$25 Great Things Happen To Cheap Assets

Executive Summary

-

Markets have been fairly benign for us—the problem with victory laps is not only that they are pedantic, useless, and universally uncool, but also that they perpetuate the misguided impression that investing is easy

-

Few saw China’s recovery coming or Europe’s pressures subsiding—now global growth outlook seems to be improving

-

ChinaTech remains cheap, European equities seem overextended, Japan’s defense of Yield Curve Control unsustainable, and commodities/energy still in a supercycle

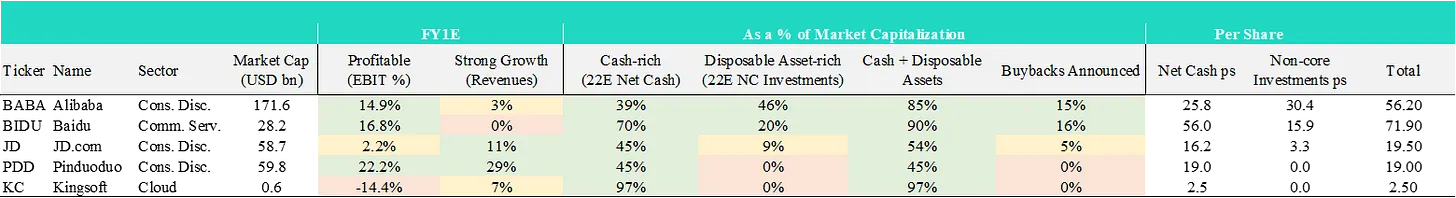

This post discusses—implicitly or explicitly—investments in ChinaTech (tickers: KWEB, BABA, BIDU, JD, PDD, KC), European equities (VNA), FX (USDJPY, EURUSD), energy equities (XOM, CVX, XLE, BP, SHEL, OXY, TTE, SPUT / U.UN), commodity futures (Brent, WTI) and bonds (JGBs, US bonds).

“Where is John Galt?”

Not the question that was popularized by Rand’s novel, but surely one many of you have asked in the past weeks, as my activity on Substack took the path of FTX.

The explanation is quite simple: I thought I had little to offer over these past weeks beyond what I had already shared. I’m not here to waste anybody’s time. Especially not my own.

Anybody that goes back and re-reads the latest missives will deduce that markets have been fairly benign for us. The situation has been generally playing out in line with our expectations, which is often not the case. Needless to say, our portfolio1 has benefitted massively, and—considering subscribers often have a view on / open positions in these assets—I hope yours did too.

(Click on image to enlarge)

Source: Going John Galt

In broader market terms we called for a “range-bound / slowly upward-sloping grind with substantial rotation within equities” ($23 A MORE BALANCED APPROACH) and that’s roughly what we got. US equities have gone nowhere in the past month…

The problem with victory laps is not only that they are pedantic, useless, and universally uncool, but also that they perpetuate the misguided impression that investing is easy. And it’s anything but.

Today’s piece represents my best effort to remain “noble and poetic” in victory. The point of it is really to provide a ‘portfolio update’ on the themes we highlighted in our past posts (i.e., China, Japanese Yen, Europe’s energy crisis, commodity supercycle, etc.) and discuss where things might be heading.

The other point is getting back into the fold of things. I’ve been developing a few new investment ideas and I’ll be sharing them in the coming missives.

Remember when China was uninvestable?

Starting end of October, I wholeheartedly made a point of pounding the table on what I considered an extraordinary investment opportunity in China, with visible, positive developments on all fronts (i.e., regulation, macro, geopolitics, and COVID). But one can only do as much and at one point there simply is little else to add.

Bottom line: assets were dirt-cheap (technical term) and you know the old adage. Great things happen to cheap assets.

In theory, should BABA, BIDU or KC decide to liquidate their non-core investments and buy back their stock, they could get very close to acquiring full ownership of the company (see ‘Cash + Disposable assets as % of Market Capitalization’ column). In theory communism works… in theory.

(Click on image to enlarge)

Source: Going John Galt

Read more: $20 ANOTHER BEAR MARKET RALLY?

Going back, it was an uncomfortably out-of-consensus call rooted in comprehensive research… that got quite some heat. This platform, however, also helped me realize that many of you were here because you somewhat agreed with me that there was value to be unlocked.

I rarely comment on my readership statistics. This time, however, it offers anecdotal evidence of how brutally polarizing the subject of China has become and how underloved this thesis is.

Four members unsubscribed from Going John Galt within 10 minutes of publishing—quite rare for a Substack with virtually zero churn (just one unsubscribed member in nearly 6 months live). Now, however polarizing the subject may be, the bigger truth is that investors love a bargain… and over 40 readers clicked the subscribe button since.

