Daily Market Outlook - Thursday, March 6

Image Source: Pixabay

Asian markets posted gains on Thursday as investor sentiment remained buoyant, fueled by optimism over potential improvements in trade relations. This followed U.S. President Donald Trump's decision to temporarily exempt automakers from tariffs for one month. Meanwhile, the euro held firm ahead of the European Central Bank's upcoming policy meeting. In Japan, government bonds faced significant pressure during Asian trading hours, driven by a sharp sell-off in German long-term bonds. This came as Germany's coalition parties signaled a move toward easing fiscal regulations. As a result, the yield on Japan's 10-year government bond surged to its highest level in nearly 16 years, underscoring persistent market uncertainty. Global trade tensions remain a key concern for investors, especially after the U.S. imposed 25% tariffs on imports from Mexico and Canada earlier this week, along with additional tariffs on Chinese goods. These actions have heightened fears of a potential economic slowdown. However, on Wednesday, the White House announced that Trump would delay the 25% tariffs on Canadian and Mexican automakers for one month, contingent on their adherence to existing free trade agreements. The announcement boosted U.S. stock markets, which in turn lifted Asian markets. The MSCI index, tracking shares in the Asia-Pacific region excluding Japan, gained, while Tokyo's Nikkei index also advanced.

Investors are closely watching today’s European Central Bank meeting, where a widely expected interest rate cut is anticipated as policymakers address challenges stemming from the trade war and regional defense spending. The meeting follows a significant 1.5% rise in the euro and a selloff in German bonds, triggered by Germany's coalition parties agreeing to establish a 500 billion euro infrastructure fund and amend borrowing rules. German 10-year Bund futures dropped 0.6% on Thursday, hinting at a possible decline in cash bond prices later in the day. On Wednesday, the eurozone's benchmark 10-year yield jumped 30 basis points—the largest single-day surge since mid-March 2020, at the height of the pandemic. Meanwhile, the euro climbed to a four-month high during early Asian trading, positioning itself for a weekly gain of over 4%, its best performance since March 2009.

The ECB's policy meeting will center on some key areas. The rate decision is expected to result in a fifth consecutive 25 basis point cut—marking the sixth reduction in this cycle—bringing the deposit rate to 2.50%. Uncertainty surrounds the phrasing of the accompanying statement, particularly whether the phrase “policy remains restrictive” will be removed following this latest cut. Dropping this term could signal a slower pace of future rate reductions. Meetings without new economic projections often trigger stronger market reactions, with next month’s meeting, where another cut is widely expected, likely to draw significant attention. New economic projections will be unveiled, which are anticipated to show minimal changes from December due to lingering uncertainty over potential US trade tariffs. However, the Q4 decline in negotiated wage growth may support a more favorable disinflationary outlook. President Lagarde’s tone and wording during the press conference will be scrutinized, particularly if the statement reflects a hawkish shift. She may need to address any perceived divisions within the Council. Amid rising trade tensions and investor concerns over Germany’s revised fiscal policies, complicating the near-term outlook are recent announcements by Germany and the European Commission regarding adjustments to fiscal regulations. Markets are digesting Germany’s major fiscal measures unveiled late Tuesday, which triggered a sharp sell-off in German bonds, propelling the DAX index to its strongest performance in over two years. Germany’s 10-year yield, the eurozone’s benchmark, surged over 30 basis points on Wednesday, marking its largest daily jump since the euro’s introduction in 1999. Investors’ generally positive reaction to Germany’s fiscal stimulus stands in stark contrast to their concerns about tightening financial conditions in the United States.

