The FTSE Finish Line - Tuesday, Nov. 25

Image Source: Pexels

UK stocks experienced gains amidst volatile trading on Tuesday as investors eagerly awaited the upcoming budget announcement, expected to introduce significant tax measures. The FTSE 100, which tracks blue-chip companies, rose 0.6%, while the FTSE 250, focused on UK mid-cap firms, advanced 0.75%. The British pound rallied for the fourth consecutive session, with traders turning to the options market to hedge against potential volatility ahead of the budget. Concerns about the pound's reaction drove the cost of hedging against sharp overnight price swings to its highest in months. Data from LSEG showed that overnight implied volatility for sterling—a key measure of demand for derivatives to manage price fluctuations—spiked to nearly 12% on Tuesday, a substantial jump from under 2% earlier in the week. Finance Minister Rachel Reeves is set to present her much-anticipated budget on Wednesday, aiming to secure tens of billions of pounds to fulfil pre-election promises and meet fiscal targets. Reeves faces the challenge of balancing the demands of Labour backbenchers, voter expectations, and the gilt market. Her strategy is expected to include scrapping the two-child benefit cap while avoiding significant new spending cuts.

Sector performance was mixed. Non-life insurers fell sharply by 3.3%, driven by a 9.4% plunge in Beazley shares after the speciality insurer cut its annual written premiums forecast. The travel and leisure sector declined 1%, with Carnival dropping 5.5%. Conversely, the banking sector gained 0.3%, supported by a Goldman Sachs note citing a Financial Times report suggesting banks may avoid new taxes. Lloyds Banking Group rose 1.8%, Barclays gained 1.1%, and NatWest advanced 1.4%. Industrial metal miners led the market gains, rising 1.1% as copper and iron ore prices strengthened. Antofagasta surged 2.7%, while Anglo American added 2.2%. The personal goods sector also performed well, with Burberry climbing 1.6%, contributing to a 1.1% sector increase. Retailers saw a 1% boost, driven by Kingfisher’s 4.7% jump after the home improvement retailer raised its profit outlook for the year. However, food catering firm Compass Group slipped 2.7% despite forecasting profit and organic revenue growth for 2026 in line with expectations.

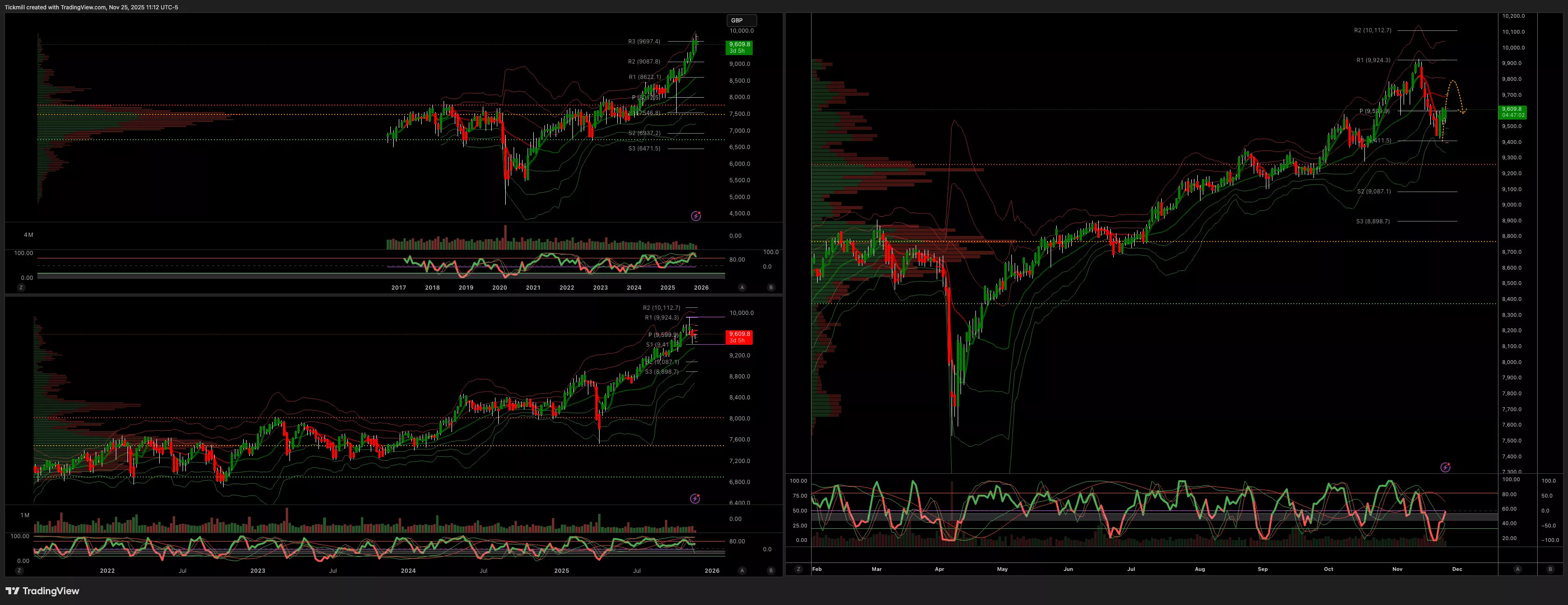

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 9689 Target 9807

- Below 9537 Target 9453

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Nov. 25Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 24

Daily Market Outlook - Monday, Nov. 24