Read more: $20 ANOTHER BEAR MARKET RALLY?

For some of these companies, I truly was their biggest advocate out there. Just type Kingsoft Cloud ($KC) alongside my handle on Twitter, for example.

Whatever the case, I continue to find these cheap relative to most equities.

I’ve not pared down my ChinaTech exposure although I’ve rotated some to Nio (NIO) at around $11 (~$18bn market cap, ~$14.7bn Enterprise Value). They are one of the leading electric vehicle (EV) companies in China with focus on delivering high-end autos. It’s expected to be profitable by the end of 2024, while revenues grew >40% this year and are expected to almost double next.

I love how horribly bad it’s been trading, as it’s taking a twofold blow. It first got struck alongside the rest of ChinaTech and it’s now joining Tesla ($TSLA) in its descent into the inferno. Not my usual investment.

Unwinding JPY shorts

A few weeks ago, I argued in favor of being long JPY (vs. USD), coinciding with the Bank of Japan’s (BoJ) decision to finally allow the tolerable trading band of Japanese 10Y bonds (JGBs) to widen from ±0.25 to ±0.5%, to arrest mounting pressures on Japan’s sovereign bond market.

Markets interpreted this as a first hawkish step, opening the door for a broader BoJ pivot. It’s both “symbolic” (as SocGen’s Juckes called it) and “a precursor to either retiring the target or even outright rate hikes” (BMO’s Lyngen & Jeffery).

Read more: $24 JPY: A GREAT 2023 STORY GETS BETTER

Since then, the “massive short JPY trade” we flagged has been unwinding, driving Yen appreciation.

This week, Japanese 10Y bonds (JGBs) broke the 0.5% ceiling, forcing widespread intervention (i.e., bond-buying by Japanese authorities). The barbarians have regrouped and are at the gate again.

Once again, it’s become only a question of when it’ll prove unsustainable. The situation looks oddly familiar to investors… and it can trigger an oddly familiar response from the BoJ. Short JGBs (higher yields) and long JPY.

What I said then remains my base case—the “low 120s [vs. ~130 today] can be in play by the end of 2023”. Caution, though. US bonds seem tactically overbought and a sell off (higher US yields) may be due. This would lead to a (temporarily) lower JPY via widening US-Japan bond yield differentials.

Europe: from terrible to just bad

In early Q4, it became particularly evident that years of compounding mistakes in their energy policy had cornered Europe’s economy. The situation seemed untenable and extremely costly... and not just literally in energy support programs.

Many expected Europe’s energy crisis to only worsen. Using an obscure reference that I will most likely regret, the bet seemed to follow the name of an English boy band captained by a handsome young man who loves skirts (quite literally).

