Is The Market Consensus Too Optimistic For 2024?

The price of gold ends 2023 with a new record closing price.

The yellow metal was one of the best-performing assets, up +16% for the entire year.

The S&P 500 index did slightly better, but gold outperformed European equity markets.

Chinese equities close 2023 on a slight rebound, but Asian markets are notably underperforming Western markets this year.

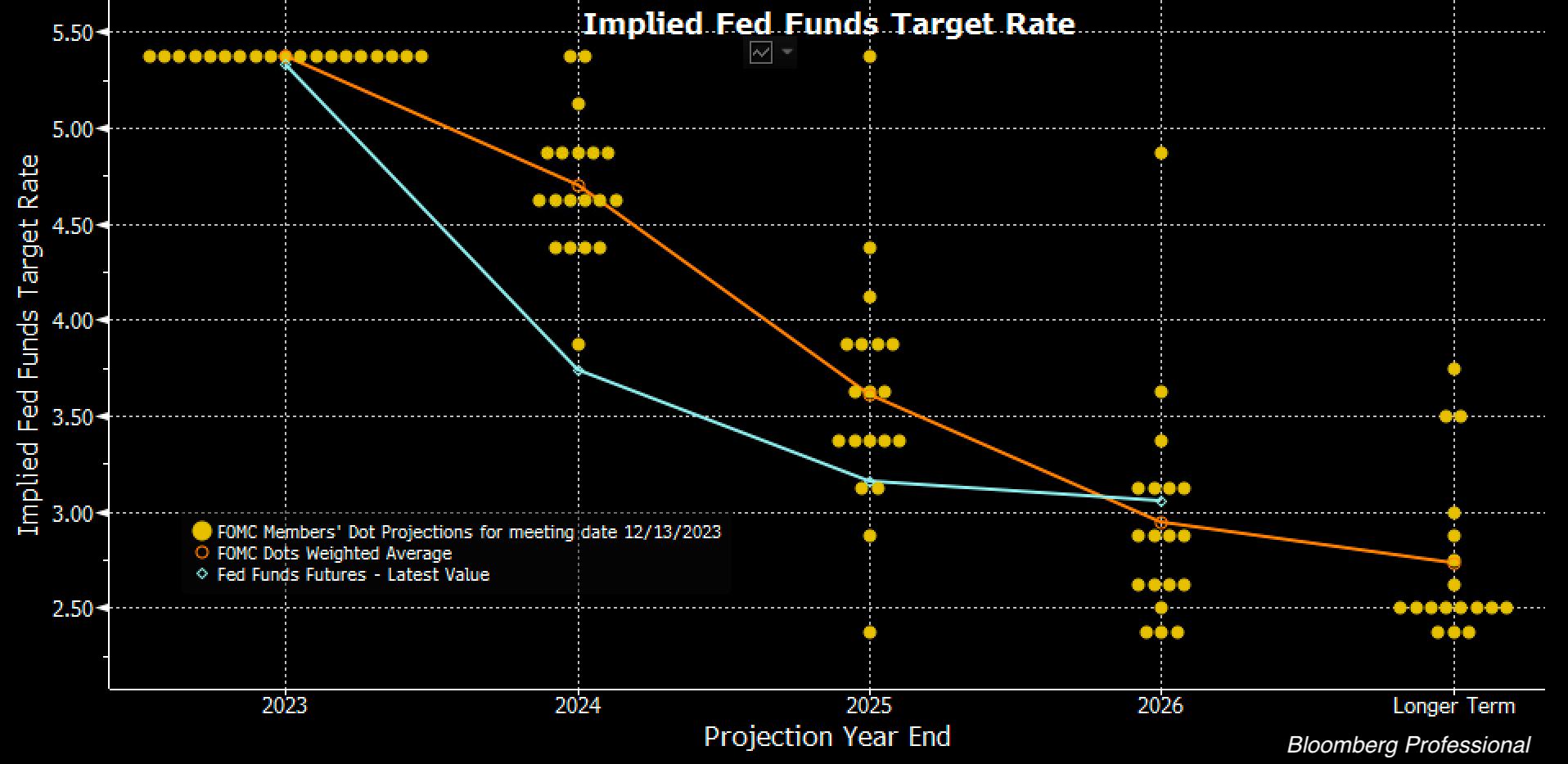

The dollar had a difficult end to the year, mainly due to the impact of the Federal Reserve's speech on the US currency:

(Click on image to enlarge)

The market is now anticipating a faster-than-expected pivot, with rates falling back below 4% as early as next year:

(Click on image to enlarge)

The highlight of 2023 was the extraordinary resilience of the US consumer, who withstood the impact of the Fed's rapid rate hike.

