$22 “It’s Pronounced Nucular"

Executive Summary

-

Nuclear’s history is that of boom and bust cycles pivoting around a couple of key incidents that shaped public perception and initiated large scale backs due to safety / waste concerns

-

Today though, nuclear is a safe, independent, clean, low carbon source of reliable base load energy

-

Public perception has turned around in favor of nuclear and the uranium market—fuel for nuclear power plants—offers a great asymmetric risk-return opportunity

This post discusses—implicitly or explicitly—investments in commodities (energy / uranium) and equities (CCJ / CCO, KAP.IL, URA, URNM, SPUT).

This week’s meme is not even one. It’s just too great as it is.

‘Long-time’ Going John Galt readers have probably asked themselves why I’ve not written about nuclear and its fuel (uranium or U3O8) yet, considering numerous references to the space across different pieces.

The reason is very simple. I’ve long considered it difficult to encapsulate the most relevant aspects of the uranium thesis in my typical 1-1.2k word missive. My friend Marina PM, been very invested in the space for quite some time has convinced me to give it a try and help me, though.

So, let’s dig in.

The Merits of Nuclear

The merits of nuclear today are not fully grasped by the general public, as technology has evolved substantially and misinformation has built over decades. The primary merits of this type of energy are:

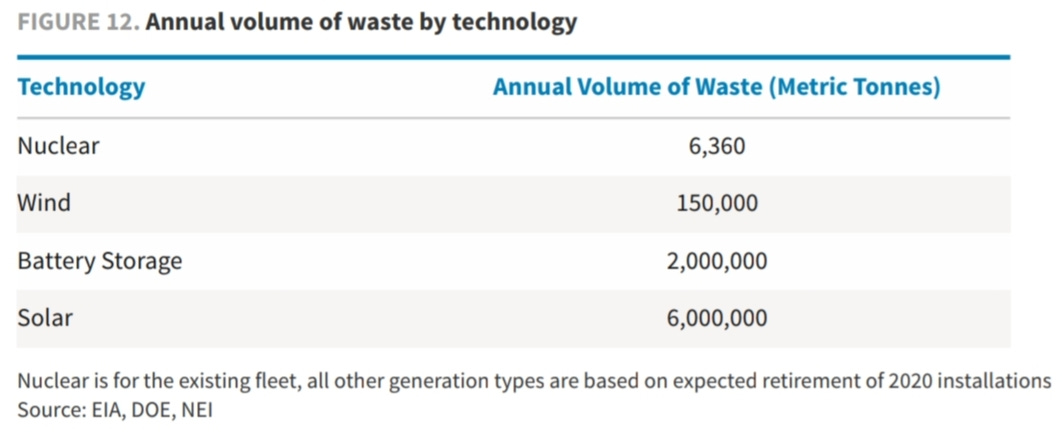

Source: Barclays Source: Our World in Data Source: Citi

-

Clean, low-carbon: The fight against climate change and an accelerated energy transition can benefit from expanding this low carbon source of energy. Due to its energy density, waste is a much smaller problem than for other energies. For context, all the waste produced by all nuclear power plants (NPP) overtime can be stored in a facility the size of a football field and the height of a large warehouse. All waste is contained onsite after energy delivery compared to fossil fuels releasing it into the atmosphere, for instance.

Source: Barclays

-

Finally, land requirements are minimal—regular NPPs take up 1-3 square miles in land.

-

Energy independence / security: Difficult to run out of uranium fuel in the short-medium term—long fuel access restrictions (i.e., embargos, sanctions, etc.) are not being a problem. NPPs have 1-3 years of inventory onsite and sign long-term, diversified delivery contracts to secure access to fuel years in advance.

