Why Is The USDX Weak Lately And Gold Not Responding To It?

The PMs continued their relative underperformances on Aug. 11, as gold fell by 0.36%, silver by 1.89%, the GDX ETF by 1.88%, and the GDXJ ETF by 2.15%. Moreover, since the drawdowns occurred alongside the USD Index’s 0.08% slide, the PMs’ inability to rally when the U.S. dollar is weak highlights their technical and fundamental fragility.

500 Narratives

With the S&P 500 in rally mode, short-covering morphed into momentum bids, which have now morphed into FOMO. Moreover, with the bulls brimming with confidence and inflation showing its first signs of slowing, investors are tripping over themselves to position for a dovish pivot.

Please see below:

Source: CNBC

To that point, CNBC’s Jim Cramer said:

“Peak inflation is nirvana for stocks, especially for out-of-favor stocks, like fast-growing tech plays or the financials or the consumer discretionary names. That means you can buy everything from Microsoft to Wells Fargo to Target.”

He added:

“Some companies will absolutely be hurt by the upcoming recession, but others will see their stocks soar because they’re worth more in an environment where inflation is at last possibly under control,”

Thus, while ‘soaring stocks’ are not part of historical recessions, the narrative is another example of making it up as you go along.

Second, the algorithmic funds – which shift their positions based on realized volatility – have increased their stock holdings as the Cboe Volatility Index (VIX) declined. In addition, with FOMO seeping into the mindsets of hedge funds and long-only managers, you better get on board before you “miss even more.”

Please see below:

Source: Bloomberg

Third, with investor sentiment doing a complete 180 from June, the chorus calling for 3,000 on the S&P 500 is now calling for new highs. For example, some believe that eclipsing 4,232 (which the S&P 500 did intraday on Aug. 11) signals the end of the bear market. CFRA Chief Investment Strategist Sam Stovall said:

“This remains a bear market rally until we close above the 4,232 level on the S&P. After that, history reminds us that no bear market ever recovered 50% of its decline only to set an even lower low. It would be an early signal that the bear is behind us.”

However, while investors cite erroneous reasons for why the S&P 500 is destined for new all-time highs, “history reminds us” that ‘never’ is also present from a fundamental perspective.

To explain, I’ve noted on numerous occasions that reducing inflation to the Fed’s 2% annual target will require much more economic pain than the consensus realizes. I wrote on May 26:

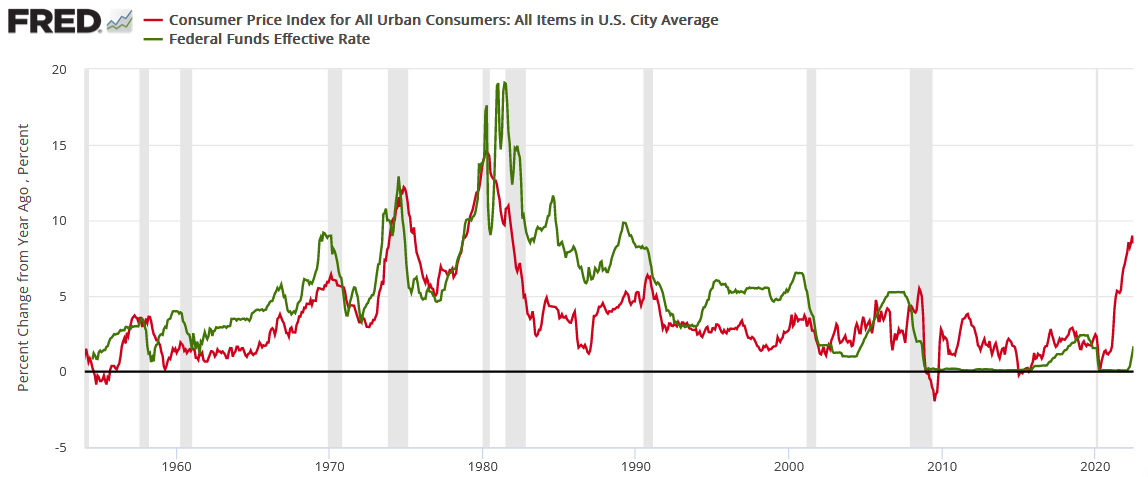

If you analyze the chart below, you can see that the U.S. federal funds rate (FFR) (the green line) nearly always rises above the year-over-year (YoY) percentage change in the headline Consumer Price Index (the red line) to curb inflation. Therefore, investors are kidding themselves if they think the Fed is about to re-write history.

