Rare Earths War Is Heating Up

Image Source: Pixabay

The global race for rare earths is accelerating into its next stage. Emerging policies are not just focused on the import and export of raw minerals – they’re also targeting production.

When we last reported on rare earths, the narrative was centered around Washington’s first equity deal in the sector. Now, that policy move has become the foundation of a broader Western strategy that’s anchored in investment, private and public coordination, and attempted control of supply and processing.

A growing rare earths war is brewing, and the impact will touch nearly every sector of the economy.

The Big Deal Around Rare Earths Today

The rare earths war entered this new phase on October 8, when Australia-based Lynas Rare Earths and U.S.-based Noveon Magnetics, a high-performance magnet producer, announced a partnership to supply magnets for U.S. defense and electric-vehicle manufacturers.

The landmark agreement will connect Australian material directly to U.S. assembly lines and follows Washington’s new authority to invest directly in critical minerals companies.

It’s a clear sign that Western governments and global companies are beginning to rebuild control of the materials chain that China has dominated for decades.

The next day, China announced measures to curtail the supply of rare earths further as of December 1. A few hours later, it asserted new curbs on car battery equipment that use processed rare earths, which will take effect on November 8.

In retaliation, the White House ratcheted up the tension and threatened to raise U.S. tariffs on all Chinese imported goods to 100 percent on November 1.

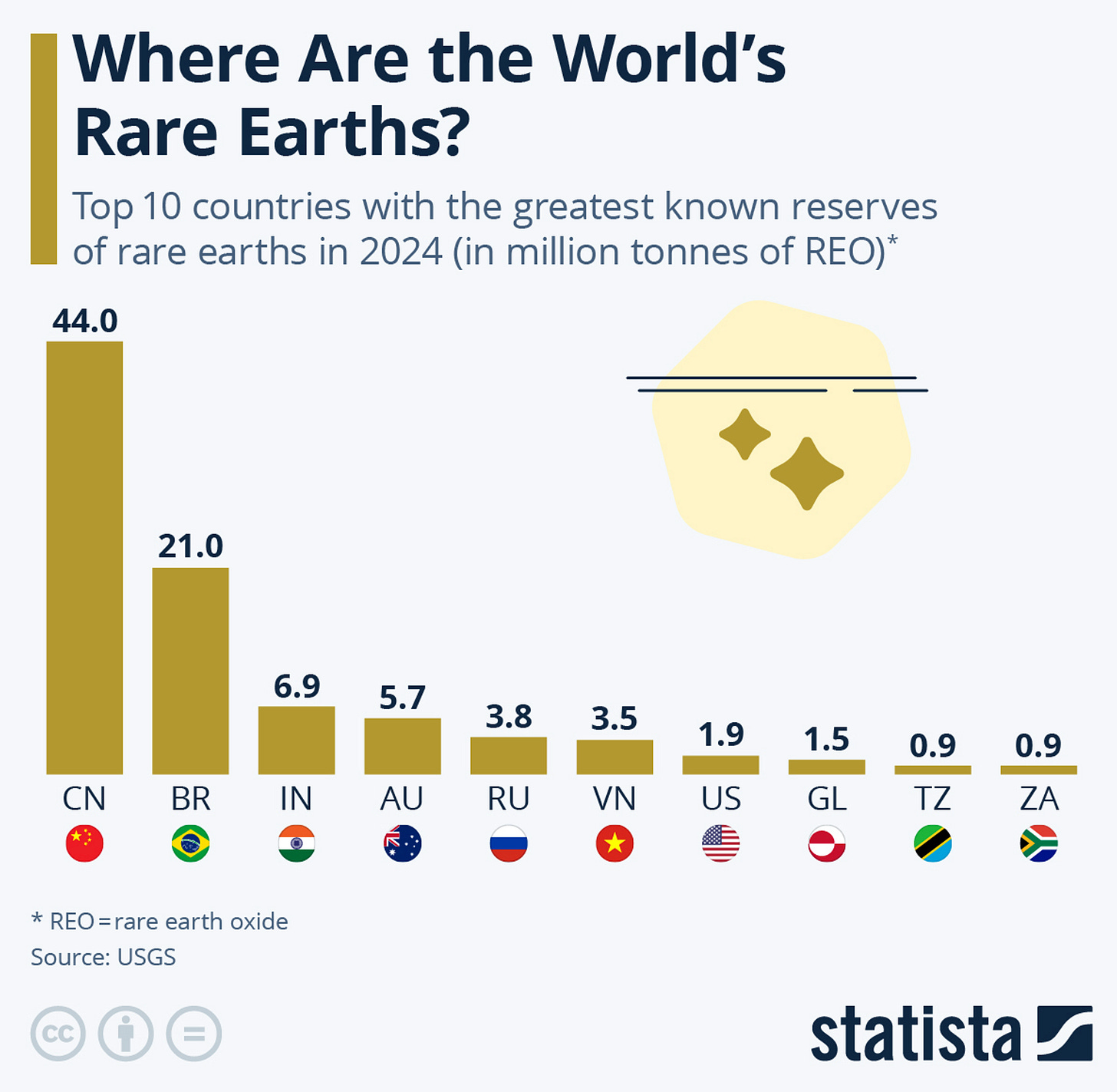

These moves demonstrate the growing conflict around the control of rare earth supplies and permanent magnet production. China currently has the largest known rare earth reserves and the greatest percentage of production globally. Brazil comes in at second place in rare earth reserves and, as our analysis here at Prinsights show, they hold the key to the future of rare earth supply chains for the West.

That geological position gives added weight to the planned meeting between President Trump and Brazil’s President Luiz Inácio Lula da Silva (Lula). That historic meeting could have a seismic impact on the rare earths supply chain for decades to come. Last week’s “friendly” phone call between the two leaders bodes well for that partnership.

