Trustworthy Companies Offer Superior Investment Returns With Less Risk

This June, Trust Across America-Trust Around the World (TAA-TAW) retained Index One, a global back testing and index creation firm based in London to evaluate our FACTS® Framework (ten year historical results) versus major US indexes.”

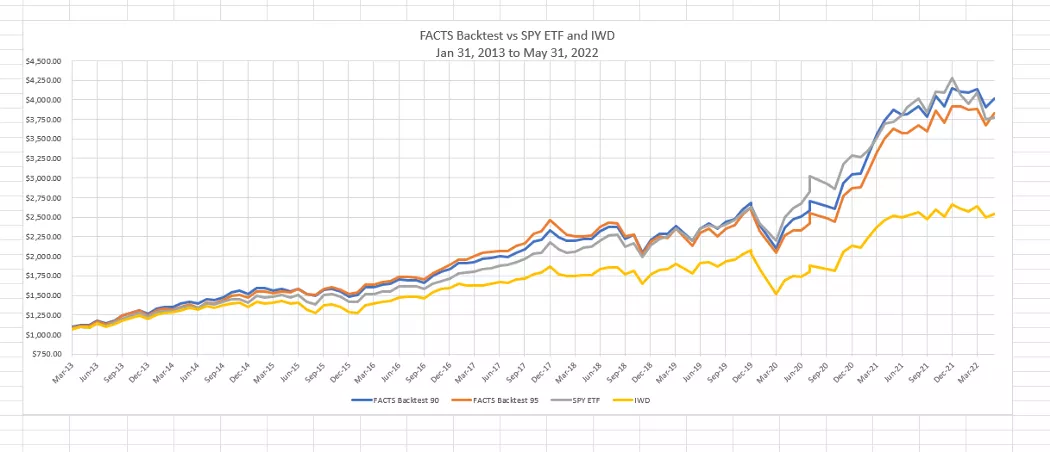

(Click on image to enlarge)

The results are as follows with annual rebalancing:

The top 50 FACTS® companies outperformed the iShares Russell 1000 Value ETF (IWD) by 47% (15.46% vs.10.51%).

The top 100 FACTS® companies outperformed IWD by 52.9%, 16.07% vs. 10.51% for IWD

Index One also performed the same analysis using the SPDR S&P 500 (SPY) ETF. 16.07% (50 companies) and 15.46% (100 companies) respectively vs. 15.27% for SPY.

(Alpha, Beta, Treynor Ratio, Upside and Downside Capture ratios produced excellent results)

Methodology: Ten years ago Trust Across America-Trust Around the World (TAA-TAW) constructed a model to evaluate the trustworthiness of public companies, incorporating quantifiable metrics and data and named it the FACTS® Framework, an acronym that includes five drivers or indicators of trustworthy business behavior. They are:

- Financial stability

- Accounting conservativeness

- Corporate governance

- Transparency

- Sustainability

Using the FACTS® Framework TAA-TAW quantitatively screens 1500+ of the largest US public companies based on publicly available data. The companies do not participate in the analysis, nor are any internal assessments or surveys completed. Understanding that no company is perfect, TAA-TAW can identify the “best of the best” in trust.

When we built this framework over ten years ago we were advised that a ten year tracked record was required before serious consideration could be given to the model. Achieving a higher return than SPY with lower risk not only strengthens the “Business Case for Trust” but also provides the investment community with an opportunity to lower risk without sacrificing returns. And perhaps even more important, it rewards companies who proactively lead with trust.

Our most trusted companies include: Abbvie (ABBV), American Express (AXP), Amgen (AMGN), AutoDesk (ADSK), Hershey (HSY), HP (HPQ), Kroger (KR), PVH (PVH), Qualcomm (QCOM), and Texas Instruments (TXN).

More By This Author:

Most Trustworthy Public Companies

Does the CIO Own Trust? If Not, Who Does?

Another Bank CEO, Another Promise to Rebuild Trust

Do any banks ever make the most trusted list?

The banks are all crooked - always getting caught stealing from their own customers. It just happened yet again:

https://www.cnn.com/2022/07/30/business/us-bank-cfbp-fine/index.html

Hi and thanks for your comment. We are looking at most trustworthy not most trusted. Big difference! The first is an internal measure while the second is external perception. It's unusual for our annual "Top 10" to ever include any of the big banks or big pharma. Keep in mind that industry is not destiny. Banks come in all shapes and sizes from community banks to JP Morgan Chase and everything in between.

Clarification that HP Inc. (Newish Ticker Symbol: HPQ, no longer HWP) is the company formerly known as Hewlett Packard Inc. and is the company in the top ten.

HP is still the ticker symbol for Helmerich & Payne, a longtime oil service and equipment company. That company did not make this list.

The article does correctly list HP's ticker symbol as $HPQ.

Great questions folks. Keep in mind that no company is perfect. However, the most trustworthy have less risk for investors and they tend NOT to blow up like Enron or Wells Fargo. We only focus on the "good guys" so you will not see reports from us on the bad actors. As far as how we define "trustworthy" it's included in the artilce. Keep the questions coming!

How can we know if a company is "trustworthy" when they are so often caught lying? People thought Enron was trustworthy until they were caught. And Wells Fargo was considered a reliable bank before Whistleblowers outed them for stealing their own clients money. And I generally trusted Facebook's algorithms until we found out they sold out our Democracy for cash, by letting Russia manipulate our recent elections.

I'm very curious to know which are the LEAST trustworthy companies!

Me too. In particular, where do #BigTech companies like #Google and #Facebook fall on the trust score? Both seem to have lost their ethical and moral compass over the years.

$GOOGL $FBAgreed. Google's motto used to be "Don't Be Evil." But they actually dropped it once they realized "Be Evil" was more profitable!

Lol, I Googled that and it's true! #Google may now be evil, but at least they aren't hypocritical enough to leave their motto unchanged!

How do you define if a public company is "trustworthy" or not?