The Fed Vs The White House: Why Gold Is The Clear Winner

Image Source: Pixabay

Gold prices just hit over $4,630 per ounce, smashing another record in its relentless march higher. This latest driver is another key catalyst because gold offers a legacy of stability that runs counter to what’s unfolding at the Federal Reserve.

There are a collision of volatility-driven forces converging right now. We’re seeing the White House unleash political pressure on the Fed, persistent inflation hitting Main Street, and global instability threatening long-standing norms and treaties, bringing chaos to countries that command reserves of natural resources.

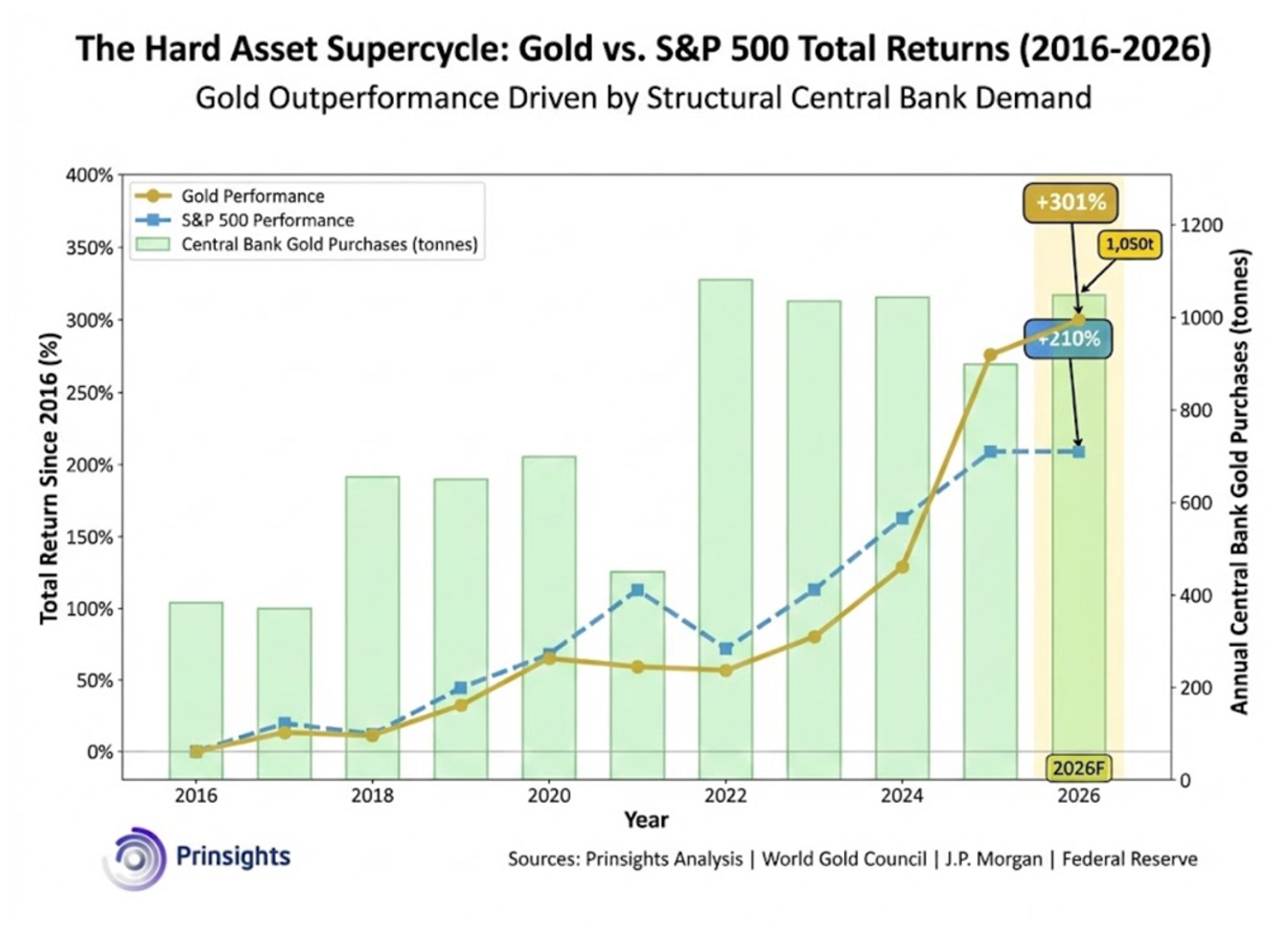

What’s increasingly clear is that hard assets, particularly gold, are positioned to continue outperforming traditional equities.

Below, we detail why this setup is so bullish for gold.

