What’s Driving The Amazing Commodity Boom?

There are at least four factors that have resulted in the explosion in commodities. The chart below shows how we have banged up against longer-term resistance in a broad basket of commodities, approaching a major trendline that extends back some 6-10 years ago. Please click here to learn more about global droughts, freezes, and what else is affecting commodity markets.

First of all, with the U.S. printing more money and the global economy rebounding from COVID-19, the demand for commodities such as grains, precious metals, etc. has been soaring. There is also an incredible need for biofuels around the world, lithium and silver for electric cars as the Green economy will forge ahead in the years to come. Stocks such as FCEL (Fuel Cell), NIO (NIO), and many others have good longer-term potential.

Next, are worries about inflation, as many investors are a bit nervous about the high price of stocks and trying to diversify into other asset classes.

Third, take a look at the US dollar. It is challenging a triple bottom on the charts. Normally, triple bottoms do not hold. As inflation takes hold, this could weaken the dollar in the months ahead. If so, commodity markets have more upside potential.

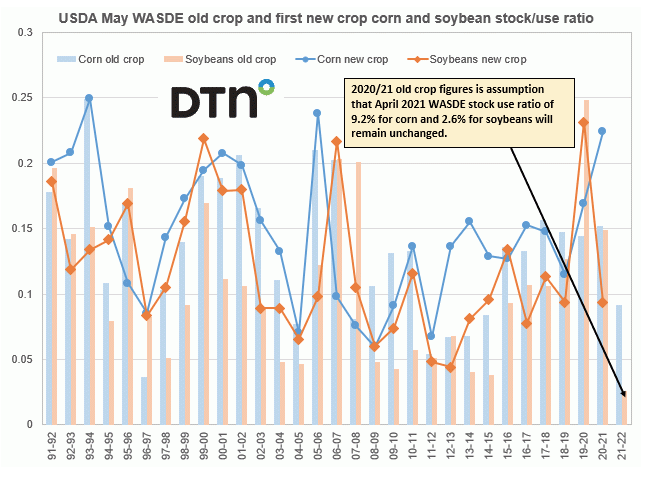

Fourth, notice the global grain stocks are the lowest in years. This was brought on by global weather issues from La Nina and stellar Chinese demand. China needs to feed its ever-expanding cattle and hog herds and countries are hoarding commodities in a post-Covid-19 world

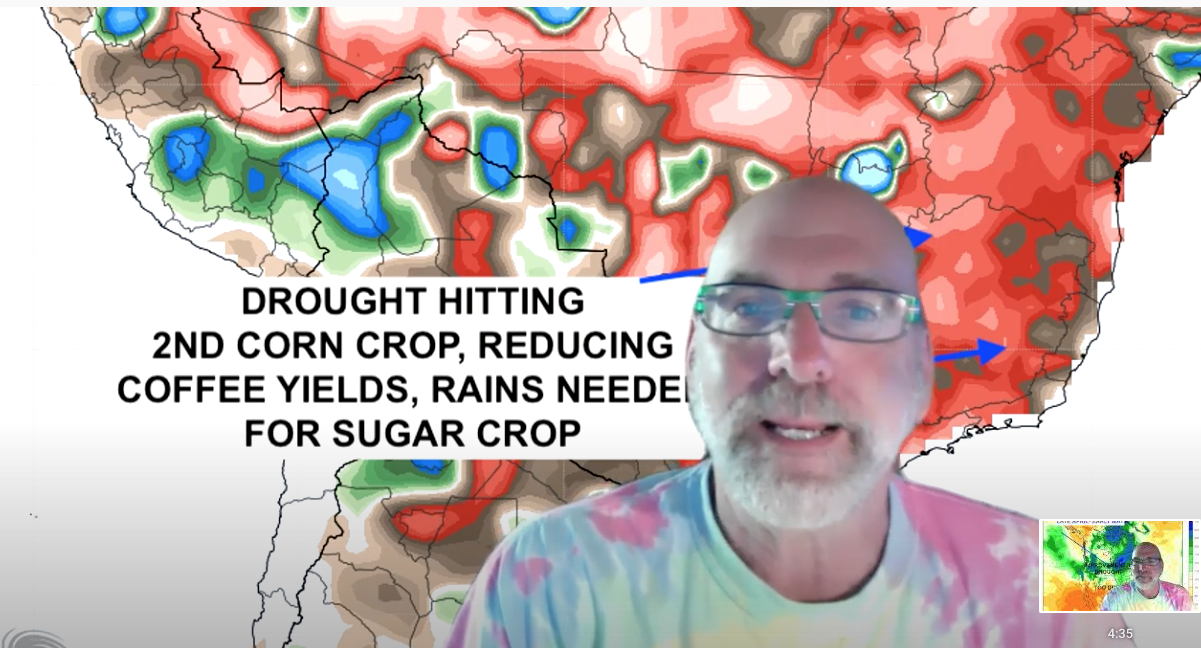

Finally, and of course where we come in, is the weather and various weather woes from Brazil’s drought hurting coffee, sugar, and corn crops to the big Midwest freeze last week, which I discussed in my Weather Wealth newsletter a week ago. This is tightening the world grain situation.

The two maps below show the major April Arctic Pig which set the natural gas (UNG) and wheat market on fire ( record cold Midwest weather earlier this week) and the drought in Brazil (red area) that has helped sugar (CANE); corn (CORN) to explode. Coffee (JO) prices to are beginning to rally on reduced supplies.

Brazil is the leading producer of sugar and coffee and #2 in the world in grain production. The red areas show a widespread drought that has threatened Ag commodities.

What will happen next and how do you trade commodity ETF’s, futures, and options on the weather? I invite you to subscribe to one of my newsletters. Spring and summer weather will have a huge impact on multiple commodities and any little change in the supply/demand situation will affect everything from coffee to grains and natural gas, cotton, and much more.

This is an excerpt from James Roemer's premium subscription newsletter. Try a free trial subscription by clicking here.