Weekly Ag Markets Update - Monday, Augusts 21

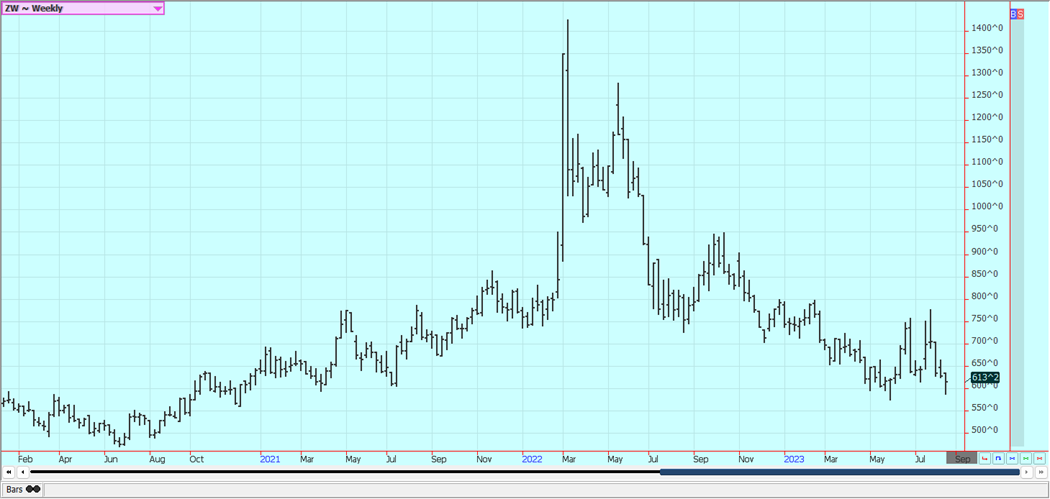

Wheat

Wheat markets were higher on Friday but lower for the week as the war between Russia and Ukraine and demand for US Wheat remained the features. It was a short covering rally on Friday caused by the US Midwest weather forecast that supported Soybeans and Corn. Demand for US Wheat needs to improve. Demand has been poor for US Wheat and should remain bad as Russia production looks strong and exports from Russia have not abated. It is certain that there will be no grain deal soon for Ukraine exports through the Black Sea and any export from the Danube will be difficult if not impossible. Ukraine will still be able to ship via land through the EU. It is unlikely that any ship owner or ship insurer will take the chance on any passage of Ukrainian grain through the Black Sea, and maybe not for Russia, either. The world access to Wheat from at least one and perhaps both countries is a lot more restricted. Weather forecasts call for drier weather for the northern Great Plains and Canadian Prairies and some areas will be real hot. Canada is now suffering potential crop losses due to dry weather.

Weekly Chicago Soft Red Winter Wheat Futures

(Click on image to enlarge)

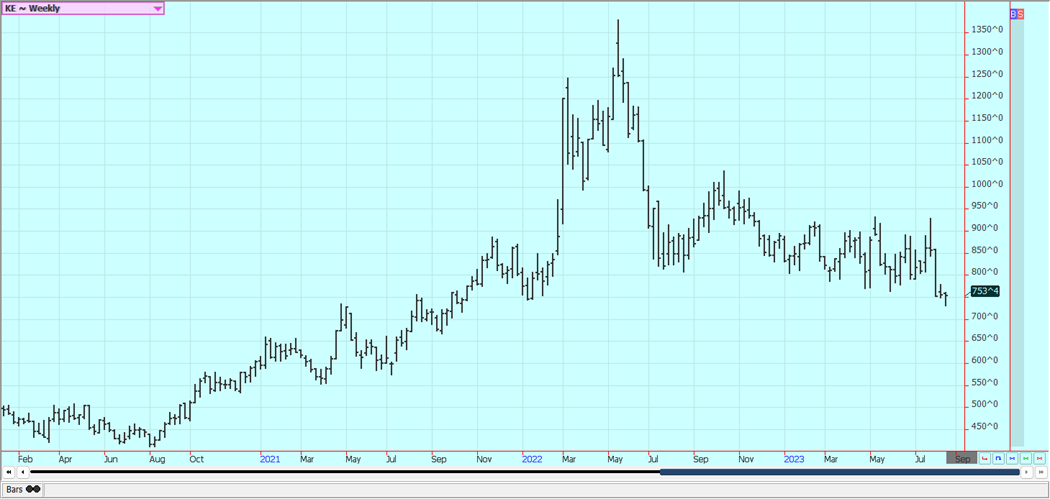

Weekly Chicago Hard Red Winter Wheat Futures

(Click on image to enlarge)

Weekly Minneapolis Hard Red Spring Wheat Futures

(Click on image to enlarge)