The Trump-Powell Battle Goes Nuclear

On Sunday evening, January 11, Fed Chair Jerome Powell released an extraordinary statement confirming that the Department of Justice had served the central bank with grand jury subpoenas over his Senate testimony about the Marriner S. Eccles Federal Reserve Board Building, which houses the main offices of the Board of Governors of the Fed and its renovation project.

Powell didn’t mince words in his response to this executive branch-led criminal investigation. He voiced his position by saying, “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

President Trump has repeatedly attacked Powell, whom he nominated, and his policies, including demanding lower rates, calling him incompetent, and now pressing legal action over the Fed’s renovation costs.

The subpoenas, on the surface, are about whether Powell may have misled Congress about the $2.5 billion project.

But that’s just the pretext.

What was noticeably missing from his statement? The word “independence.”

That’s because this latest action is seemingly about monetary policy independence. The under-the-surface grievance from the White House is over what monetary policy has been over the past year, which is not loose enough through ultra-low interest rates to meet the expectations of the White House or the Treasury Department.

As a result of the mounting tensions between the White House and the Fed, gold surged past $4,630 on the news. Yet, the move was not because investors care about the Fed’s independence, but because markets are anticipating the next result of this situation, as lower rates, easier policy, a lower dollar and the reflecting value that could emerge on the other side of it.

The world’s largest reserve currency is managed by a central bank leader that’s under criminal investigation at the behest of the sitting U.S. president. Now that may be harsh on the surface. But gold is pricing in the fact that whoever Trump appoints to replace Powell in May, will be far more accommodative. That means easier money, more liquidity, and a weaker dollar. All of that is rocket fuel for gold.

On the flip side, the FOMC (Federal Open Market Committee), even with a Trump-aligned Fed chair in place after May, could decide to keep rates where they are and outvote the new chair, or opt for more QE-type strategies to increase liquidity instead. Meaning that even with a new Trump-nominated chair in place, nothing is firmly guaranteed – and speculation will remain in place for at least the first half of 2026.

The Fed Is Stuck Between a Rock and a Hard Place

At its December meeting, the Fed cut rates 25 basis points to 3.50%-3.75%, the third cut in the 2025 cycle. But the vote was 9-3, the most dissents since 2019. Powell used that “extent and timing” language again, the same phrase that preceded last year’s nine-month pause.

Today, the market’s Fed Watch monitor now expects the Fed to hold rates at its January 27-28 meeting, with just one or maybe two cuts priced in for all of 2026.

Here at Prinsights, we agree on the January meeting results. But the market outlook will change in May.

Under its current leadership and statements, the Fed can’t cut aggressively because inflation is still stuck at 2.7% year-over-year. Producer prices came in at 3% in November, with core PPI climbing 3.5%, the largest 12-month increase since March 2025.

On the other hand, the labor market is cooling with December showing just 50,000 jobs added and the full year of 2025 posting only 584,000 new jobs, the worst performance since 2020.

So, the Fed is caught at a policy yellow light.

The central bank believes it can’t cut rates quickly enough to satisfy the White House without risking a return to the inflation that is hurting so many. Yet at the same time, it can’t stay restrictive without further damaging an already weakening labor market.

This policy paralysis is where gold thrives.

QT Is Over, And T-Bill Purchases Are Back

Now, a hidden narrative is bubbling.

The Fed is now buying $40 billion a month in T-bills (treasury bills) to maintain bank reserves. Technically, this isn’t QE (quantitative easing) but it is still providing short-end liquidity, nonetheless, to the markets.

