The FTSE Finish Line - Tuesday, March 4

Image Source: Pexels

UK stocks mirrored a global downturn on Tuesday, weighed down by new U.S. tariffs on major trading partners and declining oil prices that hit energy shares. The blue-chip FTSE 100 fell 0.65%. U.S. President Donald Trump imposed 25% tariffs on imports from Mexico and Canada, while duties on Chinese goods were raised to 20%. These measures have heightened fears of retaliatory tariffs potentially being introduced next month, triggering a global market slump and driving up demand for safe-haven assets like government bonds. The oil and gas sector suffered the steepest losses, plunging 3% to its lowest level in over a month after OPEC+ confirmed plans to increase oil production in April, the first such move since 2022. Shell’s shares dropped 2.6% as the company announced significant changes to its executive leadership. In contrast, defense stocks climbed 2%, marking their seventh straight session of gains. British Finance Minister Rachel Reeves emphasized the need to expedite defense equipment procurement, while the European Commission proposed a new joint borrowing initiative as part of an 800-billion-euro defense spending plan.

UK credit data in January showed improvement: consumer lending rose to £1.7bn from £1.1bn (forecast £1.2bn), the highest in a year, and mortgage lending jumped to £4.2bn from £3.3bn, a two-year high, beating the £3.5bn estimate. Corporate borrowing also increased, boosting overall credit momentum. However, underlying lending remains weak, and the mortgage surge is likely driven by impending stamp duty hikes, not sustained growth. Affordability challenges, a sluggish economy, labor market pressures, and contracting SME lending limit broader credit demand. Household savings continue to outpace borrowing, reflecting ongoing caution in an uncertain environment.

Single Stock Stories & Broker Updates:

- BP and Shell fell 4% and 3%, respectively, among top losers on the FTSE 100 Index, as UK energy majors tracked crude lower. Brent dropped 1.3% to $70.69/bbl, and U.S. West Texas Intermediate fell 1.10% to $67.62/bbl. Oil extended losses amid reports of OPEC+ proceeding with an April output increase and the impact of U.S.-China, Canada, and Mexico tariffs. Analysts expect tariffs to dampen economic activity and oil demand. North Sea-focused producers EnQuest, Serica Energy, Ithaca Energy, and Harbour Energy declined 1.3% to 4.8%. Additionally, Trump halting military aid to Ukraine added pressure on oil prices.

- Shares of Abrdn rose 12%, the best day since April 2020. The company projects an adjusted operating profit of at least £300 mln and net capital generation around the same amount by FY 2026. It expects long-term growth in the UK savings and wealth sector post-2025 and aims to cut run-rate costs by £150 mln by end of 2025. Year-over-year, FY adjusted operating profit increased 2.4%, while assets under management rose 3%. However, the stock is down about 20.99% in 2024.

- Shares of UK automotive distributor Inchcape rose ~8.01% to 731.50 pence as the company initiates a £250 million share buyback and expects higher EPS growth in FY 2025. Peel Hunt maintains a 'Buy' rating with a target price of 900p, anticipating positive investor reception for the new targets and capital allocation policy. The stock is up ~4.18% over the last 12 months.

- Beazley, insurer at Lloyd's of London, rose 3%, hitting an all-time high. Reports 13% rise in annual pretax profit to $1.42 billion, driven by growth in property risks premiums. Launches $500 million share buyback and rebases ordinary dividend by 76% to 25p. BEZG up ~13% YTD.

- Ashtead Group drops 2.9% to 4,659p, lowest since Nov 2023, making it a top loser on FTSE 100. The British equipment rental firm missed Q3 profit and revenue estimates due to U.S. construction sector weakness, prompting a profit warning last December. AHT plans to shift its primary listing to the U.S. but maintains FY outlook, citing confidence in demand and potential recovery from stabilising interest rates. Stock down 6.5% YTD.