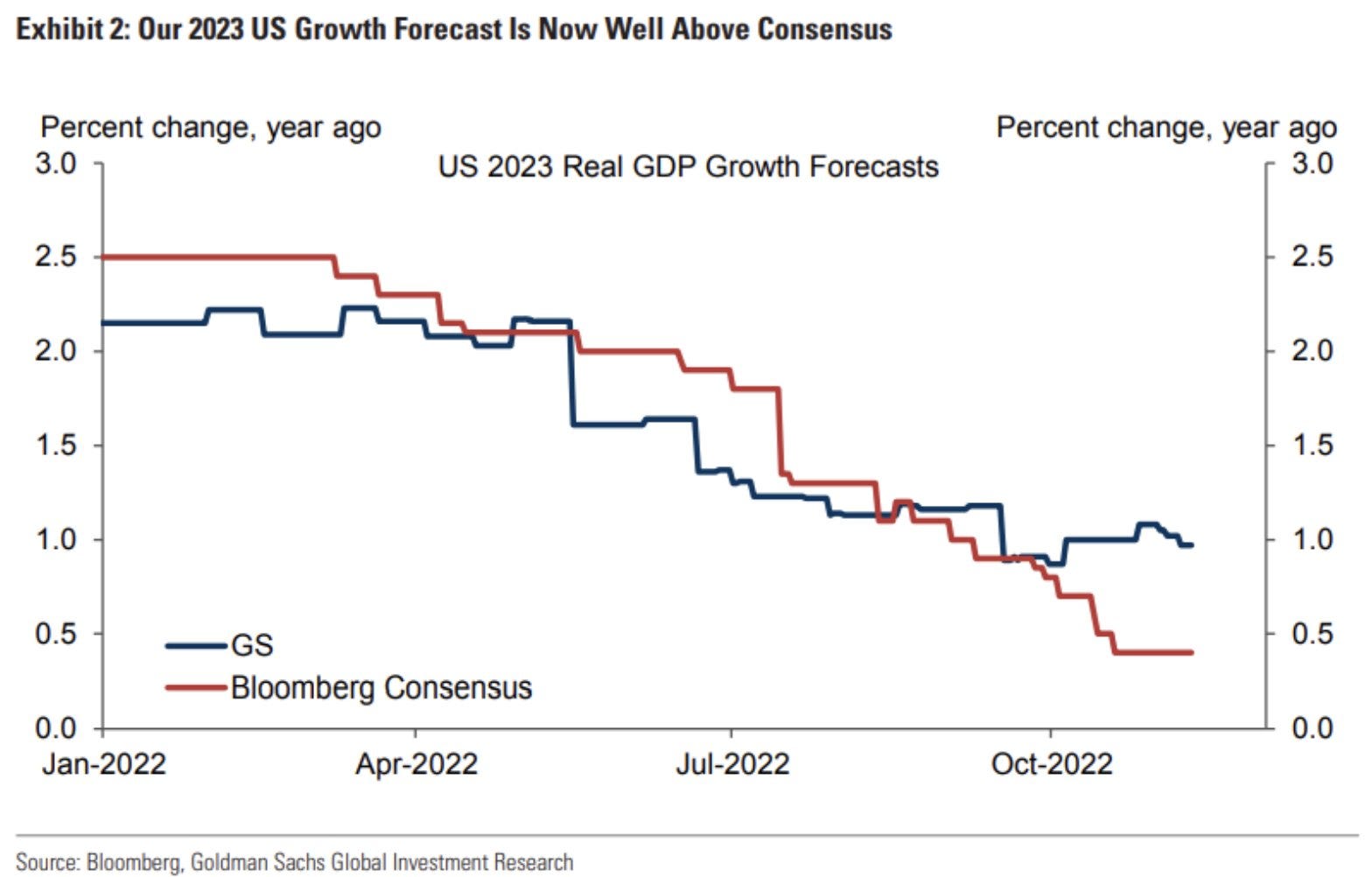

This robustness enabled US GDP to significantly exceed the forecasts of most observers. In the third quarter of 2023, US growth doubled to 4.9% annualized. This performance is mainly attributed to vigorous household consumption, despite the inflationary environment. These figures far exceed the consensus established at the start of the year:

(Click on image to enlarge)

Goldman Sachs, although among the most optimistic, saw its forecasts far exceeded by this year's actual results. Not only has recession been avoided, but the resilience of US consumer spending has surprised even the most optimistic.