To be specific, the FFR has either eclipsed the YoY headline CPI or come within ~50 basis points of its peak in every inflation battle since 1954. Therefore, please see the unprecedented gap on the right side of the chart. With the YoY headline CPI peaking (for now) at 9.1% and the FFR at 2.5% (the high end of the Fed's 2.25% to 2.5% range), the difference is 6.6%.

As a result, history implies the FFR needs to hit at least 8.6% (which marks ~50 basis points below the current CPI peak). Moreover, while we don't expect the FFR to hit this level, the purpose is to show just how laughable a 3% FFR and 9%+ inflation is from a historical perspective. In reality, a 4.5%+ FFR is much more realistic, and the prospect is far from priced in.

In addition, notice how every inflation spike leads to a higher FFR and then a recession (the gray bars). As such, do you really think this time is different?

Thus, while the bulls unveil several narratives for why the S&P 500 is on the fast track to 5,000, the reality is that inflation is much more problematic than they realize. Also, if you celebrated every substantial inflation peak since 1954, you were left holding the bag when the recession hit soon after.

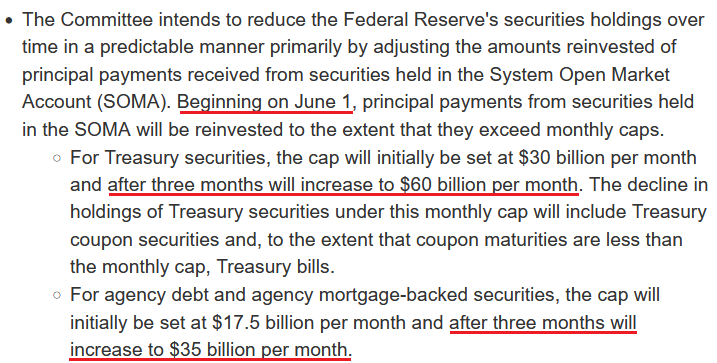

On top of that, the Fed will double quantitative tightening (QT) to $95 billion per month in September. Therefore, if QE is bullish, what is QT?

Please see below:

Source: U.S. Fed

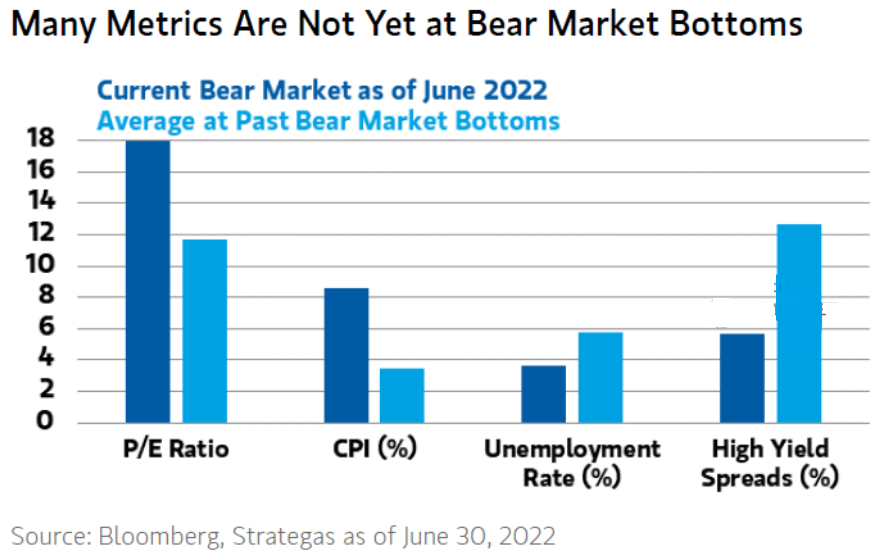

As further evidence, none of the current cross-asset metrics signal a bear market low.

Please see below:

To explain, Morgan Stanley’s data is as of Jun. 30 (the dark blue bars), but the averages (the light blue bars) are the most important. As you can see, the average bear market doesn’t end with a P/E above 17, a CPI at 8%+, high yield spreads at 4.33% and an unemployment rate at 3.5%.

