Daily Market Outlook - Wednesday, Sept. 3

Image Source: Pixabay

Japanese bonds experienced a decline in line with a global trend as a surge in corporate debt issuances and concerns regarding the budgets of developed nations weighed down European fixed-income assets and Treasuries. Rising yields affected the markets, leading to Asian stocks hitting their lowest point in three weeks. Yields on 20-year Japanese government bonds rose to levels not observed since 1999, while 30-year yields reached their highest since being introduced. Longer-dated German bond futures dropped for the fifth consecutive session. US 30-year bond yields remained close to 5% following an increase on Tuesday that had repercussions on Wall Street. The Yen weakened amid political uncertainties in Japan, coinciding with a rise in the Dollar index for the second consecutive day. Treasuries fell on Tuesday, mirroring declines in longer-term European bonds at the beginning of a month typically challenging for debt markets. The vulnerability of global long-term government debt is attributed to extensive spending that requires more bond issuances for funding, along with a general lack of trust in sovereign debt. In Japan, investors are concerned about political instability following a key political figure in support of PM Ishiba announcing he would resign as secretary-general of the Liberal Democratic Party if Ishiba agrees to specific conditions.

The UK Budget is expected on Wednesday, 26 November, according to political journalists, following No.10’s indication of a timeline in the second half of November. If confirmed, the OBR's debt servicing cost calculations will rely on gilt yield observations from 2-15 October. Current yield levels suggest half of the government’s £9.9bn fiscal headroom has been eroded since the Spring Statement. Rising gilt yields pose challenges, but the bigger risk may come from the OBR revising overly optimistic GDP forecasts. Market scepticism over a tax-led fiscal approach has further pressured yields and the exchange rate. While the Budget process has formally begun, it leaves up to 12 weeks of uncertainty for market participants.

ECB Governor Isobel Schnabel expressed a hawkish stance in a Reuters interview, citing tariff risks and rising food prices as drivers of upward price pressures. She argued policy was already mildly accommodative, dismissing calls for further rate cuts. August Eurozone inflation data showed headline CPI at 2.1% y/y (up from 2.0% due to rounding) and core CPI steady at 2.3% y/y, with services prices dropping to their lowest since March 2022. Unlike the US and UK, Eurozone disinflation is expected to persist, aided by a stronger euro, which Schnabel viewed neutrally but implied could support her inflation outlook. Europe's chemical sector faces new challenges as U.S. import tariffs disrupt trade, delaying orders and weakening demand amid recovery efforts from the 2022 energy crisis. The EU's fourth-largest exporting industry, worth €655 billion, struggles with high production costs caused by soaring energy prices after Russia's invasion of Ukraine. Slowing demand and U.S. tariffs of at least 15% on EU goods have impacted key customer sectors like automotive, machinery, and consumer goods, forcing some companies to close sites and cut jobs. Global automakers have suffered significant losses due to the trade war initiated under President Donald Trump.

Overnight Headlines

- Trump Will Ask Supreme Court For ‘Expedited Ruling’ On Tariffs Appeal

- Gold Extends Gains To Fresh Record On Rate-Cut Bets, Debt Fears

- Australia’s Growth Beats Forecasts, Boosts RBA Case To Hold

- Japan’s Long Bonds Join Global Slide As Politics Adds To Jitters

- US Revokes TSMC’s Fast-Track China Export Status As Controls Tighten

- Xi’s Parade Shows Off Energy Weapons, Robot Dogs And New Missiles

- China’s Chemicals Makers Reap Reward Of Shift From Oil To Coal

- Oil Futures Gain On Geopolitical Premium

- Putin’s Energy Wins In China Deal A Blow To Trump’s Export Push

- Lavrov: Russia Expects Ongoing Talks, Tied To Territorial Changes

- OpenAI To Buy Product Testing Startup Statsig For $1.1B

- Anthropic Valuation Hits $183B In New $13B Funding Round

- Apple’s Lead AI Researcher Heads To Meta As Part Of Latest Exits

- Alimentation Couche-Tard Logs Lower Profit, Revenue In First Quarter

- US Judge Rules Google Will Not Have To Sell Off Chrome

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1575-85 (1.2BLN), 1.1590-1.1600 (2.6BLN), 1.1610-15 (635M)

- 1.1625 (921M), 1.1650 (1.1BLN), 1.1675-80 (2.1BLN), 1.1700 (1.5BLN)