The ramifications of these developments can’t be overstated. Rare earths are the backbone of sectors ranging from energy to automotives and from electronics to defense technology. At the center of the conversation are the strongest permanent magnets that require four core elements. The first two, neodymium and praseodymium, drive most of the torque in electric motors and wind turbines. Meanwhile, dysprosium and terbium are added in smaller amounts to maintain the stability of magnets under heat and stress in jet engines, satellites, and advanced defense systems.

That’s why the West remains reliant on China for the rare earths and production – and why the concern has emerged that China controls the “plumbing” behind defense, energy, and manufacturing systems.

Current policy is now trying to reverse that dependence. Recent steps toward this goal have been accelerating since the summer. Today, speed and development are paramount for Western governments as they consider strategic alliances and private deals in the future.

July: Washington Moves First, Beijing Tightens Grip

The latest stage of this rare earths supply shift had its roots events from July. The U.S. Department of Defense took a direct equity stake in MP Materials (NYSE: MP), the operator of America’s only large-scale rare-earth mine. The agreement set a ten-year floor price of $110 per kilogram for neodymium-praseodymium (NdPr) oxide, which offers nearly twice the level in China. What you should know is that the deal guaranteed magnet purchases for U.S. defense contractors. That marked the first time leaders in Washington moved from policy statements to firm direct market intervention.

Days later, Beijing issued its 2025 rare-earth production quotas, quietly extending them to imported material for the first time. That change gave China control not just over its domestic output but also over all shipments entering its refining system.

At the same time, Japan and the European Union announced plans to coordinate procurement and establish shared reserves. Although it was largely unspoken, the move was a joint effort to counter future Chinese supply restrictions.

August: Financing Becomes Strategy

On August 13, Washington backed its latest strategy with real capital. The administration proposed $1 billion in critical minerals funding, including $135 million dedicated to rare earths. The deal was monumental in the modern era because it signaled plans to expand federal co-investment authority in private producers within the U.S.

Later that month, Critical Metals (Nasdaq: CRML) in Greenland signed a ten-year supply memorandum with Ucore Rare Metals (UURAF) to provide heavy-element concentrate for U.S.-aligned processing operations in Louisiana.

The efforts expanded in parallel. Japan has confirmed a pilot for seabed-mining operations, set to launch in 2026.

Each of these steps extended a growing supply network that is being designed to route production and processing through Western-aligned economies instead of China.

September: Consolidation of Allies

The result is that the world will now trade rare earths on two diverging price tracks.

In Europe, on September 19, the EU unveiled its first state-of-the-art rare earth magnet factory run by Canada-based Neo Performance Materials in Narva, northern Estonia. The facility aims to produce around 2,000 metric tonnes of magnet blocks per year. That would be enough magnets to support over a million EVs or 1,000 offshore wind turbines.

Over in Brazil, projects are underway that could supply those same plants, while U.S. agencies extended technical assistance and long-term purchase guarantees. Meteoric Resources, through its standing offtake agreement with Neo, could be one key supplier to that factory.

The looming talks between the U.S. and Brazil could focus on the South American giant’s ionic-clay deposits, which are geological formations rich in both light and heavy rare earths that can be processed with far lower waste and radiation than hard-rock mines. These clays contain the key rare earths, dysprosium and terbium, that remain China’s strongest source of leverage.

Those once-fragmented domestic initiatives have now started to align into a trans-Atlantic network linking Brazil’s deposits to North American and European processing capacity. All steps that could unlock the Western shift away from Chinese dependence.

October: Parallel Systems are Emerging

What you should know is that in early October, the structure of the emerging global rare earth shift is taking a fresh shape.

The Lynas–Noveon partnership confirmed that the private sector is building around the same goal of a China-independent rare-earth supply chain that runs through Western nations.

The Pentagon’s multiyear purchase agreements with Vulcan Elements in North Carolina and other magnet makers indicate that U.S. demand for non-Chinese materials is now permanent. These contracts ensure support for Western producers that can deliver magnets at scale.

Now, China is getting nervous.

Its two main conglomerates now control light- and heavy-element quotas, manage export permissions, and coordinate pricing through China’s State Council. That concentration keeps production steady while giving Beijing a political lever over every industry that depends on its supply.

That’s why on October 9, China exerted its rare earth muscle further by announcing more restrictions on exports of rare earth metals as of December 1.

Enter Brazil’s Opportunity and the Road Ahead

As many here know, I sit on the board of Meteoric Resources. The junior miner is headquartered in Australia with a world-class ionic clay rare earths asset, the Caldeira project, residing in the heart of Brazil. In that role, I’ve seen much of this movement unfold in real time.

Brazil’s position is central to this realignment. Its ionic clays hold both light and heavy rare earths and can be processed without the radiation or waste of hard-rock mining.

Caldeira contains a rare balance of elements, dominated by neodymium and praseodymium, but with unusually high levels of dysprosium and terbium compared with Western peers such as MP Materials. That mix gives strategic weight, light elements for volume, heavy elements for defense in a rapidly evolving arena.

The question is no longer whether the West can find rare earths. It’s whether it can process and deliver enough of them fast enough to alter the global landscape.

The reality is that China’s rare earths systems are already built. On the other hand, the Western one is still taking shape. Today, the rare-earth advantage that once belonged to China alone is starting to split. What happens next will determine who controls the next generation of energy, industry, and defense.

More By This Author:

Here’s Why Silver’s Moment Is Coming

Nuclear Momentum: September Signals That Can’t Be Ignored

What Wall Street Knows About This Fed

Disclosure: None.