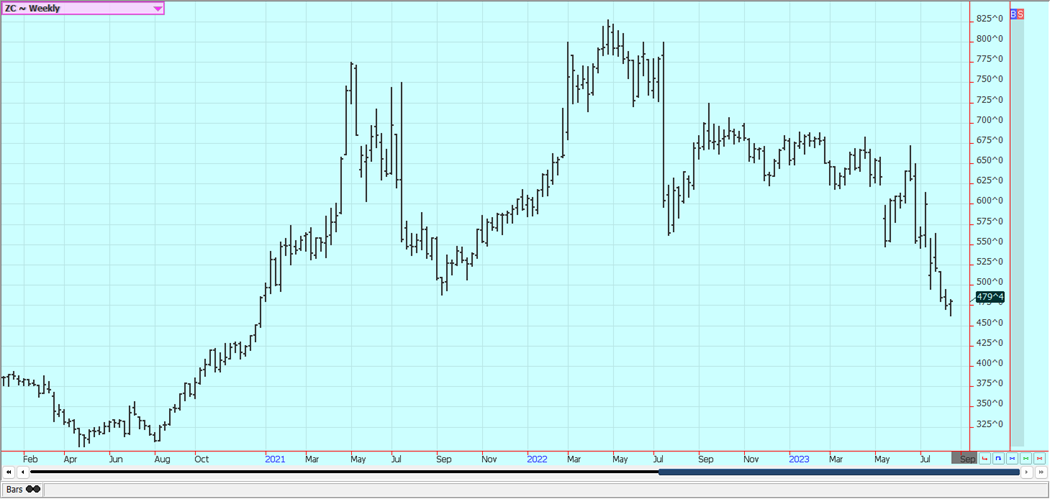

Corn

Corn was higher last week on weather concerns. Weather forecasts remain mostly dry and warm for the Midwest for this week and the next couple of weeks. The crops are reported to be in mostly good condition now but will need rain constantly to maintain the condition due to the lack of soil moisture from three months of drought that ended at the end of June. A return to hot and dry weather now could impact yields in a bad way, but ideas are that much of the yield has been already made. Cooler temperatures after this week will help, but the Corn still needs rain and the lack of rain is more important. Demand for US Corn in the world market has been very low and domestic demand has been weak due to reduced Cattle and other livestock production. The Brazil Corn harvest is underway and so export prices for Corn from Brazil are getting relatively cheap and Brazil is getting the business.