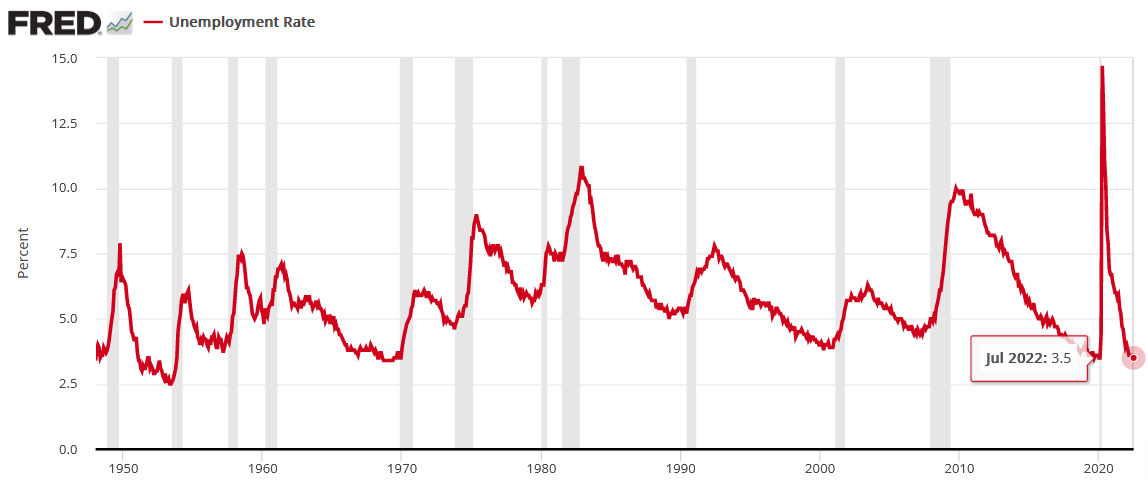

To that point, the U.S. unemployment rate hit a new 2022 low of 3.5% in July. However, the metric always bottoms before a recession.

Please see below:

To explain, notice how the U.S. unemployment rate always troughs and then steadily rises before a recession hits. Thus, with the metric heading south in July, the bearish turn still awaits us. Of course, the uninformed crowd assumes that this time is different.

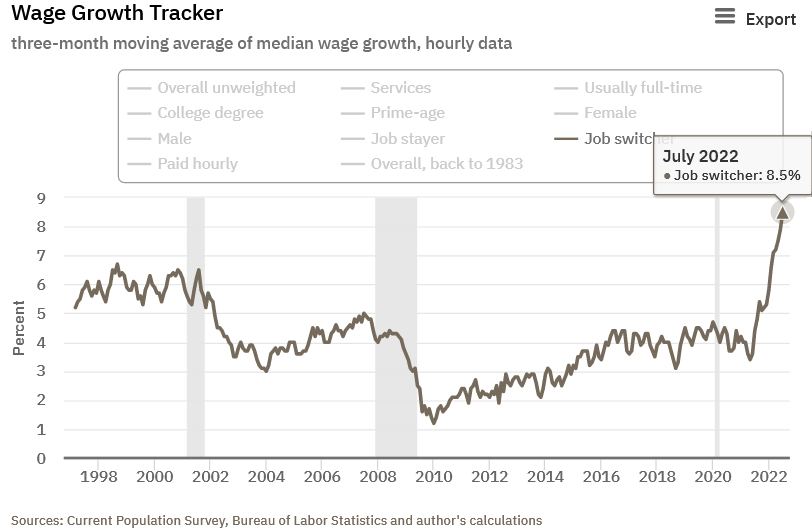

Furthermore, the unemployment rate needs to rise to curb inflation. The Atlanta Fed updated its Wage Growth Tracker on Aug. 11. Moreover, the overall index matched its record high set in June at 6.7%. However, job switchers – Americans that leave their job for a new one – saw their wages increase by 8.5% (a new all-time high and up from 7.9% in June). As a result, it highlights how companies are still paying up to attract new employees.

Please see below:

All in all, while the consensus and the media want you to believe that the bear market is over, their lack of fundamental objectivity highlights why narratives are so destructive. Remember, if normalizing inflation and reducing its balance sheet were so easy, the Fed would have done it already.

