$24 JPY: A Great 2023 Story Gets Better

Executive Summary

-

Bank of Japan (BoJ) took a first hawkish step this week, opening the door for a broader pivot in 2023

-

Japan’s path leads to higher domestic bond yields, lower US-Japan bond yield differentials, and strong JPY appreciation

-

Implications for global assets are vast, as this pivot risks the flight of Japanese capital from global toward domestic assets

This post discusses—implicitly or explicitly—investments in FX (USDJPY) and bonds (JGBs, US bonds).

Preparation meets opportunity

If you’ve stuck around with me long enough (thanks!), you know I’ve been spending quite a bit of time in Asia this quarter. I concede the nomadic lifestyle is not for everyone, but it does have its unexpected perks.

At least that’s what I thought when the Bank of Japan’s (BoJ) decision to finally allow the tolerable trading band of Japanese 10Y bonds (JGBs) to widen from ±0.25 to ±0.5% caught me savoring my third cup of morning brew, with the homework done and the finger on the sell trigger. Luck and such.

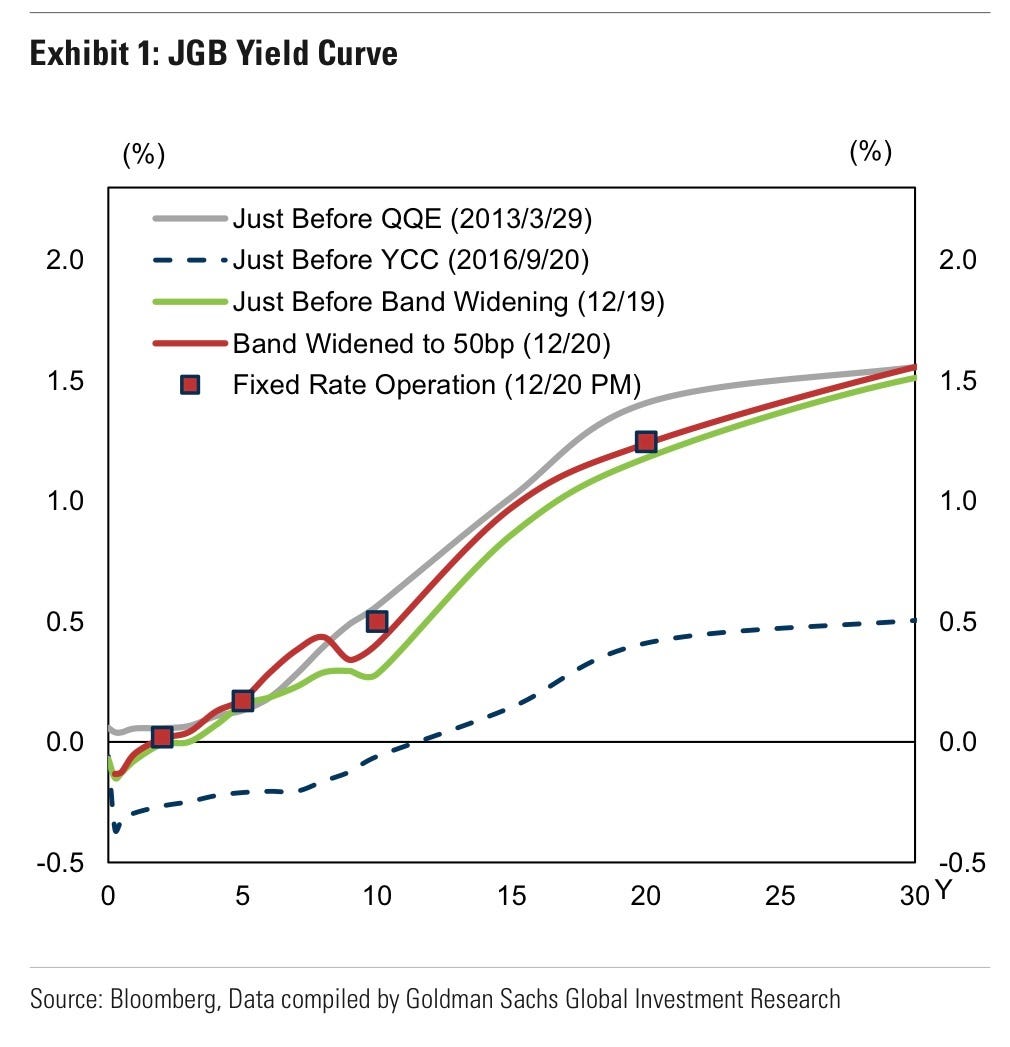

For years, the BoJ has been the most dovish central bank in the world, holding rates at 0% while aggressively engaging in Quantitative Easing (QE). Yield Curve Control (YCC)1 was instituted in 2016 and yields responded accordingly.

