The $12,000 Signal: This Massive Disconnect Is Fueling A Copper Supercycle

Image Source: Pixabay

Last month, we shared in our Founders+ monthly issue why copper is an industrial metal worth consideration for investors and those following the commodity markets.

That’s because copper rarely experiences wild swings. Instead, the metal, historically moves in incremental ways that make sense if you’re tracking them day by day.

What we highlighted was that in November, the pattern of rising copper prices and depleting inventories pointed to a strong sign of copper demand exceeding available supply.

The ramifications of that sign are now moving quicker than we expected. As of this morning, copper prices have shattered the copper ceiling, crossing $12,000 a ton for the first time in history.

Now, while our Founders+ November recommendation is already up more than a cool 40% since we shared with readers, the story is not done there – and neither is the momentum.

So, what is going on?

The clear and obvious story is that supply and demand issues are at play here. As we’ve called attention to, industrial metrics show that several mining outages are impacting prices and trade issues related to the latest tariffs from the Trump administration are further complicating matters.

As always through, there is a deeper story – one about geopolitical maneuvering, trade interventions and a desperate global scramble for the raw materials that actually support infrastructure and make the world run.

But what you should know is that this isn’t just a spike. It’s a signal. The gap between speculative markets and physical needs is snapping.

That’s why we are exploring below the bullish roadmap for 2026 that goes far beyond a single daily all-time record.

Here are the four reasons why copper is one of the best plays of the year – and why this trend is only just warming up.

The “Tariff Trade” Squeeze

At Prinsights, we’ve often detailed how political decisions force market prices to react. Right now, we are seeing a classic example of this. The knee jerk response to front-run potential U.S. import tariffs has created an artificial vacuum in the global copper market.

Traders and major corporations are seemingly hoarding physical copper in the U.S. to beat new levies. Because of that, it is effectively sucking supply out of parts of rest of the world.

This has created a massive disconnect. What’s now unfolding is a “premium” on U.S. copper prices compared to the London Metal Exchange (LME).

What you should know is that this isn’t a typical market function. Instead, it is a policy-driven wedge. As history shows, when influential governments intervene in markets and ultimately supply chains, the resulting volatility can create opportunities for investors who are positioned correctly.

The AI Power Drain

As we head into 2026, the Wall Street focus on AI is nowhere close to cooling. And while investors get caught up in the headlines and chase Artificial Intelligence (AI) plays, the smart money is looking at the plumbing.

Even the most capable and advanced AI capabilities are restricted by physical power to drive them forward. In many ways, data centers are the future of technology and they are being support by copper.

Cooling systems and power grids require the industrial metal to sustain the massive computational load of AI chips need 25-35% more copper than traditional centers. What we are now seeing is a structural shift in the tech world where “digital” growth is increasingly forcing a “physical” squeeze.

The demand from hyperscalers (think of the major players like Amazon, Google, and Microsoft) isn’t slowing down in 2026. If anything, the trend is accelerating as more businesses, from defense to healthcare, get involved. They all have the deep pockets to cough up nearly any price for copper. That effectively puts a floor under the market, and wind to the sails in 2026.

The Supply Cliff

For years, I have spoken with policymakers in Washington DC warning that underinvestment in infrastructure, and ultimately in the mining sector, would come back to haunt the economy.

By building, modernizing and upgrading infrastructure from things like bridges to railways and from ports to electric grids economies either compete on a global scale or get left behind. Today, that warning is increasingly coming to fruition.

What’s unfolding is an “ore grade decline” across major mines from South America to Asia. Put simply: miners are having to dig up more earth to get the same amount of metal. Combine this with the recent outages we’ve seen at major sites like in major copper players like Peru and Chile this year, and what we’re experiencing is a major recipe for deficit troubles.

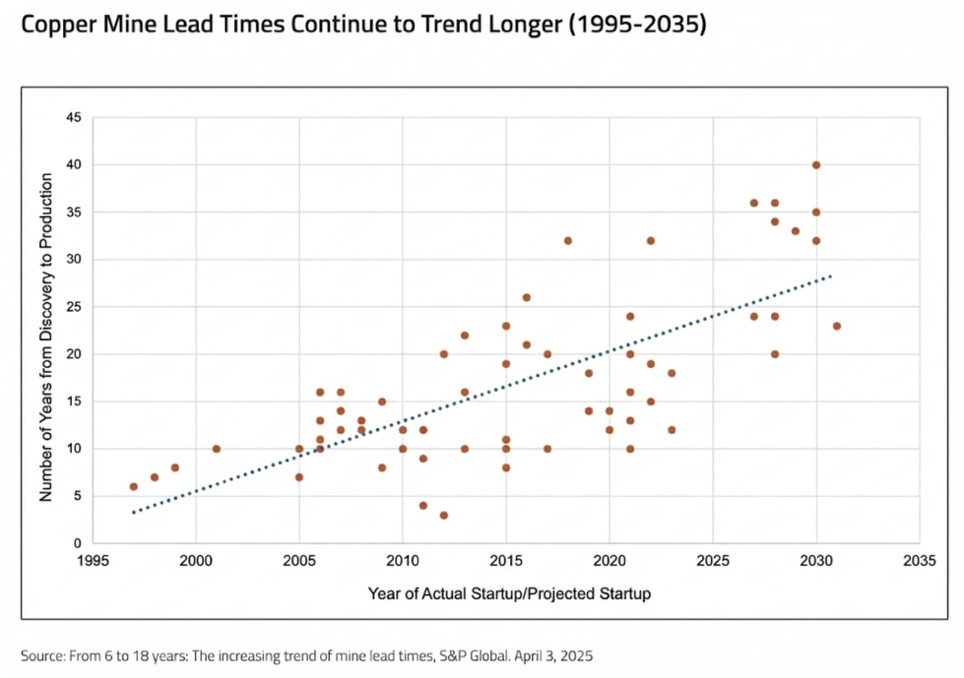

As we’ve detailed, while central banks might be able to print money, the real economy can’t print a copper mines. That can take a decade to develop and bring new supply online.

We expect that in 2026, copper demand will be at a fever pitch, but supply will crawl.

A Flight to “Real” Assets

Finally, this is a monetary story.

As faith in fiat currencies and debt levels reach breaking points, central banks and institutional investors are quietly diversifying.

Look no further than gold and silver’s run this year as a signal of this shift. What’s different is that the trend is spreading to industrial metals. While copper is not viewed as a traditional store of value in the ways gold is, it does offer a potential hedge against inflation, volatility and speculation.

As the Federal Reserve gears closer toward loose monetary policies and fiscal expansion, finding real assets that create real value is critical for a diversified and balanced portfolio. When volatility surges, capital flows into things that are tangible, essential and in demand. Copper checks every box.

Copper scarcity is now a strategic problem that’s signaling a tactical moment of opportunity.

More By This Author:

Nuclear Power Is Having Its Moment (And Most Investors Are Missing It)

The DC Energy Bill Investors Are Watching Next

The Gold Supply Crisis Nobody’s Talking About

Disclosure: None.