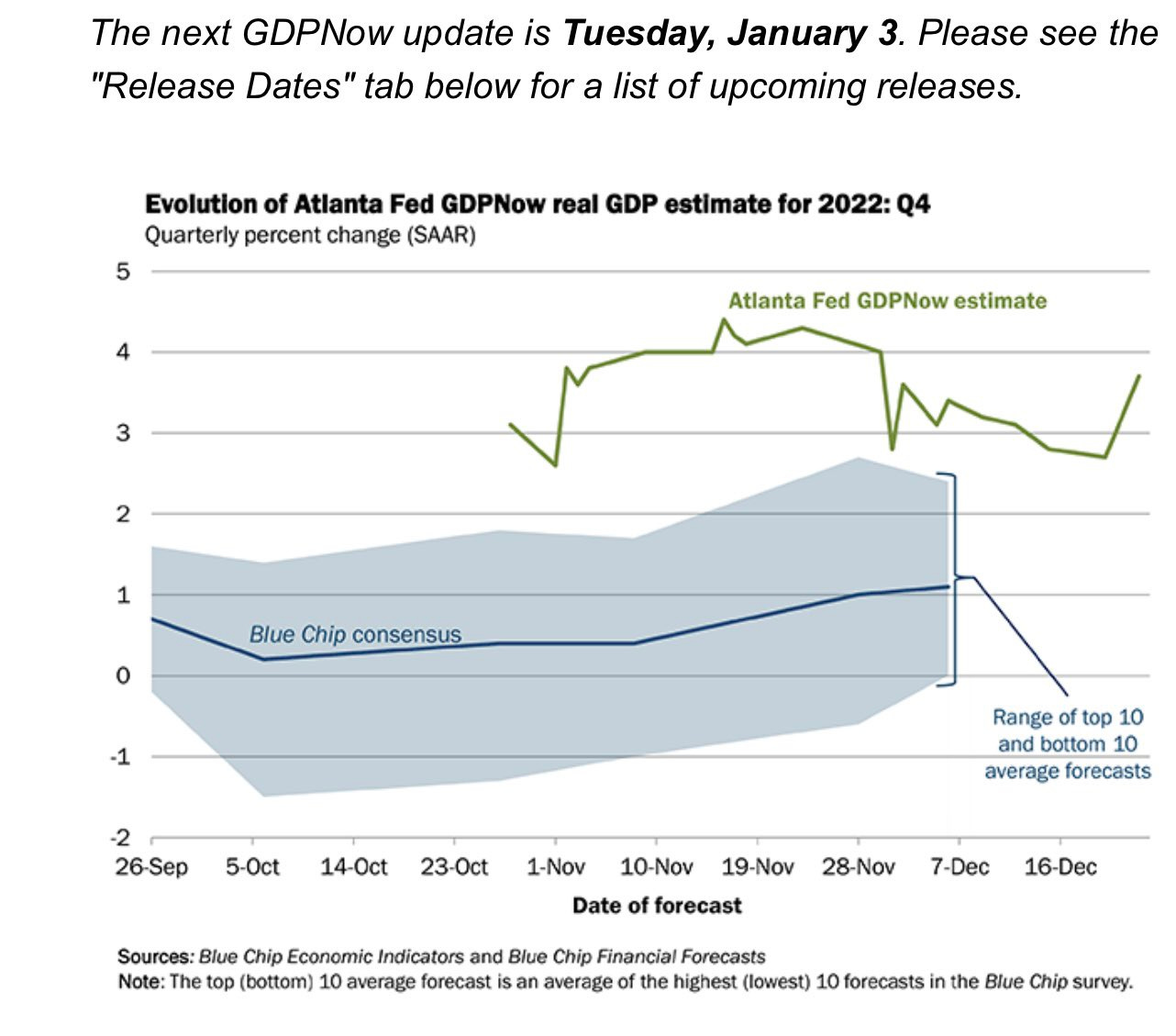

Most analysts' expectations of a recession at the end of 2022 proved to be completely wrong:

(Click on image to enlarge)