- USD/CHF: 0.8030 (636M). EUR/CHF: 0.9375 (195M), 0.9400 (240M)

- EUR/GBP: 0.8750 (445M)

- GBP/USD: 1.3325-30 (230M), 1.3350 (475M), 1.3400 (265M)

- AUD/USD: 0.6440-50 (682M), 0.6475 (781M), 0.6600 (465M)

- NZD/USD: 0.5790-0.5800 (407M), 0.5865 (226M)

- USD/CAD: 1.3850 (472M), 1.3880-85 (494M). CHF/JPY: 183.00 (342M)

- USD/JPY: 148.00 (1BLN), 148.50 (811M), 149.00 (642M), 149.90-150.00 (1.5BLN)

CFTC Positions as of the Week Ending August 29

- Speculators have reduced their net short position in CBOT US Treasury bonds futures by 15,030 contracts, bringing the total to 36,013. They have also increased their net short position in CBOT US Ultrabond Treasury futures by 6,783 contracts, resulting in a total of 248,945. Speculators have cut their net short position in CBOT US 10-year Treasury futures by 61,687 contracts, now totaling 883,829. The net short position in CBOT US 5-year Treasury futures has been trimmed by 44,412 contracts, down to 2,463,971. Meanwhile, the net short position in CBOT US 2-year Treasury futures decreased by 61,457 contracts to 1,263,082.

- Equity fund managers have boosted their net long position in S&P 500 CME by 3,284 contracts, leading to a total of 867,359. In contrast, equity fund speculators have increased their net short position in S&P 500 CME by 62,459 contracts, now totaling 428,262.

- The net long position in Japanese yen stands at 84,484 contracts, while the euro net long position is at 123,039 contracts. The British pound has a net short position of -31,353 contracts, and the Swiss franc shows a net short position of -26,978 contracts. Lastly, Bitcoin holds a net short position of -372 contracts..

