This Zone Could Set The Stage For The Next Market Surge

Could the market still have room to push higher despite short-term overbought signals?

Watch the video from the WLGC session on 8 Jul 2025 to find out the following:

- The key support zone that could trigger the next leg up.

- How could news like tariffs or geopolitical tensions disrupt the current market trend?

- How to spot consistent, high supply level to anticipate the start of a pullback

- And a lot more…

Video Length: 00:02:55

S&P 500: Still Climbing, With Healthy Signs

Last week’s action confirmed: despite the index being overbought in the short term, there is no major spike in supply or significant sell-off pressure.

In fact, any localized increase in supply is being swiftly absorbed by buyers, as shown by the presence of demand tails—signals that bulls are ready to step in whenever the market dips.

Support Levels to Watch:

- The 6100 to 6150 zone is crucial. This was a previous swing high and now serves as an important support area.

- Should we see any pullback, a drop to this region would be considered a “healthy pause”—giving the market room to consolidate before moving higher.

- If the index pulls back further, keep an eye on the 6050 to 6000 area for additional support.

Market Structure & What’s Next:

- Candlestick spreads and volatility remain contained; recent candles are small and indicative of a market “grinding up.”

- Any selling attempts have quickly found buyers, reinforcing the trend to the upside.

- Despite news events (such as tariffs or geopolitical tension) that could trigger choppiness, the swing remains upward, and momentum remains positive.

Strategies and Key Takeaways

- Expect another push higher before a meaningful pullback or extended consolidation.

- Even during a pullback or sideways market action, there are still plenty of bullish setups among outperforming stocks. Don’t hesitate to “test the waters” with small position sizes and scale in as favorable charts emerge.

- Stay mindful of news catalysts that could cause temporary volatility, but remember: overall, the uptrend is intact, and the market structure looks encouraging for bullish traders.

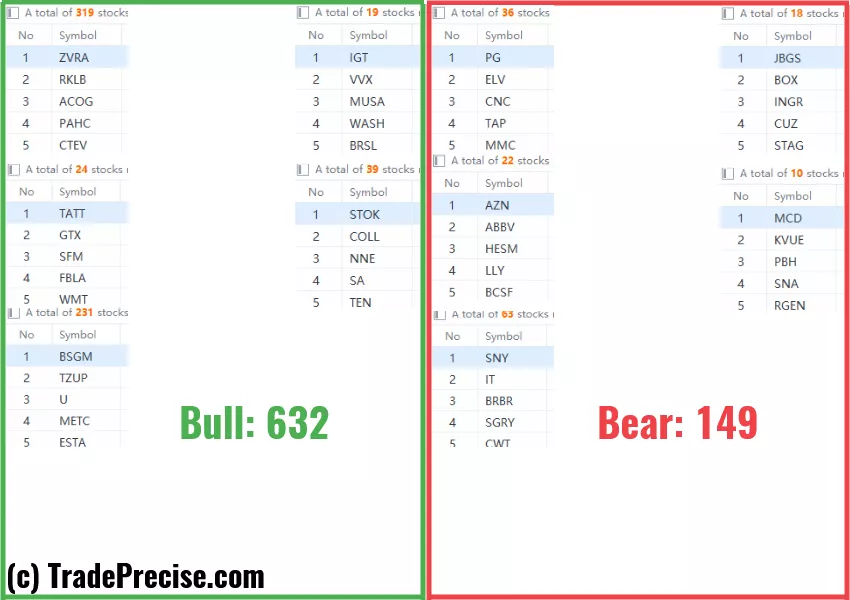

Market Environment

The bullish vs. bearish setup is 632 to 149 from the screenshot of my stock screener below.