(Click on image to enlarge)

Source: Going John Galt

Things seem to be changing though. Today’s post is an explainer of how I see the situation in Japan playing out, the way to play it, and its global implications.

“You’re probably just having a mid-life crisis. Did you buy a Porsche yet?”

You might recall this quote by Charlotte, impeccably portrayed by Johansson in Coppola’s Lost in Translation (cliché?). Not sure this qualifies as a mid-life crisis for BoJ Governor Haruhiko Kuroda2—now well into his 70s—but I’m sure many investors would have preferred for him to buy a Porsche.

Last Tuesday, the BoJ decided in its Monetary Policy Meeting to leave policy generally unchanged for the 50th (!) meeting in a row, but… tweak the tolerable trading band for their 10Y bonds from ±0.25 to ±0.5%! Surprise, surprise.

None of the Bloomberg-surveyed economists expected this so soon, as Kuroda-san had done a magnificent job squashing rumors. To be clear, the expectation was there, but the domino was only expected to fall after Kuroda's term expires in April 2023 (in two meetings' time).

Whatever the case, several circumstances underpinned the decision:

-

JGB yield curve displaying a wrinkle (see green and red curves below showing a dip in the 10Y, maturity of the BoJ targets), which put the functioning of the broader bond market (i.e., bank loans, corporate bonds, etc.) at risk. Note how the curve shifted up after the tweak (red curve), yet still displayed the wrinkle. Interestingly, this “malfunction” is the primary reason quoted by Kuroda for this week’s step.

Source: Goldman Sachs

-

Widening US-Japan bond yield differentials putting strenuous pressure on a rapidly depreciating Japanese yen (JPY), notwithstanding the most recent US bond rally.

(Click on image to enlarge)

