Daily Market Outlook - Tuesday, Sept. 2

Image Source: Pexels

Stocks remained relatively stable as traders awaited guidance from Wall Street's reopening after the long weekend, which historically marks the weakest month for US shares. Asian market indicators showed minor fluctuations between gains and losses, while equity-index futures in the US and Europe fell slightly. Gold prices reached a new peak on Tuesday, as speculators anticipated the Federal Reserve to reduce interest rates this month. The Treasury curve steepened as cash trading resumed post-holiday. The yield on the 10-year benchmark rose by almost 2 basis points to 4.25%. Oil prices increased as focus turned to the upcoming OPEC+ meeting. In Japan, 10-year bonds climbed following the highest auction since 2023. The Yen depreciated by 0.3% against the Dollar, with no new insights into the interest rate outlook from BoJ's Himino's speech. Additionally, Trump mentioned that India proposed to reduce its tariff rates after the US imposed 50% duties last week in response to India’s imports of Russian oil.

Investors are preparing for a jobs report from the U.S. on Friday, which will impact the Federal Reserve's short-term policy decisions. There is a widespread expectation of a 25 basis-point rate cut during the September meeting. Continued criticism of the Fed by President Donald Trump has made investors cautious, particularly with Trump's attempts to dismiss Governor Lisa Cook raising concerns over potentially more dovish appointments at the central bank. Treasury Secretary Scott Bessent's remarks further fueled worries about the Fed's independence and credibility. "The Fed should be independent. The Fed is independent, but I also believe they have made several errors," Bessent stated in a recent interview.

At the heart of the issue in next week’s confidence vote on the French government is the proposed €44bn of budget savings put forward by PM Bayrou. That equates to ~£38bn, not out of the realm of the potential scale of the fiscal challenge the OBR will present Reeves with for the UK’s Autumn Budget. Of course, the politics are very different with a minority government fighting for opposition party support in France, versus a working majority of 156 for the UK Labour Party. So, in theory, limited read-across from France to the UK, but it won’t be completely irrelevant. Defiance from the French opposition could further embolden rebels within Labour’s ranks, but in the scenario of a disorderly fallout from a lost confidence vote in France the UK government could find it easier to corral fiscal liberals to back new tightening measures, especially on tax. After all, with long-dated gilts underperforming US Treasuries by a further 15bps in August and the outright level of 30yr yields rising above 5.60%, the UK has little room for manoeuvre. Add in dynamics with inflation-linked debt and QT mechanics and the UK’s debt servicing costs look less favourable versus France (see chart), a partial offset to some of the relative political stability.

Overnight Headlines

- China’s Margin Trades Surge To Record As Stock Rally Extends

- Gold Holds Close To Record As Demand For Precious Metals Surges

- BoJ’s Deputy Chief Steers Clear Of Hinting At Rate Hike Timing

- Australia’s No. 2 Pension Cuts Treasuries Bet On Rising US Risks

- Trade Adds To Aussie's Q2 Growth, Govt Spending Underwhelms

- Trump Family Amasses $5B Fortune After Crypto Launch

- Russia Intensifies Strikes In Ukraine, Defying Trump’s Peace Deadlines

- Syria Ships First Oil Cargo In Years After Trump Ended Sanctions

- EU Nations Seek To Close Off Loopholes For Russian Gas Flows

- Sterling Faces Hit From Unfavourable Inflation, Growth Mix

- Deutsche Bank To Rejoin Euro Stoxx 50 After Seven-Year Absence

- Trump Weighs Declaring National Housing Emergency, Bessent Says

- CapVest Jumps Into PE Big Leagues With €10B Stada Buyout

- Saudi Arabia, Iraq Stop Oil Shipments To Nayara After Sanctions

- Amazon To Invest $4.4B In New Zealand Data Centres

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1650-55 (1BLN), 1.1670 (906M), 1.1695-1.1700 (1.9BLN)

- 1.1745-55 (1.5BLN)

- EUR/CHF: 0.9350 (382M)

- AUD/USD:0.6500-10 (337M), 0.6550 (328M)