Technical & Trade View

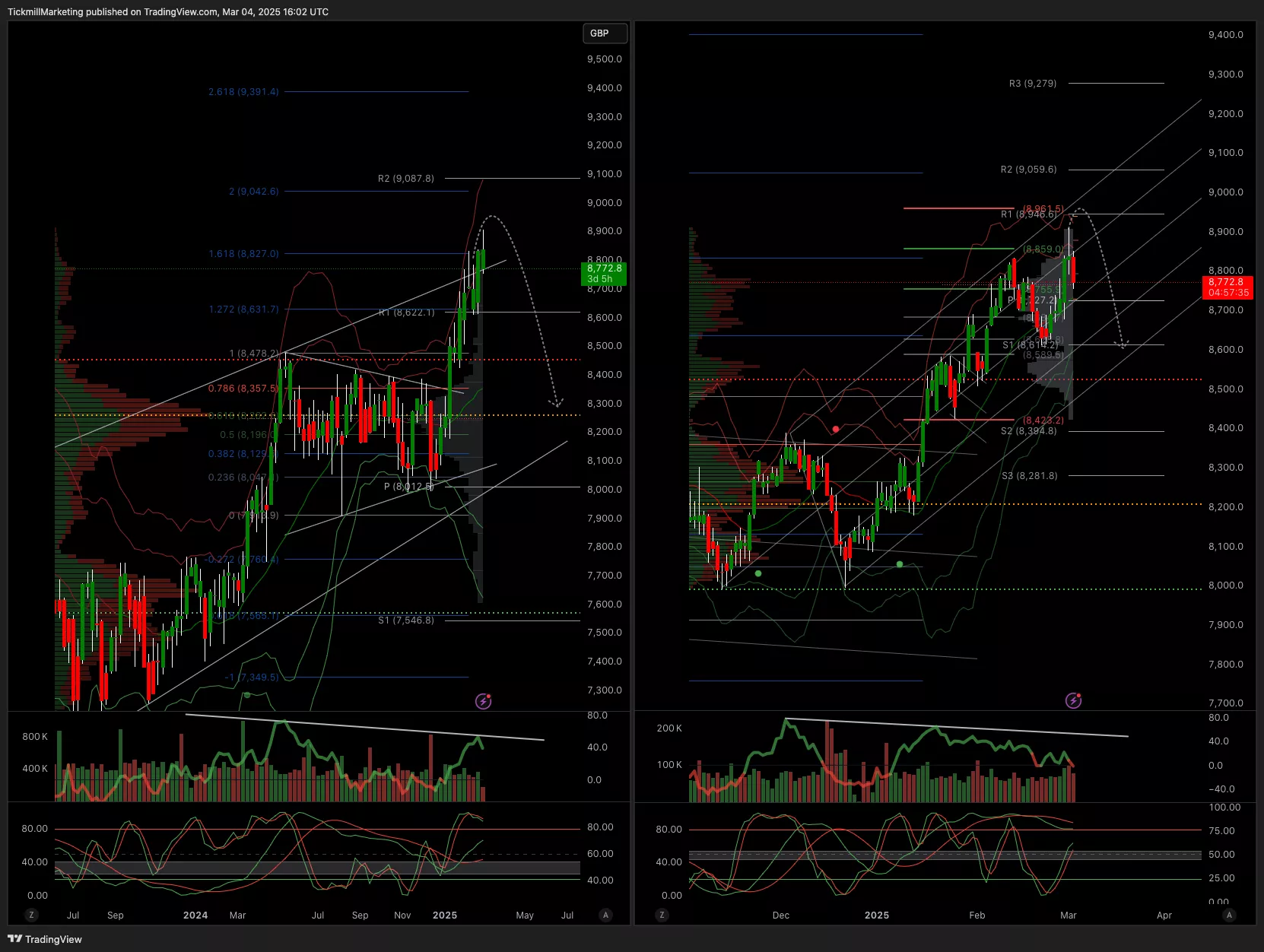

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook: Tuesday, March 4Daily Market Outlook - Monday, March 3

FTSE Finish Line - Friday, Feb.28