Nuclear Power Is Having Its Moment (And Most Investors Are Missing It)

Image Source: Unsplash

I’ve been watching the nuclear power sector closely for several years now, and something shifted in the past six months.

What actually caught my attention wasn’t a headline – it was electric power utilities quietly fielding inbound calls from hyperscalers asking one blunt question: Can you guarantee power, yes or no?

Not promises about renewable energy credits or 2030 targets. Just baseload capacity they can rely on today.

Nuclear went from “maybe someday” to “we need it yesterday”.

The reason? Data centers. Specifically, the kind of massive, power-hungry data centers that are processing AI workloads 24 hours a day, seven days a week.

The market is still pretending this is a renewable-timing problem. It isn’t.

AI data centers don’t shut down at night. They don’t care about the weather. They need constant, reliable and resilient electricity – the kind that only comes from baseload sources at scale.

In the near-term, that means nuclear or natural gas. And with pressure mounting to decarbonize, natural gas is looking less attractive every year.

The Hyperscalers Are Figuring This Out

Amazon, Google, Microsoft and Meta are all expanding data center operations at an unprecedented pace. Now they’re starting to realize their power requirements are becoming a serious problem.

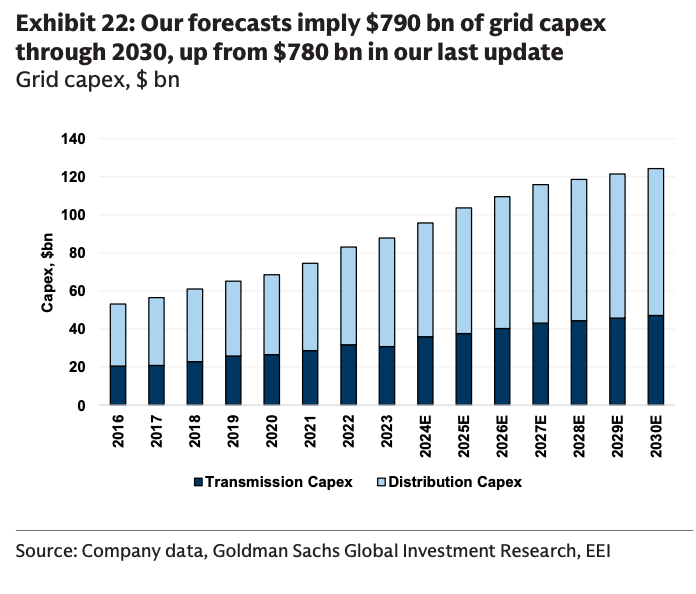

My old firm, Goldman Sachs, recently projected that powering AI infrastructure globally could require roughly $790 billion in grid spending through 2030. That’s about 45% more than what the U.S. spent building the entire Interstate Highway System, adjusted for inflation.

You can’t just build more solar farms and call this demand covered. Large load data centers processing AI workloads consume power continuously. A 100-megawatt data center running at full capacity uses the equivalent electricity of about 80,000 homes. Except it never scales back during off-peak hours. The load is constant. Solar and wind don’t work that way – they’re inherently intermittent. Batteries help, but at this scale, you’d need storage capacity that doesn’t exist and won’t exist for years, if ever, at a reasonable cost. The physics don’t change because the use case is trendy.

Why Nuclear Is the Answer to This Problem

Nuclear reactors run at steady output for 18-24 months between refueling. They don’t care about the weather. They produce no carbon emissions. And most importantly, they deliver exactly the kind of predictable, 24/7 baseload power that data centers require.

The U.S. currently has about 94 operating commercial nuclear reactors, which provide roughly 20% of the nation’s electricity. Most were built in the 1970s and 1980s. Many have received license extensions to operate for 60 or even 80 years.

These aren’t aging dinosaurs limping toward retirement; they’re long-life assets that will keep generating power for decades. And suddenly, nuclear energy is valuable in ways it wasn’t five years ago.

I’ve watched utilities that operate nuclear plants start getting serious attention from hyperscale data center operators. These companies aren’t looking for promises about future renewable energy credits. They’re looking for utilities that can guarantee multi-megawatt power delivery right now, under long-term contracts.

Nuclear delivers that. In practice, nothing else does quite as reliably without heroic assumptions about grid balancing and storage.

Small Modular Reactors Could Accelerate Everything

The other development worth paying attention to, as nuclear moves from afterthought to necessity, is small modular reactors, or SMRs.

You see, traditional nuclear plants take 10-15 years to build and cost billions. That’s a big barrier. SMRs are different because they’re factory-built, modular, and can theoretically be deployed in 3-5 years at a fraction of the cost.

They’re also sized to match specific loads. A hyperscale operator could theoretically build a dedicated data center campus powered by its own SMR, eliminating grid dependency entirely.

Is SMR technology proven at a commercial scale yet? No. But the Department of Energy (DOE) is backing multiple SMR development programs, and several utilities have announced plans to deploy them. The first U.S. commercial SMR could come online in the mid-2030s.