Overnight Newswire Updates of Note

- ECB Poised For Rate Cut Amid Flagging Growth, Nascent Trade War

- Goldman Sees Faster German Growth On Fiscal Push, Fewer ECB Cuts

- Traders’ Euro Optimism Has A Time Limit, Options Market Shows

- Bank Of England's Bailey Urges US To Step Back From Trade Wars

- Fed’s Perli: Debt-Limit Dynamics Could Disrupt Money Markets

- Trump Grants One - Month Tariff Reprieve To Help US Automakers

- Trump Issues New Ultimatum For Hamas To Release Israeli Hostages

- Trump’s Tariffs Push Xi To Overhaul China’s Ailing Growth Model

- US Firms Demand Crackdown On Tariff-Evading Chinese Importers

- China’s Fuel Production Cuts Could Undermine Global Oil Demand

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0700-10 (920M), 1.0845-50 (3BLN)

- USD/CHF: 0.8770 (514M), 0.9010 (200M), 0.9100 (393M)

- GBP/USD: 1.2800-05 (290M), 1.2820 (253M),

- AUD/USD: 0.6240-50 (861M), 0.6290-0.6300 (494M)

- USD/CAD: 1.4330 (490M), 1.4350-55 (1.3BLN), 1.4375 (586M), 1.4400 (1.1BLN)

- USD/JPY: 148.00 (786M), 148.70 (385M), 149.00 (740M), 149.20 (496M)

- 149.75-85 (1BLN)

- EUR/JPY: 160.80 (890M). CHF/JPY: 167.00 (370M)

CFTC Data As Of 28/2/25

- CFTC Positions for the Reporting Week Ending February 25th

- Speculators reduced their net long position in CBOT US Treasury bonds futures by 6,869 contracts, bringing it down to 40,912.

- Speculators decreased their net short position in CBOT US Ultrabond Treasury futures by 18,507 contracts, now totaling 227,735.

- Speculators trimmed their net short position in CBOT US 10-year Treasury futures by 9,672 contracts, resulting in a total of 699,855.

- Speculators cut their net short position in CBOT US 5-year Treasury futures by 111,760 contracts, which now stands at 1,625,773.

- Speculators lowered their net short position in CBOT US 2-year Treasury futures by 140,066 contracts to 1,149,453.

- The euro has a net short position of -25,425 contracts.

- The Japanese yen has a net long position of 95,980.

- The British pound holds a net long position of 4,463.

- The Swiss franc shows a net short position.

- The net long position for Bitcoin is 204 contracts.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Above 6075 target 6195

- Below 6040 target 5675

(Click on image to enlarge)

EURUSD Pivot 1.05

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0535 target 1.0860

- Below 1.0505 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.26

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.30

- Below 1.2560 target 1.2450

(Click on image to enlarge)

USDJPY Pivot 151

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5330 target 154.40

- Below 151.30 target 148

(Click on image to enlarge)

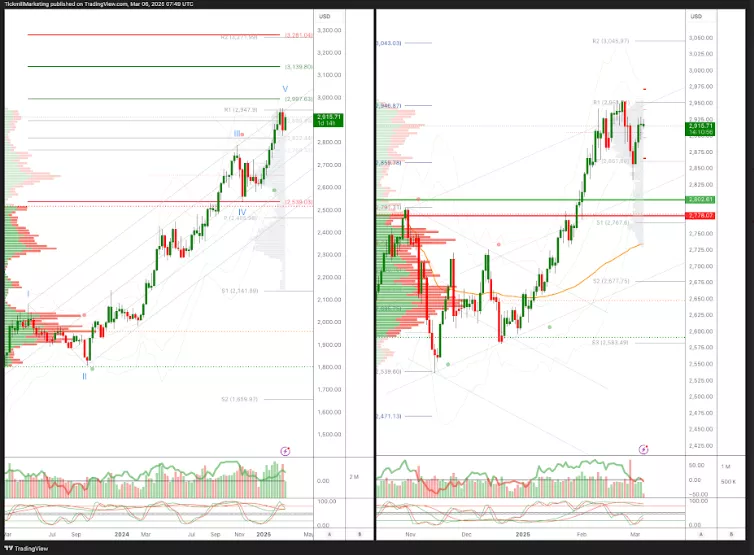

XAUUSD Pivot 2800

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2800 target 2997

- Below 2750 target 2650

(Click on image to enlarge)

BTCUSD Pivot 95k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 95k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, March 5

Daily Market Outlook - Wednesday, March 5

The FTSE Finish Line - Tuesday, March 4