Nuclear Momentum: September Signals That Can’t Be Ignored

Image Source: Unsplash

Fresh milestones in nuclear energy, packaged with global agreements, are coming fast and furious. According to key sources in Politico reporting, the U.S. Department of Energy is poised to announce the deployment of nearly $900 million to jump-start domestic uranium enrichment capacity before the 2028 cutoff for Russian imports. The money could be directed at several domestic uranium miners.

That’s another sign that capital and policy are moving faster than supply chains can adjust.

The move comes fresh on the heels of other critical developments this month in the national defense and energy security sectors.

On September 15, the U.S. and the United Kingdom signed a landmark agreement to secure supplies of high-assay low-enriched uranium (HALEU) for advanced reactors.

Billed as the dawn of a ‘true nuclear renaissance,’ the pact between President Trump and Prime Minister Keir Starmer is the clearest signal yet that coordinated nuclear is moving toward actualization. And it was only one of several key nuclear breakthroughs over the past two months.

The Atlantic Partnership for Advanced Nuclear Energy, signed during President Trump’s state visit to the UK, is part of a broader technology prosperity framework that’s linking nuclear development with AI, infrastructure and energy security.

The move was heralded by both allied governments in glowing terms as a “golden age of nuclear” move that signals the start of a “true nuclear renaissance.”

The agreement aims to reduce nuclear reactor permit timelines from 3–4 years down to 2. The pact comes on the back of a flurry of actions supporting the sector.

Separately, last month, the U.S. Department of Energy issued the first contracts for new reactor fuel. Then, on September 8, tariff exemptions for uranium, gold, and tungsten took effect under a new executive order.

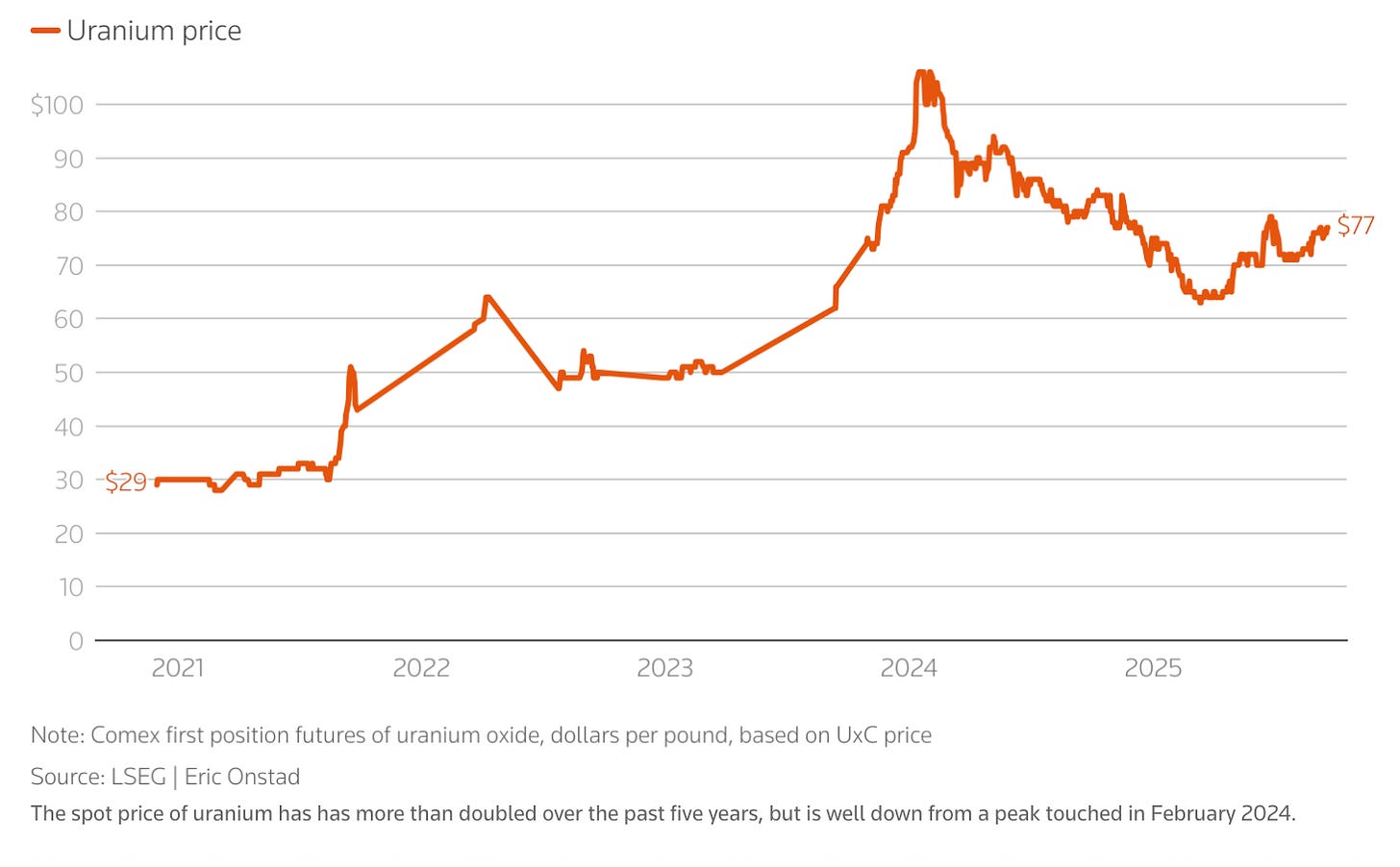

Uranium Prices Have Yet to Absorb This News

Uranium markets have only begun to reflect these events. Uranium prices climbed into the mid-$70s per pound in the spot market, while long-term contracts are still in the low $80s.