Technical & Trade Views

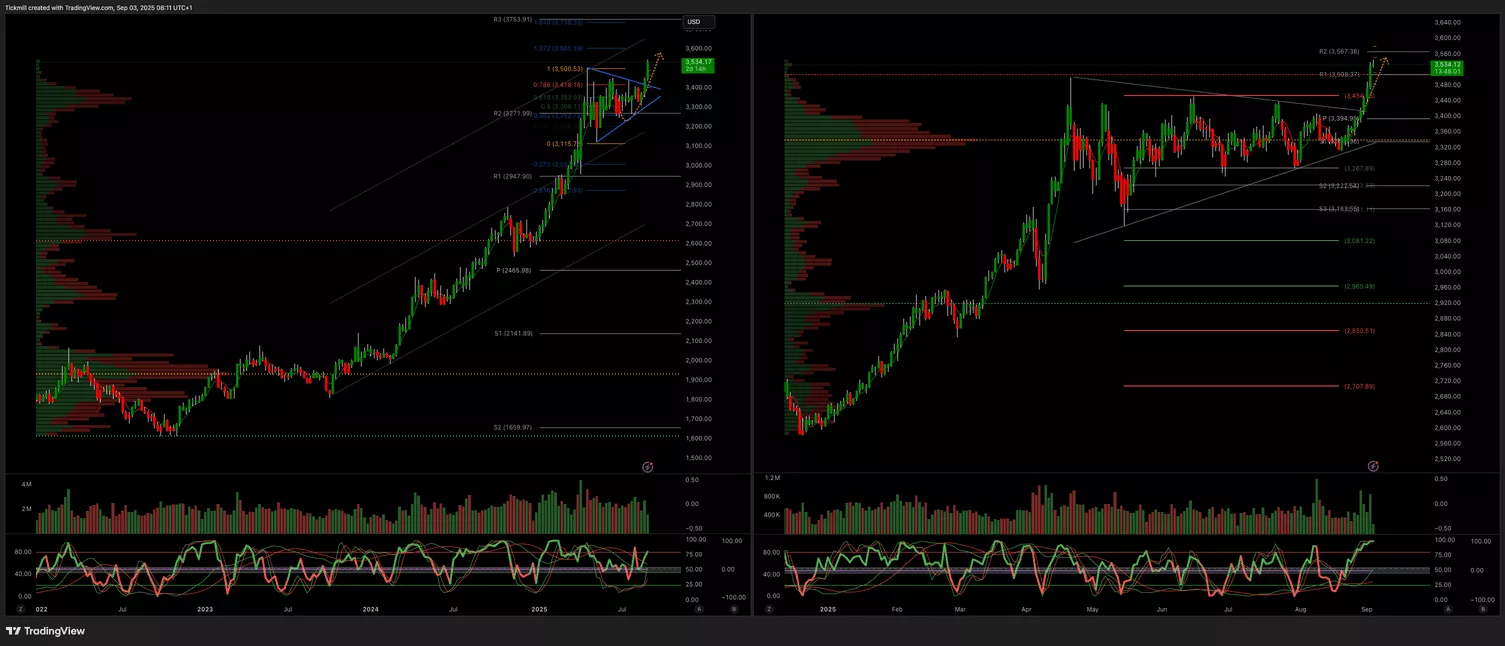

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6440 Target 6600

- Below 6420 Target 6370

(Click on image to enlarge)

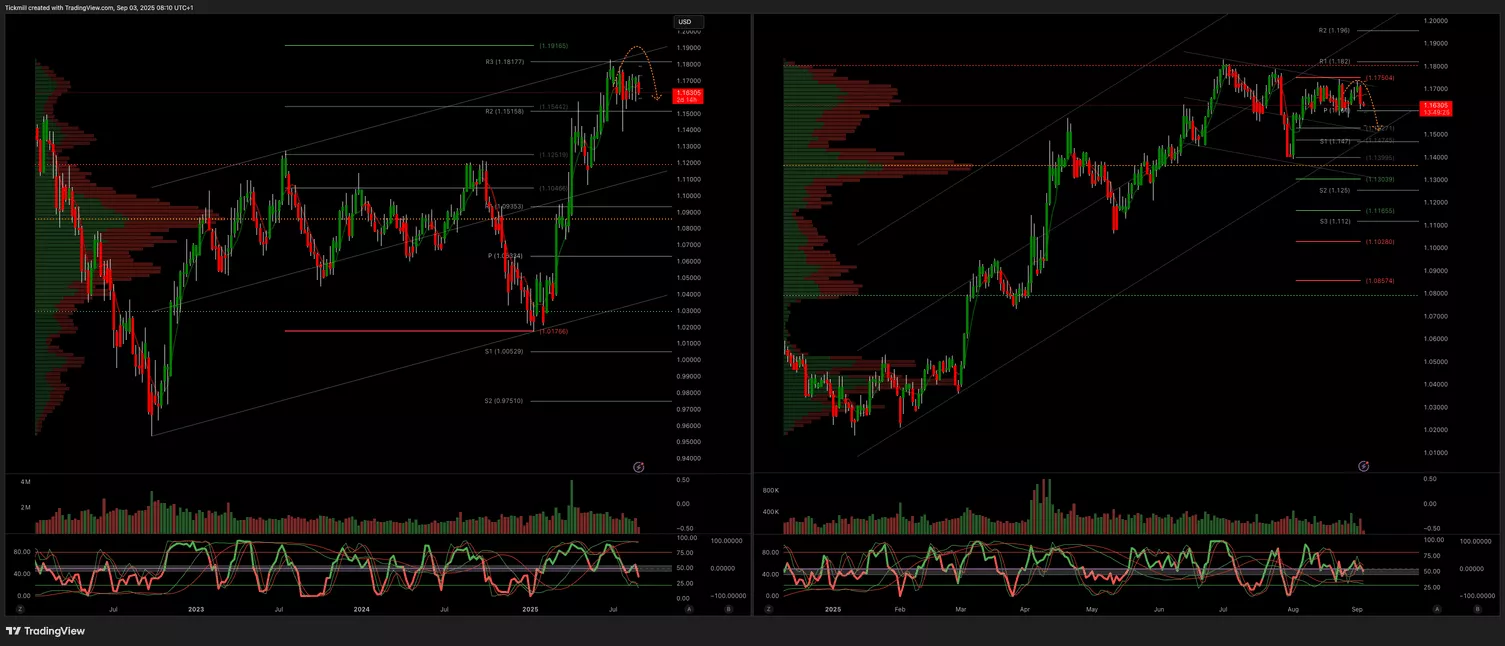

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3450 Target 3600

- Below 3300 Target 3260

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 110k Target 118k

- Below 109k Target 105k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, Sep. 2

Daily Market Outlook - Tuesday, Sept. 2

Daily Market Outlook - Friday, Aug. 29