Could Demand Exhaustion Trigger A Sharp Pullback Into Seasonally Weak Months?

Image Source: Unsplash

Watch the video from the WLGC session on 22 Jul 2025 to find out the following:

- The one key sign that could warn traders when bullish momentum is truly running out.

- The role of seasonality (August–September softness vs. October rally) in shaping market expectations.

- How to interpret indecision in price action — and what it means for short-term versus long-term trends.

- How to spot the exhaustion of demand with price volume analysis.

- And a lot more…

Video Length: 00:04:05

Market Environment

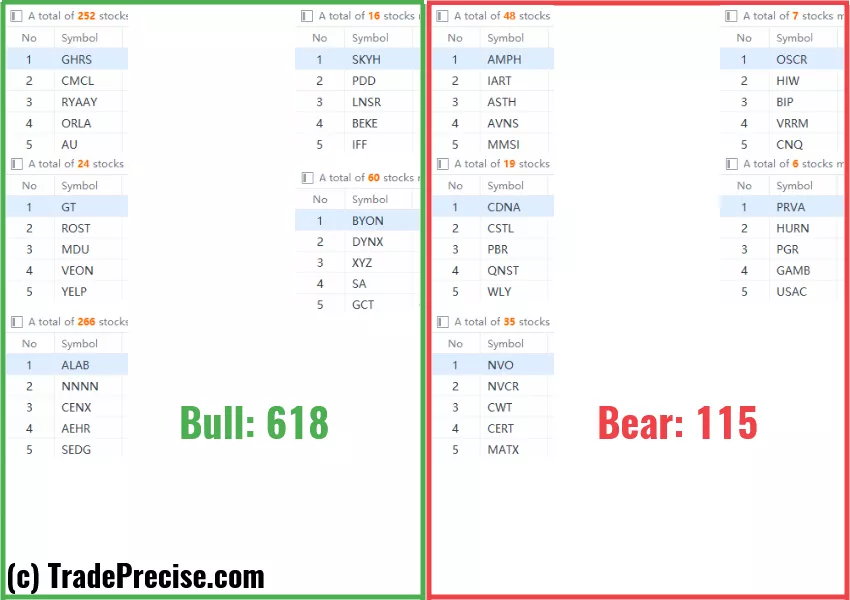

The bullish vs. bearish setup is 618 to 115 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

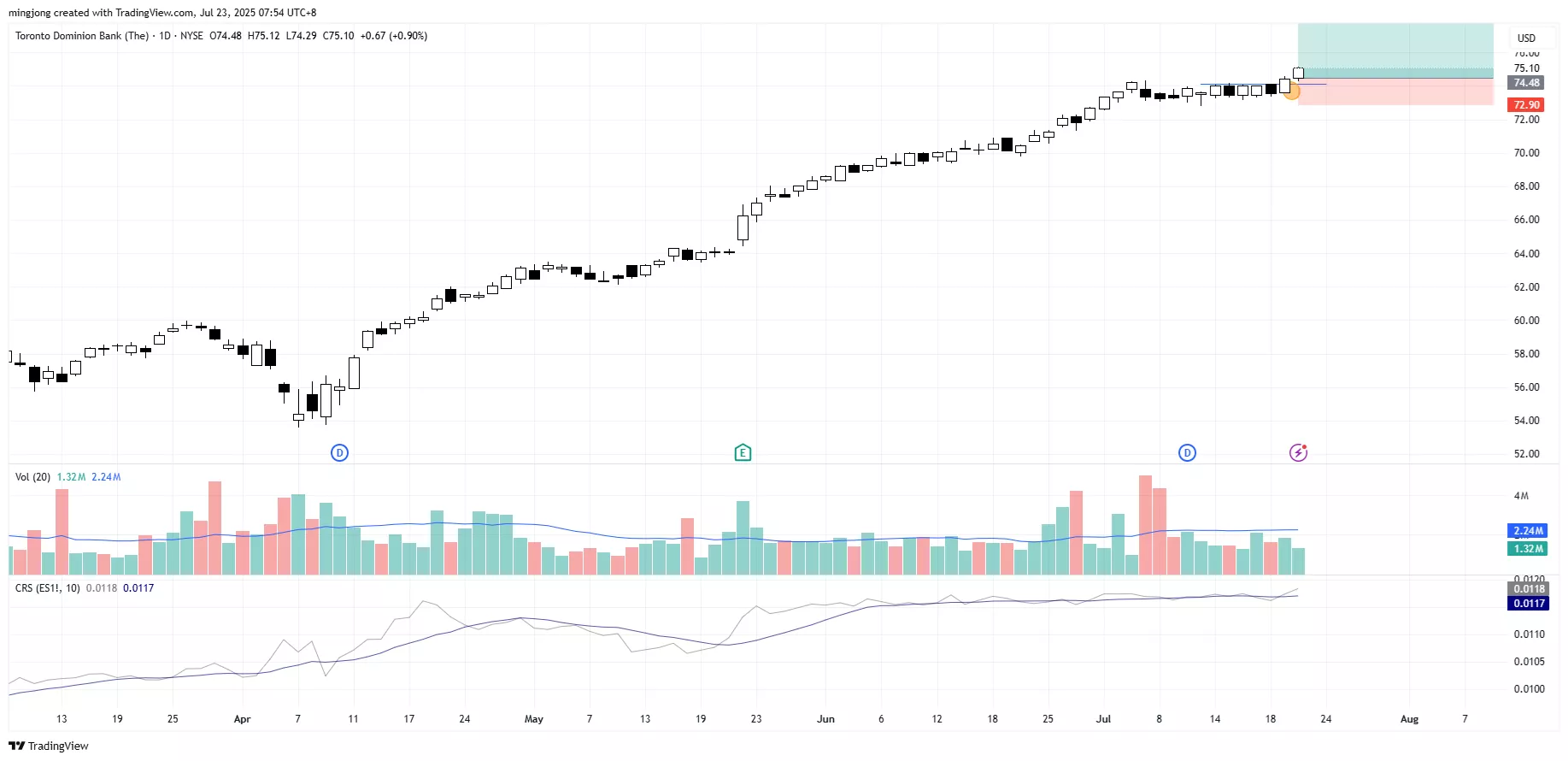

19 actionable setups such as STX, TD, EYE were discussed during the live session on 15 Jul 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

Forget The Golden Cross: These Overlooked Clues Could Signal The Market’s Next Big Move

This Zone Could Set The Stage For The Next Market Surge

This Quiet Warning Sign Could Signal A Pullback

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.