-

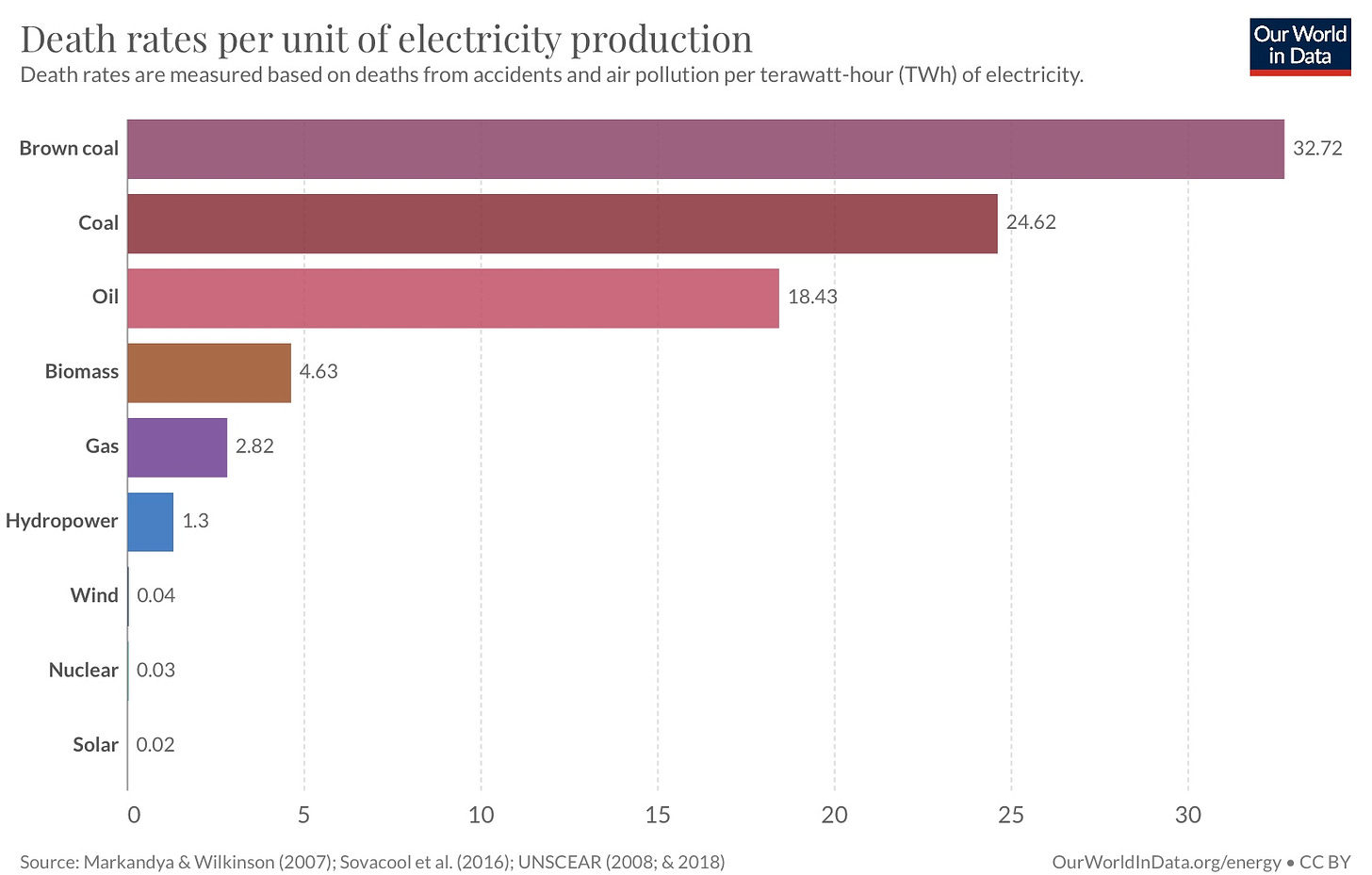

Safety: No energy source has a pristine track record here, but nuclear is one of the safest energy sources.

Source: Our World in Data

-

Reliable, base load energy: Nuclear boasts the highest capacity factor across the mix, with plants operating >90% of the time. This compares positively with renewable, intermittent sources which aren’t great for base load.

Source: Citi

Finally, a thought. It would be a shame if we become the first generation in history that transitions to a less energy-dense fuel as its primary energy source. Wood > coal > oil > uranium, the trend should be clear.

Nuclear: History sometimes does more than rhyme

The history of nuclear since the build out of the first commercial NPP in the 50s is that of boom and bust. Cycles pivoted around a couple of key incidents (i.e., Three Mile Island in 1979, Chernobyl in 1986 and Fukushima in 2011) that shaped public perception and initiated large scale backs due to safety and waste concerns1.

The price of NPP fuel (uranium or U3O8) in the spot market historically is a function of those cycles and the broader economic environment. You can use the chart below to follow along the fundamental changes over time.

Source: Sprott Physical Uranium Trust

The 60s and 70s brought a major global boom in NPP construction along with the development of the uranium mining industry. The 1973 oil embargo led to an era of turbulent energy markets that culminated in the 1979 energy crisis intensified calls for energy security and diversification away from fossil fuels administered by ‘unfriendly’ states. Long lead times in uranium mine development—often 10Y+ affairs—instilled great concerns for availability and put tremendous pressure on uranium prices.

For many years, higher prices and planned NPP development incentivized the expansion of uranium production. With plans for new NPPs coming to a screeching halt following the Three Mile Island (United States) incident in 1979, demand was unable to catch up to increasing uranium supply and stockpiles grew from the surplus. The infamous Chernobyl incident in 1986 unleashed powerful demand destruction forces, which put the proverbial final nail in the coffin of NPP construction. A long walk in the desert ensued.