(Click on image to enlarge)

Our analysis here at Prinsights indicates that it’s only a matter of time before long-contract prices return to the $100+ level we saw in early 2024, bringing spot prices with them due to the realities of demand versus supply.

Cameco, the world’s largest publicly traded uranium producer, already has commitments for roughly 28 million pounds of annual deliveries through 2029.

Meanwhile, the World Nuclear Association projects reactor demand will rise by about 28% by 2030 and warns mine output could fall by half between 2030 and 2040 as today’s deposits deplete. That combination of contracted supply and rising demand explains why both spot and long-term prices are increasing – and will likely continue to do so.

Governments and Markets Are Compressing the Cycle

We stand at a pivotal juncture for nuclear and uranium enrichment strategy worldwide. Governments are joining forces to secure fuel and production capacity. Tariff exemptions are redirecting trade inside trusted alliances.

Public policy, as well as public and private capital, is flowing into enrichment and nuclear technology investments along with strategic initiatives.

For instance, on September 16, BWX Technologies won a $1.5 billion contract from the U.S. DOE’s National Nuclear Security Administration to build a pilot centrifuge plant for low-enriched uranium. That contract ties enrichment directly to U.S. defense supply and confirms federal commitment to scaling domestic capacity.

At the same time, the DOE disbursed nearly $156 million in financing to restart the Palisades reactor in Michigan, with the target of bringing the plant back online in Q4 2025.

If completed, it will be the first time in U.S. history that a retired reactor has been returned to service. The move will serve as a milestone for major customers, governments, and investors – all of which will send bullish signals with significant implications for grid reliability and nuclear’s role in energy security.

Enrichment capacity is being expanded beyond BWX. Urenco, a European enrichment company that supplies about a third of the Western market, just announced that it will add 700,000 separative work units (SWU) of capacity at its New Mexico facility between 2025 and 2027. That’s a 15% boost in U.S. enrichment at a moment when allies are moving to reduce dependence on Russian supply.

Policy, trade, production and capital are converging. The nuclear fuel cycle is being secured before shortages hit, and the space left for late entrants is shrinking.

Confirmation of a Trend We Flagged Early

This acceleration builds directly on what we laid out in August and have been reporting for years. Then, we highlighted how soaring power costs and AI-driven electricity demand were colliding with an aging U.S. grid. Nuclear stood out as the only scalable baseload option with the resilience to meet that pressure.

We highlighted the Department of Energy’s pilot program for advanced reactors, the Nuclear Regulatory Commission’s new license roadmap, and the fast-tracking of uranium permits under the Federal Permitting Improvement Act.

On the back of those shifts, we added two key uranium names to our Founders+ model portfolio with our August monthly issue. Our thesis was straightforward: policy was aligning with demand pressure, and the fuel cycle was moving higher on the national agenda.

Since then, the evidence has only multiplied. Global agreements are being penned. Future supply is being locked up. Uranium prices are climbing in both spot and term markets. Governments are coordinating supply, technology, and delivery agreements at speed.

Nuclear is advancing on multiple fronts at once.

Looking Ahead

September showed how fast the nuclear sector keeps evolving from a policy perspective.

Investors are taking note, as well.

Uranium ETFs are seeing record inflows, with the industry flagship Global X Uranium ETF (NYSE Arca: URA) volume increasing by nearly 30% last month, vs. the prior 3-month average. The ETF has appreciated from $20.51 per share in April to around $48 today, but remains well below its 2011 highs. Leading domestic and allied uranium mining company shares have seen triple-digit returns over the past year.

(Click on image to enlarge)

Now, cross-border deal momentum has only quickened since the Trump–Starmer pact. On September 18, U.S. and UK regulators agreed to coordinate on licensing advanced reactors. On September 19, Britain’s energy supplier Centrica partnered with U.S. firm X-Energy to plan up to a dozen new small modular reactors at Hartlepool, in northeast England, the site of an aging nuclear station scheduled for retirement. The speed of these follow-on moves shows just how fast government cooperation is translating into agreements and the infrastructure buildouts.

These trends matter because policy, trade, and capital are converging around nuclear fuel, technology and capacity. That convergence is accelerating just as electricity demand from AI and data growth strains an aging infrastructure.

Investors who are positioned will have a chance at a real advantage as the next phase unfolds. That’s why, in our August monthly Founders+ issue, we recommended two key companies that are already showing major gains on the back of movements in the nuclear space.

We are analyzing new additions to our model portfolio for next month that leverage these developments along with those sitting at the intersection of commodities and power.

More By This Author:

What Wall Street Knows About This Fed

Fast-Tracking Uranium Changes Everything

Here's What Trump Vs Powell Means

Disclosure: None.