Weekly Corn Futures

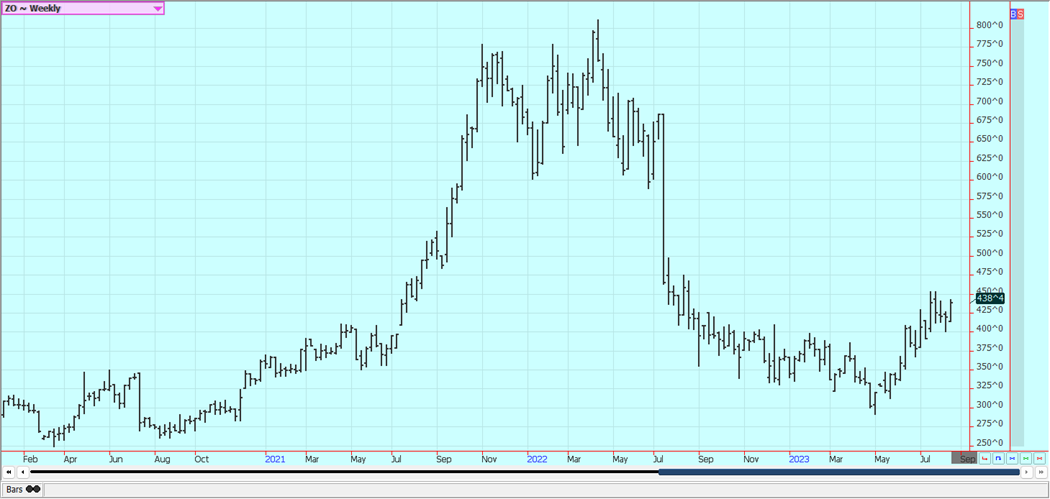

Weekly Oats Futures

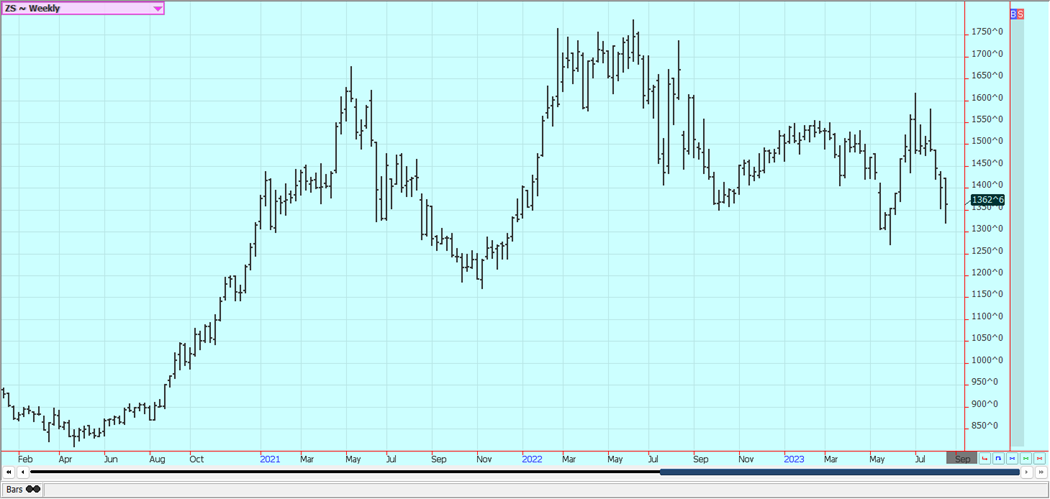

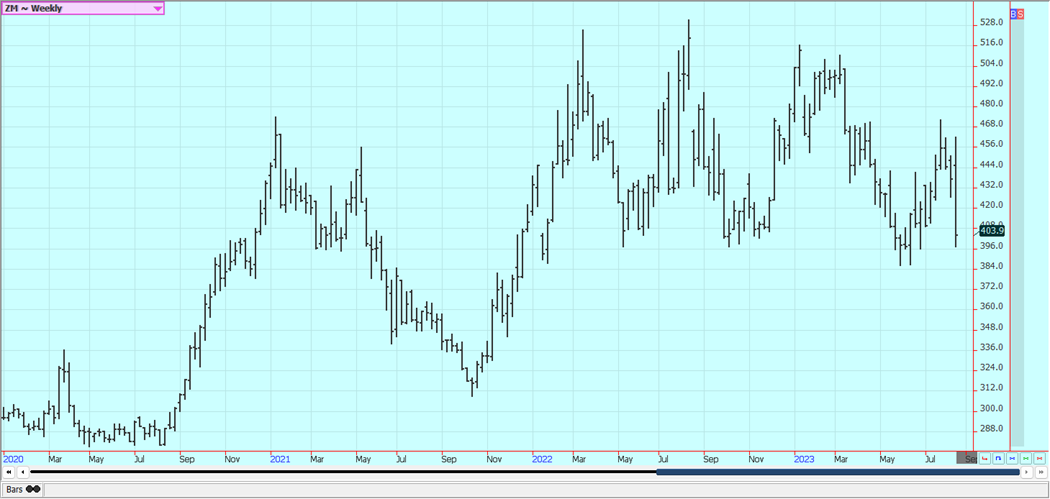

Soybeans and Soybean Meal

Soybeans and Soybean Meal were lower last week and Soybean Oil was higher. Demand forced the soy complex lower early in the week. Weather forecasts calling for very warm and dry conditions for the Midwest for this week and the next few weeks supported Soybeans futures late in the week and could support futures again this week. Most longer-range maps indicate the potential for dry weather. Temperatures are expected to be above normal. Ideas are that the top end of the yield potential is gone but severe damage has not been reported yet but is becoming possible in some areas. Reports indicate that bio fuels demand for Soybean Oil is very strong despite the moves in Washington to keep bio fuels demand at more moderate levels and is pushing domestic demand for Soybeans. Brazil basis levels are still low, and the US is being shut out of the market for most importers, but the US is price competitive now. Brazil is still selling a lot of Soybeans to China and other countries. Brazil has a very good crop, but the additional Soybeans grown in Brazil will be partially wiped out by the losses in Argentina.

Weekly Chicago Soybeans Futures

(Click on image to enlarge)

Weekly Chicago Soybean Meal Futures

(Click on image to enlarge)

