Towards A Radical Paradigm Shift In The Investment World?

Are we on the verge of a radical paradigm shift in the investment world?

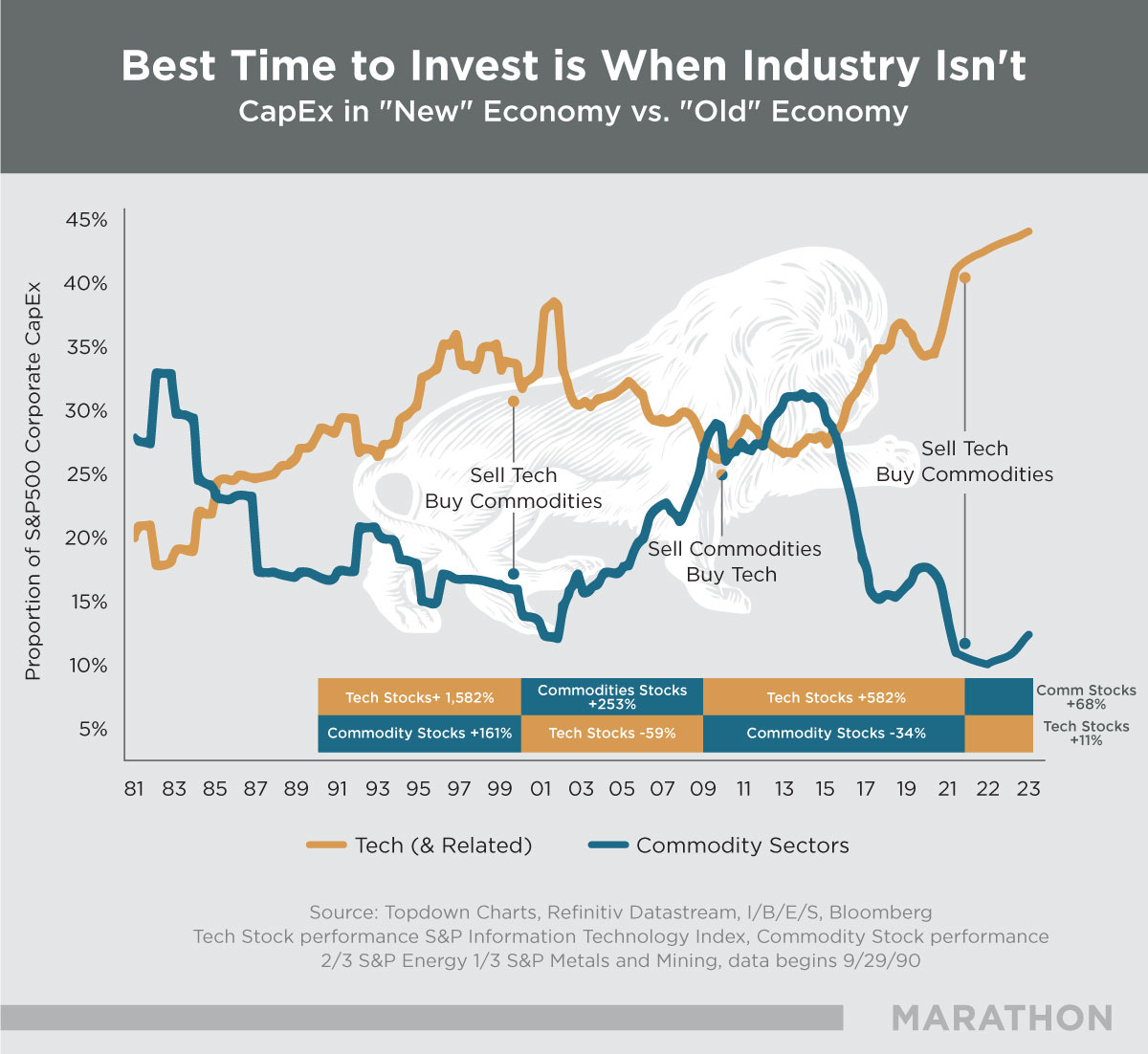

San Francisco-based Marathon has just published a very telling chart on the cycle shift underway: since 2022, the new economy has been underperforming the old economy. Technology stocks have continued to grow but at a much slower pace than in the previous cycle 2011-2022.

Since 2022, commodity-related stocks have halted their downward slide:

Is this the start of a new cycle in which it would be appropriate to sell technology stocks and buy commodities?

