Daily Market Outlook - Wednesday, March 5

Image Source: Pexels

The U.S. dollar hovered near a three-month low against major currencies on Wednesday, weighed down by the latest round of U.S. tariffs and retaliatory measures from Canada and China, which have further escalated the ongoing trade conflict. The euro surged to a nearly four-month high after German political parties reached a consensus on launching a 500-billion-euro infrastructure fund. The British pound also remained strong, trading near a three-month peak. In Asia, Hong Kong stocks saw gains, and the offshore yuan in China slipped 0.1% to 7.2640 per dollar, following a 0.7% rally on Tuesday. To counter the impact of escalating U.S. tariffs, Beijing upheld its 5% economic growth target and allocated more fiscal resources than last year. China is projecting a budget deficit of approximately 4% of its GDP in 2025, an increase from 3% in 2024. Growth, inflation, and fiscal spending targets were largely in line with expectations. Crude oil prices slid to six-month lows, while bitcoin steadied at approximately $87,500 following a volatile week. Market sentiment reflected growing concerns over a potential slowdown in U.S. and global economic activity, with cyclical stocks leading the decline. Japan's Nikkei rose 0.4% after wavering between modest gains and losses, while Hong Kong's Hang Seng jumped 2.1%.

The escalating trade conflict spearheaded by Donald Trump—dismissed as "dumb" by Canadian Prime Minister Justin Trudeau—continues to capture the attention of investors, dampening sentiment across multiple asset classes. This week, despite the overarching uncertainty, the situation presents a nuanced picture. Wall Street seems poised for a rebound, with futures pointing to a higher opening following Tuesday’s decline, and European markets are projected to post even stronger gains. Adding a layer of optimism, the coalition parties negotiating Germany’s next government have reached pivotal agreements, including the creation of a substantial 500 billion euro ($530 billion) infrastructure fund and the relaxation of fiscal rules to boost defense spending and economic growth. Furthermore, the European Commission has proposed borrowing up to 150 billion euros to lend to EU member states as part of a rearmament initiative. These developments unfold against the backdrop of volatile peace negotiations in Ukraine, where Washington appears to be recalibrating its stance—distancing itself from European allies while fostering closer ties with Moscow. Encouragingly, a thaw in relations seems increasingly plausible. U.S. President Donald Trump expressed satisfaction with a conciliatory letter from Ukrainian President Volodymyr Zelenskiy, following their contentious Oval Office meeting last week. Trump shared excerpts of the letter during his first congressional address since returning to office, where he also highlighted the breadth of his executive actions just six weeks into his term. However, investors have raised concerns over Trump’s proposal to repeal a bipartisan law that allocates $52.7 billion in subsidies for semiconductor manufacturing, although market reactions to this development have been muted. Meanwhile, investors have interpreted the ongoing tariff measures between nations as relatively restrained for now.

Over the past month, there has been a noticeable divergence in yield composition specifically across the US, UK, and Germany. Key factors include: US real yields have fallen due to shifting Fed expectations, from pausing over tariff-related inflation in January to responding to potential activity slowdowns in February. The Bank of England's cautious stance on rate cuts has supported UK real yields. Gilt and Bund nominal yields trail US Treasuries, partly due to increased defense funding in Germany. UK nominal yields underperform US yields amid fiscal credibility concerns following January's rise. While these factors may shift with new data, market participants believe the pricing reflects a structural trend, while the UK market pricing hinges on the OBR Spring Forecast on 26 March, given the government's preference for a single annual fiscal event.