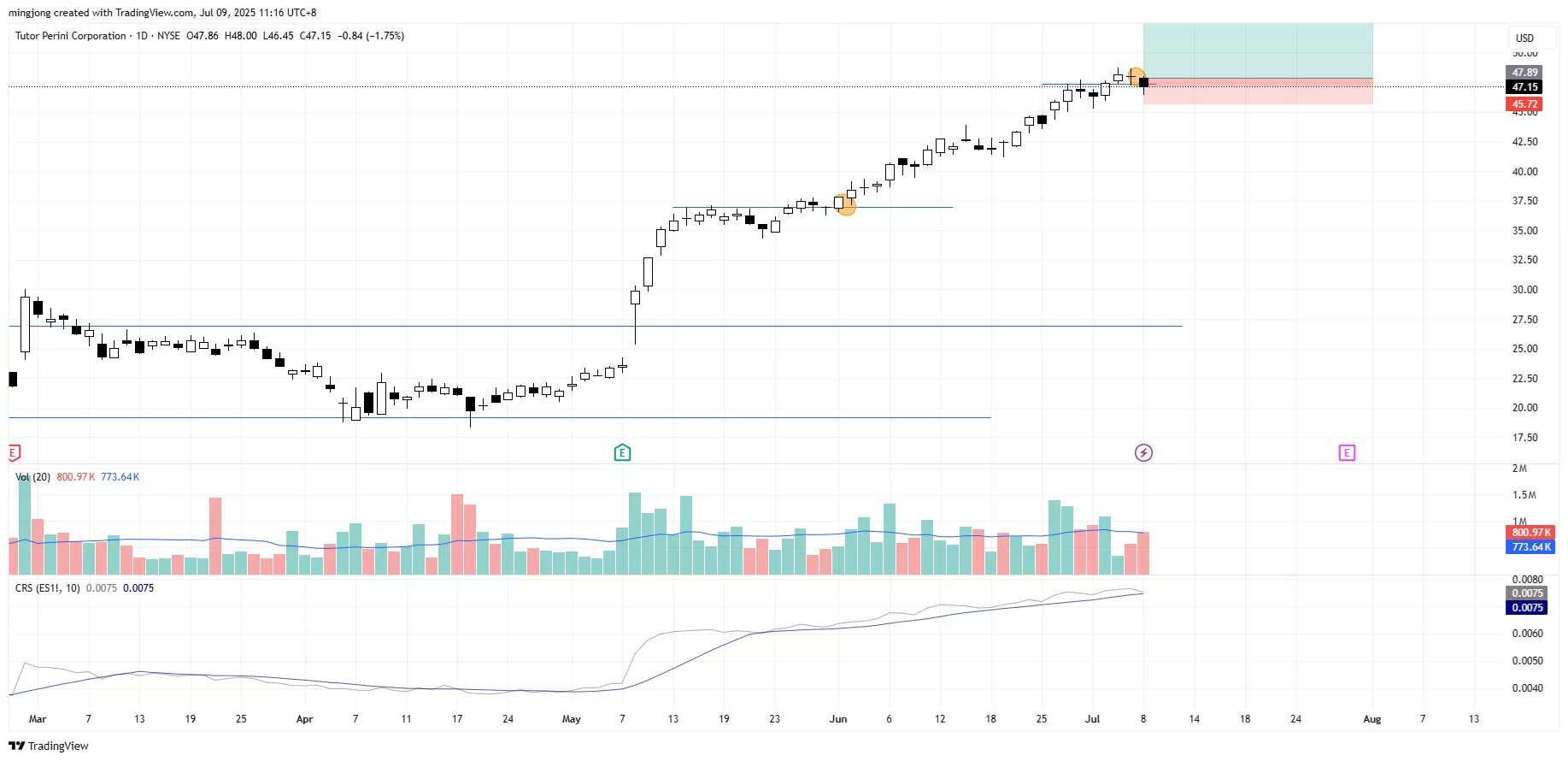

3 Stocks Ready To Soar

23 actionable setups such as CCJ, TPC, VRNS were discussed during the live session on 8 Jul 2025 before the market open (BMO).

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

This Quiet Warning Sign Could Signal A Pullback

The Bull Is Still In Control — But One Spike In Supply Could Flip The Script

Market Ignored War Headlines - Are We Headed For A Blow-Off Top?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.