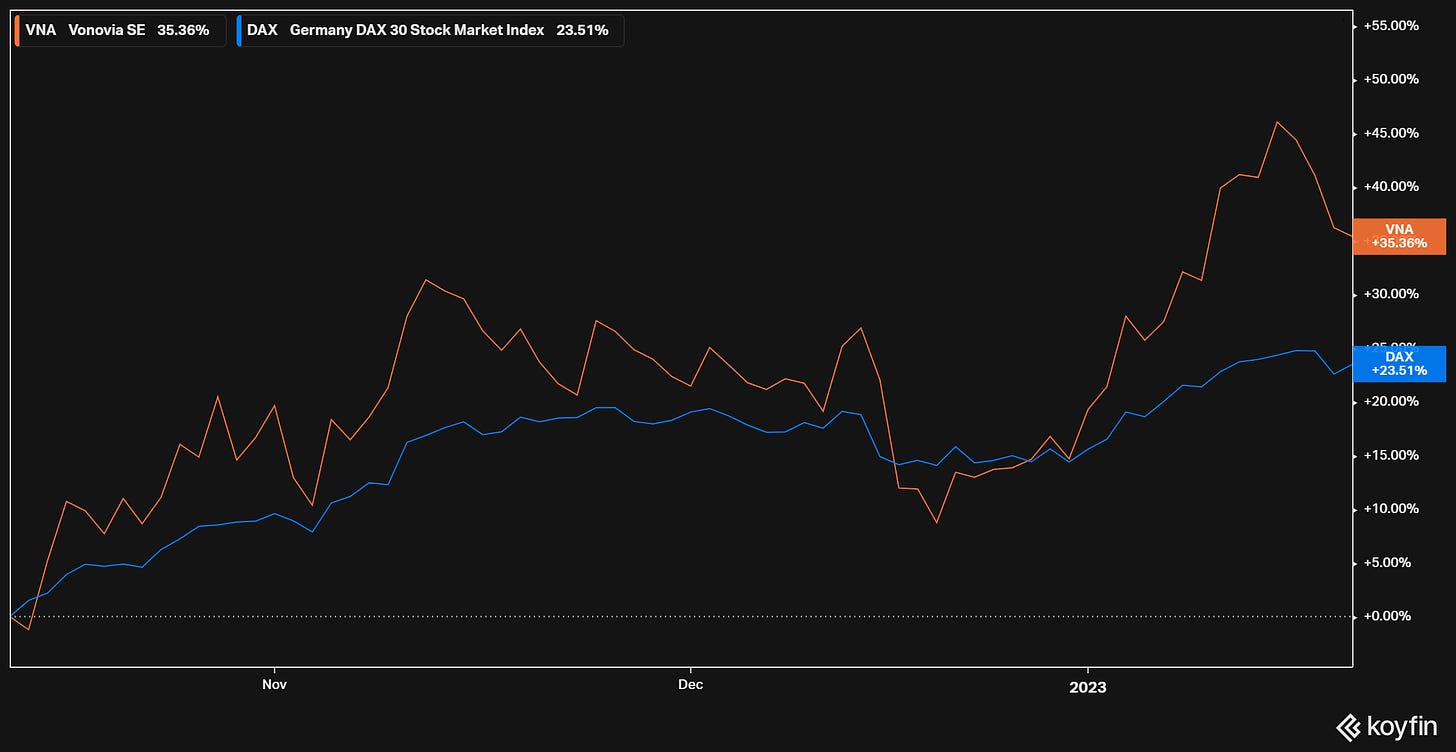

Anyway, European companies—good and bad—were getting hammered in this environment and some reached long-term attractive levels. Finding a price vs. looking for the price. Enter Vonovia ($VNA).

This is a bet that Germany makes it through the crisis.

Read more: $18 DRINKING RED BULL & VODKA

In the note above we picked Vonovia as our preferred European / German recovery play, considering it’s the largest real estate company in Europe, managing >600k residential units mostly in Germany (~89%). We went through the main financial metrics and concluded that few things are safer and offer superior risk-return than an above-average quality residential portfolio in Germany at deep value/discount to valuation. Again, great things happen to cheap assets.

(Click on image to enlarge)

Source: Going John Galt

Demand destruction and mild winter temperatures (La Nina played a role) drove natural gas prices off a cliff (now at Q3 2021 levels). Energy prices fell sharply. Gas storage levels are uncommonly elevated (~90% vs. ~65% for mid-January, historically). Headline inflation remains high, yet rapidly declining. Bomb, defused. For now.

(Click on image to enlarge)

Source: Goldman Sachs

With European growth resilient yet soft and financial conditions tightening, the steep repricing phase for $VNA and European equities is largely over. Exit.

On a related note, all these developments are incrementally EUR-positive. I’ve been shifting my FX exposure accordingly. In case you were wondering.

