The New Monetary Map: Gold Is The Anchor

Image Source: Pixabay

Gold’s trajectory past $4000 this year says more about the world we’re moving into than the one we’ve left behind. The geopolitical and monetary boundaries that defined the last cycle no longer hold.

The first phase of the multi-year shift toward gold’s resurrection began when fiscal pressure, geopolitical risk, and reserve diversification all moved in the same direction in the aftermath of the 2022 Russia-Ukraine war escalation. The U.S., meanwhile, has been issuing debt at a pace the global system hasn’t seen outside wartime, while its interest expense is running near $1 trillion a year.

The world has set new debt records every year since then. Those conditions have pushed policy to the point where it can’t tighten any further to combat inflationary pressures without undermining the government’s own financing.

Yet, the U.S. isn’t alone in facing the limits of its fiscal capacity. Japan will be locked into yield control because its debt load won’t allow an unwind. Europe’s anemic growth doesn’t support significantly higher real rates. And emerging markets have been buying insurance through gold for the better part of 18 months.

We are now in a second phase of that shift to gold, defined by a deeper divergence between what fiscal conditions demand and what monetary policy can realistically enforce. Into that gap, gold has once again become a reliable anchor. Only this shift is not set up as a formal standard like the pre-1971 dollar-gold link, but as a foundation for how policy and reserves operate now in the rapidly evolving global monetary system.

That’s why gold crossed $4,000 on October 8 and kept moving, reaching an intraday high above $4,380 around October 20, and even with some interim dips, has held above $4,000 every day since. Markets don’t maintain levels like this unless the underlying dynamics are structural. In 2025, they were.