Overnight Newswire Updates of Note

- Germany’s Merz Strikes Debt Deal To Fund Defence And Infrastructure

- Europe’s Clampdown On Chinese EVs Forces U-Turn At GAC

- Geely Signs €2.4B Loan To Refinance Volvo Truck Deal

- China Boosts Official Budget Deficit To Highest In Over 30 Years

- China Sets Annual Economic Growth Target Of 5%

- Australia’s Economy Accelerates, Backing RBA’s Hawkish Tone

- New Zealand Central Bank Announces Surprise Exit Of Governor

- Trade War Erupts As Trump Hits Canada, Mexico And China With Tariffs

- Trump Defends Economic Agenda As Democrats Protest Address

- Ukraine Willing To Sign Minerals Deal Days After Agreement Fell Apart

- Putin Agrees To Help Trump Broker Nuclear Talks With Iran

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0480 (1.3BLN), 1.0500 (1.7BLN), 1.0550 (317M), 1.0600-10 (1.1BLN)

- USD/CHF: 0.8950 (220M). EUR/CHF: 0.9450 (201M)

- EUR/GBP: 0.8225 (335M)

- AUD/USD: 0.6220 (227M), 0.6350 (1.2BLN)

- USD/CAD: 1.4375 (455M), 1.4400 (813M), 1.4430 (648M), 1.4450 (375M)

- 1.4465 (362M), 1.4475-80 (1.3BLN), 1.4495-1.4500 (2.3BLN)

- USD/JPY: 148.50 (505M), 149.00 (1BLN), 149.85 (303M), 151.00 (1.3BLN)

- EUR/JPY: 161.75 (1.2BLN)

CFTC Data As Of 28/2/25

- CFTC Positions for the Reporting Week Ending February 25th

- Speculators reduced their net long position in CBOT US Treasury bonds futures by 6,869 contracts, bringing it down to 40,912.

- Speculators decreased their net short position in CBOT US Ultrabond Treasury futures by 18,507 contracts, now totaling 227,735.

- Speculators trimmed their net short position in CBOT US 10-year Treasury futures by 9,672 contracts, resulting in a total of 699,855.

- Speculators cut their net short position in CBOT US 5-year Treasury futures by 111,760 contracts, which now stands at 1,625,773.

- Speculators lowered their net short position in CBOT US 2-year Treasury futures by 140,066 contracts to 1,149,453.

- The euro has a net short position of -25,425 contracts.

- The Japanese yen has a net long position of 95,980.

- The British pound holds a net long position of 4,463.

- The Swiss franc shows a net short position.

- The net long position for Bitcoin is 204 contracts.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Above 6075 target 6195

- Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.05

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0535 target 1.0634

- Below 1.0505 target 0.9758

(Click on image to enlarge)

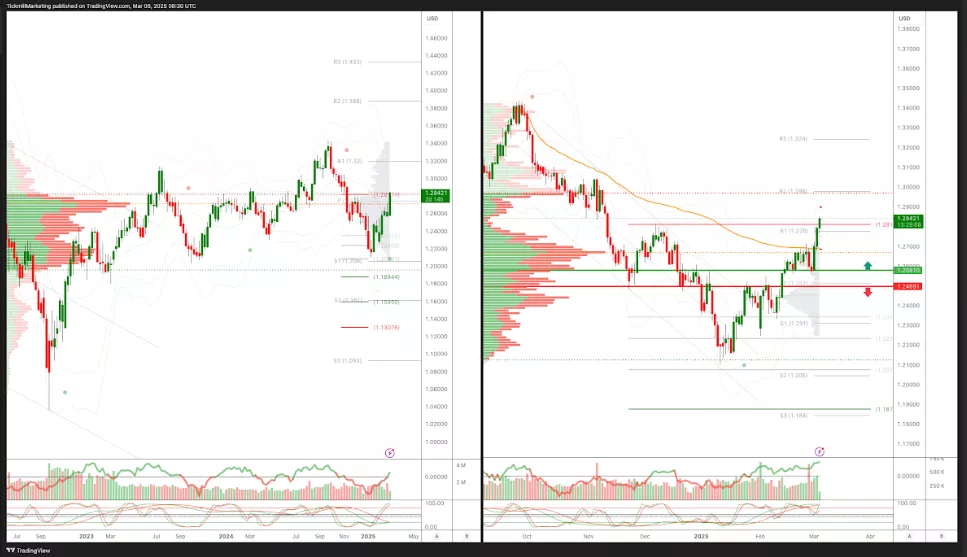

GBPUSD Pivot 1.26

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.26 target 1.2810

- Below 1.25 target 1.24

(Click on image to enlarge)