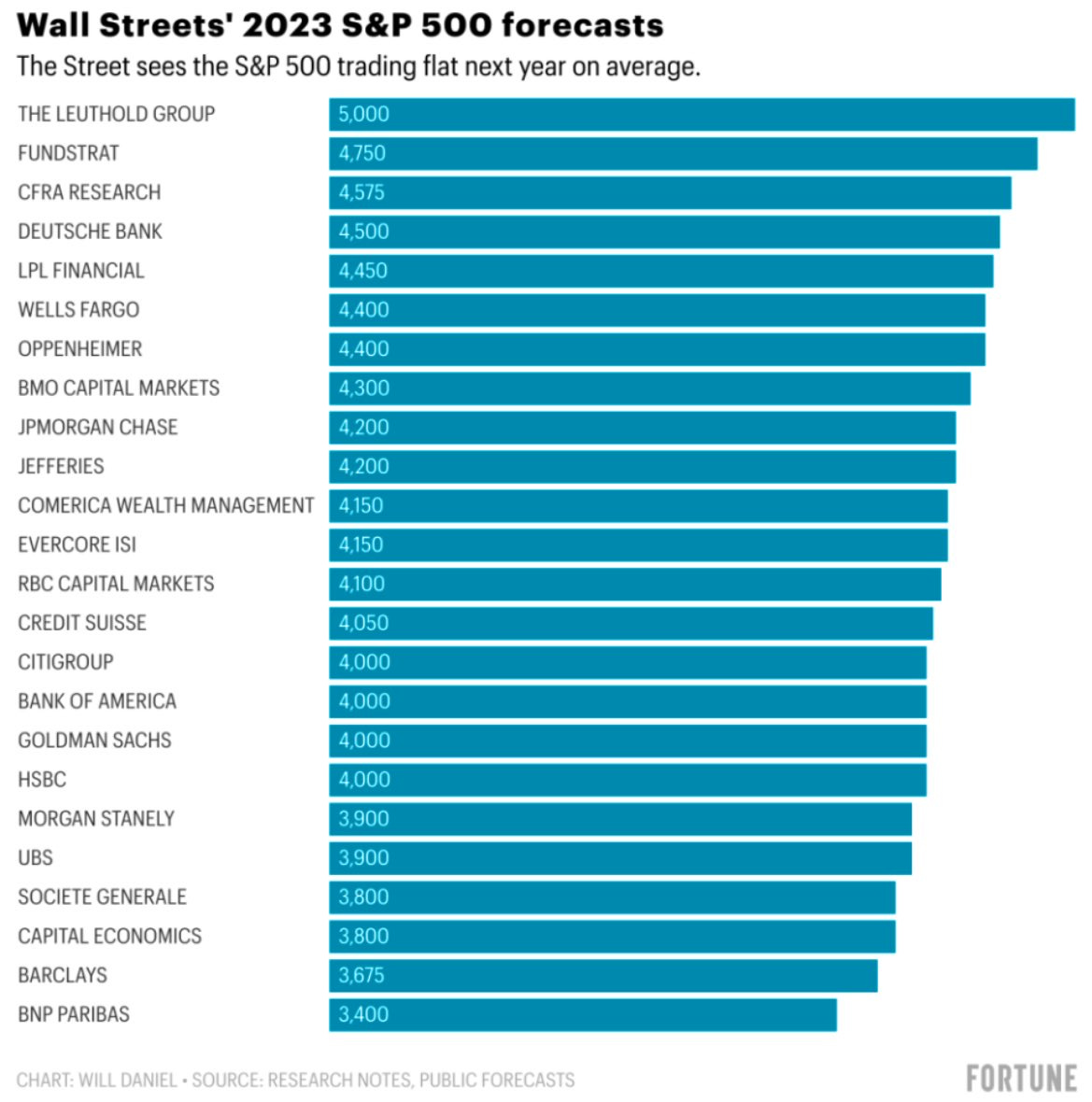

The solid performance of US economic growth enabled the US financial markets to significantly outperform the pre-established consensus. The S&P 500 ended the year above 4,800 points, exceeding all forecasts. Only The Leuthold Group had made a higher forecast last year. Such pronounced market outperformance against consensus is rare enough to merit special mention.

(Click on image to enlarge)

