Daily Market Outlook - Thursday, Nov. 27

Image Source: Pixabay

Global stocks were close to recouping their losses from November as increasing expectations for interest rate cuts by the Federal Reserve revitalised the market after a downturn due to fears of inflated AI valuations. On Thursday, the MSCI All Country World Index gained for the fifth straight session, bringing its November deficit down to 0.5%, which follows seven months of consistent growth. Similarly, Asian stocks gained 0.5% on Thursday, reducing their November losses to 2%. The U.S. markets are closed on Thursday for Thanksgiving and will have a brief trading session on Friday; Wall Street is on track to break a three-week losing trend. Japan's Nikkei and South Korea's Kospi recorded increases of over 1%. China's focus turned to the property sector following a proposal to delay payments on local bonds, which led some financial instruments to drop to historic lows. Bitcoin soared past 91k. The activity across different asset classes reflects a careful optimism in global markets after tech valuation concerns negatively impacted stocks earlier this month. Sentiment has been further lifted by the possibility of a pro-rate-cutting official being appointed as the next head of the Fed. In the commodities market, oil prices decreased as investors monitored US-led attempts to address the violence in Ukraine and awaited an OPEC+ meeting scheduled for this weekend.

Gilts surged as the early OBR report revealed the government’s fiscal headroom had more than doubled to £21.7 billion. One perspective is that the government made difficult decisions, raising taxes to address a gap caused by unfavourable OBR productivity revisions. However, the backloaded nature of these tax hikes raises questions about their execution while also overlooking critical elements of the OBR forecast. For instance, the 0.3 percentage point reduction in assumed productivity growth alone would have slashed £16 billion from tax revenues, all else being equal—but it wasn’t. In fact, the OBR’s pre-measures tax receipts forecast for 2029-30 was revised upward by £16 billion. This upward revision partly reflects expectations of higher inflation and wage growth. However, a key factor appears to be a shift in GDP composition. On the income side, the economy is now more reliant on wage growth than corporate profits; on the expenditure side, consumption is playing a bigger role compared to investment. These changes have significant implications for tax revenues, as labor income carries an effective tax rate of 40%, compared to just 17% for corporate profits. Similarly, consumption has an effective tax rate of 10%, while investment, due to allowances, effectively sits at -10%. In essence, the OBR has offset the drag from lower productivity growth with the boost from a more tax-rich GDP composition. That said, uncertainty looms large. The OBR’s sensitivity analysis shows that a 1 percentage point drop in the overall effective tax rate could reduce the current budget balance by £35 billion in 2029-30—more than enough to wipe out the £21.7 billion fiscal headroom. While the initial market reaction was upbeat for gilts, the question remains: has one optimistic OBR assumption simply been swapped for another?

The budget’s short-term currency impact appears limited, but it highlights deeper economic issues for the UK, reinforcing Sterling's long-term challenges. Policy leaks unsettled markets, leading to downside risk positioning for GBP. The pound’s rally during the Chancellor’s presentation seems reasonable as uncertainties eased, but the overall policy mix remains problematic. Inflationary pressures persist due to expanded welfare provisions, pension increases, and higher minimum wage. While nominal growth aids fiscal drag and debt sustainability, real growth remains absent. Tax hikes are delayed, impacting confidence and complicating the tax system. Supply-side measures are minimal, relying on uncertain planning reforms. Sterling remains overvalued and needs to weaken to support the domestic economy amidst growth risks.

Overnight Headlines

- UK Taxes Hiked To ‘All-Time High’ By Reeves As Growth Forecasts Cut

- Bets Surge On Kevin Hassett Becoming Next Fed Chair

- Fed's Beige Book: Economic Activity Little Changed

- Prosecutor Declines To Pursue Georgia Election Case Against Trump

- ECB's Lane: ECB Still Needs To See Slowdown In Non-Energy Inflation

- ECB’s Guindos Sees ‘Limited’ Risk That Inflation Will Undershoot

- ECB's Vujcic: Should Cut Only If Inflation Path Points Downward

- Italy Could Slightly Raise Corporate Tax On Larger Banks

- France’s Macron To Meet Xi Jinping During China Trip Next Week

- Japan To Issue Over $73.5 Bln In New Bonds To Fund Stimulus

- BP's Whiting Refinery Returns To Normal Operations After October Fire

- HSBC Backs AI Rally, Predicting S&P 500 At 7,500 By End-2026

- Rio Said To Seek Sale Of Some Critical Minerals Assets In US

- Anthropic CEO Called To Testify On Chinese AI Cyberattack

- Pentagon Cited Alibaba On China Military Aid In Oct. 7 Letter

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1500 (297M), 1.1520-25 (375M), 1.1550-55 (504M)

- 13.1575-85 (1.71BLN), 1.1590-00 (680M),

- USD/JPY: 154.00 (665M), 155.65-75 (851M), 157.00 (277M)