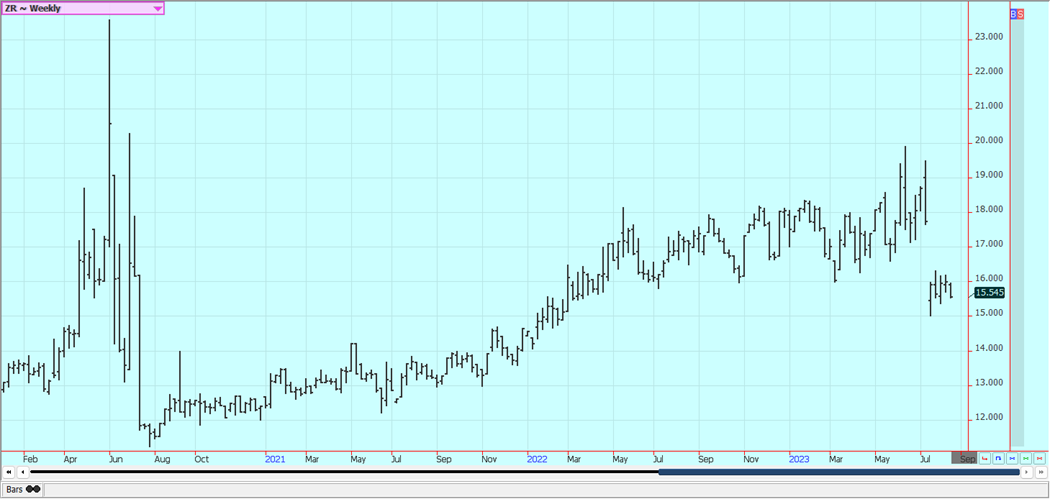

Rice

Rice closed slightly higher on Friday in consolidation trading as the US harvest expands and good yields are reported. Yields are called average to well above average in the southern US and average to above average so far in Arkansas. The quality has been a little uneven with some crops affected by the extreme heat in southern areas that has hurt field yields in some areas. USDA showed that crop progress was a little ahead of the five year average and that crop condition deteriorated slightly from last week and remains a little behind the quality of last year. India will not allow Rice exports except for Basmati for now because of too much rain on some the crops and not enough for other areas. Northern areas are too wet and southern areas are too dry. India is the largest exporter of Rice in the world, so it was big news and one that implies that a sharp increase in world price is now possible.

Weekly Chicago Rice Futures

(Click on image to enlarge)

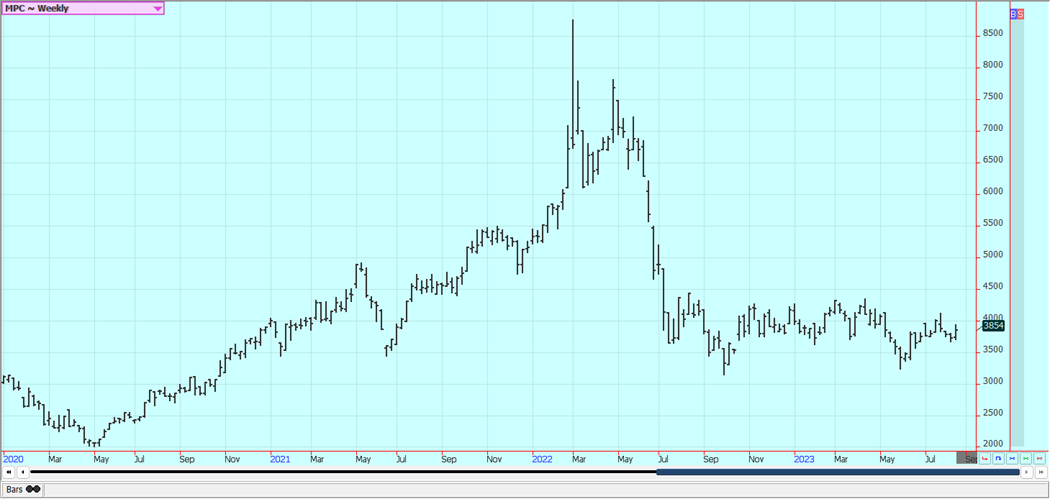

Palm Oil and Vegetable Oils

Palm Oil was higher last week as the private export data released in the middle of the week was strong and on strength in Chicago Soybean Oil. The market held support and trends are turning up again. Ideas are that export demand has improved as the private sources reported at 10.8% increase in exports for the month to date. Canola was higher on Chicago price action and on dry Prairies growing conditions. Drier weather is generally forecast for the Prairies.

Weekly Malaysian Palm Oil Futures

(Click on image to enlarge)

