Copper, Silver And Uranium Join U.S. Critical Minerals Club

Image Source: Pixabay

In the midst of its shutdown, the U.S. government dropped one of its most consequential policy updates this week. Buried in the headlines is the final 2025 List of Critical Minerals, as published November 7 in the Federal Register.

The Federal Register serves as the official journal of the U.S. government. And while it is not as well-followed as the U.S. Treasury or other institutions, it contains public notices, proposed rules, final rules, and other documents from federal agencies and organizations.

The organization is essential because it provides legal notice to the public, businesses and even savvy investors looking to the future.

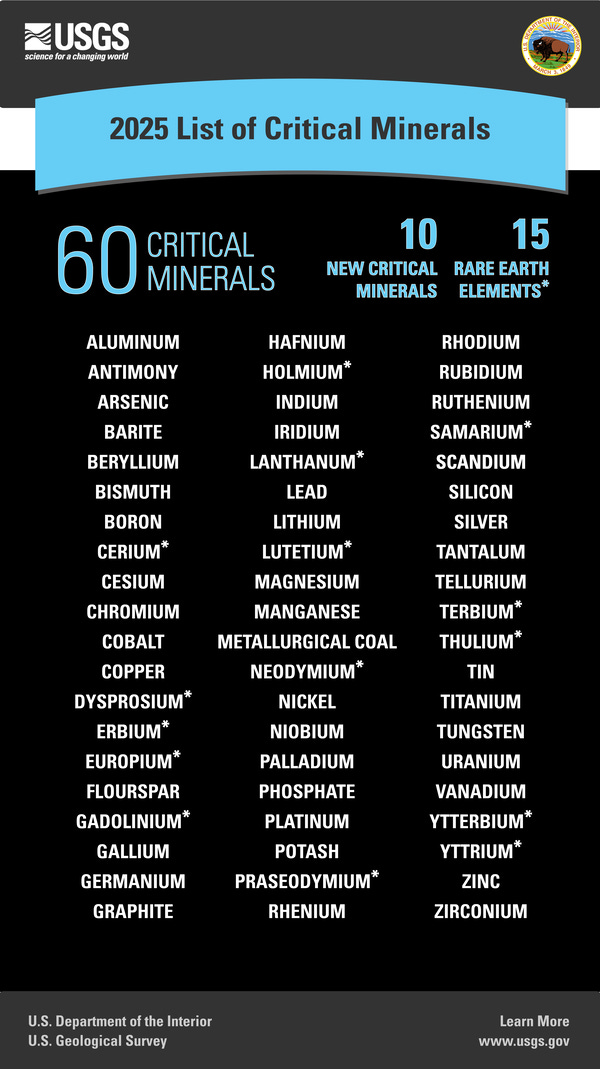

The new list, compiled by the U.S. Geological Survey (USGS) under the Energy Act of 2020, expands America’s official roster of “critical” materials by 20% from 50 to 60 minerals.

That list reveals a direct window into how Washington now defines economic and national security priorities, where it expects the next supply-chain shocks to hit, and how the White House will position funding and public-private initiatives to get ahead of them.

A Broader, Heavier Critical Minerals List

The last version of this U.S. Geological Survey List of Critical Materials, released in 2022, focused more on battery metals. And while that remains materially important, this 2025 update expands on that foundation – now with an extra industrial edge to it.

Added to lithium, nickel, and cobalt are copper, silver, boron, rhenium, lead, silicon, and potash – materials that span the electrical grid, semiconductors, advanced manufacturing and food production.

Today, given the administration’s focus on energy and security, the updated list now includes uranium, phosphate, and metallurgical coal – minerals tied to crucial nuclear power, advances in fertilizer and key steelmaking for industrial development.

The inclusion of those more “traditional” resources signals a strategic turn from inputs for electric vehicles or smartphones to everything from baseload power to fertilizer, which constitute the physical foundations of industrial life and expansion.

The USGS notes the 2025 list draws on more than 1,200 supply-disruption scenarios covering 84 commodities and 400 industries. That modeling found that even small interruptions in trade could have outsized economic consequences across key sectors. Copper, silver, uranium, silicon, and potash scored high on that metric, hence their promotion to “critical.”

Who’s New, Who’s Back, Why It Matters

The 2025 list, at 60 minerals, reads like a global map of power and strategic competition. Aluminum, graphite, nickel, and the full suite of rare earths remain on it. New entrants include copper, silver, lead, boron, phosphate, potash, metallurgical coal, uranium, and silicon.

The additions reflect broader risk metrics, including processing concentration, co-product dependency, and single-source exposure.

The list itself doesn’t create automatic subsidies or tariffs, but it does set the ground rules for them. That’s because being labeled “critical” opens the door to streamlined permitting, Defense Production Act funding, and access to influential government organizations like the Department of Energy and Department of Defense and their loan programs. It also shapes trade policy, stockpiling priorities, diplomatic strategy, and private investment.

The practical message is that Washington now officially views mineral security as industrial policy, and industrial policy as national security.

For investors, this is a signal. Copper, already the bellwether of global growth, now carries an added geopolitical premium. Silver sits at the intersection of green tech, electronics, and monetary hedge. Uranium’s presence confirms what the market has been pricing in all year and what we’ve written about extensively, that nuclear power is intrinsic to the future of any energy-security plan.

And while often overlooked, phosphate and potash, both fertilizers, were elevated to the same strategic tier. With fertilizer supply chains still concentrated in Russia, Belarus, and Morocco, the U.S. is acknowledging that food security and mineral policy are two sides of the same coin.

What Comes Next and Why It Matters

The Federal Register notice made it clear that this list isn’t final. It will be reviewed “as needed,” at least every two years, to capture shifts in supply and production risk. The methodology is now fully quantitative, relying on trade figures as well as production data.

That makes the process more transparent, but also more political. Which minerals make or miss the next cut will depend as much on policy direction as on geology.

Meanwhile, this new list also gives Washington a stronger hand in shaping federal industrial investment, funding private-sector companies and projects. Federal loan programs can now back projects across a broader range of metals, from copper smelters to uranium processing and domestic fertilizer plants, all of which we’ve been watching closely for years.

We’ve been following developments across silver, copper, uranium, and the rare-earth space long before they became official. This latest confirmation matters. Each of these materials now sits squarely inside the U.S. definition of “critical.”

With Prinsights Founders+ readers, we’ve delivered key recommendations in our August and October monthly issues that serve to complement these moves in the critical mineral space – and we’ll continue to deliver opportunities like these in the future.

And we’ll continue tracking the companies, projects, and policies driving this major shift from domestic and allied miners and processors to the global supply chains that move and rely on them. Because this new list names the elements that matter today and will in the next investment cycle.

More By This Author:

Surviving The Fed Vs Wall Street (Again)

Rare Earths War Is Heating Up

Here’s Why Silver’s Moment Is Coming

Disclosure: None.