Source: Sprott Physical Uranium Trust

The collapse of uranium prices catalyzed violent demand destruction via curtailment of operations / full business exit. Surpluses turned into deficits in the early 90s again, allowing demand to digest inventories2 over the subsequent decade until uranium prices bottomed in 2001. The start of a nuclear renaissance.

Prices of uranium started rising again around 2003, unleashing a bull market for the ages driven by:

-

Robust global economic development and demographic expansion turbocharged evergreen energy growth

-

China’s 11th 5-year plan promoting nuclear power and other populous countries embracing it

-

Unsustainability of secondary uranium sources and renewed push for energy diversification away from carbon

-

Disruptions of production by natural and man-made external shocks / disasters (e.g., floodings of McArthur River mine in 2003 and of Cigar Lake mine in 2006)

-

Increasing financialization of uranium and growing investor interest

This financialization exposed the industry to excess, only burst by the Great Financial Crisis (GFC) in 2008. Uranium prices cratered. The 2011 Fukushima incident dealt the final blow to a struggling industry as public perception of nuclear energy turned on a dime once more. Existing reactors closed in Japan and other countries scheduled closures (e.g., Energiewende). NPP development plans were scrapped. Uranium was once again oversupplied.

An entire $150bn+ industry collapsed down below $20bn. History sometimes does more than rhyme.

Uranium Market today—Supply and Demand

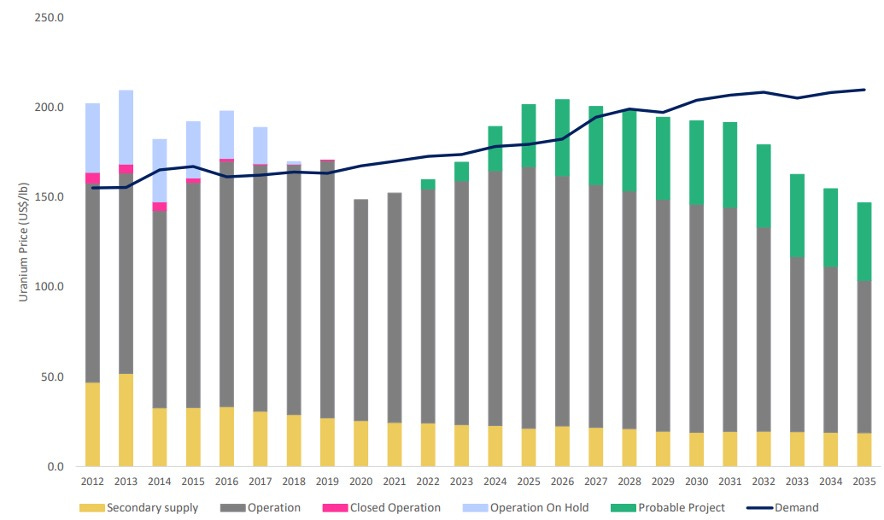

Today’s healthy, uptrending uranium market stems from bold and unprecedented measures by the industry’s largest players dating back 5Y to push supply and demand back into deficit.3 Supply—primary and secondary—is roughly ~155mn lbs today with demand at ~170mn lbs.

Source: Yellow Cake, UxC

Supply

The wildly popular Lyn Alden recently said “uranium was forged in the heart of stars”. Certainly the most beautiful way to describes the energy-density of this fuel. Now, while true from a cosmological sense, it is by no means rare on Earth. It’s commonly found in rocks / earth on the ground and in seawater, but the only relevant material is what can be economically mined.

-

Primary Production: The above chart shows currently operating mines (“operation”) at ~125mn lbs, well below annual demand requirements. Today’s reality is that current uranium prices remain below cost of production, generally estimated at ~$55-65 / lbs. And even if uranium reached an economically viable price for new mines to come online, mine development is always a multi-year / often a multi-decade affair.

-

Secondary Supply: A significant, yet decreasing, source of supply which includes stocks / inventories, nuclear fuel reprocessing of spent reactor fuels and from surplus military plutonium, underfeeding4 and uranium produced by the re-enrichment of depleted uranium tails.

The most frustrating aspect of the uranium thesis is the lack of reliable information relative to legacy stock / inventories. Some sources indicate we might be getting close to full depletion, while others point to a few more years of additional supply.

Demand

There are three main sources of uranium demand, all tied to its use as NPP fuel:

-

NPPs—existing / under construction / planned / proposed: Number of NPPs worldwide expected to double from ~440 NPPs today, with governments recognizing nuclear’s role as a safe, low / zero-carbon, independent, base load energy source.

Today, nuclear has a ~10% share in the world’s energy matrix. Even maintaining that share, nuclear generation should grow on the back of steady population growth (~11bn est. in 2100 vs. 8bn today) along with rising living standards, tied to increases in energy consumption per capita. The International Energy Agency (IEA) projects >2x nuclear generation by 2050.