- USD/CHF: 0.7920 (693M), 0.8050 (389M), 0.8240 (279M)

- GBP/USD: 1.3080 (200M)

- AUD/USD: 0.6425-30 (330M), 0.6490-00 (553M), 0.6540 (330M)

- 0.6650 (728M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Data for the week ending September 30 published Wednesday. October 14 data next Tuesday (Nov 25). Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions for the Week Ended October 7th:

- - S&P 500 CME net short: +20,343 contracts (458,398 total)

- - S&P 500 CME net long: +9,589 contracts (944,434 total)

- - CBOT US 5-year Treasury net short: +3,838 contracts (2,267,738 total)

- - CBOT US 10-year Treasury net short: +48,050 contracts (787,958 total)

- - CBOT US 2-year Treasury net short: +12,837 contracts (1,219,958 total)

- - CBOT US UltraBond net short: +7,409 contracts (266,858 total)

- - CBOT US Treasury bonds net short: -16,378 contracts (62,352 total)

- - Bitcoin net short: -1,108 contracts

- - Swiss franc net short: -27,470 contracts

- - British pound net short: -4,476 contracts

- - Euro net long: 118,365 contracts

- - Japanese yen net long: 46,307 contracts

Technical & Trade Views

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6734 Target 6834

- Below 6701 Target 6631

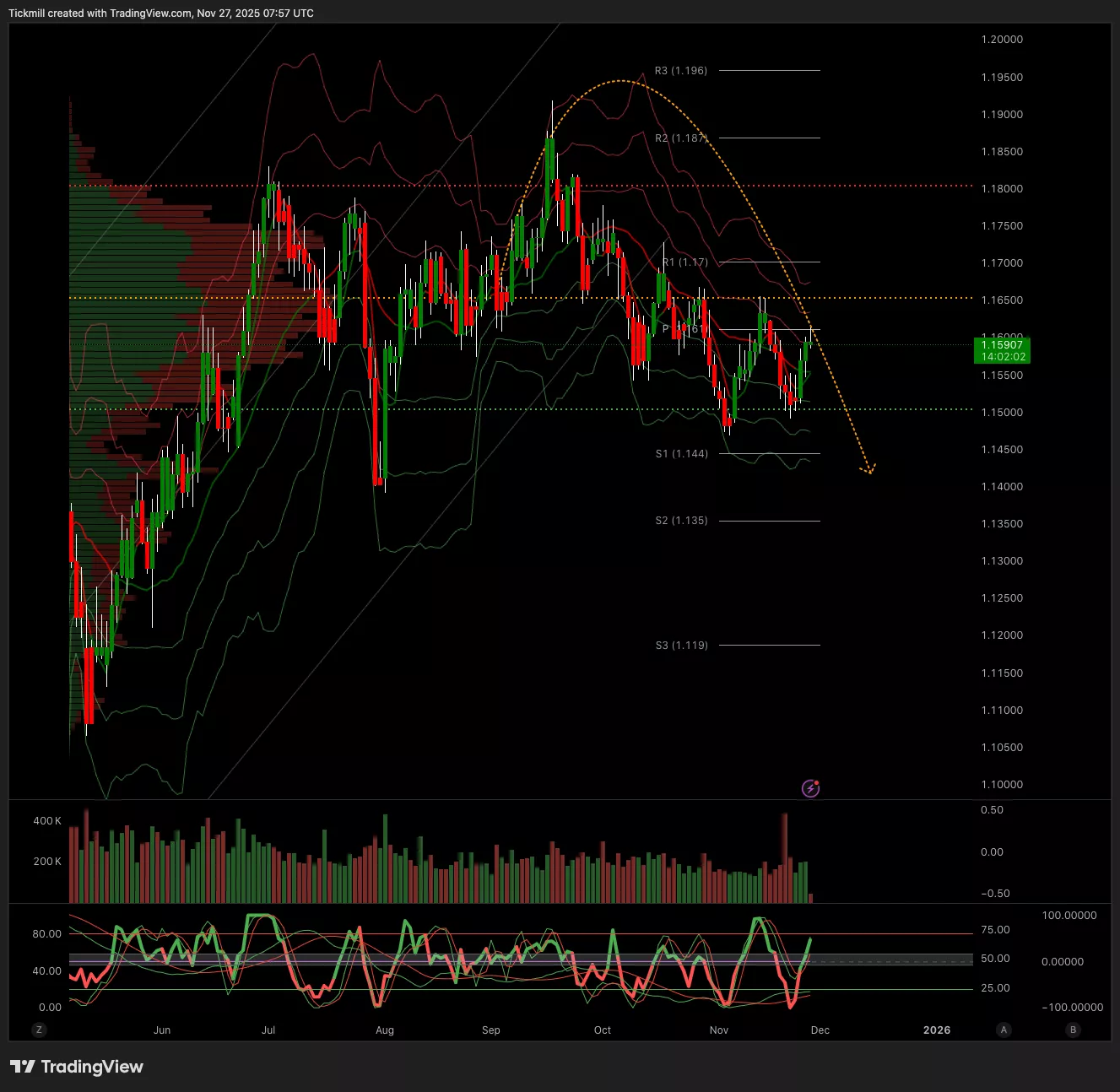

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1554 Target 1.1651

- Below 1.1520 Target 1.1429

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3188 Target 1.3298

- Below 1.3157 Target 1.3078

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 156.84 Target 158.06

- Below 155.25 Target 153.50

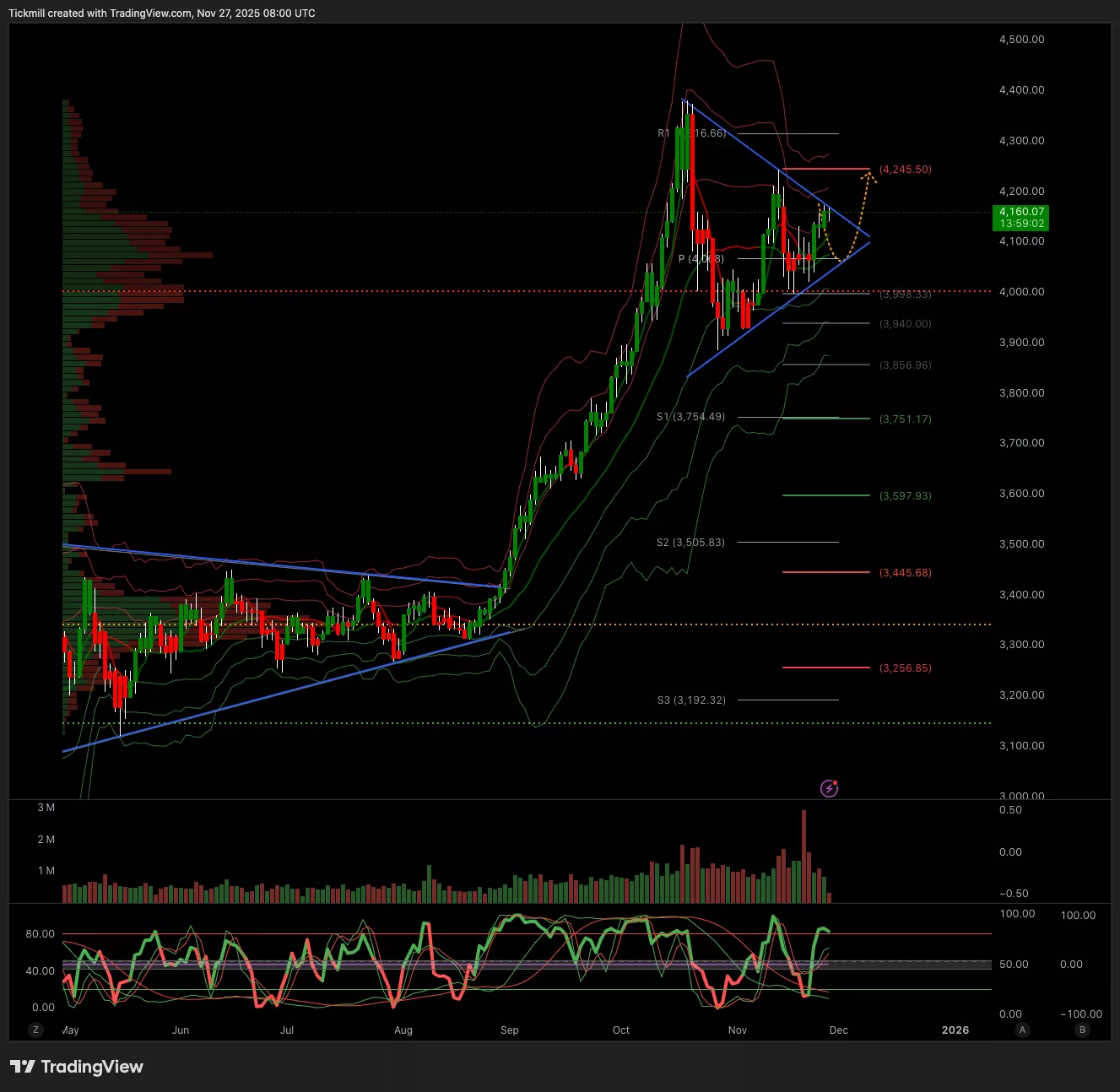

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4116 Target 4208

- Below 4075 Target 4008

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 92k Target 98k

- Below 88.5k Target 86k

More By This Author:

The FTSE Finish Line - Wednesday, Nov. 26

Daily Market Outlook - Wednesday, Nov. 26

The FTSE Finish Line - Tuesday, Nov. 25