This Quiet Warning Sign Could Signal A Pullback

Image Source: Unsplash

Market Discussion

Find out the subtle signs that could hint at a sudden market reversal in the S&P 500 at this all-time high level.

Watch the video from the WLGC session on 2 Jul 2025 to find out the following:

- What does the volume say about the strength of this rally?

- The key support levels that traders are watching right now.

- The anticipation of a “pause to charge up” for the next leg up.

- And a lot more…

Video Length: 00:03:35

S&P 500 Approaches All-Time Highs

Yesterday’s market action was bullish, with the S&P 500 making its first major attempt to break out of the previous all-time high of 6150.

We’ve been expecting this move and warned it was likely the market would keep climbing toward these lofty targets before we see any meaningful correction.

Limited Pullbacks—Bullish Momentum Remains

Since the most recent bottom, pullbacks have been shallow and almost negligible. The majority of the moves have been “grinding up,” suggesting continued upward momentum.

Both supply and demand are decreasing, but crucially, supply is still less than demand, keeping the bulls in control for now.

Warning Signs to Monitor

Despite the bullish trend, traders should keep an eye on:

- A sudden spike in supply (profit-taking or new short positions at all-time highs)

- Potential pullbacks to the 6000 level, which now serves as psychological and technical support

Looking for Healthy Pauses

If we see a slight uptick in supply or increased volatility, a healthy pullback or pause could be in the cards.

This would give the market a chance to consolidate and “charge up” for another attempt higher—possibly setting the stage for a classic rounding pattern or handle formation before a breakout.

Overall Market Health

Despite brief dips and news-driven bearish bars, buyers keep stepping in (“demand tail”—buying the dip), and the higher highs/lows structure confirms the swing remains bullish.

Caution is still warranted near the all-time high resistance, but so far, the market action remains constructive.

Market Environment

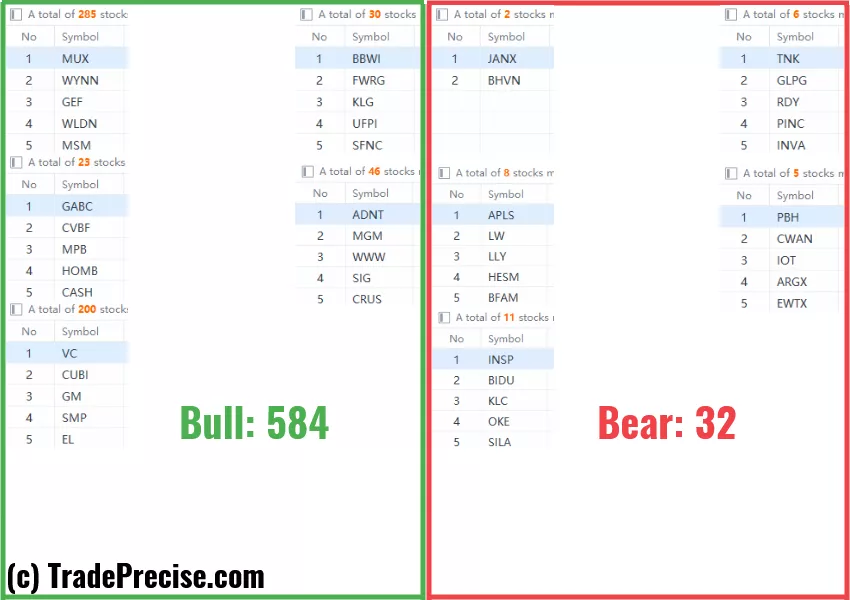

The bullish vs. bearish setup is 584 to 32 from the screenshot of my stock screener below.

3 Stocks Ready To Soar

17 actionable setups such as DINO, AMRN, CTVA were discussed during the live session on 2 Jul 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

The Bull Is Still In Control — But One Spike In Supply Could Flip The Script

Market Ignored War Headlines - Are We Headed For A Blow-Off Top?

3 Clues The S&P 500 Is Warming Up For A Breakout

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.