WTI Extends Losses After Biden Admin Drains SPR By Most Since December

Oil prices are lower this morning, after a quick trip higher on weaker-than-expected CPI (less Fed tightening). However, this 'dovish' dip in CPI was not enough to quell concerns about a recession and implicitly weak oil demand.

“Wall Street remains unsure of how long this disinflation journey will take to get to the Fed’s inflation target of 2.0%,” said Ed Moya, senior market analyst at Oanda.

Prices were also weighed down by API's report which showed an unexpected crude build (the biggest since Feb).

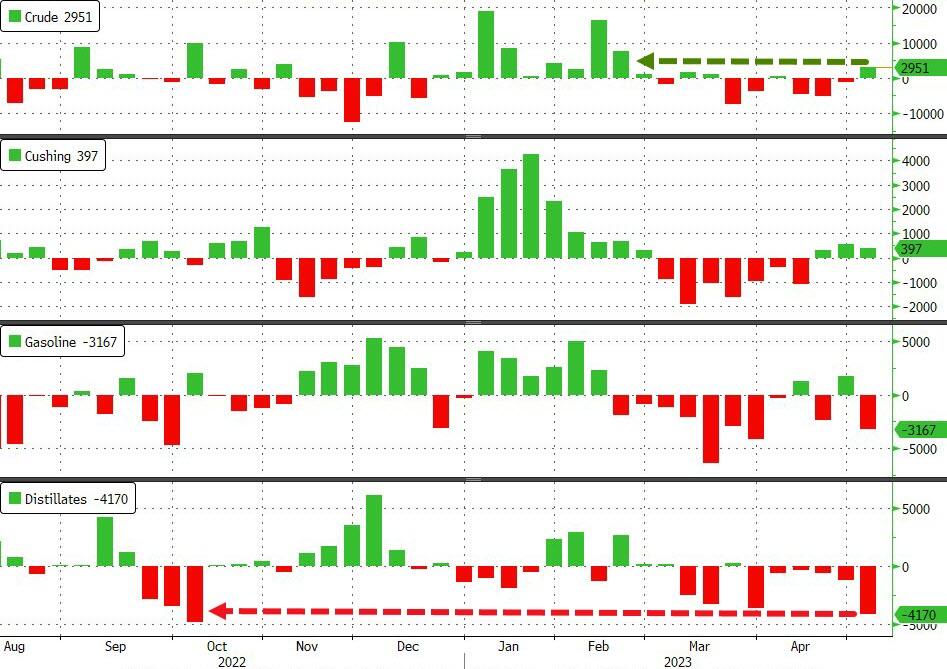

API

- Crude +3.618mm (-800k exp) - biggest build since Feb

- Cushing -1.316mm

- Gasoline +399k (-800k exp)

- Distillates -3.945mm (-400k exp)

DOE

- Crude +2.951mm (-800k exp) - biggest build since Feb '23

- Cushing +397k

- Gasoline -3.167mm (-800k exp)

- Distillates -4.17mm (-400k exp) - biggest draw since Oct '22

The official data confirmed API's reported and unexpected crude build and gasoline;s large inventory draw...

(Click on image to enlarge)