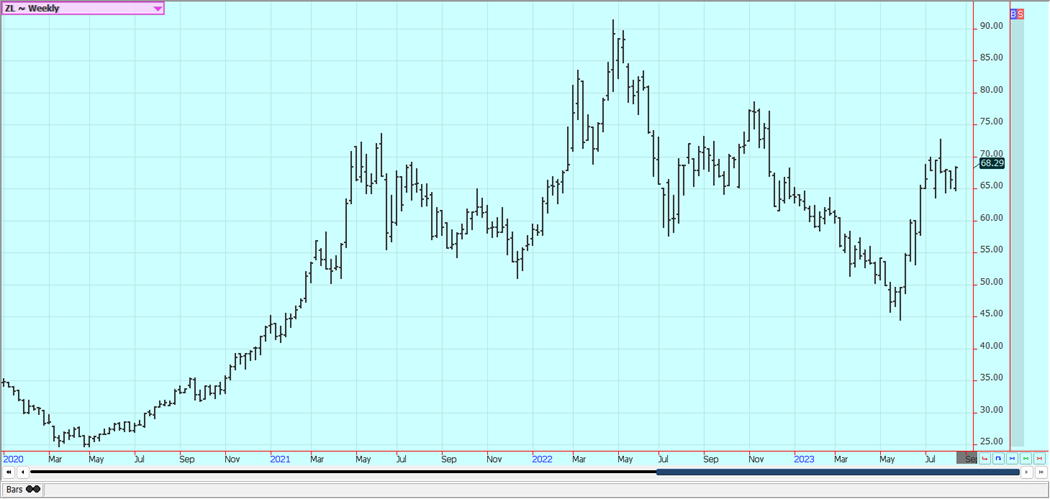

Weekly Chicago Soybean Oil Futures

(Click on image to enlarge)

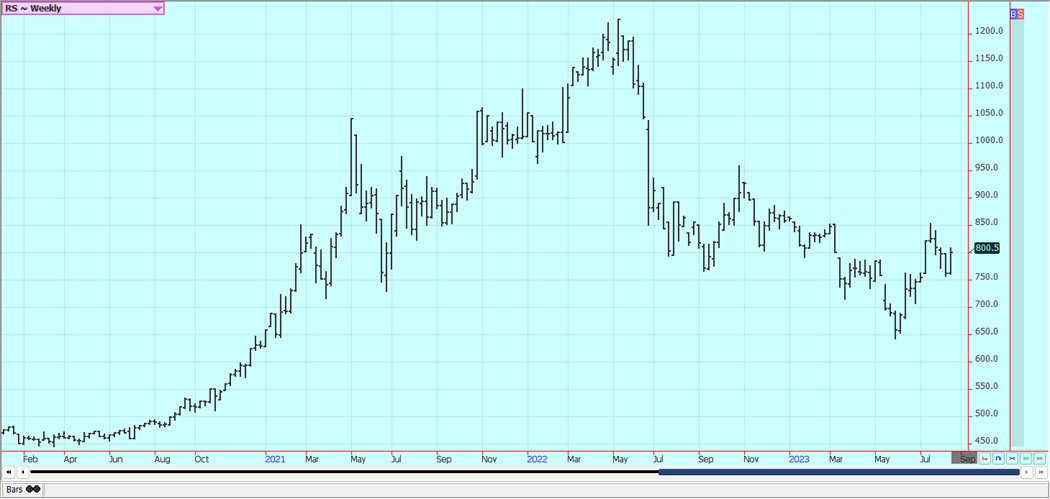

Weekly Canola Futures

(Click on image to enlarge)

Cotton

Cotton closed lower last week despite deteriorating crop conditions reported by USDA on Monday as ideas are around that Chinese economic data implies less US cotton demand for the coming year. There is more talk of a contraction that could develop in China and Cotton demand could be hurt if people have less money to spend on clothes. The heat is still extreme in the southern US and has yet to moderate. Ideas of weaker demand due to economic problems in Asia and improved production prospects here at home continue and Chinese economic data continues to show weakness. There are still many concerns about demand from China and the rest of Asia due to the slow economic return of China in the world market and as China is trying not to buy from the US. There are also worries developing that the US could be moving into a mild recession after many months of superlative growth.

Weekly US Cotton Futures

(Click on image to enlarge)

Frozen Concentrated Orange Juice and Citrus

FCOJ closed sharply higher last week and made new highs for the move. Trends are up on the daily and weekly charts. Futures remain supported by very short Oranges production estimates for Florida. Futures are also being supported in forecasts for an above average hurricane season that could bring a storm to damage the trees once again. Historically low estimates of production due in part to the hurricanes and in part to the greening disease that have hurt production, but conditions are significantly better now with scattered showers and moderate temperatures. The weather remains generally good for products around the world for the next crop including production areas in Florida that have been impacted in a big way by the two storms seen previously in the state. Brazil has some rain and conditions are rated good.