Energy: ultimate compounders & 2022 winners

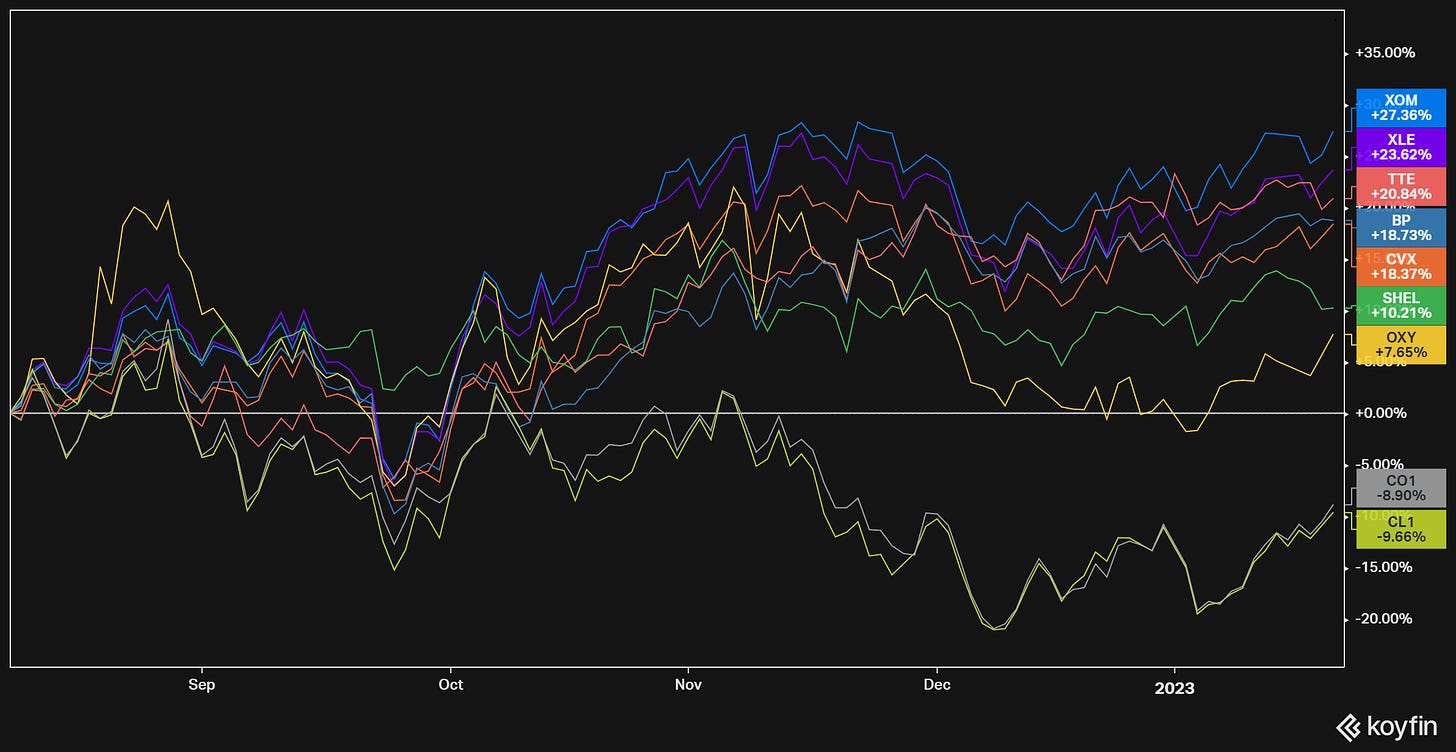

At the core of the commodities/energy thesis is the decade-long structural underinvestment in natural resources and ever-growing global demand, which conspire in favor of higher prices. I see the commodities supercycle only being tamed in the longer term by eventual capacity expansion/project development or recession.

On the latter, its impact would only be temporary as it would not alleviate these pressures in the long run. With the Chinese / European growth outlook improving considerably, the chances of an all-out recession in 2023 seem to have somewhat subsided. Left tail, less fat.

If US indexes continue trading sideways in the medium term, I favor “extraordinary performance not tied to price appreciation, but rather to shareholder remuneration (dividends and share buybacks/repurchases)” and in that scenario I “expect energy companies to become the dividend stocks of our generation, […] great businesses with high yields that institutions don’t want to own” (Read more: $13 THE BOOK OF MUIR).

This is how my picks (XOM, XLE, CVX, BP, TTE, OXY, SHEL) have fared since the note on oil was published compared to owning oil futures (i.e., Brent and WTI) outright. Anywhere close to these oil prices, their equities print cash.

(Click on image to enlarge)

Source: Going John Galt

Finally, uranium is one of the big winners of 2022 despite its relatively lackluster performance in 2022. 3

The Sprott Physical Uranium Trust (SPUT)—which delivers exposure to the spot price of uranium—ended the year up only ~15%. But…

Public perception is doing a 180. The world's soap opera in energy markets has been great publicity. Governments have consolidated this pivot via pro-nuclear regulation. Structural underinvestment across commodities applies to uranium as well. Miners are confirming the start of a new contracting cycle with the signature of massive long-term agreements. M&A and consolidation is happening. And... there are chances that sanctions limit access to Russian uranium

Read more: $22 “IT’S PRONOUNCED NUCULAR"

The set-up is great into 2023 and until uranium trades at the very least in line with the upper range of its cost of production ($55-65 per pound).

If you were actually asking the question “where is John Galt”, just know that he’s made his way back from Asia and is currently enjoying the European ski season. The land of milk and money.

Hope all of you enjoyed the holidays and started off the year on the right foot. I also hope you are as excited about this 2023 as I am.

1 Note this is clearly not a diversified book and it does not include all the positions on our portfolio.

2 The ECB hiked 200bps in 2022 and is projected to raise 50bps in consecutive meetings (February and March) followed by 25bps in May to reach a terminal rate of 3.25%.

3 It would be a shame if we become the first generation in history that transitions to a less energy-dense fuel as its primary energy source. Wood > coal > oil > uranium, the trend should be clear.

More By This Author:

$24 JPY: A Great 2023 Story Gets Better

$23 A More Balanced Approach

$22 “It’s Pronounced Nucular"

Disclosure: This publication's content is for information and entertainment purposes only and should not be relied upon for investment decisions. Nothing produced under the Going John Galt brand ...

more