If SMRs actually deliver on their promise – and that’s still an “if” – they change the economics of matching nuclear generation directly to data center load. You wouldn’t need to overbuild transmission or worry about grid congestion. You’d build the reactor right next to the data center.

That’s years away from being reality. But the regulatory framework is starting to align, and states with existing nuclear operations are passing legislation to support SMR cost recovery.

Why This Means for You

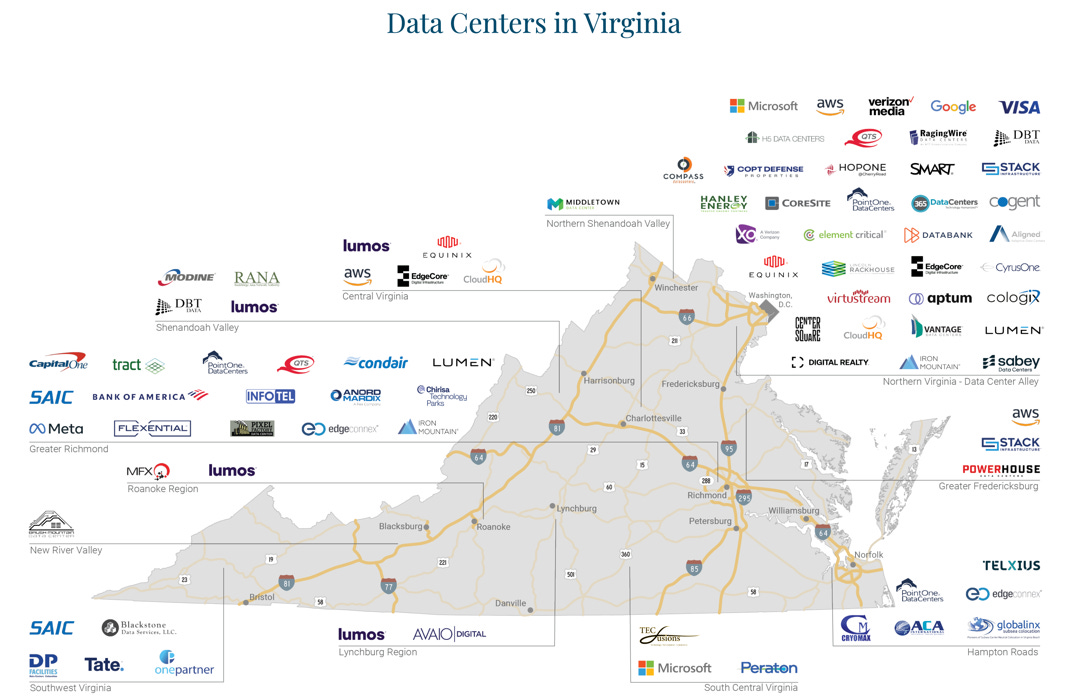

If you’re wondering where this all plays out first, look at Northern Virginia right outside of Washington D.C.

Loudoun County, known as “Data Center Alley” to many, moves an outsized share of global internet traffic. Amazon, Google, Meta, Microsoft all have massive operations there. And they keep expanding.

(Click on image to enlarge)

Virginia Economic Development Partnership

Virginia now has roughly 13% of global data center operational capacity. The state’s power demand is projected to grow 5.5% annually through the next decade. By 2039, demand will double.

That’s growth rates Virginia largely hasn’t seen since World War II.

And unlike some other regions where data center growth is theoretical, Virginia’s demand is backed by signed contracts and interconnection queues. The build-out is already happening.

That kind of demand doesn’t just change grid planning – it changes how utilities with direct exposure to Virginia’s data center buildout should be valued.

You see, most utility stocks trade like bond proxies. Steady dividends, slow growth, boring returns.

And there’s a reason for that.

Regulated utilities earn returns on infrastructure investments. When demand is flat, there’s not much reason to build new capacity. When demand is growing 5%+ annually and backed by long-term contracts with hyperscale operators, suddenly there’s $50 billion worth of infrastructure to build. And all of it flows into the rate base and earns regulatory returns.

The math gets interesting fast when dealing with utilities that have both existing nuclear assets and transmission infrastructure already in place to serve the densest data center markets.

The market is starting to figure this out, but it’s happening unevenly. Some investor-owned utilities with nuclear assets are still trading like traditional slow-growth plays, even as their demand pipelines accelerate.

We’ve been tracking one particular utility that checks every box mentioned here: operates nuclear reactors providing 24/7 baseload power, controls transmission infrastructure in the nation’s largest data center market, and is moving forward with SMR development.

Yet the stock still trades well below its 2022 peak, despite the fundamental picture being dramatically stronger.

That disconnect won’t last forever.

More By This Author:

The DC Energy Bill Investors Are Watching Next

The Gold Supply Crisis Nobody’s Talking About

The New Monetary Map: Gold Is The Anchor

Disclosure: None.

Yet the stock still trades well below its 2022 peak, despite the fundamental picture being dramatically stronger.

That disconnect won’t last forever.