Daily Market Outlook - Wednesday, Nov. 26

Image Source: Pexels

Stocks climbed while the Dollar took a hit as weak U.S. consumer data and the emergence of a pro-rate-cutting candidate as the likely Federal Reserve chairman fuelled expectations of an imminent reduction in interest rates. The MSCI All Country World Index continued its recovery for a fourth consecutive day, trimming its losses from this month's market selloff to just 1.3%. Asian markets surged by 1.4%, buoyed by Wall Street's rally, and the positive momentum seemed set to continue, with S&P 500 and European futures pointing to further gains. Meanwhile, U.S. Treasuries gave back some of the ground they gained during the prior session. This came after reports that Kevin Hassett, head of the White House National Economic Council, had emerged as the leading candidate for the next Fed chair, pushing bond prices higher. The Dollar weakened against most of its Group-of-10 counterparts, while gold, often seen as a safe haven in times of rate cuts, gained 0.9%, reaching $4,166 per ounce. Across the Atlantic, the UK's budget announcement looms as Europe’s biggest financial event. Chancellor Reeves faces the challenge of introducing measures that appease both sceptical MPs who have put Prime Minister Starmer under pressure and bond investors demanding higher premiums on UK debt compared to U.S., German, and Japanese bonds. In other markets, oil prices remained stable after hitting their lowest level in a month, as news of a peace agreement in Ukraine offered some stability to energy markets.

A combination of delayed Federal statistics and more current survey data provided a wealth of U.S. economic information on Tuesday, all pointing to a consistent narrative. Retail sales fell short of expectations, with control group sales declining month-over-month (-0.1% vs. +0.3% forecast). Though this data pertains to September and is somewhat outdated, the weakness in demand aligns with policymakers' concerns about the labour market's health. Additionally, the delayed Producer Price Index (PPI) report revealed limited price pressures, particularly in the ex-food, energy, and trade services category (0.1% m/m). This supports the argument that tariff effects remain minimal, even if overall inflation remains slightly elevated. More recent data, however, painted a more troubling picture. The weekly ADP employment print showed another decline (-13.5k), followed by a weak Richmond Fed index reading (-15 from -4), including a drop in its employment component. Most concerning was the continued decline in consumer confidence. The headline index fell to 88.7 from 95.5, marking its lowest point since the economic turbulence following “Liberation Day” in April. The drop was driven by concerns over current conditions, with respondents expressing clear apprehensions about the economic outlook. Notably, there was little apparent relief from the end of the government shutdown (data cutoff was November 18, a week after the shutdown ended). The decline mirrored similar weakness in the Michigan consumer sentiment survey. Given these developments, a December rate cut appears to remain the most prudent course of action for the Federal Reserve.

The long wait ends at 12:30pm GMT today. As the UK Chancellor addresses the Commons and official OBR/DMO documents drop, the rates market will immediately hunt for critical signals.

First, fiscal headroom is the headline number; a buffer below £15bn in 2029-30 looks weak. Second, the scale of tightening matters—specifically, whether it exceeds the expected £30bn mark and how those tax hikes are timed. Beyond the headlines, the devil is in the debt details. Markets are pricing in a five-year borrowing requirement around £656bn and a £10bn increase in gilt issuance for the year. Finally, traders will scrutinise the inflation forecast and the extent to which new policies might stifle GDP growth alongside the already-flagged productivity slump.

