Gold And Silver With Bullish Set Ups Heading Into 2024

As we start a new trading year, gold and silver are both presenting long-term set-ups that may well propel prices to much higher levels over the coming years.

(Click on image to enlarge)

Starting with silver, note how the price continues to obey the massive arc and wedge that I showed earlier this year. Within those patterns, a compelling bull flag continues to develop, and within that flag, a very possible inverted head and shoulders with two well-defined necklines (NL1 & NL2). The setup looks explosive and may ignite a 2x move over the next few years - toward the top of the arc.

(Click on image to enlarge)

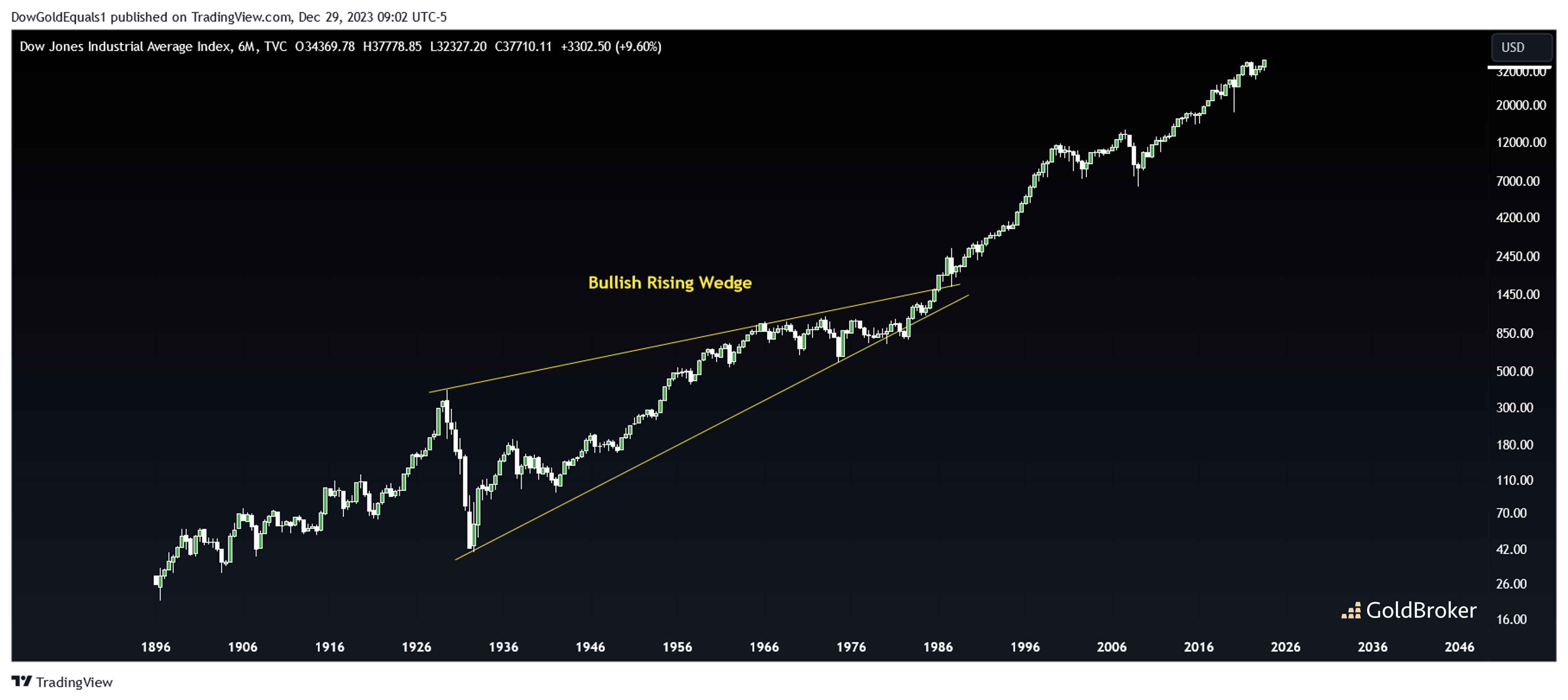

A long-term chart of gold presents a rising wedge. Many analysts assume that a rising wedge is inherently bearish, but not so.

(Click on image to enlarge)

(Click on image to enlarge)

A bullish rising wedge also exists, as supported by the accompanying long-term charts of Apple and the Dow Jones Industrial Average, just to name two. Had a trader followed the Bearish Rising Wedge thesis, the Dow would have been sold in the mid-$1980s at under 1,000. Yikes! The Dow exited the Bullish Rising Wedge from a massive inverted head and shoulders that developed from the mid-1960s to the mid-$1980s. With gold, a bullish resolution looks quite possible as it builds out a bull flag near the apex of its wedge.

More By This Author:

2024 Outlook: Gold Heading Towards New Peaks?Is The Market Consensus Too Optimistic For 2024?

Chinese Are Embracing Gold As A Safe-Haven Investment: Will Europeans Soon Follow?

Disclosure: GoldBroker.com, all rights reserved.