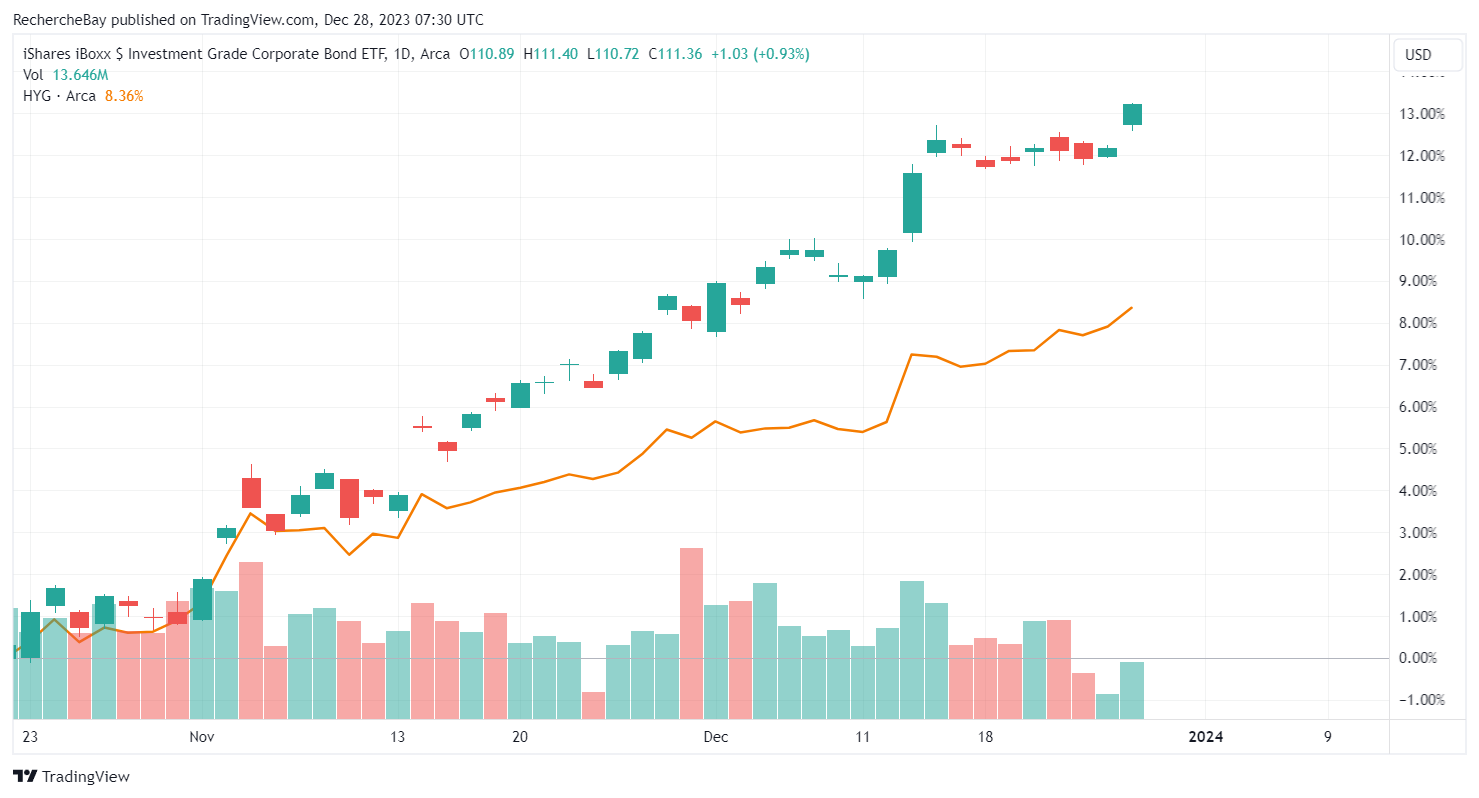

The robust economy, combined with higher interest rates, produced exceptional results for fixed-income securities.

The LQD and HYG indices, which measure the performance of long-term corporate debt, closed the year strongly, posting gains of almost 10% over the past three months. Such performances on these products often occur when recession forecasts are thwarted, and these strong variations are largely influenced by hedging movements.

(Click on image to enlarge)

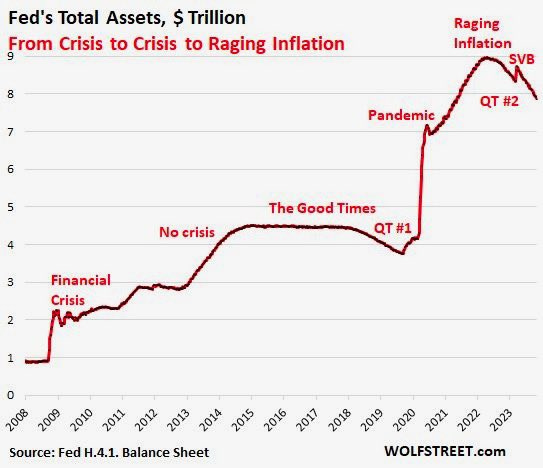

Analysts largely underestimated the powerful impact of the Fed's support during the banking crisis of 2023. The measures introduced by the Fed significantly alleviated the liquidity crisis at regional banks.

The Fed's balance sheet also remains at a very high level:

(Click on image to enlarge)

