No, Stocks Are Not The Best Long-Term Investment

It's time to put a stop to this belief, oversold by certain bankers (who earn commissions on stock purchases) and financial magazines (financed by banks and stock-selling platforms): No, stocks are not the best long-term investment.

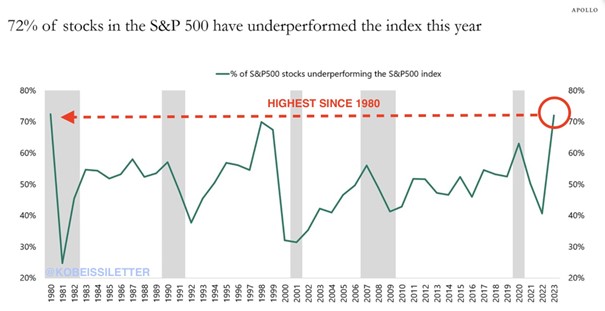

A new illustration shows this. The financial letter Kobeissi (financed by its readers, that changes everything) has published on X/Twitter this chart which reveals that 72% of S&P 500 stocks (the main index of US equities) have underperformed the index over 2023, the highest figure since 1980! In fact, the index's rise comes from a handful of stocks: the top 7 do 20 times better than the 493 others over 2023, and the top 10 stocks account for 35% of the S&P 500! A few stocks drive the whole market, that's the reality.

(Click on image to enlarge)

The stocks that practically single-handedly drive the S&P 500 are all tech stocks (GAFA, Microsoft, Tesla, NVIDIA,etc.), as is the case on the CAC 40, where the few stocks that account for the bulk of performance are those in the luxury goods sector (LVMH, Hermès, Kering, which account for 40% of the index). We warned of this optical illusion last July, which completely distorts our view of the stock markets.

Ultimately, you might as well buy an ETF of the index, but buying shares on the assumption that you'll be a winner in the long term is a fundamental mistake. Those who bought European banking stocks are in the red. Consumer staples (food and durable goods), with inflation and declining purchasing power, are in the doghouse. Energy is faring better with rising prices. All in all, nothing to be proud of.

So let's buy American tech and French luxury! But we had to do it at a time when the market didn't believe in it, and that's proving awfully difficult. For example, American chipmaker NVIDIA has exploded in recent months ($120 on 7/10/2022, $480 on 2/1/2024) in the wake of AI (artificial intelligence), of which it is one of the main suppliers. Well done to those who sniffed it out, even if there weren't that many of them. Is it still time to add this stock to your portfolio? NVIDIA shares are expensive, and we don't want the AI craze to turn...

In mature, competitive sectors, i.e. the bulk of the economy, margins are low, so there's not much to look forward to. In fact, the companies that succeed are those that have managed to create a de facto quasi-monopoly, by becoming essential (Google, Facebook, Microsoft) or thanks to the prestige of their brand (Apple, Tesla, French luxury goods). This enables them to keep prices high or even raise them (known as pricing power)-an extremely rare privilege. These companies are effectively outside the competitive market as we usually imagine it, and all the better for it. We certainly contrast the real economy with the financial economy, but we should also distinguish between competitive/monopolistic companies, or pricing weakness/pricing power.

In short, let's be wary of the lure of equities, which is played out daily in the media with the "performance" of the CAC 40, which in reality concerns a handful of the world's leading luxury companies. The best long-term investment is physical gold, but we've known that for a long time.

More By This Author:

Gold And Silver With Bullish Set Ups Heading Into 2024

2024 Outlook: Gold Heading Towards New Peaks?

Is The Market Consensus Too Optimistic For 2024?

Disclosure: GoldBroker.com, all rights reserved.