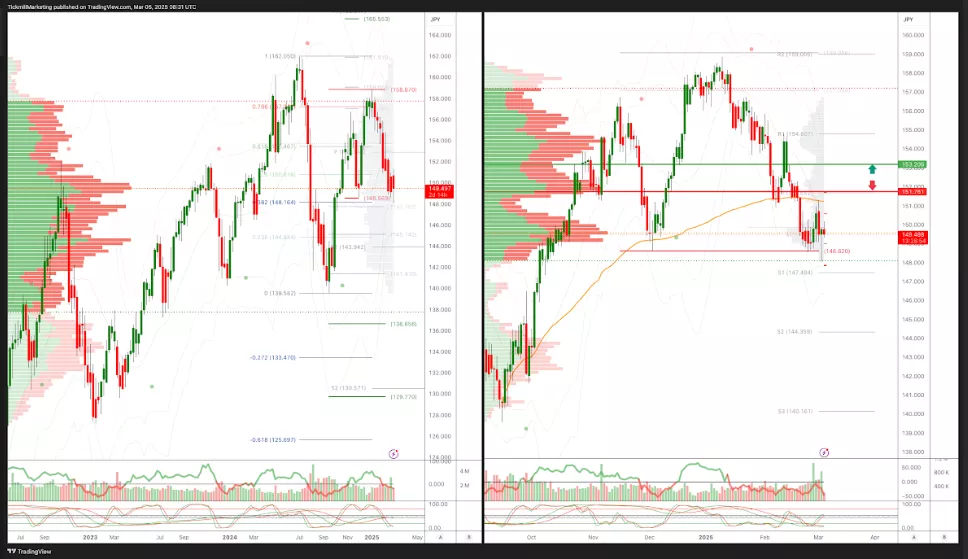

USDJPY Pivot 151

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5330 target 154.50

- Below 151.70 target 148

(Click on image to enlarge)

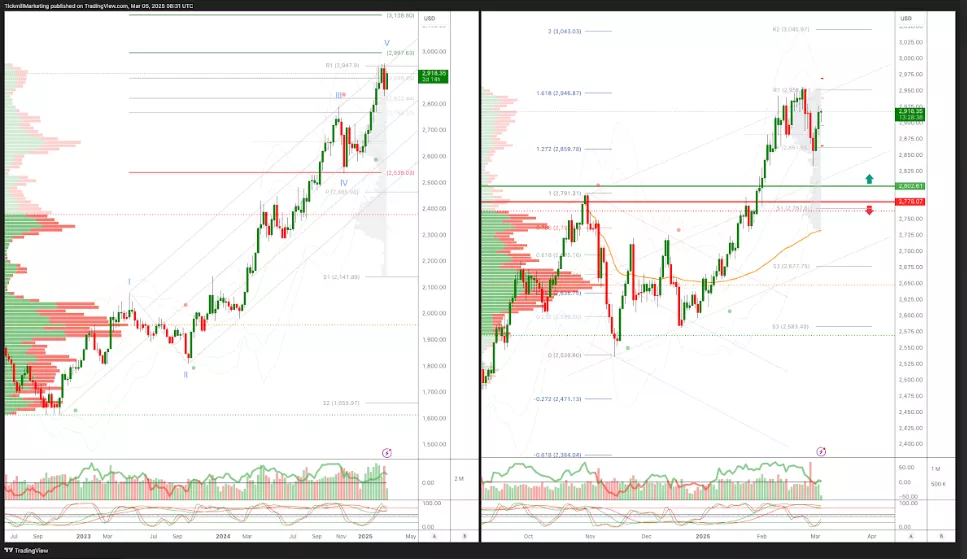

XAUUSD Pivot 2800

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2800 target 2997

- Below 2750 target 2650

(Click on image to enlarge)

BTCUSD Pivot 95k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 95k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, March 4

Daily Market Outlook: Tuesday, March 4

Daily Market Outlook - Monday, March 3