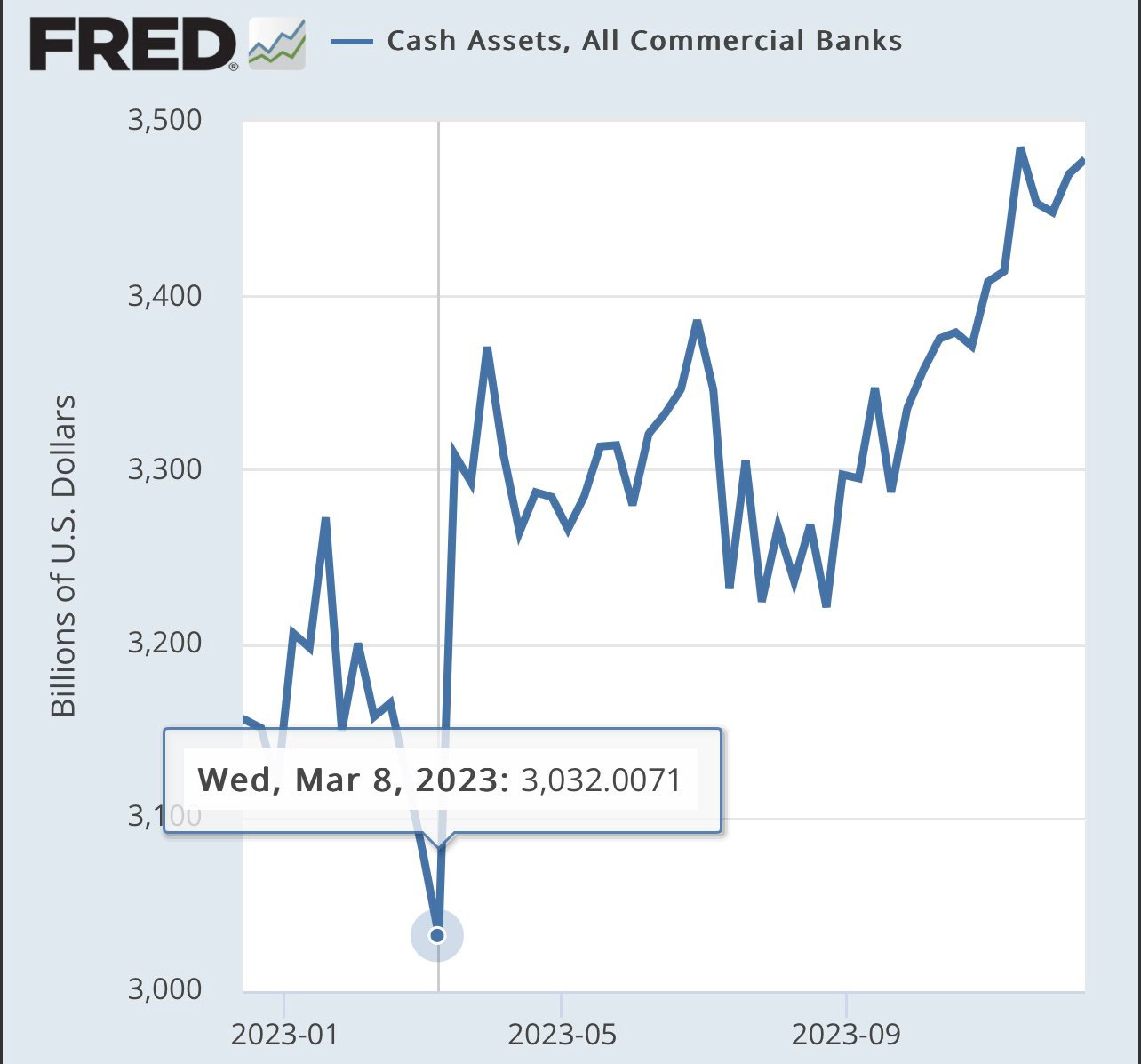

For the time being, the repercussions of rate hikes are having no impact on the banking sector. On the contrary, the Fed's support measures and rising yields on fixed-income securities have enabled banks to build up a comfortable financial cushion as the year draws to a close:

(Click on image to enlarge)

The unexpected recapitalization of Silicon Valley Bank during the banking shock, combined with the anticipation of a rapid Fed rate cut, now favors a consensus in favor of a soft landing.

The debt refinancing crisis could even be avoided if rates fall faster than expected.

At the end of 2022, the consensus was pessimistic; at the end of 2023, on the contrary, it is very optimistic.

The consensus now predicts that there will be no credit event linked to the previous episode of abrupt rate hikes.

The expected speed of the rate cut would help avoid a debt refinancing crisis.

This optimism contrasts with the current situation.

