The FTSE Finish Line - Tuesday, Sep. 2

Image Source: Pexels

UK stocks declined on Tuesday, pressured by banks, utilities, and real estate companies that are sensitive to interest rates, as investor worries about the country's financial situation grew. Britain's borrowing costs for 30 years reached their highest point in more than 27 years, while the value of the pound dropped nearly 1% due to investor concerns regarding the UK's financial management. The yield on 30-year gilts climbed to 5.69%, an increase of five basis points for the day, marking the highest level since May 1998. Markets are questioning if Reeves can balance responsibility with results. The Budget will be a pivotal moment for her. Should she stumble, borrowing costs will escalate, the value of sterling will decline, and confidence will wane. Banking stocks, which had seen a slight recovery in the last session following declines on Friday, dropped about 1% each for NatWest, Barclays, and Lloyds today. They fell on Friday after a think-tank proposed a new tax on lenders as a potential means for Reeves to generate revenue. The real estate sector also saw a decline, with Rightmove and Segro decreasing by 2.7% and 2.2%, respectively. The homebuilders' index dropped 2.7%, while utility stocks fell as well, with SSE down by 2.7% and United Utilities down by 2.8%.

-

Shares of the biotech company Oxford Nanopore Technologies fell by 9.3% to 168.05p. The company maintains its full-year guidance, despite anticipations of a possible upgrade. A Peel Hunt analyst comments that some investors overlooked that there was a pull-forward of revenues due to a new 'capex first' pricing strategy. The analyst also notes it’s realistic to think that this initial surge in revenue may decrease over time, potentially affecting future sales of flow cell products and other consumables. ONT transitioned from a "lease" model, in which machines were available for free with a commitment to purchase flow cells, to a "capex first" model that requires upfront payments for equipment. ONT reported half-year revenue of £105.6 million ($142.66 million), marking a 28% increase on a constant currency basis, driven by growth in Asia and Europe. When including session gains, the stock has risen approximately 43% year-to-date.

-

Shares of Ecora Resources have risen 3.5% to 76p, marking its highest point since June 2024. The critical minerals-focused royalty company is the top percentage gainer on the FTSE small cap index, which has dipped by 0.82%. The company plans to sell its Dugbe Gold royalty to a subsidiary of Elemental Altus Royalties Corp. for up to $20 million. Including recent movements, the stock has increased by 18.6% year-to-date, while the FTSE Composite Index is up 3.6%.

-

Ithaca Energy, a producer of oil and gas in the North Sea, saw its stock drop by 14.5% to 203p, marking its largest percentage loss in a single day. The stock was the worst performer among all companies listed in London. Israel's Delek Group and Italy's Eni raised approximately £106 million ($143.2 million) by selling shares in the company. Ithaca's two main shareholders sold 49.6 million shares at 213.75p, which accounts for about 3% of the company’s total outstanding stock. Despite this decline, Ithaca's shares have surged by 115.1% this year, as of the last closing.

Technical & Trade View

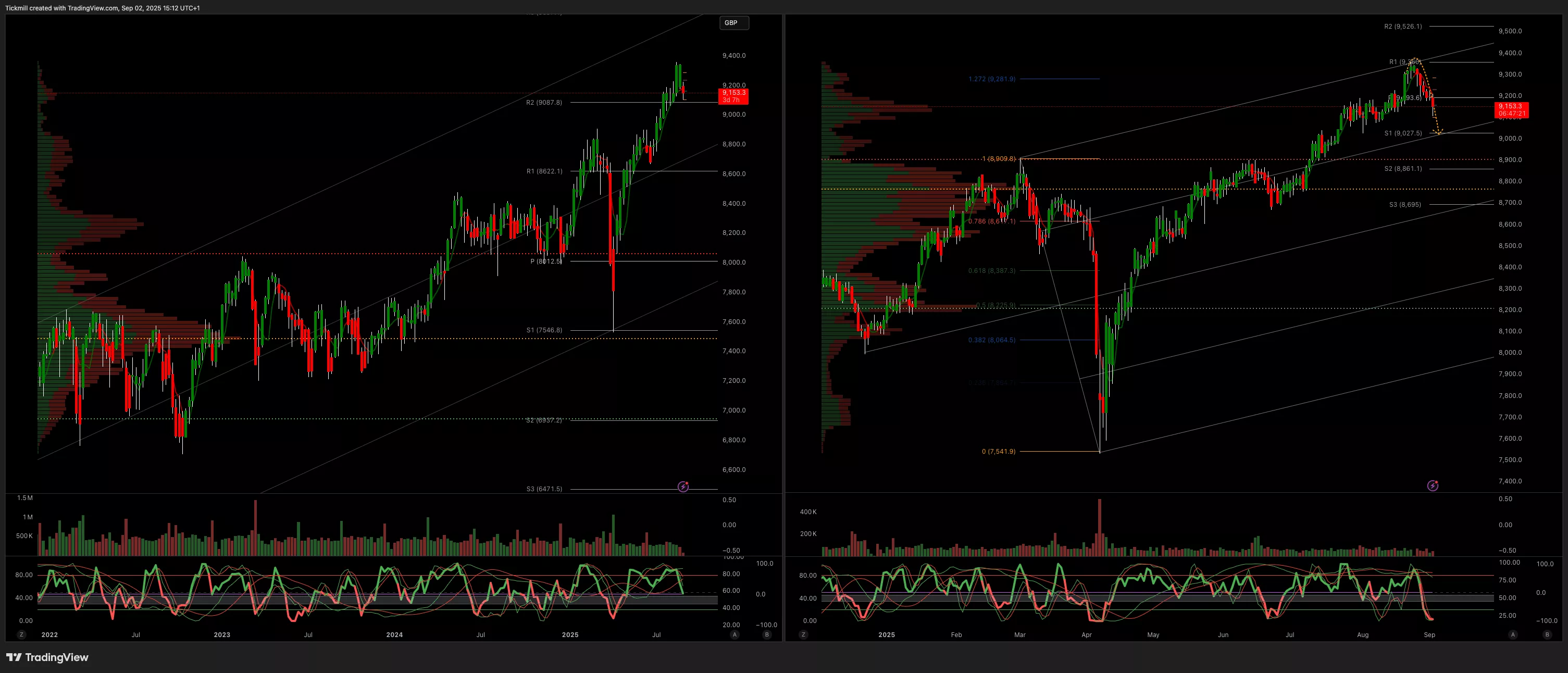

FTSE Bias: Bullish Above Bearish below 9000

- Primary support 9000

- Below 8900 opens 8600

- Primary objective 9600

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Sept. 2

Daily Market Outlook - Friday, Aug. 29

The FTSE Finish Line - Thursday, Aug. 28