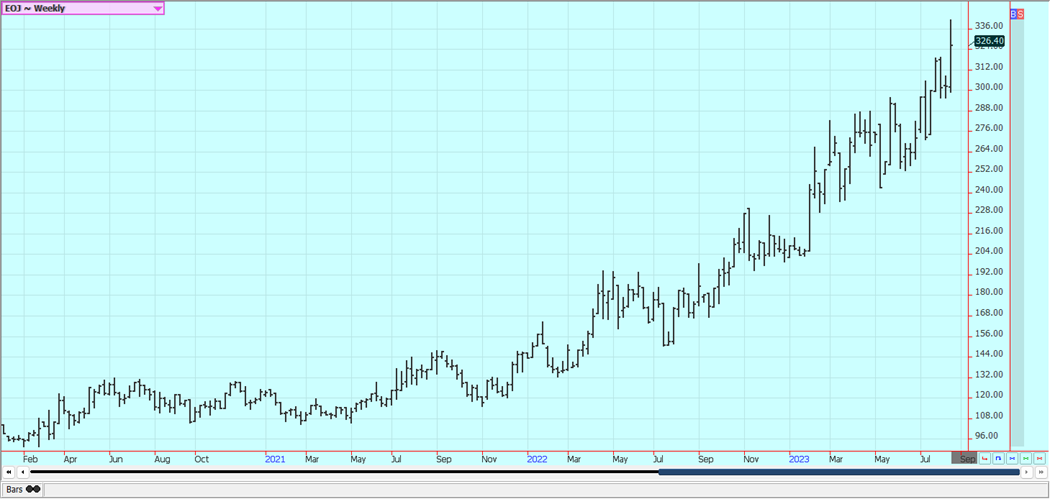

Weekly FCOJ Futures

(Click on image to enlarge)

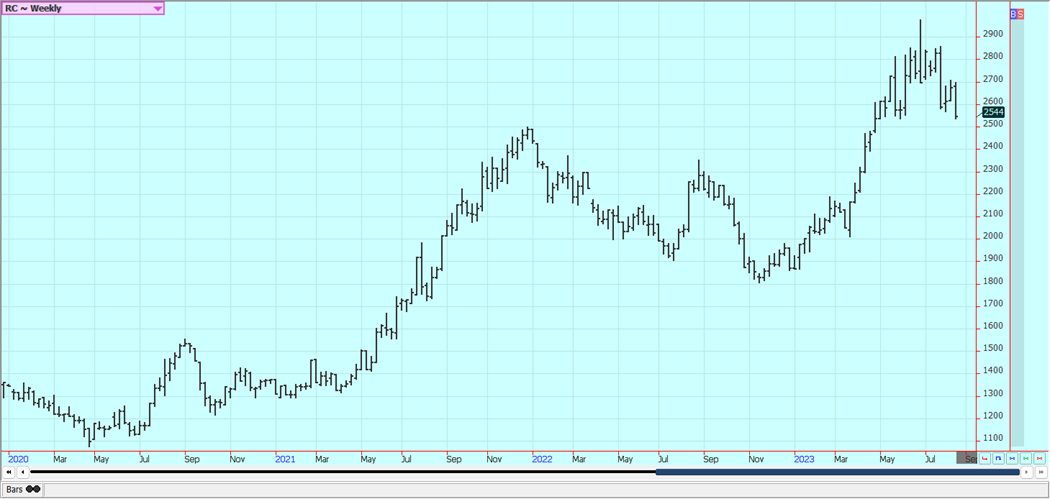

Coffee

New York closed a little higher and London closed a little lower on Friday as offers from Brazil and other countries in Latin America could be increasing. Both markets were lower for the week. It looks like speculative selling hit the London market last week. The Brazil harvest moving quickly along and offers should be increasing. Vietnam is not offering at all into the world market as domestic cash prices are very high. Ideas are that roaster demand is relaxing with more Coffee seen in the market now. There are reports of dry weather for the harvest in Arabica production in Brazil with high production expectations. There are still tight Robusta supplies for the market amid strong demand for Robusta with no offers from Vietnam in the world market due to very high domestic prices. Producers in Indonesia are said to have almost nothing left to sell. Central America is featuring Coffee offered with very high differentials. The market really needs big offers from Brazil to sustain any downside movement. And this seems to be happening right now.

Weekly New York Arabica Coffee Futures

(Click on image to enlarge)