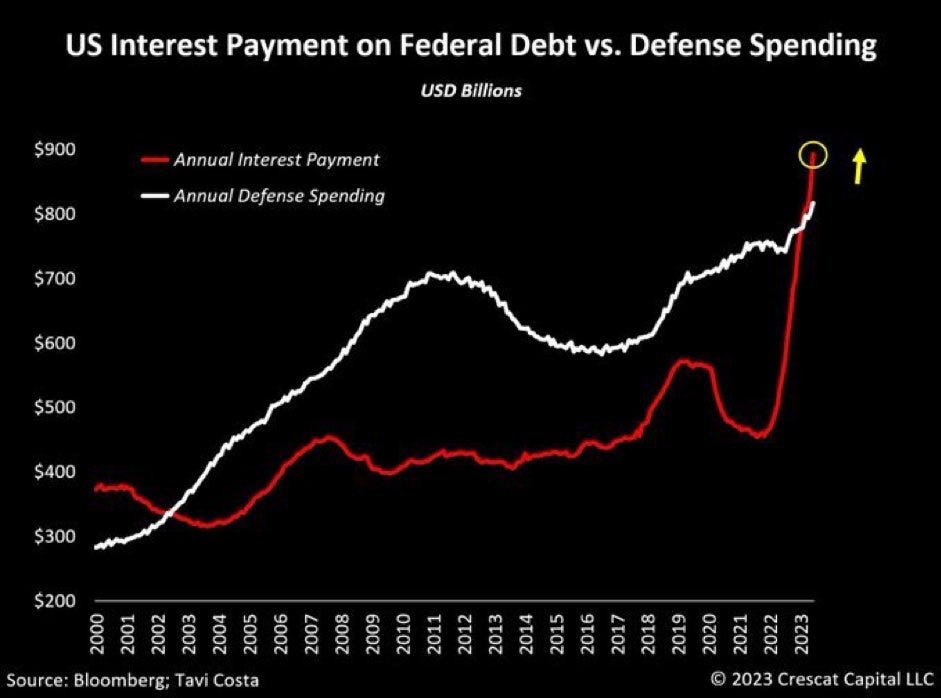

We are facing a wall of debt, with the US government at the forefront.

For the first time, interest payments on the US debt have exceeded the budget allocated to the military. If rates don't come down soon, 2024 is likely to be a very complicated year for the US budget. Once again, the Fed may have to intervene to alleviate the debt burden that has become unsustainable for the US Treasury.

(Click on image to enlarge)

The recent failures of the Treasury bill auctions underline just how difficult this 2024 public debt refinancing period will be for the Treasury without Fed support.

Here too, the consensus is now for active Fed support to resolve the debt wall.

However, such intervention, if it materializes, could radically alter the attractiveness of the most prized assets in 2023.

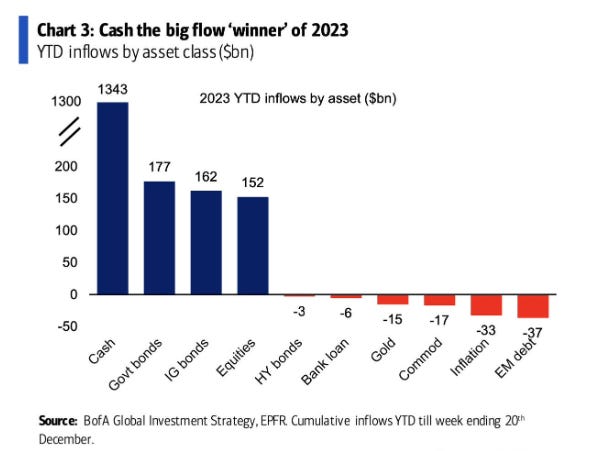

In 2023, cash investments were the asset class most appealing to investors:

(Click on image to enlarge)

This positioning could be seriously challenged if the Fed is forced to intervene to relieve the US Treasury.

Currently, rising rates benefit holders of cash positions, as they are remunerated by the high yields offered by Treasury bonds.

It's as if the Treasury were paying these investors directly, creating a kind of inverted tax in which the state pays its wealthiest corporations and taxpayers, while at the same time widening its deficit and exceeding its army's budget in interest payments.

An untenable situation in the long term. The highly optimistic consensus for 2024 completely ignores the fragility of the US fiscal situation.