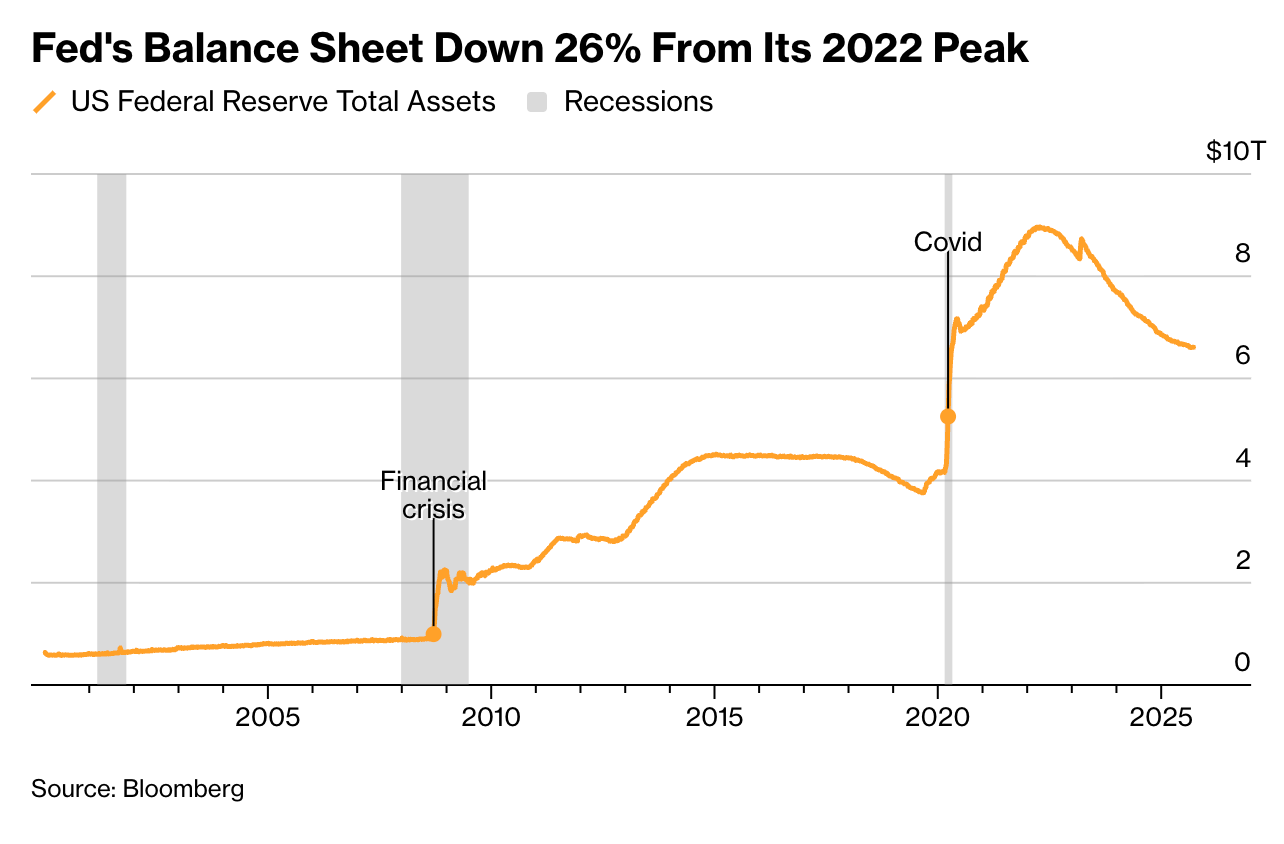

Three years of quantitative tightening drained $2.43 trillion from the Fed’s balance sheet, bringing it down from roughly $9 trillion post-COVID to about $6.6 trillion today. That’s still about $2 trillion higher than the post-2008 financial crisis peak of approximately $4.5 trillion.

What really caught our attention was the year-end repo facility, which spiked to a record $75 billion on December 31. That’s a sign of stress in the banking system.

In other words, banks are now scrambling for liquidity. Plus, the U.S. Treasury flooded the market with T-bills last year (84% of 2025 issuance was T-bills).

This is an issuance pattern that will force the Fed’s hand toward easier policy down the road – delivering to us a clear bullish sign for gold.

Geopolitical Chaos Is Accelerating

Beyond the world of Washington, the Fed and trouble on Wall Street, geopolitical tensions are intensifying nearly everywhere.

Yes, Venezuela, Iran, China-Taiwan are all hotspots for risks. In the first week of 2026, the U.S. toppling of leadership in Venezuela set off a clear signal that volatility was still in place for the year. Now, the White House has been increasingly threatening to acquire Greenland, including through military force. The move saw Trump launch into a new trade war unraveling with NATO and European allies in the balance. All while Europe threatens decisive retaliation.

This ongoing turmoil spurs safe-haven demand.

That’s why central banks have been net buyers of gold for years. That’s not stopping. JPMorgan forecasts central bank purchases will reach around 755 tons in 2026.

We expect that to be higher, and we’re forecasting another 1050+ ton buying spree year.

When governments and investors are diversifying away from the dollar and into gold at this pace, regardless of price, it tells us everything we need about where we’re headed.