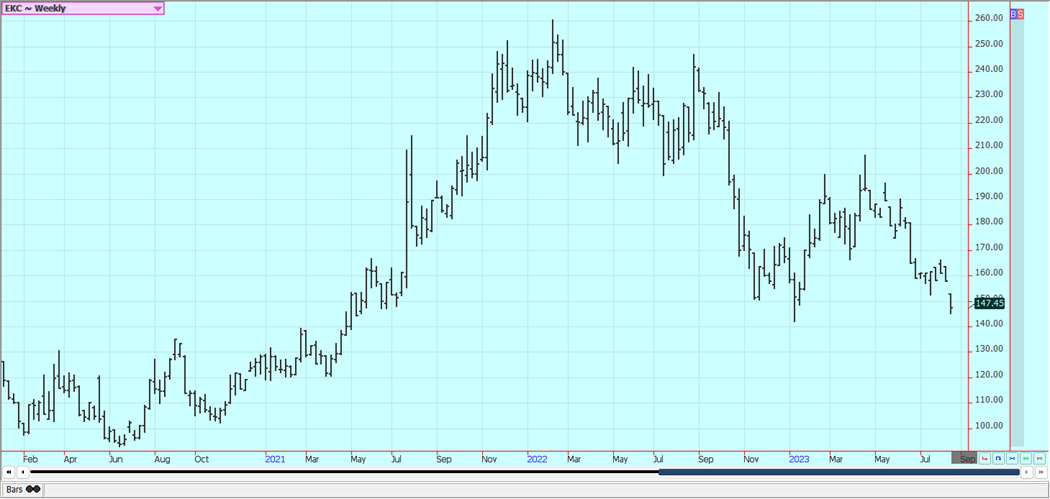

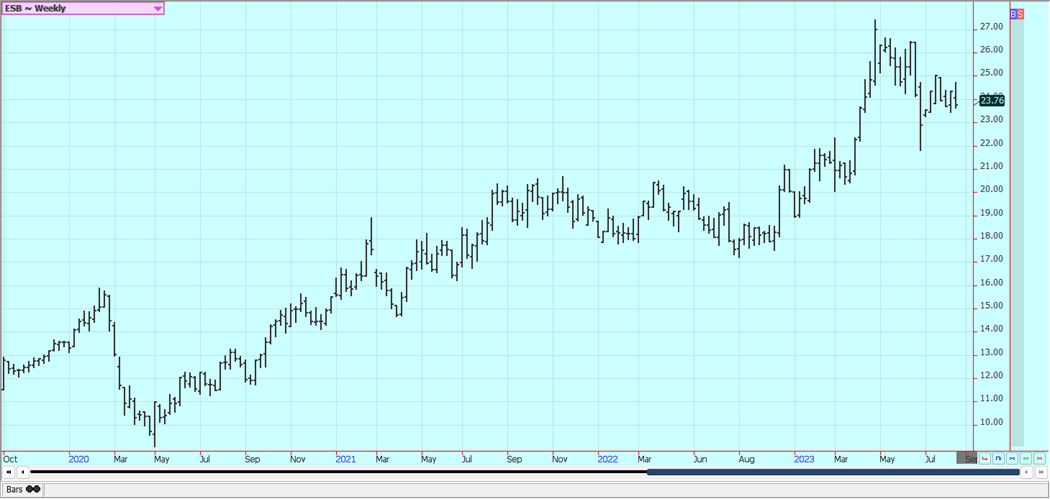

Weekly London Robusta Coffee Futures

(Click on image to enlarge)

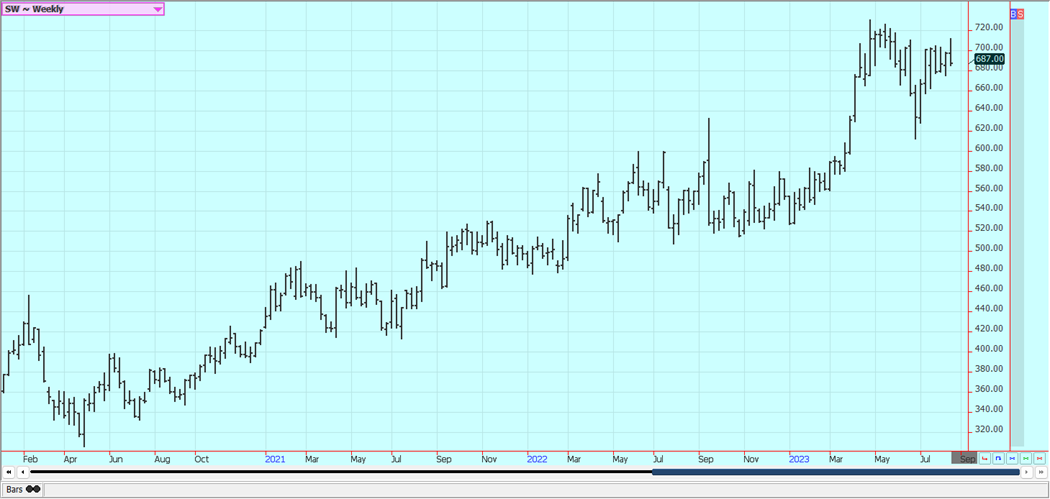

Sugar

New York and London closed lower last week after a failed breakout higher earlier in the week. Trends are now trying to turn down for the short term in both markets. Reports of increased offers from Brazil are still around but other origins are still not offering and demand is still strong. Brazil production increasing on reports of very good harvest conditions and the weather in Southeast Asia is currently good for the next crop production prospects so relief could be coming soon. More Sugar is now available to the world market. India still has problems with current and future production potential. The current year export quota is already gone and the government has no plans to allow for additional exports at this time. Indian production is less this year and Pakistan also has reduced production and the monsoon has been uneven so far in both countries. Some areas have remained dry while others have seen too much rain. India announced a higher base price for Sugar paid to farmers to help promote additional planted area. Thailand production is also down a lot this year and many Asian countries are worried about El Nino impacting future production. Conab in Brazil estimated Sugarcane production at 652.9 million tons, from 647.1 million tons in April and 610.1 million tons last year. Sugar production is estimated at 40.9 million tons, from 38.8 million in April and 37 million last year. Ethanol production is estimated at 33.8 billion liters, from 33.2 billion in April.