Let's take a look at the NAS100/SPGSCI chart, which measures the performance of US technology stocks against a basket of commodity-linked stocks:

This chart peaked in 2020, marking the end of a euphoric phase in a bullish cycle initiated in 2011.

This peak has never been retested, and since 2020, we've been engaged in a consolidation phase that could come to an end in 2024 if the negative divergence on this chart is confirmed:

(Click on image to enlarge)

Looking at the NAS100/GDX chart, which compares technology stocks to mining stocks in weekly variation, we also see a bearish divergence at the last peak:

(Click on image to enlarge)

Analysis of these two curves suggests a fairly marked trend reversal in 2024.

What factors could trigger such a change of cycle?

Resource stocks are "bargains".

Unfortunately, this is usually not enough. It will take more to change the flow of capital from one sector to another.

The monetary policy of zero rates has so far encouraged the shift of capital and attention to speculative technology stocks, including cryptocurrencies. This has given rise to inflation and asset price bubbles in this sector.

During this new economic cycle, investment in development projects in the commodities sector has, on the contrary, declined. This trend is even more marked in the case of geological exploration projects, where financing has plummeted.

This period of under-investment is generating a significant imbalance between supply and demand for raw materials, prompting investors to turn to investments in this sector.

The growing influx of capital into technology companies has, in turn, led to lower returns on investment, which could be problematic given their generally high valuations. Stagnant earnings are already indicative of this phenomenon, and we expect it to persist over the coming years.

On the other hand, commodity-related companies are in the process of cleaning up their balance sheets, by paying down their debts.

A concrete example is Fortuna Silver, which has just announced the repayment of over $40 million thanks to the cash flow generated by its new mine in Ivory Coast. This initiative is aimed at reducing the debt burden on its balance sheet and mitigating the impact of construction costs associated with its latest operations.

This type of balance sheet restructuring helps to improve the outlook for future returns for companies in the sector.

Exceptional returns on investment occur when two conditions are met: the initial price paid for a company is relatively low in terms of valuation, and the company is going through a period of improving returns on invested capital. This is precisely what is happening for many resource companies.

Returns from commodity companies have improved, and many resource companies are generating financial returns as strong as, if not stronger than, some of the best-performing technology companies.

According to the OGM Institute's study, the current valuation of resource stocks is among the 3% cheapest of the last 100 years.

Improving valuations and accelerating profitability are a powerful and historic combination that could explain the coming cycle change. When the market becomes aware of this paradigm shift, we could see, as usually happens at every change of cycle, substantial gains in resource-related stocks.

Conversely, the growing influx of capital into technology companies is likely to lead to lower returns on investment, which could be problematic given their generally high valuations. The stagnation of earnings already bears witness to this phenomenon, and it is expected to continue over the coming years.

For the time being, the market remains fixated on its pessimistic short-term view of commodities. The supply imbalance resulting from under-investment in the sector has not yet been reflected in prices. Under these conditions, the supply shock could be all the more brutal.

Fears of a short-term slowdown are currently driving the markets. Although the situation in China is a source of concern, it is above all Europe that seems to be sinking further into recession with each passing week.

The market is anticipating a powerful export force of deflationary movements from China and Europe. For the time being, these forces are warding off the risk of an imbalance between supply and demand for raw materials.

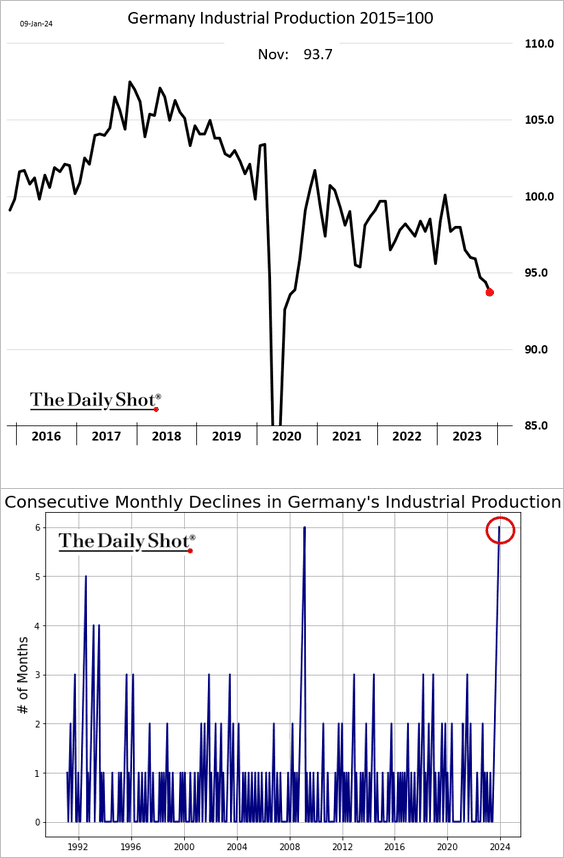

Germany recorded its biggest drop in industrial activity since 2008:

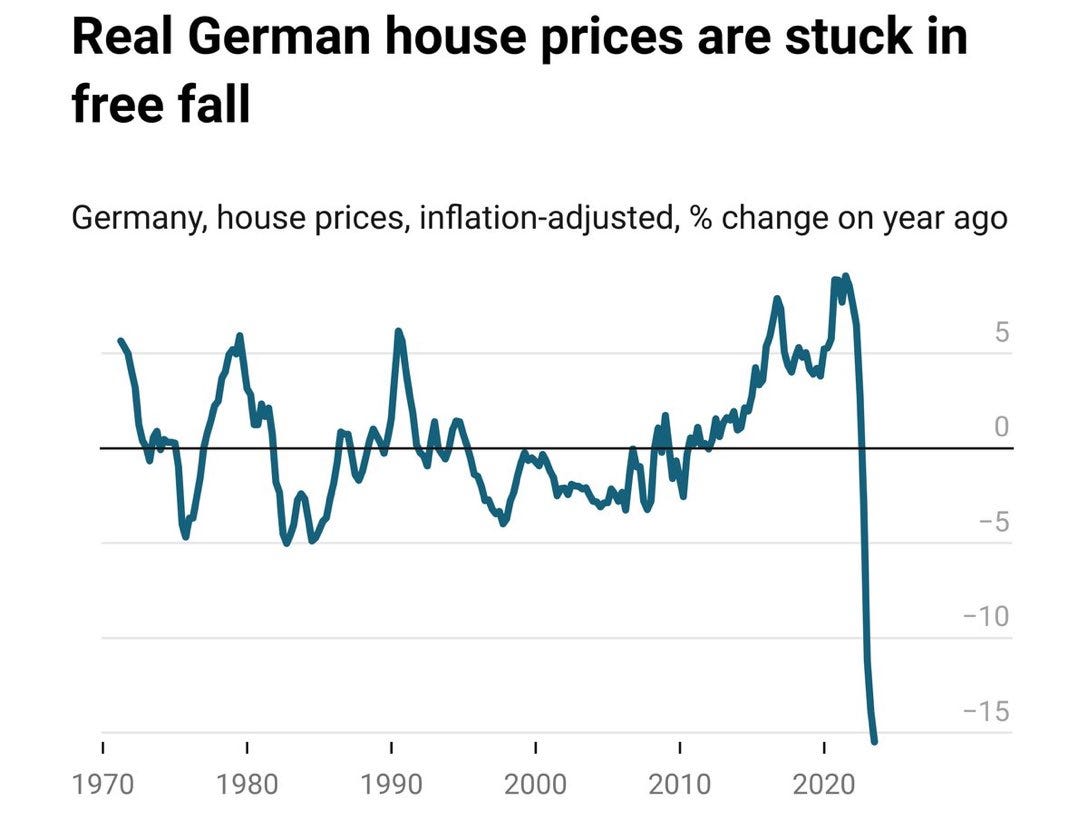

The real estate market is feeling the full force of this economic slowdown:

The price of gold anticipates the shift in the investment cycle from growth stocks to tangibles. The yellow metal is also benefiting from its safe-haven status in a context of economic uncertainty.

Demand for physical gold, already strong in Asia, is spreading to the UK.

The Royal Mint has reported a 7% increase in the number of investors in precious metals in 2023 compared to the previous year. This growth stems from the desire to find a safe haven in the face of macroeconomic pressures, with a notable rise in customers (77%) opting for new investment choices, including coins and bullion.

The Royal Mint underlines the popularity of investments starting at £75, accessible to even the most modest households. The Sovereign gold coin and the Britannia silver coin remain very popular, the latter being the leading investment product.

More By This Author:

What Is The Economic Outlook For 2024?2024 Is Likely To Be A Volatile Year Due To The Debt Wall

No, Stocks Are Not The Best Long-Term Investment

Disclosure: GoldBroker.com, all rights reserved.