- USD/JPY: 146.95-147.00 (408M), 147.35-40 (410M), 148.30 (335M)

- EUR/JPY: 171.80 (258M), 172.00 (160M)

- AUD/JPY: 95.20 (905M)

CFTC Positions as of the Week Ending August 29

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 15,030 contracts, bringing the total to 36,013. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 6,783 contracts, resulting in a total of 248,945. Speculators have cut their net short position in CBOT US 10-year Treasury futures by 61,687 contracts, now totaling 883,829. The net short position in CBOT US 5-year Treasury futures has been trimmed by 44,412 contracts, down to 2,463,971. Meanwhile, the net short position in CBOT US 2-year Treasury futures decreased by 61,457 contracts to 1,263,082.

- Equity fund managers have boosted their net long position in S&P 500 CME by 3,284 contracts, leading to a total of 867,359. In contrast, equity fund speculators have increased their net short position in S&P 500 CME by 62,459 contracts, now totaling 428,262.

- The net long position in Japanese yen stands at 84,484 contracts, while the euro net long position is at 123,039 contracts. The British pound has a net short position of -31,353 contracts, and the Swiss franc shows a net short position of -26,978 contracts. Lastly, Bitcoin holds a net short position of -372 contracts..

Technical & Trade Views

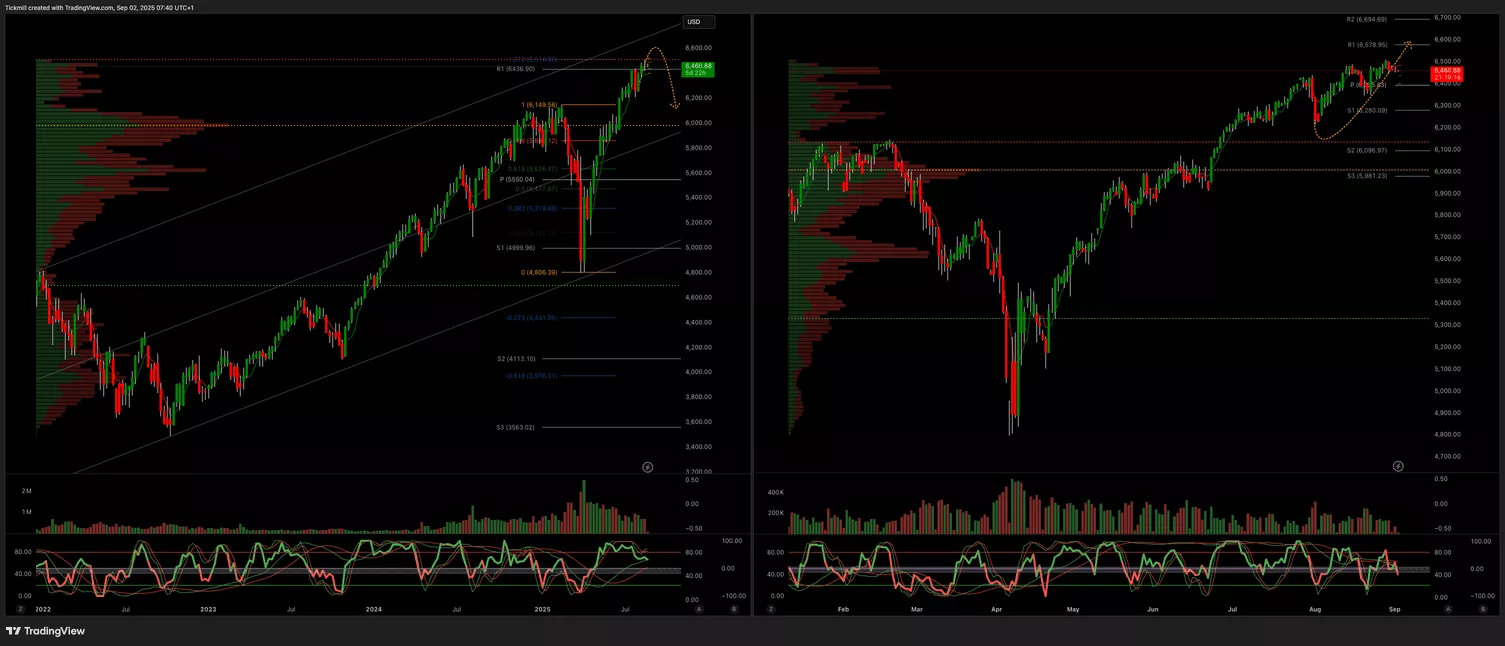

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3450 Target 3600

- Below 3300 Target 3260

(Click on image to enlarge)

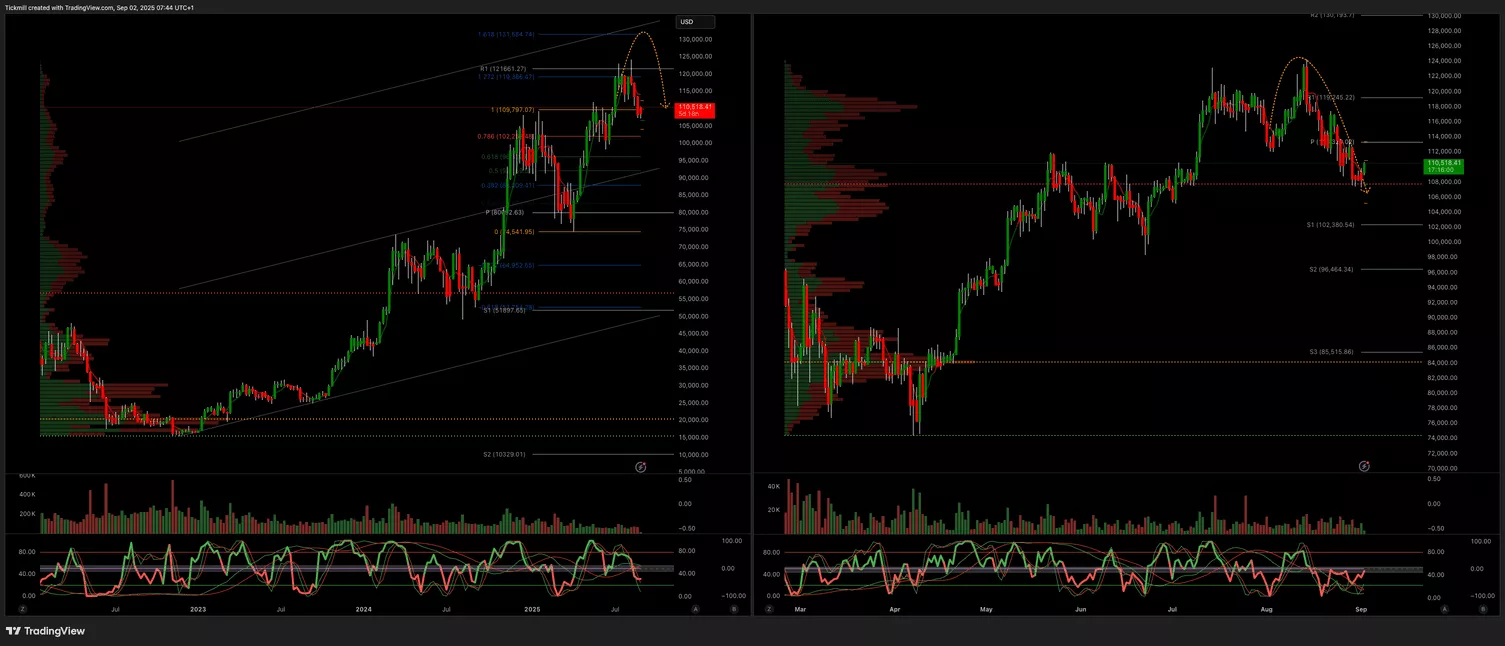

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Aug. 29

The FTSE Finish Line - Thursday, Aug. 28

Daily Market Outlook - Thursday, Aug. 28