year Treasury futures has been trimmed by 44,412 contracts, down to 2,463,971. Meanwhile, the net short position in CBOT US 2-year Treasury futures decreased by 61,457 contracts to 1,263,082.

- Equity fund managers have boosted their net long position in S&P 500 CME by 3,284 contracts, leading to a total of 867,359. In contrast, equity fund speculators have increased their net short position in S&P 500 CME by 62,459 contracts, now totaling 428,262.

- The net long position in Japanese yen stands at 84,484 contracts, while the euro net long position is at 123,039 contracts. The British pound has a net short position of -31,353 contracts, and the Swiss franc shows a net short position of -26,978 contracts. Lastly, Bitcoin holds a net short position of -372 contracts..

Technical & Trade Views

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

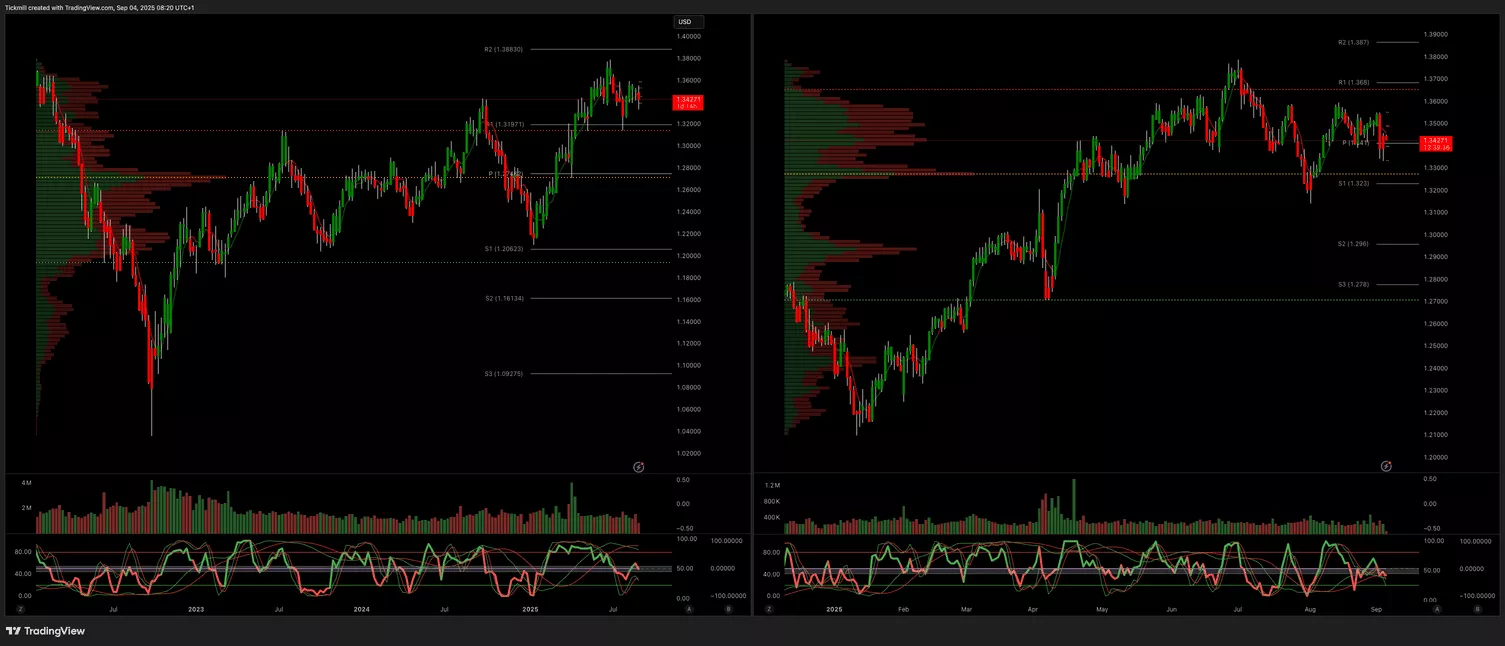

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3450 Target 3600

- Below 3300 Target 3260

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, Sep. 3

Daily Market Outlook - Wednesday, Sept. 3

The FTSE Finish Line - Tuesday, Sep. 2