Source: Bloomberg

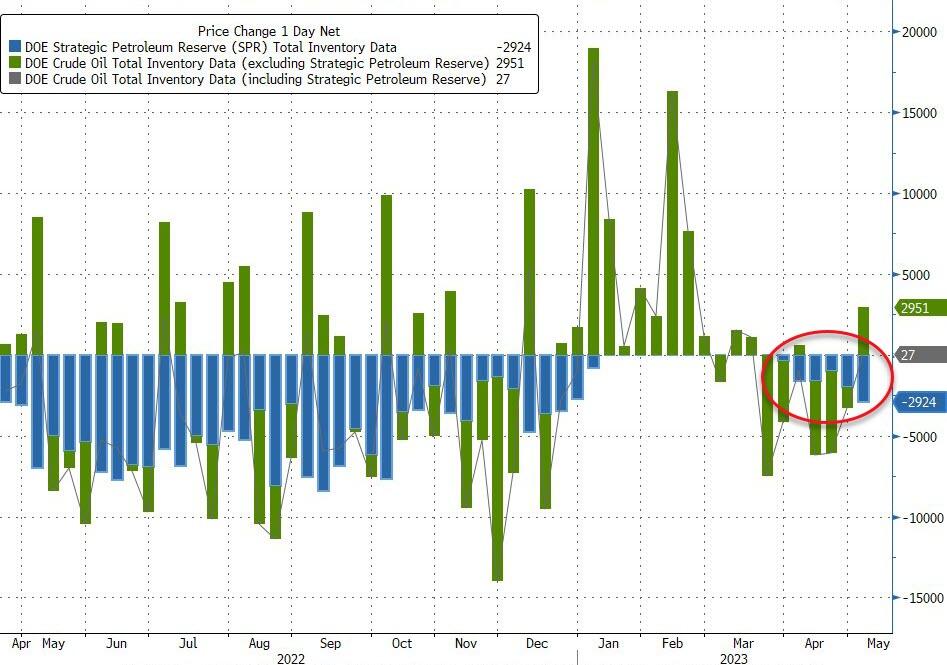

Despite all the chatter about refilling, the Biden admin drained 2.924mm barrels from the SPR (the 6th straight week of draws)...

Source: Bloomberg

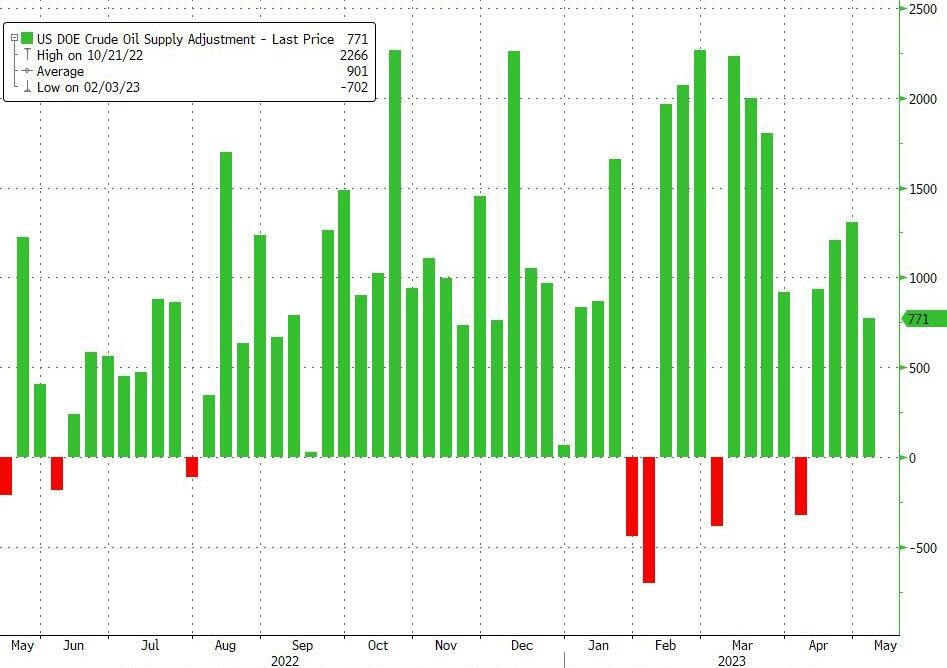

The so-called 'adjustment' factor was positive yet again...

Source: Bloomberg

US Crude production remains at cycle highs despite the rig counts decline...

Source: Bloomberg

WTI was hovering around $72.50 ahead of the official data and is extending those losses after a brief spike as the belief in the admin's plan to refill fades...

(Click on image to enlarge)

The White House’s plan to begin purchasing oil to replenish the nation’s emergency reserve added some price support, along with output disruptions in Canada. Wildfires in Alberta may have reduced energy production by the equivalent of 500,000 barrels a day, according to Rystad Energy.

Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle on what to expect this week: Short positions on WTI could drive a spike in prices short term if there’s a positive shift in demand signals. Positions doubled to 47 million barrels as of May 2 vs. 22 million on April 19. A more dovish Federal Reserve speech on May 3 pushed Brent and WTI future curves higher. The respective short position on diesel is more significant with CFTC data showing the most bearish setup in three years. Freight and travel indicators are slowing down, but signs of a resilient consumer could drive a short squeeze in the coming weeks.

More By This Author:

WTI Holds Gains Despite API Reporting Biggest Crude Build Since Feb

SLOOS Finds Even Tighter Credit Standards, A Collapse In C&I Loan Demand, And A Dire Outlook For Rest Of 2023

NY Fed Finds Inflation Expectations Mixed, As Spending Growth Outlook Tumbles To Two Year Low

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more