The FTSE Finish Line - Wednesday, Nov. 26

Image Source: Pexels

Markets were caught off guard by what began as a chaotic fumble—with the OBR’s assessment leaking online before the Chancellor even took the podium—and ultimately landed with a dull thud. The lack of market volatility wasn't a sign of government competence but rather a symptom of exhaustion; the entire playbook had been telegraphed weeks in advance. While ministers might claim vindication, the reality is that investors had simply priced in the bad news long before the official release. The fiscal picture remains fragile despite the optical wins. Welfare costs are projected to swell by another £11bn—driven by reversals on winter fuel payments and the scrapping of the two-child benefit cap—while local government budgets continue to bleed. To secure a seemingly robust £21.7bn in fiscal headroom, the Chancellor had to raid pockets for £26bn in new revenue. Rather than transparent hikes, the strategy relies on a messy cocktail of minor tax code tweaks and the aggressive use of fiscal drag. By extending the freeze on tax thresholds, the government technically adheres to its manifesto pledges, though the millions of workers quietly pulled into higher tax brackets will likely see it as a distinction without a difference. The benchmark FTSE has continued to stage a relief rally, closing up over 0.5% in a volatile trading session.

The UK's tightening budget contrasts with Japan, the U.S., and France, potentially allowing for a cut in Bank of England interest rates. Political implications for Prime Minister Keir Starmer and the Labour government are significant, but markets have likely anticipated much of the impact. For investors in gilts, key details will emerge from debt sales, and a correlation with the declining U.S. Treasury yields offers some cushion ahead of the budget. The Bank of England is also expected to cut rates to address fiscal tightening and lower inflation concerns.

British ad firm WPP is set to be relegated from the FTSE 100 index to the FTSE 250 midcap index amid a 64% fall in shares due to disappointing earnings and a CEO re-shuffle. WPP lost its title as the world's largest ad group to France's Publicis last year, although Publicis shares have also fallen nearly 20% this year. In contrast, Publicis is optimistic and raised its growth forecast. Meanwhile, Interpublic Group will be removed from the S&P 500 due to its acquisition by Omnicom Group.

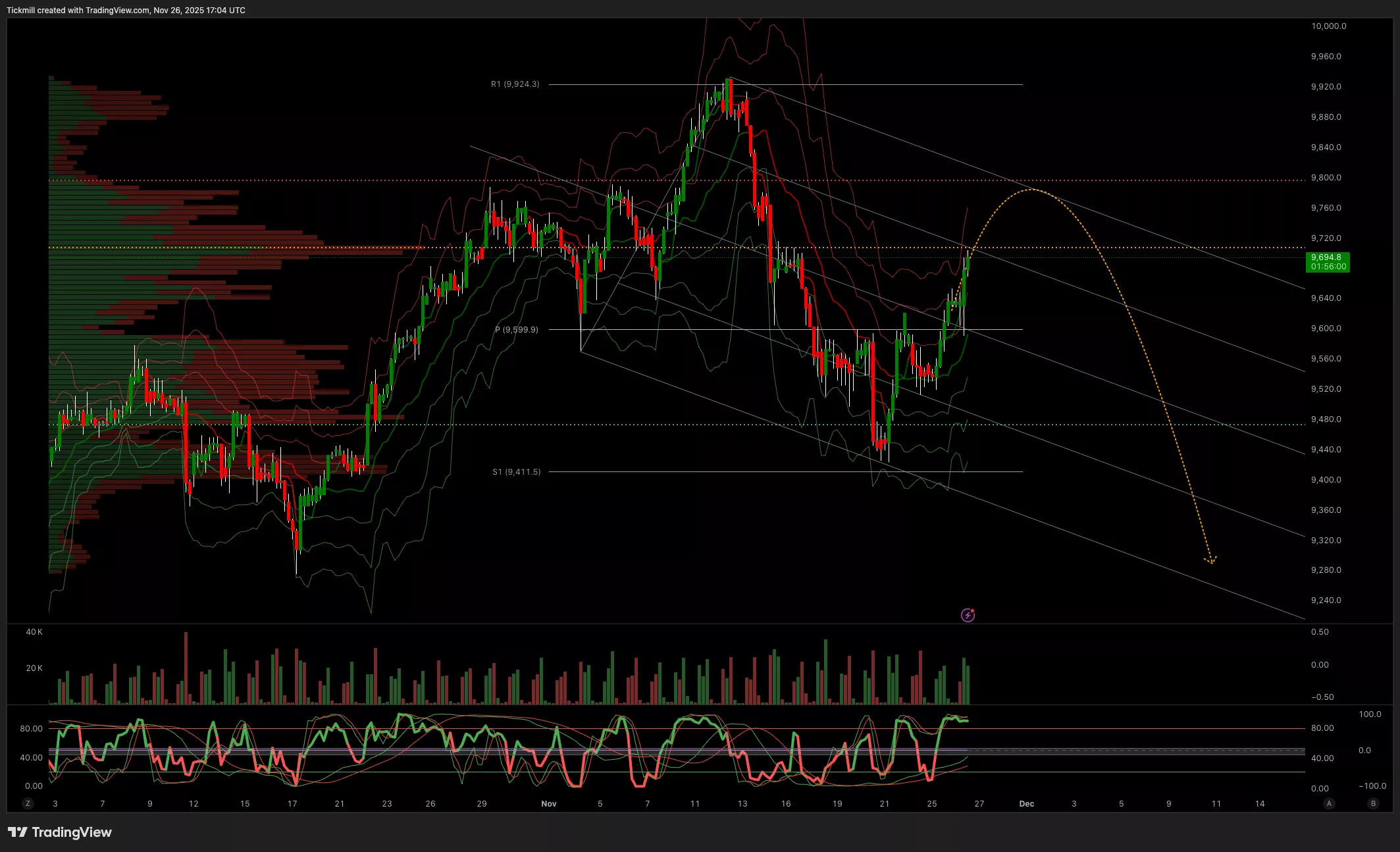

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 9689 Target 9807

- Below 9574 Target 9453

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Nov. 26The FTSE Finish Line - Tuesday, Nov. 25

Daily Market Outlook - Tuesday, Nov. 25