Overnight Headlines

- RBNZ Cuts Rates To 2.25%, Signals Likely End To Easing Cycle

- Australia’s Oct Inflation Beats Forecasts, Trims Rate Cut Bets

- Trump To Meet Zelensky, Putin Only In Final Stages Of Ukraine Peace Deal

- Ukraine Open To Signing New Peace Deal, US Officials Say

- Traders Crowd Into Fed Futures Targeting December Rate Cut

- Traders Push 10-Year Yield To 4% As Hassett Tops Fed Chair Field

- Alphabet On Track To Hit $4T Valuation On AI Optimism

- Nvidia Shares Fall As Google Gains AI Momentum

- Dell Raises FY Outlook For AI Server Shipments

- HP Inc Falls On Layoffs, Weak Guidance Amid US Trade Regulations

- HPE Wins $931M US Defense Cloud Contract

- Lilly Endowment Hits $100B Milestone On Stock Surge

- Asset Managers Apollo, Ares Sued Over Alleged Credit-Market Cartel

- UK’s Reeves Hikes Minimum Wage Ahead Of Tax-Raising Budget

- Trump Says Xi ‘Pretty Much’ Agreed To Expand Agricultural Buys

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1495-00 (1.9BLN), 1.0505-15 (1.7BLN), 1.1525-35 (1.9BLN)

- 1.1540-50 (1.62BLN), 1.1555-65 (1.0BLN), 1.1575-85 (527M)

- 1.1595-05 (3.2BLN), 1.1610-20 (837M), 1.1525-35 (1.3BLN)

- 1.1640-50 (1.0BLN), 1.1555-60 (2.0BLN), 1.1670-80 (2.1BLN)

- 1.1685 (341M), 1.1700-10 (1.2BLN), 1.1715-25 (2.4BLN), 1.1730-35 (1.1BLN)

- 1.1745-50 (1.14BLN)

- USD/JPY: 154.00 (2.72B), 155.00-10 (2.3B), 155.60 (546M)156.00 (874M), 156.50 (578M), 156.75 (250M),157.00 (821M) 157.40-50 (542M)

- EUR/JPY: 179.90-00 (200M), 182.00 (744M)

- USD/CHF: 0.7995-00 (1.0B), 0.8010 (350M), 0.8025 (479M) 0.8040-50 (535M), 0.8060-70 (500M), 0.8095-00 (407M)

- EUR/CHF: 0.9300-10 (334M)

- GBP/USD: 1.3180 (230M), 1.3200 (293M), 1.3240 (230M)

- EUR/GBP: 0.8750 (232M), 0.8770 (254M)

- AUD/USD: 0.6450-60 (1.3B), 0.6470-80 (774M), 0.6485-90 (800M) 0.6500-10 (1.62B), 0.6515-25 (1.3B), 0.6530-40 (2.52B) 0.6545-55 (1.1B), 0.6570-80 (1.74BLN), 0.6600-10 (766M)

- NZD/USD: 0.5670-75 (1.31B)

- USD/CAD: 1.3990-00 (922M), 1.4040-50 (563M),1.4085-90 (560M) 1.4100 (1.0B)

- USD/ZAR: 16.70-80 (545M), 17.00-17.05 (840M), 17.20 (450M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Data for the week ending September 30 published Wednesday. October 14 data next Tuesday (Nov 25). Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions for the Week Ended October 7th:

- - S&P 500 CME net short: +20,343 contracts (458,398 total)

- - S&P 500 CME net long: +9,589 contracts (944,434 total)

- - CBOT US 5-year Treasury net short: +3,838 contracts (2,267,738 total)

- - CBOT US 10-year Treasury net short: +48,050 contracts (787,958 total)

- - CBOT US 2-year Treasury net short: +12,837 contracts (1,219,958 total)

- - CBOT US UltraBond net short: +7,409 contracts (266,858 total)

- - CBOT US Treasury bonds net short: -16,378 contracts (62,352 total)

