The FTSE Finish Line - Wednesday, Sep. 3

Image Source: Pexels

UK shares bounced back on Wednesday, driven by strong performances in healthcare and mining stocks, following their steepest decline in nearly five months during the prior session due to fiscal worries. However, early gains faded by the close as investor caution over the fiscal outlook resurfaced, pushing the benchmark index into negative territory for the day.British Finance Minister Rachel Reeves announced that she would present her annual budget on November 26, highlighting a "strict control" on public expenditures to aid in reducing inflation and borrowing costs. There has been increased market scrutiny of the UK amid worries regarding fiscal management, leading to concerns that tax increases might hinder growth without significantly enhancing revenue. On that day, yields on 20- and 30-year British gilts climbed to their highest levels since 1998, surpassing the previous day's peaks while the pound continued to experience significant declines. In response UK PM Starmer has bolstered his economic team by naming Darren Jones as chief secretary to the prime minister and enlisting former Deputy Governor of the Bank of England, Minouche Shafik, as an economic advisor. Although these appointments might improve the government's economic reputation, they also indicate a pressing urgency that could negatively impact sterling if the budget does not instill confidence. Precious metal mining stocks saw increases as gold prices soared to a new record high. Fresnillo and Hochschild Mining shares rose by 6.1% and 6.5%, respectively. Additionally, industrial miners like Glencore, Anglo American, and Antofagasta also gained more than 2.5%.

-

Shares of British insurer and asset manager M&G dropped 2.6% to 250p, making it the biggest loser on the FTSE 100 index, which is down 0.1%. The company fell short of market expectations for its half-year adjusted operating profit, reporting 375 million pounds ($506.59 million), below analysts' consensus of 398 million pounds. They also reported net inflows of 2.6 billion pounds, reversing last year's outflows. With the current session's losses, the stock is down 25.8% year-to-date, while the FTSE 100 has fallen by 0.1%.

-

Ashtead's shares rise by 2.7% to 5,522p, making it the top percentage gainer on the FTSE 100 index. The British construction equipment rental company reported Q1 revenue of $2.80 billion, up from $2.75 billion a year earlier. The company is making headway on its NYSE re-listing, which is planned for March 2026. It has reaffirmed its FY revenue and capital expenditure guidance and has increased its projections for free cash flow to between $2.2 billion and $2.5 billion, up from $2 billion to $2.3 billion. Year-to-date, Ashtead has seen a 10.8% gain, while the FTSE 100 has increased by 11.7%.

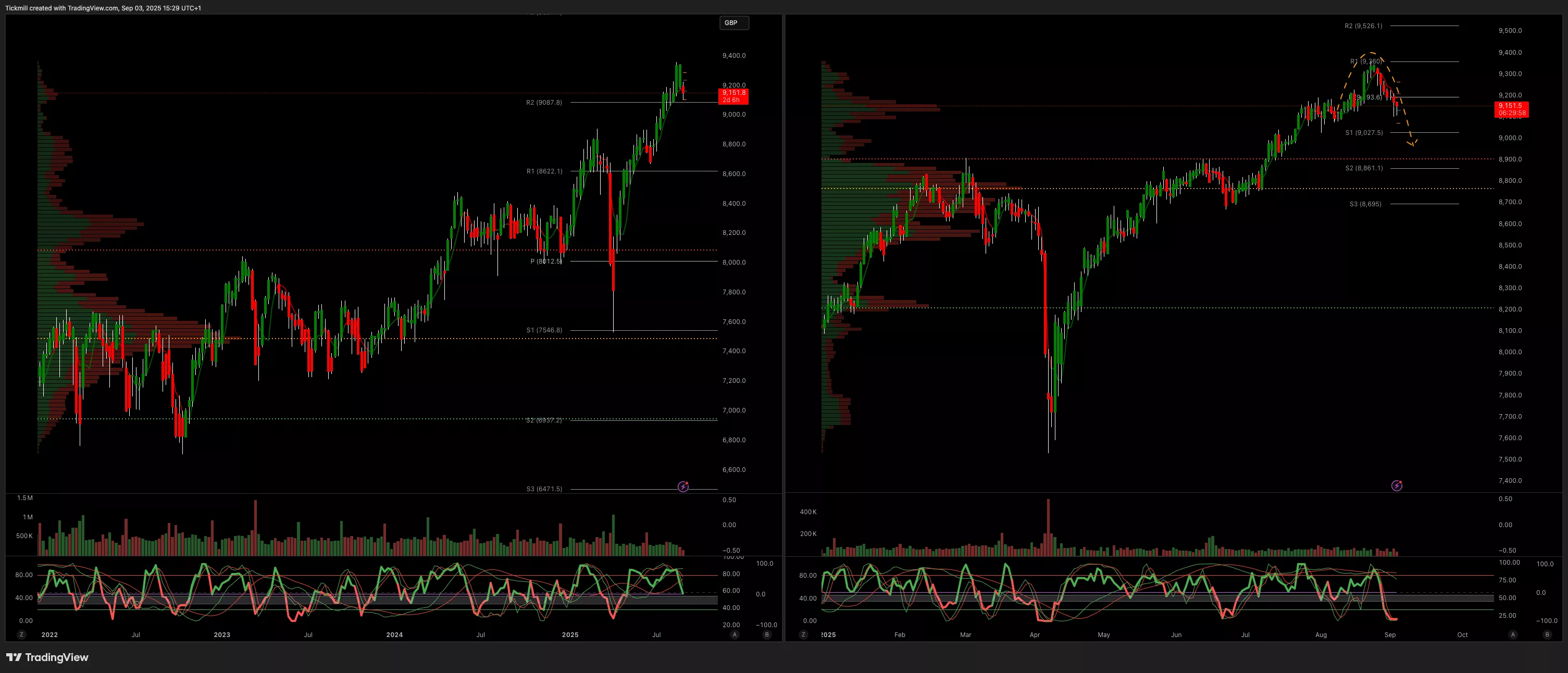

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

- Primary support 9000

- Below 8900 opens 8600

- Primary objective 9600

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Sept. 3The FTSE Finish Line - Tuesday, Sep. 2

Daily Market Outlook - Tuesday, Sept. 2