The Bottom Line for Investors

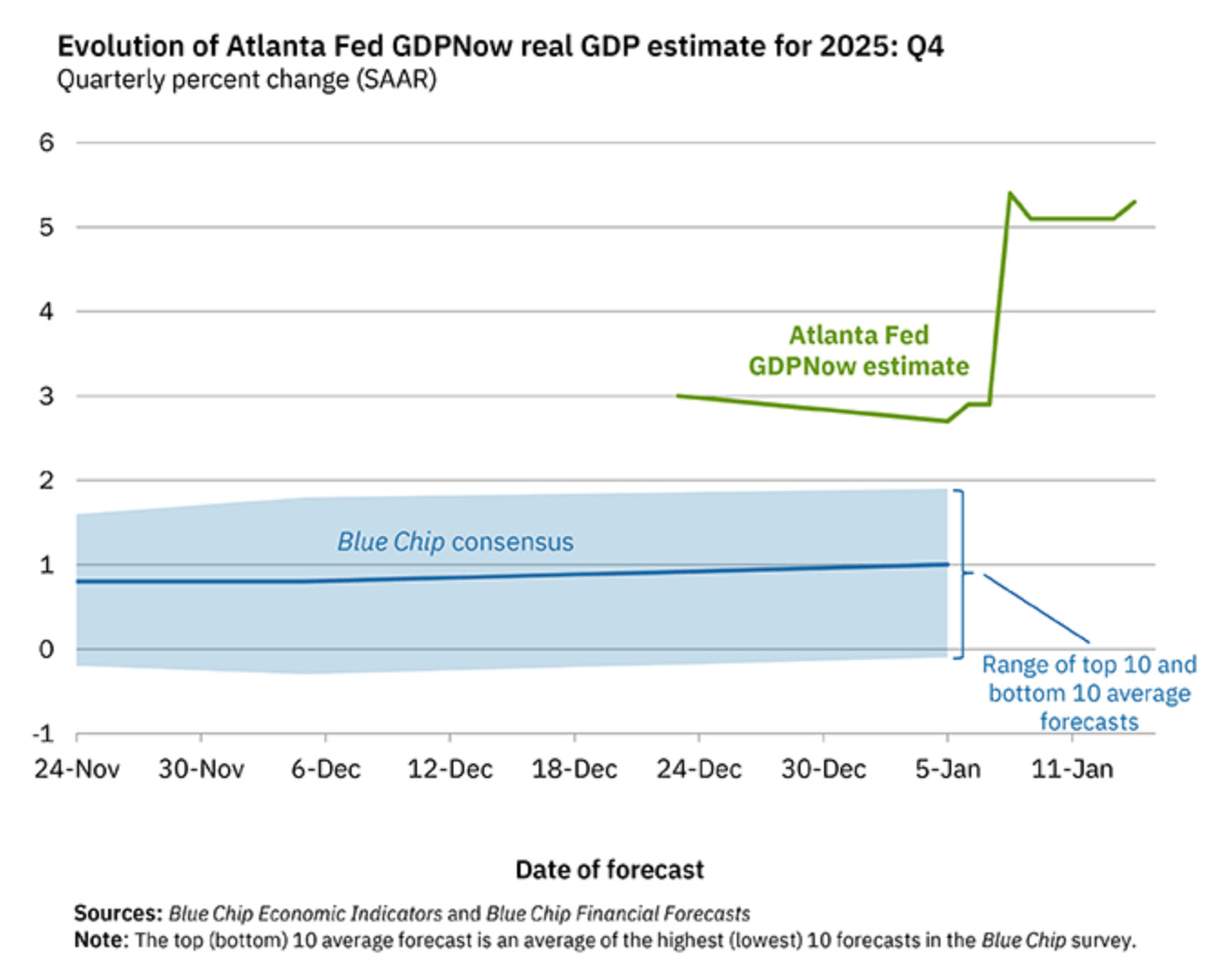

Economic growth looks strong on the surface.

The Atlanta Fed is tracking Q4 GDP at 5.3%. But that’s masking serious underlying problems – persistent inflation, a cooling labor market, a Fed under pressure, mounting fiscal deficits and escalating geopolitical risks.

These conditions don’t bode well for a stable dollar or monetary policy.

Gold has already risen about 70% year-over-year. Silver has nearly doubled since late October and is now trading around $90. Either of these are bubbles in the making. Instead, they are rational responses to monetary instability, geopolitical posturing and dollar weakness.

The collision we’re seeing between Fed independence and political pressure, between growth and inflation, between domestic policy and global chaos, is the perfect background for a sanity-check alternative.

And in that environment, hard assets are the only place to be positioned for this level of uncertainty. Mining companies, in particular those with beneficial geography along with the right resources and cost structures, will be the clear beneficiaries of this secular shift.

The market is telling us something important. Gold at $4,616 isn’t expensive. It’s still underpriced for the geopolitical and monetary turmoil-related demand ahead.

More By This Author:

The 2026 Power Play: Why The Grid Is The Trade That Matters

The $12,000 Signal: This Massive Disconnect Is Fueling A Copper Supercycle

Nuclear Power Is Having Its Moment (And Most Investors Are Missing It)

Disclosure: None.