Think about it: the Fed was so cautious about tapering its asset purchases that officials waited until inflation was so unanchored that it couldn’t be ignored. However, now that the Fed will hike interest rates to 3.4%, sell $95 billion in bonds per month and increase the U.S. unemployment rate to 3.7% (the Fed’s 2022 SEP projections), while the S&P 500 hits new highs? All the while, reducing the YoY headline CPI to 2%, even though it’s never been done since 1954 without the FFR coming within ~50 basis points of the cycle peak. Good luck.

What’s Wrong With the USD Index?

With the USD Index languishing recently, you may be concerned about the dollar basket's recent pullback. However, the short answer is: nothing is wrong with the greenback. For starters, the U.S. dollar always suffers when investors adopt a risk-on mentality; and with short squeezes lifting the most speculative assets, the fervor has spread to the currency market and uplifted the 2022 laggards.

However, it's important to remember that the same unrealistic expectations that fuel the S&P 500's rise also fuel the USD Index's fall.

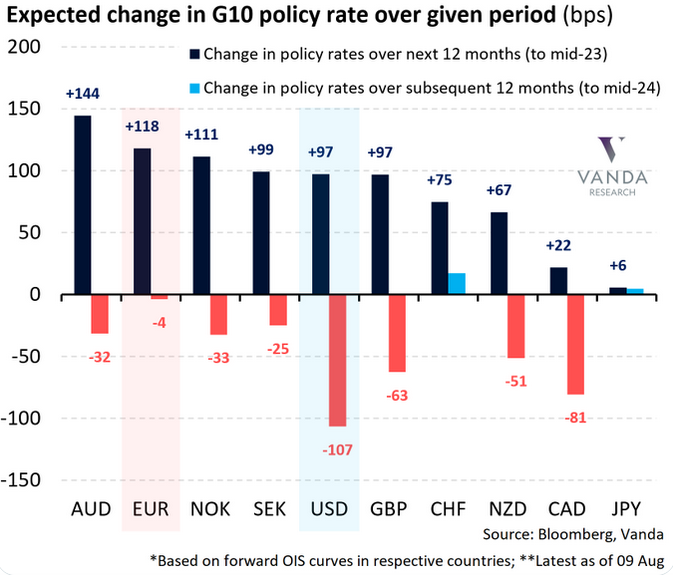

Please see below:

To explain, the dark blue bars above depict the market-implied changes in overnight policy rates for various currencies (regions) from now until mid-2023, while the light blue and red bars above depict the market-implied changes 12 months thereafter.

If you analyze the USD column, you can see that “peak inflation” has investors pricing in 97 basis points of rate increases over the next 12 months and 107 basis points of rate cuts from mid-2023 to mid-2024. Therefore, the consensus expects the U.S. dollar to be a relative underperformer as other central banks play catch-up.

To that point, the EUR column shows that investors expect 118 basis points of rate increases over the next 12 months and 4 basis points of rate cuts from mid-2023 to mid-2024. Thus, expectations are bullish for the EUR/USD, which accounts for nearly 58% of the USD Index’s movement.

However, investors’ rate hike/cut expectations are in la-la land. The idea that the ECB will out-hawk the Fed by hiking more and cutting less contrasts with fundamental reality. Furthermore, the Eurozone is in much worse economic shape than the U.S., and the EUR/USD should continue its descent when investors realize this.

The Bottom Line

Down is up, bad is good, and the narrative is that if you don’t board the bull train, it may leave the station. However, while the crowd is eager to ignore the fundamental imbalances that threaten the outlooks for the S&P 500, gold, silver, and mining stocks, it’s important to remember that gravity is undefeated. Therefore, while sentiment can keep asset prices uplifted in the short term, fundamental warning signs are flashing red.

In conclusion, the PMs declined on Aug. 11, and the GDXJ ETF was the worst performer. Moreover, while the USD Index has suffered recently, it’s likely only a correction within a medium-term uptrend. Furthermore, with investors expecting much more heavy lifting than the ECB can deliver, the EUR/USD’s recent rally is likely on borrowed time.

More By This Author:

The GDXJ Didn’t Benefit From Investors’ Bullish Frenzy

Is There Any Chance Of An Interest Rate Cut In 2023?

The Booming U.S. Economy Forces The Fed To Hit The Hawkish Gas

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more