Source: Going John Galt, Goldman Sachs

-

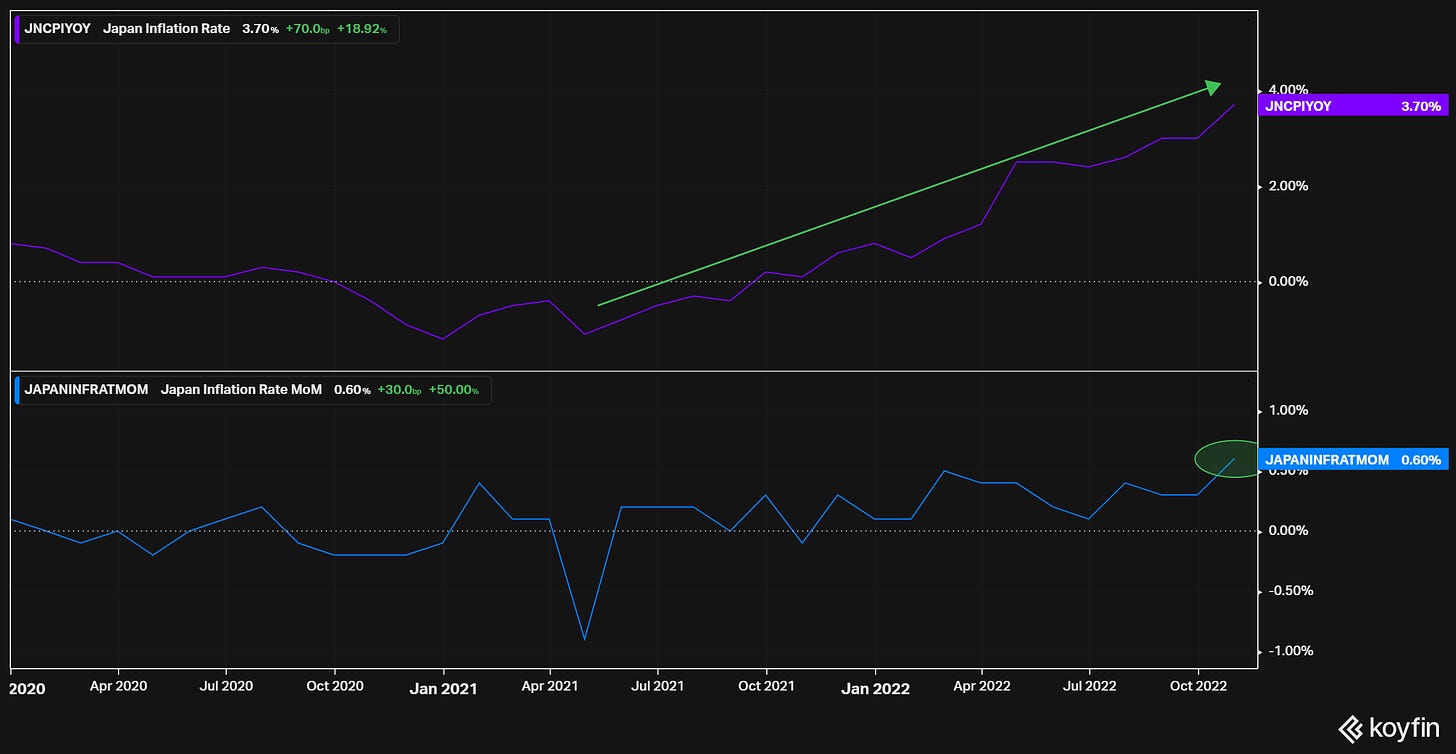

Monetary policy works with a lag—today’s changes are to be felt in 12-24 months—and inflation has already started to veer off the BoJ’s 2% mark (3.7% YoY, 0.6% MoM), despite other measures (e.g., CPI swaps, CPI expectations) still at subdued levels / lagging. Yen depreciation had likely been amplifying price pressures, importing inflation. Furthermore, Japan’s largest trading partner (China) reopening skews inflation risks to the upside.

(Click on image to enlarge)

Source: Going John Galt

In short, conditions were no longer compatible with the BoJ’s long-standing dovish monetary stance.

What followed was a massive reaction across global markets:

-

Appreciation of the yen against the dollar (USDJPY from ~138 down to ~131), is now no longer the worst-performing currency Year-To-Date (a dubious honor passed on to the SEK).

-

10Y JGB yields almost doubled to ~46bps (sounds like some Chamath math!) and the 2Y rising above zero for the first time since 2015. A move cheered by banks—which rose over 7% at one point as their business benefited from higher rates—while the broad Nikkei stock index lost 2.5%3. The latter is because of the expected loss in the competitiveness of Japanese goods/exports when priced in a higher currency (JPY).

-

US bond yields moved >10bps lower, their curve steepened, and the S&P was ~0.9% down. Textbook risk-off.

A great story gets better

Markets interpreted this as a first hawkish step, opening the door for a broader BoJ pivot. It’s both “symbolic” (as SocGen’s Juckes called it) and “a precursor to either retiring the target or even outright rate hikes” (BMO’s Lyngen & Jeffery).

Now, what would that pivot look like and when would it be?

It’s unlikely that any decision is made before Kuroda’s term expires and the BoJ gains visibility on the outcome of shunto wage negotiations playing out in the spring4.

The BoJ would have two main paths at that point:

-

Widen the tolerable trading band from today’s ±0.5%

-

Outright terminate YCC / Negative Interest Rate Policy (NIRP), in favor of no or a milder version of QE

I favor the second outcome. First, Kuroda alluded to bond market “malfunction” (the yield curve wrinkle around the 10Y described above) as the main reason for the tweak. The malfunction still exists today after the tweak—the curve (red) only shifted up. pushing it further up offers no guarantees of a functioning market. Secondly, the band is already ridiculously stretched at 100bps…

Whatever the case, both paths lead to higher Japanese bond yields, a lower US-Japan bond yield differential (ceteris paribus), and JPY appreciation (USDJPY down).

How to play it?

My preferred play is shorting USDJPY—betting on JPY appreciation. The bigger question is when we'll get the next leg down, considering the timing.

Several reasons underscore the coming yen appreciation:

-

Bond yield differentials: BoJ is turning more hawkish, while the Fed has telegraphed their intent for the next two meetings and will be soon on hold (priced in). Yield differentials will likely have to compress. Taking the chart produced by the powerhouse on 200 West St. above, the low 120s can be in play by the end of 2023. By almost any measure, JPY remains undervalued.