Weekly New York World Raw Sugar Futures

(Click on image to enlarge)

Weekly London White Sugar Futures

(Click on image to enlarge)

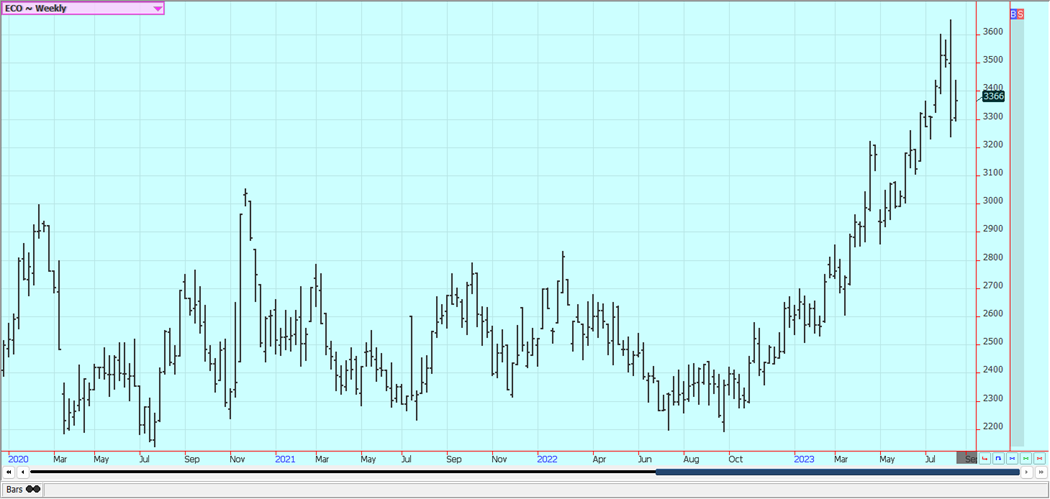

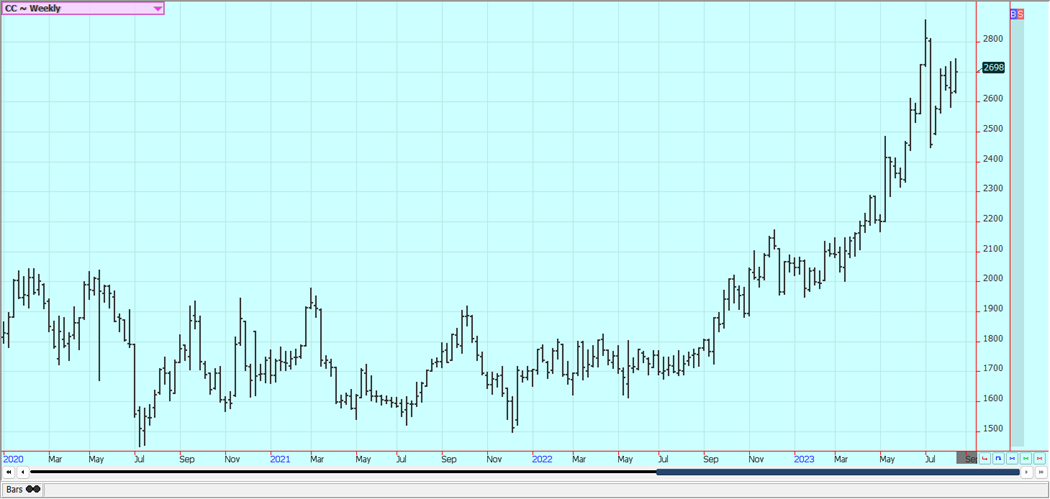

Cocoa

New York and London closed higher last week as ideas of tight supplies continue. The markets are both developing trading ranges now so the lack of Cocoa in the market might be part of the price structure for now. Ideas of tight supplies remain based on more reports of reduced arrivals in Ivory Coast and Ghana continue, Talk is that hot and dry conditions reported earlier in Ivory Coast could curtail main crop production, and main crop production ideas are not strong. Midcrop production ideas are lower now with diseases reported in the trees due to too much rain.

Weekly New York Cocoa Futures

(Click on image to enlarge)

Weekly London Cocoa Futures

(Click on image to enlarge)

More By This Author:

Grains Report - Friday, Aug. 18Softs Report - Wednesday, Aug. 16

Grains Report - Tuesday, Aug. 15

Disclaimer: A Subsidiary of Price Holdings, Inc. – a Diversified Financial Services Firm. Member NIBA, NFA Past results are not necessarily indicative of future results. Investing in ...

more