- - Bitcoin net short: -1,108 contracts

- - Swiss franc net short: -27,470 contracts

- - British pound net short: -4,476 contracts

- - Euro net long: 118,365 contracts

- - Japanese yen net long: 46,307 contracts

Technical & Trade Views

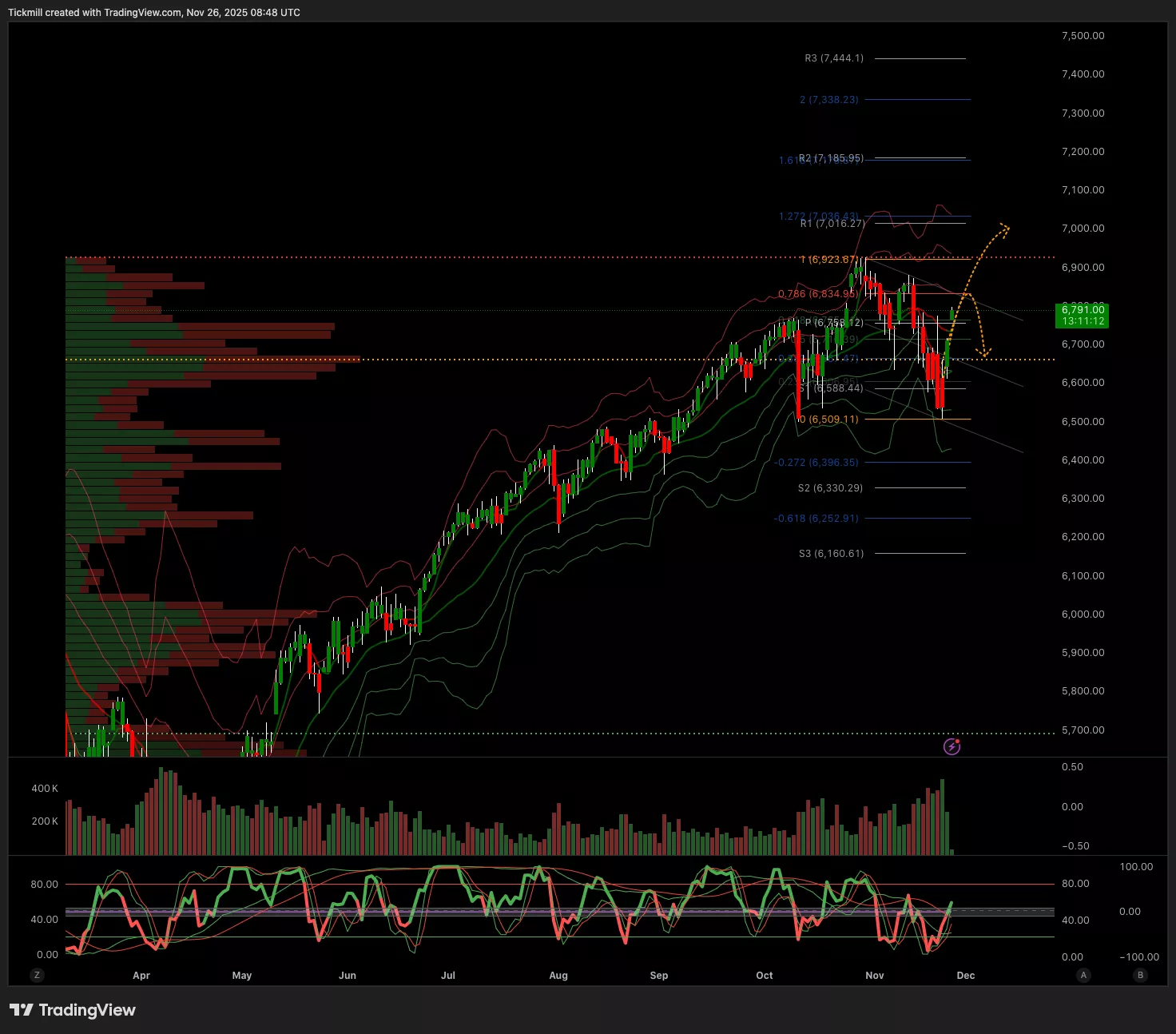

SP500

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 6734 Target 6834

- Below 6630 Target 6527

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1554 Target 1.1651

- Below 1.1520 Target 1.1429

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3135 Target 1.3264

- Below 1.3126 Target 1.3034

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 156.84 Target 158.06

- Below 155.25 Target 153.50

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4084 Target 4199

- Below 4050 Target 3990

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 87.1k Target 93.2k

- Below 86.1k Target 80.7k

More By This Author:

The FTSE Finish Line - Tuesday, Nov. 25

Daily Market Outlook - Tuesday, Nov. 25

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 24