-

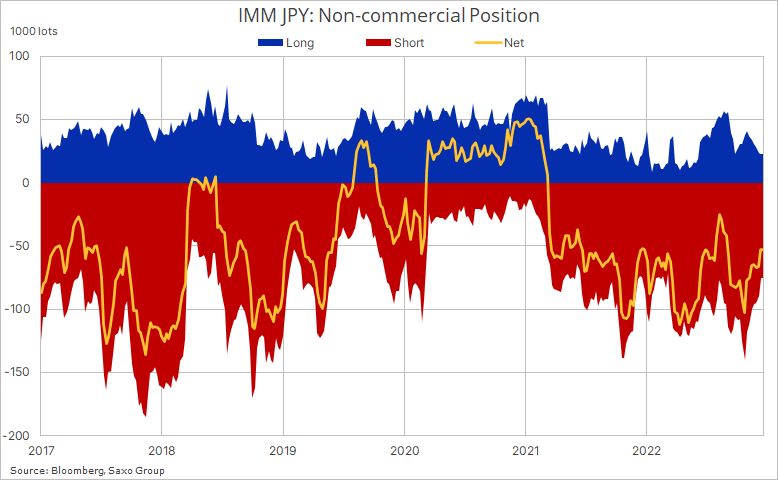

Positioning: Short JPY is a massively crowded trade. A monster position that seems to be unwinding as we speak, driving positive flows.

Source: Saxo Bank

-

Global recession concerns: JPY commonly outperforms in global recessions and tough macro environments, as yield differentials tighten, and JPY-denominated investors import / repatriate capital.

Also, in unstable macro environments, FX benefits from safer, ‘relative’ returns. While stocks can (and often do) go to zero, FX quotes the relative value of a pair of currencies. Thus, unlevered FX positions are effectively impossible to go to zero.

Allow me to be clear. Because I’m patient and recognize the potential for it to become a massive 2023 story, I'm already somewhat short. But I’m similarly cognizant of the fact that bond yield differentials compressed from the ~400bps peak even before the BoJ’s tweak, due to US bond yields coming off their highs. I consider US yields tactically overbought, which could trigger a reversion providing a headwind for JPY.

I intend to add as things progress. Coincidentally, this was already a great story that has gotten only better… as it was one of my preferred short USD plays for 2023 already ($21 THE ‘EVERYTHING TRADE’).

Shorting JGBs is a close second. The problem is that a terrific trade can turn terribly fast if the global recession everyone foresees crystalizes, as JGBs benefit from safe heaven flows and the BoJ would likely go ballistic.

Finally, I’m in the camp that expects this pivot to have vast implications for global assets as it can significantly alter cross-border capital flows.

Japan’s ~$5tn economy is highly intertwined with global markets, as one of the world’s leading exporters/importers. More importantly, though, Japan is a large exporter of capital with savings exceeding $20tn due to high household saving ratios (~10% recently). NIRP and Japan’s central bank monopolizing the domestic bond market forced Japanese investors to purchase foreign assets for years.

The risk for global assets is that these increasingly pull out / shift their large global allocation toward domestic assets, as over time and on the margin, these become more attractive for long-term investors looking to hold them to maturity (remember: some JGB maturities have started to yield positive!).

On Monday we got a first taste of what that might look like (i.e., US bonds and stocks sold off) and, if right, we’ll see further re-routing of cross-border capital flows in the coming months.

1 “What is Yield Curve Control?” (ChatGPT): Yield curve control (YCC) is a monetary policy tool that involves the central bank actively managing the yield curve, which is the relationship between the interest rates at which the government can borrow money for different time periods. The central bank does this by setting a target for the interest rate on certain government securities, such as long-term bonds, and actively buying or selling these securities in the market to keep the interest rate at the targeted level.

2 For those unfamiliar with Governor Kuroda, he’s probably the longest-running central banker in the developed world, after holding the position of Japan’s Minister of Finance. Interestingly, he moved up the ranks in the ministry as an FX expert.

3 Contrary to spot assets (such as commodities), where pricing generally does depend on current supply relative to demand, financial assets are forward-looking.

The outsized rally in banks is projecting an increasingly hawkish central bank stance. And so is USDJPY after this week's sell-off. Compare it with the move in the US-Japan bond yield differential driving the pair for the better part of 2022…

4 Anyone at this stage knows how important wages are for inflation. Japanese authorities have stated before that a 3% wage growth would be consistent with their 2% CPI target.

More By This Author:

Disclosure: This publication's content is for information and entertainment purposes only and should not be relied upon for investment decisions. Nothing produced under the Going John Galt brand ...

more