Central Bank Reserve Shift is Irreversible

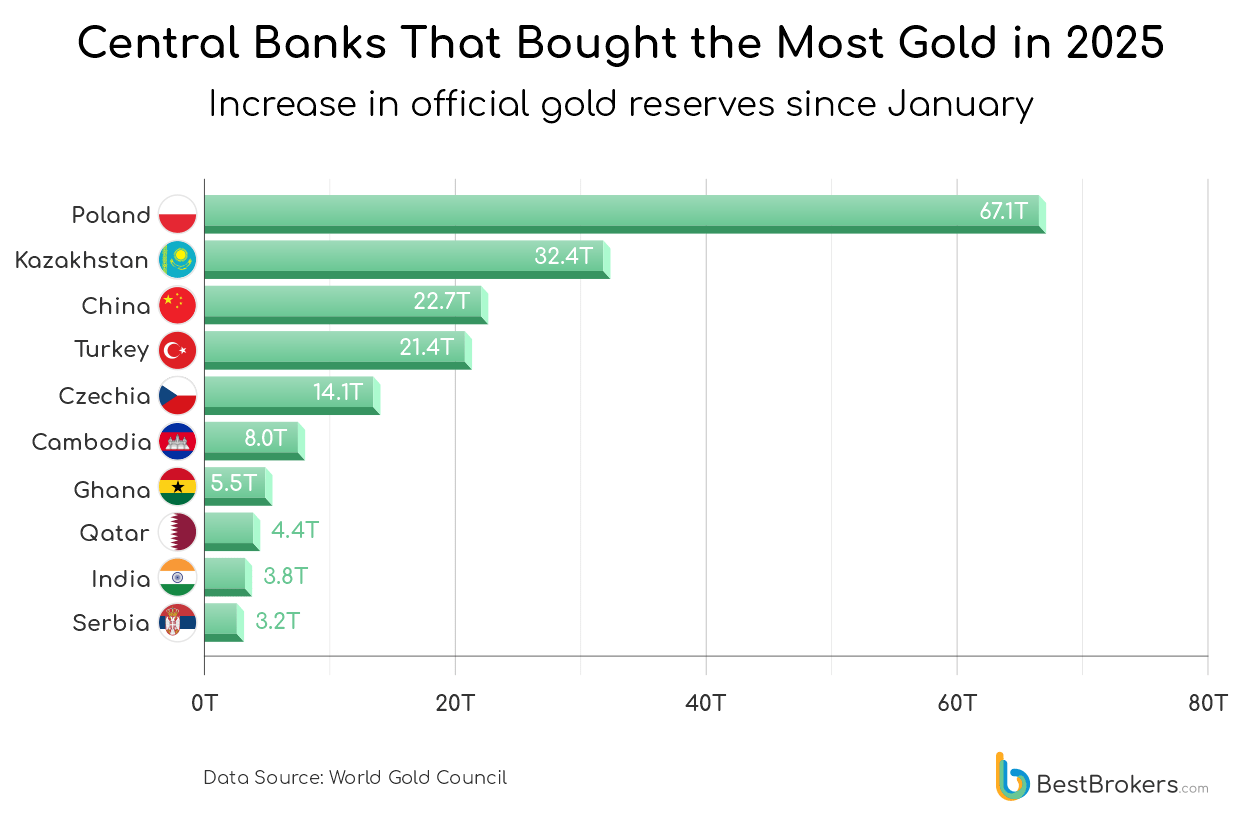

Central banks added roughly 634 tonnes of gold through Q3, far above the pre-2022 norm of about 450 tonnes a year. September alone saw more than 60 tonnes. Q3 buying was 28% higher than Q2. China added steadily. Turkey, Poland, Kazakhstan and India have continued building their gold positions. Gulf states increased allocations. None of this slowed as gold reached new highs.

(Click on image to enlarge)

Gold ETF holdings increased through new highs, not on dips, by about 220 tonnes in Q3, taking year-to-date inflows to roughly 620 tonnes through September. Notably, as we reported here, Western retail investment contributed to that growth. But the sustainable long-term demand still came from sovereign balance sheets. When central banks accumulate through the highs, not on pullbacks, the motivation is policy.

The geopolitical backdrop explains the rest. The post-2008 reserve framework relied on alignment between the major monetary centers. I wrote about that coordination in my book Collusion: How Central Bankers Rigged the World.

The old paradigm, crafted in the WWII-era at Bretton Woods, assumed the U.S. dollar could carry global financial stability in the wake of the banking crisis, and that the politics around that role were predictable. That isn’t the world of 2025.

The risk of sanctions is now being integrated into reserve decisions by central banks. Supply chains now have growing fault lines across energy, minerals, and semiconductors. Currency alignments are shifting, and gold is becoming the common reserve denominator for a wider group of central banks and governments.

Countries that once held minimal gold, such as the ASEAN region, parts of the Gulf, and several African economies, are incorporating it into their reserve frameworks at a meaningful scale. Gold is the reserve asset rising in importance because governments are managing political exposure and hedging directly through their reserves.

That’s why we’re not looking at a ceiling for gold prices. We’re simply looking at the mid-point of a new range. A move toward $5,000 reflects where these fiscal and reserve pressures converge if nothing shifts geopolitically or in terms of debt issuance through 2026.

Gold Supply is Stretched

Meanwhile, mined supply hasn’t expanded enough to keep up with the demand for this newly forming monetary system. It surpassed the 2018 record, but at about 3,700 tonnes this year so far, that’s still just about 1% greater than last year. Major producers haven’t entirely replaced mined ounces for several years. These are structural constraints – and they are showing up at the exact moment demand has shifted upward relative to existing supply.

Unmined reserves tell the same story. Russia and Australia each hold about 12,000 tonnes, or together nearly 40% of global untapped supply. Canada, China, and the U.S. are around 3,000 tonnes. Future production is increasingly concentrated in a handful of jurisdictions, and not all of them are stable or accessible. In this environment, long-life assets in predictable regions will carry far more weight than they did in the prior cycle.

This is why many miners haven’t caught up with gold price levels – and why they eventually will. Markets always lag when the metal breaks into a new range. But once gold holds that range, valuations have to adjust to a cash flow reality. At $4,000+, large-scale producers with stable cost bases are running margins far above what their current pricing reflects.

And our analysis shows that 2026 is the year when the gap closes, given the sustained pull of those higher prices.

The bottom line is simple: Gold prices have already captured the realities of the new global monetary policy framework. Most miners haven’t caught up. The companies with scale, discipline, and jurisdictional strength are the ones that sit at the center of this next phase. For investors wanting broad exposure to gold miners, consider the Gold Miners (GDX) ETF by VanEck, which tracks the overall performance of companies involved in the gold mining industry.

More By This Author:

The Material Reality: Why Hard Assets Win, Regardless Of AI Hype

Copper, Silver And Uranium Join U.S. Critical Minerals Club

Surviving The Fed Vs Wall Street (Again)

Disclosure: None.