It is logical that in this optimistic, high-interest-rate environment, where cash is generating attractive returns, many investors have been moving away from gold-linked ETFs. The GLD ETF returned to a level of 878 tons, similar to that of four years ago. At the end of 2019, gold was quoted at $1,500. It was physical demand from central banks and Asia that prevented gold from falling to these levels, despite such significant outflows from gold ETFs.

A change in investor perception of the attractiveness of cash investments and an unpleasant surprise against a very optimistic consensus at the end of 2023 could completely change the way these investors look at gold.

In May 2019, the ETF GLD held just 733 tons and gold was worth $1,290. However, Western investors have begun to turn their attention to gold, adding 535 tons to their GLD holdings in the space of fifteen months. Gold rose by a spectacular +60% during this period.

Western investors' renewed interest in gold could well enable gold to enjoy a sustained rise in 2024, provided that the consensus of this late 2023 is once again contradicted. The markets punished an excessively pessimistic 2023 consensus, resulting in a historic short squeeze.

The question remains: is the 2024 consensus too optimistic?

More By This Author:

Chinese Are Embracing Gold As A Safe-Haven Investment: Will Europeans Soon Follow?The Real Estate Crisis Is Far From Over

Gold, The Asset Of Choice In Recessionary Times?

Disclosure: GoldBroker.com, all rights reserved.