Most of the new NPPs being built and planned are in emerging markets (EMs). Despite the strong shift in public perception across western developed markets (DMs) and the renewed push for energy security / diversification forcing governments to announce NPP life extensions (e.g., Inflation Reduction Act in the US, Europe and South Korea’s new “green” taxonomy, UK, Japan, etc.) and new builds in those jurisdictions, this was always a DM demand story.

Source: YellowCake, WNA

-

Finally, new technologies such as novel Small Modular Reactors could unleash a new wave of demand.

-

Financial demand: Vehicles of the likes of Sprott Physical Uranium Trust (“SPUT”) or Yellowcake PLC were formed to stimulate price discovery in the physical spot market. The strength of this demand should not be underestimated. Since SPUT’s inception in July 2021 it has “sequestered” ~41mn lbs of uranium (U3O8) through its at-the-market mechanism of capital formation, which allows it to accumulate uranium as money flows into the fund.

For years I’ve been an advocate of nuclear energy. I’m an investor in the space since 2019 and it’s one of my highest conviction, long-term investments.

What is clear is that stars are aligning. Public perception is doing a 180. The world's soap opera in energy markets has been great publicity. Governments have consolidated this pivot via pro-nuclear regulation. Structural underinvestment across commodities applies to uranium as well. Miners are confirming the start of a new contracting cycle with the signature of massive long-term agreements5. M&A and consolidation is happening. And... there are chances that sanctions limit access to Russian uranium.

I started off owning Cameco (CCJ)—the largest, safest producer / miner based out of Canada)—but I soon moved onto riskier pastures adding two thematic ETFs (ticker: URA and URNM). These ETFs own primarily (junior) miners, offering explosive exposure to uranium prices along with substantial risk.

As URNM approached ~$90, I transitioned out of equities into outright exposure to the uranium spot market via Sprott Physical Uranium Trust (SPUT, SRUUF). My investment had become a bit too spicy and I did not want to give back P&L, so I simply chose a less risky expression of that view. History has taught me that uranium cycles aren’t short and sweet, but long and winding. Manage your risk accordingly.

SPUT remains to this day one of my largest positions and a great buy at today’s levels after yesterday’s questionable fire sale:

-

Spot uranium trades at ~$50 / lbs. It’s >2x from the cycle lows, but only one third of the all-time highs and well below cost of production. Asymmetry. You can follow the price here (spot) and here (long-term contracting price).

-

SPUT trades at $15, which represents a 10% discount to NAV. This essentially means you can buy uranium held in drums across different facilities in North America and Europe ~$45 / lbs. Discounts aren’t rare and tend to close shortly.

With that… John Galt out. I’m off to add some SPUT.

$$$

Thanks for reading,

John Galt

1 Incidentally, these also fostered stark technological development with focus on security, reliability and efficiency, leading to the modern Gen IV type of nuclear reactor, the Small Modular Reactor (SMRs, <300 MWh vs. 1-1.6k MWh for your typical reactor) or the light-water reactor.

2 An unlikely source of strong secondary uranium supply was the “Megatons to Megawatts” Program. In February 1993, the US and the Russian Federation signed a 20Y, government-to-government agreement for the conversion of 500 metric tons of Russian highly enriched uranium from nuclear warheads to low-enriched uranium to fuel US nuclear reactors. The program ended in 2013 and added ~25mn lbs of uranium per annum to global supplies.

3 Starting in 2017, the two largest uranium producers—Cameco (ticker: CCO and CCJ) and Kazatomprom (KAP.IL)—substantially cut production. Cameco closed the McArthur River mine (~18mn lbs / year) and Kazatomprom added a 20% production cut, both committing to reduced production levels through the end of 2023. The COVID pandemic further curtailed production. “Shrinking to greatness” borrowing from UBS' Ermotti.

4 Secondary supply shrank due to the Russian invasion of Ukraine.

In the interest of not veering too much off piste here, I’ll let my expert friend John Quakes explain the important concepts of over and underfeeding here. He’s a great follow and a great dude, for what I’ve seen.

Now, factor in that Rosatom is the biggest uranium enricher in the world with ~40% of global enrichment capacity and ~20% of conversion. When western nuclear fuel buyers started self-sanctioning Rosatom, secondary supply coming from underfeeding which had been relied upon historically started to shrink and turned into overfeeding. More uranium was then required to generate the same amount of fuel.

5 Only Cameco has signed roughly 77mn lbs Year To Date (YTD).

Disclosure: This publication's content is for information and entertainment purposes only and should not be relied upon for investment decisions. Nothing produced under the Going John Galt brand ...

more

Welcome, nice to see you here.

Patience is a virtue when it comes to these kinds of stocks.

I go nuclear for nuclear stocks!

Not a fan of renewable energy?

Good read. I'm long as well.